meiroy

Member-

Posts

1,188 -

Joined

-

Last visited

Content Type

Profiles

Forums

Events

Everything posted by meiroy

-

Commodities. https://theovershoot.co/p/the-implications-of-unrestricted?s=r

-

Now the Admin can say prices went up thanks to their ban, which was put in place for security/freedom reasons. Taxes and price caps could follow. Better hold brent/wti futures directly.

-

If the situation in Ukraine deteriorates significantly there will most likely be a European ban, or, Putin stops the flow and the price outcome is similar, at least for awhile.

-

I slept 4 hours last night thinking about this. Still holding. The world does not seem to be in a good place right now. EDIT: ok to add some minimal value to this post: If EU had put some ban, then it's 150 to 200 in no time. But, they didn't. And heating oil and whatnot is actually being limited now in Germany. Maybe Putin decides to cut-off Nord 1. Then what? Edit 2: nag-gas, right now, is down 5%. So it's not some broad market speculation going on.

-

Off topic: Peacetime CEO/Wartime CEO: https://future.a16z.com/peacetime-ceo-wartime-ceo/

-

The anticipation that perhaps the EU will follow at some point? Or, that it's not over until it's over? That is, more to come.

-

BTW I was buying options on the gold futures, not sure what's the advantage of buying options on the ETF?

-

Yepp. I've been loading up. A decent asymmetrical bet.

-

Lovely, you guys are impressive doing all this stuff...

-

Amazing! So, what's the youtube channel?

-

I own CL1 calls for awhile now, obviously I'm not going to hoard the physical... My point is, that yes the USA can severe Putin's income streams but he can clearly do the same. If you're saying that he won't do that because of this and that? I think that at a certain point he might absolutely do it.

-

What happens to call options if the situation escalates and Putin decides to take down American exchanges, together with some pipelines and financial institutions? Asking for a friend. The post WWII new world order sure was fun while it lasted.

-

Alberta Oil sands pollution, ESG, and share price

meiroy replied to SharperDingaan's topic in General Discussion

https://seekingalpha.com/article/4420032-esg-focused-oil-majors-are-underperforming ESG-Focused Oil Majors Are Underperforming -

Movies and TV shows (general recommendation thread)

meiroy replied to Liberty's topic in General Discussion

First three seasons of Shetland are still available on Netflix India. The only reason I still have Netflix is because of the VPN... -

What are you listening to ? (Music thread)

meiroy replied to Spekulatius's topic in General Discussion

-

Interesting discussion about investing in Brazil and Brazilian companies.

-

about that 1990 https://en.wikipedia.org/wiki/Early_1990s_recession "Primary factors believed to have led to the recession include the following: restrictive monetary policy enacted by central banks, primarily in response to inflation concerns, the loss of consumer and business confidence as a result of the 1990 oil price shock,[1] the end of the Cold War and the subsequent decrease in defense spending,[2] the savings and loan crisis and a slump in office construction resulting from overbuilding during the 1980s.[3] The US economy returned to 1980s level growth by 1993[4] and global GDP growth by 1994.[5]" But yea, also the invasion of Iraq. https://en.wikipedia.org/wiki/1990#:~:text=Important events of 1990 include,independence from the Soviet Union "Important events of 1990 include the Reunification of Germany and the unification of Yemen,[1] the formal beginning of the Human Genome Project (finished in 2003), the launch of the Hubble Space Telescope, the separation of Namibia from South Africa, and the Baltic states declaring independence from the Soviet Union amidst Perestroika. Yugoslavia's communist regime collapses amidst increasing internal tensions and multiparty elections held within its constituent republics result in separatist governments being elected in most of the republics marking the beginning of the breakup of Yugoslavia. Also in this year began the crisis that would lead to the Gulf War in 1991 following the Iraq invasion and the largely internationally unrecognized annexation of Kuwait. "

-

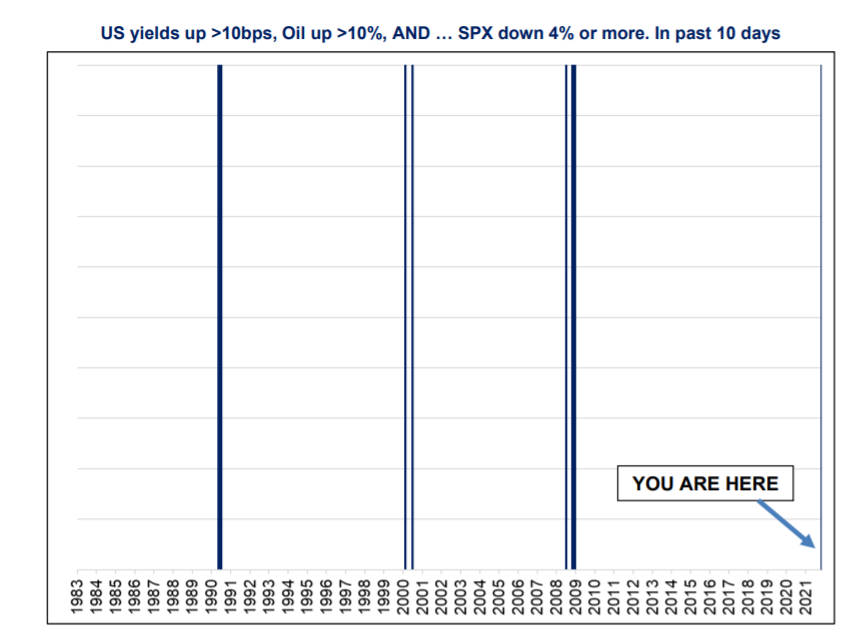

Very interesting am/FX by Brent Donnelly today. I think his letters are worth reading. Keep in mind he's a trader, not an investor. Meaning he's agnostic about everything. "Something weird is going on"

-

2018 was about QT. QT is sucking liquidity out of the system, the opposite of QE. It's not just about interest rates. The current QE of the past two years has leaked into risky assets resulting in what we are seeing now. If the Fed starts QT we will most likely see liquidity draining from various risky assets. This liquidity is why the market has been going up these past years and why buying the dip is a thing. I'm not justifying any investment calls in 2018, just pointing out it's mostly about liquidity.

-

Insider Trading By Politicians Should Be Stopped!

meiroy replied to Parsad's topic in General Discussion

https://unusualwhales.com/i_am_the_senate/full I hope the top five start a substack. -

Are you seeing any DAOs that are already starting to replace well established corporations? In the coming 5 years, who is the most at risk?

-

A certain economy is starting to show signs of weakness, households are moving from fiat and other assets into crypto such as Bitcoin, just in case. Perhaps the country itself encourages this transformation. A couple of years pass and the country is now on the brink of default; in order to stop a bank run and foreign currency outflows, it tries to enforce it via regulation. Alas, as by now most households have significant amount of their money in crypto this feeble attempt by the government has little impact the entire financial system is now gone beyond repair and with it the political system. Without crypto, it might have been possible to buy some time to save the whole system. That's the main systemic risk. It's of course also one of the main arguments why individuals should hold Bitcoin.

-

It's unbelievable these discussions on basic measures are still going on. When there's a fog of war, the person in charge has to make quick decisions based on partial information and uncertainty, they don't wait until everything is known and clear or just pretend there's no war, because they will lose. From day 1, people should have worn surgical masks, avoid unnecessary gathering, ventilate, test as much as possible etc. A complete no brainer based on what we know about viruses. This is exactly what they did in South Korea/Taiwan and some other countries. Once these basic measures are taken, something can be taken out or added when it's clearer what's going on. But here we are, it's almost the middle of July and we're still debating if to take these measures. FFS.

-

Several members of my extended family are anti-vaxxers. Once there's a legit vaccine out, we'll get it, and then I'm not sure we'll want any contact with these people. Sadly. If people are not willing to wear masks, will they get vaccinated? If plenty won't, it can't be contained. I'm not too optimistic.

-

I have a small amount dedicated to options gambling investing, just so I don't mess around with the larger sums. It has done surprisingly well.