Leaderboard

Popular Content

Showing content with the highest reputation on 07/31/2024 in all areas

-

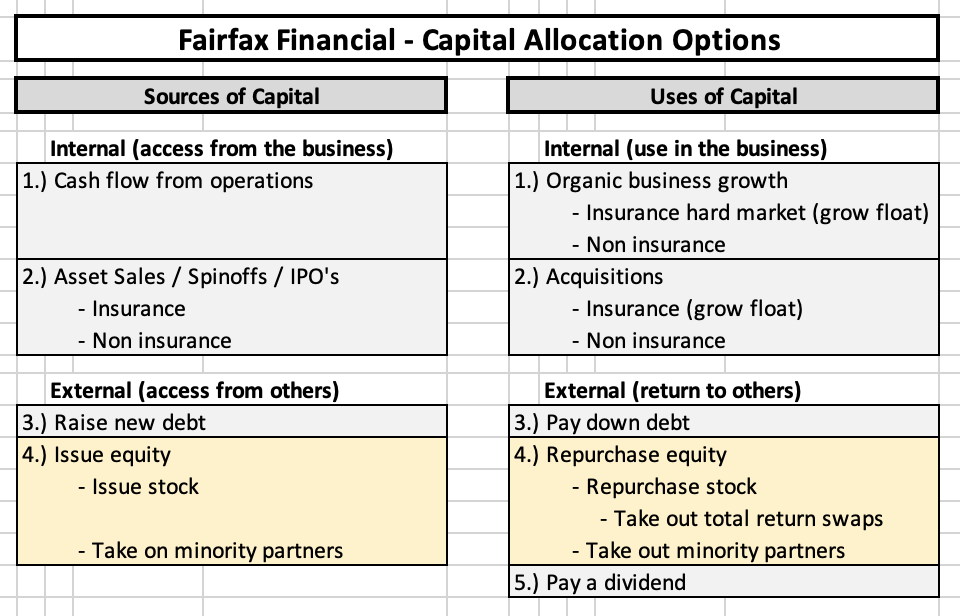

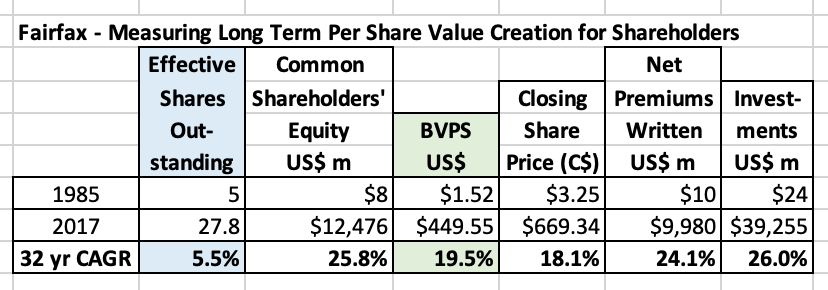

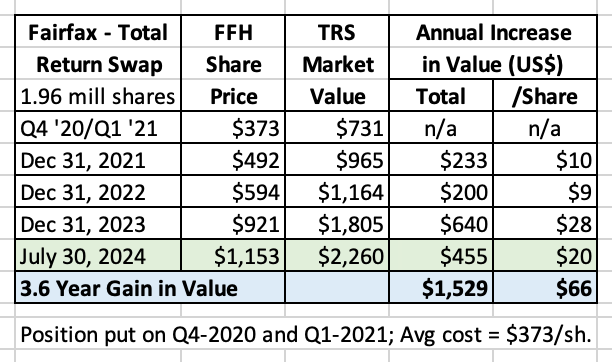

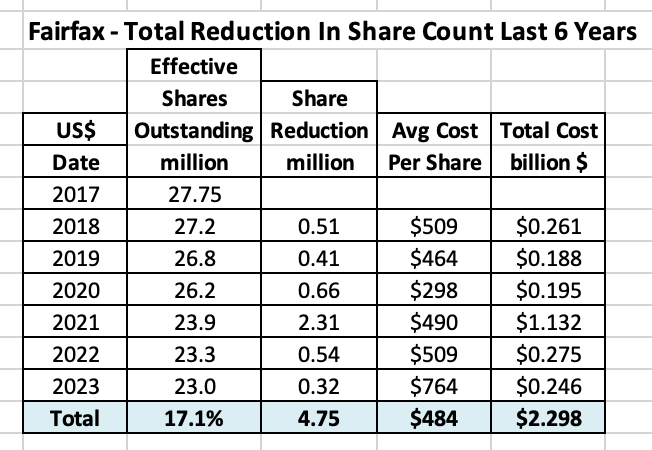

Fairfax - The Influence of Henry Singleton “History never repeats itself, but it does often rhyme.” Mark Twain In my last post I did a short review of Henry Singleton. He has been an important influence/mentor to Fairfax. Today we are going to try to connect some of the dots. We are going to focus on capital allocation and one tool in the capital allocation toolbox - shareholders’ equity. And how, when it is used properly, it can build significant long term per share value for shareholders. But remember… when comparing the present with the past we will never find an exact ‘repeat.’ That is not the point/objective of doing this exercise. However, if we look closely, we can find important examples of where the present does indeed ‘rhyme’ with the past. And that, in turn, can help improve our understanding of Fairfax - what they are doing and what they might do in the future. --------- Link to my previous post on Henry Singleton https://thecobf.com/forum/topic/20517-fairfax-2024/page/65/#comment-572533 ---------- Let’s start with the big picture A CEO has two basic responsibilities: Operations (run the business) Allocate capital When allocating capital, the basic choices available to the management team at Fairfax have been captured in the table below. In this post, we are going to focus on one tool in the capital allocation toolbox - shareholders’ equity - both as a source of capital (issuing stock) and as a use of capital (repurchasing stock). Shareholders’ equity The playbook of how a management team can use shareholders’ equity to drive long term per share value for shareholders is pretty simple: Issue stock when it is overvalued - and buy assets that are undervalued. Buy back stock when it is undervalued. Be aggressive at extremes (overvaluation and undervaluation). Keep doing both as long as conditions remain favourable. There are two key reasons this strategy works so well: Mr. Market’s behaviour can very irrational at times - and it can persist for years. The management team knows what the intrinsic value of the company is - it has a big information advantage over Mr. Market. The proper execution of this strategy over time can lead to extraordinary results for long term shareholders. Henry Singleton taught us this when he ran Teledyne. ————— Fairfax Financial - Shareholders’ Equity - A 38-Year Journey Let’s review how Fairfax Financial has used shareholders’ equity over their 38 year history to see what we can learn. We will break our analysis into two time-frames: Phase 1 - 1985 to 2017 - Building out the P/C Insurance Platform Phase 2 - 2018 to today - Optimize the Operating Businesses and Aggressively Shrink the Share Count Phase 1 - 1985 to 2017 - Building Out the P/C Insurance Platform In 1985, the year it was founded, Fairfax began its journey with 5 million shares outstanding. From 1985 to 2017, Fairfax: Issued 29.5 million shares Repurchased 6.7 million shares As a results, effective shares outstanding at the end of 2017 were 27.8 million (5 + 29.5 - 6.7) - they increased by a total of 22.8 million over the previous 32 years. Over the first 32 years of their existence (from 1985 to 2017), share issuance was used aggressively as a source of cash - and this cash was used to grow Fairfax’s global P/C insurance platform. From 1985 to 2017, Fairfax issued a total of 29.5 million shares. Shares were generally issued at a premium to book value (sometimes a significant premium). Proceeds were used to buy other P/C insurance companies trading at a much lower valuation. Bottom line, looking at share issuance in aggregate, Fairfax got good value. Share buybacks have also been a meaningful use of cash for Fairfax. From 1985 to 2017, Fairfax repurchased a total of 6.7 million shares. Repurchases were 22% of issuance - over the years, for every 5 shares that were issued, Fairfax repurchased 1 share back. Share were generally repurchased when Fairfax’s stock was trading at a discount/on sale. Like with share issuance, Fairfax got good value when they repurchased shares. So in general, Fairfax issued stock when its shares were trading at a high valuation and used the cash to buy P/C insurance companies that were trading at a much lower valuation. Fairfax also bought back modest amounts of stock at times when its shares were trading at a low valuation. This looks like it was textbook application of the principals of what a management team should do. Is there a way we can actually measure how successful this strategy has been? Yes. We can look at the change in long term per share book value (BVPS). From 1985 to 2017, Fairfax increased: the share count at a CAGR of 5.5%. common shareholders equity at a CAGR of 25.8%. BVPS at a CAGR of 19.5%. Using its stock to drive the growth of its P/C insurance platform resulted in enormous long term per share value creation for shareholders. From Fairfax’s 2017AR: ————— An important strategic change in 2017 With the purchase of Allied World in 2017, Fairfax officially completed the aggressive 32-year build out of their global P/C insurance platform. Moving forward, Fairfax would be focused on two things: Continue to do smaller bolt-on P/C insurance acquisitions. Optimize its existing insurance operations and investment portfolio. Truth be told, Fairfax got to work optimizing its insurance operations back in 2011, when Andy Barnard was appointed President and COO to manage Fairfax’s total insurance business. When it comes to investments, fixed income has always been a strength of Fairfax. The issue at Fairfax in 2017 was its equity portfolio - it was stuffed full of underperforming companies, many of which were significant cash drags (they were not delivering cash to Fairfax - they needed cash from Fairfax). By optimizing the insurance operations and investment portfolio Fairfax would be able to improve the ‘cash flow from operations,’ the most important source of cash. What was the company planning on doing with the future free cash flow? In the 2017AR, Prem told investors what was to come - Fairfax intended to get much more aggressive with share buybacks. “Henry Singleton, at Teledyne, reversed this trend (of growing share count), as you know, and over the next ten years we expect to do the same - use our free cash flow to buy back our shares!” At the time, Prem was laughed at (pretty loudly) for what he said. Let’s look at what has happened at Fairfax since then. Phase 2 - 2018 to Today - Optimize the Operating Businesses and Aggressively Shrink the Share Count What did Fairfax do? 2018-2023: Aggressively reduce the share count Effective shares outstanding at Fairfax peaked at 27.75 million in 2017. Over the past 6 years (to December 31, 2023), Fairfax reduced effective shares outstanding by 4.75 million, or 17.1%, at an average cost of $484/share. From 2018 to 2023, Fairfax was able to repurchase a significant amount of shares at a very low valuation. This is a great example of exceptional value creation by the management team at Fairfax. What does this do to the important per share metrics? Here is Prem’s slide from Fairfax’s AGM in April 2024. Before moving on, we are going to take a minute to review a couple of things Fairfax did in 2020 and 2021. Because they provide some great insight into how Fairfax thinks about and executes capital allocation. ————— Classic Fairfax - Turning Lemons into Lemonade Fairfax’s share price got historically cheap in 2020/2021. I won’t get into the reasons as to why that happened (I have covered that topic in detail in many past posts). 2020 and 2021 was a great time for Fairfax to buy back a meaningful amount of its stock. The problem Fairfax had at the time was they were cash poor. What to do? Classic Fairfax - get creative. Fairfax made two brilliant moves in late 2020 and 2021. 1.) Fairfax Total Return Swap In late 2020/early 2021, Fairfax established a position in a total return swap giving it exposure to 1.96 million Fairfax shares at an average price of $373/share. Although not technically a buyback, establishing this position serves as the next best thing. This position gave Fairfax exposure to 7.5% of its effective shares outstanding (26.2 million at Dec 31, 2020). That is a massive position. 2.) Dutch Auction In late 2021, Fairfax executed a dutch auction and repurchased 2 million Fairfax shares at $500/share. To fund the repurchase, Fairfax sold a 9.99% equity stake in their largest P/C insurance company Odyssey Group to CPPIB and OMERS for proceeds of $900 million. This was a wicked smart way to quickly source a significant amount of cash from trusted, external sources. In turn, this allowed Fairfax to capitalize on a short term opportunity (share price trading at crazy low price). https://www.fairfax.ca/press-releases/fairfax-announces-us1-0-billion-substantial-issuer-bid-and-sale-of-9-99-minority-stake-in-odyssey-group-2021-11-17/ How have these two moves worked out? 1.) The FFH-TRS position is up $1.5 billion over the past 3.6 years (before carrying costs). This has turned into one of Fairfax’s best ever investments. 2.) Fairfax’s book value is $945 at March 31, 2024. Buying back 2 million shares at $500/share only 2.5 years ago was a steal of a deal for Fairfax and its shareholders. Both of these moves executed by Fairfax scream Henry Singleton. They were: Very creative - establishing TRS and selling 9.99% of Odyssey to external partners. Very rational - Fairfax’s stock was trading at a historically low valuation. Highly opportunistic - seize the moment. Executed in scale. Both of these moves were of a significant size. Very unconventional - both were classic Fairfax moves. Most impressively, these two deals were executed at a time when investors in Fairfax were literally ‘freaking out.’ But the management team at Fairfax was not ‘freaking out.’ Instead, the management team at Fairfax saw the opportunity and made two outstanding investments - the temperament the senior management team displayed during these dark times shows, among other things, great character. This should speak volumes to investors about the quality of the management team in place at Fairfax. This bodes well for the future. It should also be noted that before Fairfax made either of these two investments, Prem told Fairfax shareholders very loudly that he thought Fairfax’s shares were dirt cheap. In June of 2020 he purchased $149 million in Fairfax shares at an average price of $309/share. https://www.fairfax.ca/press-releases/prem-watsa-acquires-additional-shares-of-fairfax-2020-06-15/ ————— OK, let’s circle around and get back on track. Has Fairfax continued to buy back its shares in 2024? My guess is when Fairfax reports Q2 results later this week, effective shares outstanding will come in at less than 22.4 million at June 30, 2024. Fairfax is on track to reduce effective shares outstanding by 1 million in 2024. This is at a much higher pace than we have seen in recent years. Why is the pace of buybacks picking up in 2024? I can think of two reasons: 1.) Low valuation: Fairfax’s stock continues to trade at a cheap valuation - its valuation is well below that of peers. 2.) Record free cash flow: Fairfax is now generating a record amount of free cash flow. It is coming from two sources: Record cash flow from operations (primarily operating income) Significant cash from asset sales Since 2018, Fairfax has been working hard at optimizing its cash flow from operations. Importantly, the equity portfolio has been fixed. All three of Fairfax’s economic engines are now performing at a high level at the same time - and they have never been positioned better for the future: Insurance Investments - fixed income Investments - equities Asset sales have historically been an important source of cash for Fairfax (and investment gains). This strength of Fairfax continues. The most recent example was the just-announced sale of Stelco. In 2023, it was the sale of Ambridge. In 2022 it was the sale of pet insurance and Resolute forest Products. All four sales were executed with the buyers all paying a premium price. As a result, Fairfax is generating record free cash flow. And this looks set to continue in the coming years. Summary From 1985 to 2017, Fairfax was focussed on building out its global P/C insurance footprint. To fund this growth, Fairfax used its stock - usually issued when the stock was trading at a premium valuation. In 2017, with the Allied World acquisition, Fairfax was officially done building out its global P/C platform. The focus of the company shifted to optimizing the cash flow from the insurance operations and investment portfolio. From 2018 to today, Fairfax has reduced effective shares outstanding by more than 19%. Fairfax was very opportunistic and shares were repurchased at a very low valuation. Over the past 38 years, Fairfax has put on a clinic on how to use shareholders’ equity to build long term per share value for shareholders. Henry Singleton would be proud of what they have been able to accomplish. But the Fairfax story is still being written. Free cash flow at Fairfax has exploded over the past three years. The size and certainty of future earnings have both markedly improved at Fairfax in recent years. Buffett teaches us that certainty is the key variable to properly value an investment. At the same time, Fairfax’s management team is best in class among P/C insurance companies - measured though the growth in book value per share over the past 5 years. Fairfax continues to trade at a significant discount to P/C insurance peers. Given what we know, this makes no sense. And if we know it, I think it is safe to say that Fairfax knows it. As a result, like Henry Singleton, it would not surprise me to see Fairfax continue to buy back a meaningful amount of Fairfax’s stock in the coming years. After all, Prem told us what the plan was all the way back in 2017. PS: This post is long. Thanks for hanging in there and making it to the end. As I was writing, it became clear to me that the influence of Henry Singleton on Fairfax goes far beyond just shareholders' equity (issuing stock at a premium valuation and then buying it back at a low valuation). Henry Singleton's influence on Fairfax was likely much bigger - how to structure the company, how to run the operations (focus on cash generation) and how to think about capital allocation (be rational, use all the tools in the toolbox, be creative, go big, don't be afraid to be unconventional etc). And to focus on building long term per share value for shareholders.1 point

-

I posted it in the investment idea thread. In short its a super cheap low leveraged internally managed medical net lease REIT that just bought back 4% of outstanding shares. Its growing and from i could see has no troubles with tenants right now, unlike other publicy traded medical REIT's.1 point