anders

Member-

Posts

108 -

Joined

-

Last visited

Content Type

Profiles

Forums

Events

Everything posted by anders

-

Great stuff.. Seth Klarman brought this matter up in one of his letters... i cant remember which one it was but you can prob google it... All my life... or at least from around 3 years old when you start to challange your parents... I have had a "built-in" contrarian view... ie when 7 years old, a person says A, I automatically said B.. if the whole group said B, I more strongly argued for A... I think that comes from curiosity and inverting... as a corollary, sound logic does not betray me at the point of maximum pessimism.. But when i started investing, the contrarian approach - buying 50 cents on dollar - hurt me a lot.. so I had to change my investing process... First off, I dont like to be a contrarian - a person that rejects popular opinion. I want to be an intelligent investor.. an investor that connects contrarian, growth, value, into one process with a clear view and knowledge about the business.. IMO, an intelligent investor know when to use the contrarian tool.. when the market is gripped by panic or euforia which creates great distortions in prices to value.. but when these emotions are fairly intact and balanced, the conseus view will very often be correct - because the market is efficient in discounting the news, but not in discounting them correctly and thus the margin of safety to price will not become big enough without the effect of strong human emotions.. BP: Being a Contrarian 1 So following up on the oil/gas comps... When the rig blew up in the mexican gulf and BP quickly depreciated in price.. I thought that not only did the market discount in lower revune and damage cost, but it would exaggerate it quite a lot.. and when the market started to talk about bankruptcies, I thought the probability said no so I bought it around 28.. It was probably luck that it bounced at that level, it could have easily gone down to 15.. but bankruptcy? not very likely at the time.. So why around 28?.. It was because at that level, the consensus in the market discounted in 100 billion of damages to the company, and by analysing the company and previous similar accidents ie exxon valdez, I came to the conclusion that no way could consensus be right on projecting the damage so fast, 100 billion seemed like a made-up-easy-to-rember-number... The news was effeciently disounted in, but very inefficient in doing it correctly... and even with big damages, BP could pay it off with CF over time.. So if the risk came down, the price would certainly go up.. and even if the consensus was right about the 100 billion mark damage, I would still probably get a good div yield while waiting for the risk to come down... That was a good investment imo and a good way to use the contrarian tool.. BP: Being a Contrarian 2 Buying BP because of lower oil prices is another sort of game imo.. then its the direction of oil price which is hard to predict... What happens when all the oiltankers that got filled up - with steep curve contango in oil futures - gets sold in the market later this year..? What happens when the maintanence period of storage / refineries start this spring, and if maintenance gets interrupted ? what happens if storage runs out ? Waht happens if sanctions is lifted from Iran and their supply comes out in the market ? and so on.. its too many "what ifs" to determine a high enough probability for investing.. and consensus is probably more right than wrong since the market has more time to better correct the data into the price... That would be a bad investment imo and a poor way to use the contrarian tool.. Hope it made a bit sense.. Cheers!

-

How do you figure out what you don't know in investing?

anders replied to LongHaul's topic in General Discussion

Posted a thread about this some year ago.. still trying to figure it out and its a slow process.. You know when buffett said.. "investing is part art part science" but he never mentioned in my knowledge details about the "parts"... so how much is part art ? and how much is part science..? As I get older, the part art is becoming increasingly larger because it includes many more dimensions and thus logically it is where I should put my focus which imo goes hand in hand with schloss view that you have to own a business to really understand business dynamics: the culture, the product, the dealer, the employed, the leaders, the margins, the marketing, the consumer, the economic environment and so on.. That is why if you can understand how a business is built from the inside, it is easier to understand the problems it may face from the outside and thus makes it less of a problem to put a price on it.. This is also why I believe the circle of competence is much smaller than many people think because no two businesses are ever the same even if it looks like it on paper.. "Diversification is a protection against igonrance, It makes little sense if you know what you are doing." For your third point I am following the advice from Buffett to deal with ignorance: Write down on paper why you are buying the business, what could go wrong, the ifs and buts, how the CF move, how the margins are created and so on.. and if you cant apply it pencil to paper then you should think it through some more.. I believe that if one really does that process, many would be surprised on how little of that paper that gets filled and their igonarance would be illustrated by themselves.. at least that was what happend to me first time I started doing it.. Best Regards, -

yadayada, Check out gapminder, great tool that visulizes data. Best,

-

Thank you for a great debate. It seems to me we are talking around the same argument. Net energy imports account for about half of the total U.S. trade deficit and value of the trade flow moves of course with production, consumption, and prices. With higher oil price, production and energy export increase and import decline which improve the energy trade deficit (why USA reached its lowest trade deficit in 2013, and also the reason why saudi arabia is not keen on cutting production since they are on the losing side of the trade). My assumption is that with lower oil prices, production level for export will decline and import rise thus increasing the trade deficit. If US oil import would be absent, the US trade deficit would go from -700bn to -300bn. Yes, Buffett is the basis for my argument. I have a vague memory of him saying that only looking at gov debt to gdp is misleading and also need to take in total asset base into consideration. Also him speaking on charlie rose about the fiscal deficit being a stimulans and not worried unless it go more than -10% of gdp. But not worried at this level doesnt mean a link does not exist (in economics they are interlinked and you can read all about it at NBER) and, it does not mean he wouldnt be worried if it gets worse. My interpretation when I first red the article, it that he is concerned for the future of USA, and he explains it quite colorful.

-

@ JB, I would call it "deflationary money printing" if there is a word for it. And my reason is since it gets stuck at the banks it becomes unproductive borrowing thereby the money velocity declines and a weakening economy follows. If it gets out to the public, it becomes productive since money volocity increses and strengthes the economy. I believe that the intention from the fed is for printed money to reach out in all corners of the system but the banks hold it as insurance. I believe FED lost its power to influence rates and can only guide where they like it to be in future. And after going up x bs and economy starts to halter again.. the mother of all QEs will arrive.. And when the printed money starts its journey out into the system the velocity will be impossible to stop.. I hope Im wrong.. Best,

-

@ Tim, If it sounded that I had an offensive tone, it wasnt my purpose. 1) I would prefer not to deep dive into math and sources. I simply red EIA report 2014 and their projection and thought it made sense - that is, US oil production will decrease and US oil consumption increase over the next coming years and as a corollary will put negative pressure on the trade deficit. IMO it is very unlikely that USA will maintain its production level the coming years if prices stay at these levels. ...Quota // Level... Since english is not my mother tongue I do appreciate all help I can get improving it thank you, but you dont need to feel that you have to do it for my sake. 2,3) But it is not two totally different things. Fiscal policy and balance of trade is interlinked and the topic is "who will pay pack the debt". And I believe that balance of trade is where you find the root of increased debt level in a society and thus where I find it most interesting to disuss, it is where it begins. And if you factor in income and payments to get to current its still negative since decades. Blending in fiscal policy; A goverment surplus = trade surplus + excess of investment over private saving. So if USA keeps its spending fixed and lower the taxes thereby go into deficit, then either the trade surplus or investment over saving must decline, or both. So can you imagine USA to raise taxes to cover a negative balance of trade?!? Is there any example of where USA have a budget surplus and current deficit? Every budget is balanced, there is no thing as an unbalanced budget and the true tax in a country is how much the government is spending and how much the country is buying goods from other countries. And the citizens are paying for it, if not through direct taxes than indirectly in the form om inflation or borrowing debt. No way a country can directly raise taxes and not increase its production without harming its citizens buying power. This is why average joe have seen his dollar decline over 90% over the last 90 years. 4) Yes, I never argued differently, but I think it is pretty clear that somewhere down the road, USA will face some hard choices. And Buffett has made a great job in raising a big red flag for what he thinks awaits the next generations of americans. Its simple arithmetic, Japan will at a point default, USA continuing at same pace will at some point default. Not acknowledging this is imho ignorence. ----- Since 1940, the US has had 12 budget surpluses out of 74.. roughly each 6th year. How is that a recipe for success without somewhere on the road correcting the balance sheet? And how does this effect future americans ? Will USA be able to make trade surplus - through production or FED devaluing the USD increasing export? or will the treasury just write off the debt to the FED? or will it be colonized by purchase with cheap dollars? I apologize for previously being blurry and I hope I better illustrated my point. I would much appreciate that we skip the deep diving, take a step back and I would very much appreciate your thoughts on who you think will be standing left with the bill ? Rgds

-

@ Tim, That implies that USA will maintain its production quota with WTI @ $47 ?!? Production will fall and imports will rise putting pressure on the trade deficit. Plz read EIA paper on projection. Depends on what side of equation you are on. Importing more than exporting for decades, buying more than you produce for decades and borrow to do so - yes that is inherently bad for future americans imo. A constant outflow of USD will at some point find its home again. The discussion is about the trade deficit. 'So far' does not mean permanent. I think it is a interesting topic since it touches “intergenerational inequities”. It will be very interesting to see how the US will handle the debt level when it becomes inbearable. For decades the US has been selling pieces of the country coupled with increasing the debt level. If thus the Fed start embracing highly inflationary policies (which I believe is the case) the holders of USD will most likely opt for US land instead of US Bonds and, a true colonization of USA by purchase would be initiated. Rgds

-

I remember when I first red the article made by WB "Americas growing trade deficit" in 2003. I revisited the article because there is a couple of words in that article that i never forget: "every time you hear that foreigners will start move out of the dollar, dismiss it". When was the last time the US had a trade surplus ? Correct me if Im wrong but that hasnt happend since mid 70s and, with lower oil price the US trade deficit will most likely increase again. And with a stronger dollar, it will probably increase even more. So it continues, the US gradually giving away a part of their national net worth. It easy to get lost in this credit jungle environment but it always comes down to the simple fact that credit is borrowing from the prosperity of the future. But at one point, someone will have to pay it back and, looking back at history its been through war. Should the coming generations work harder days due to of our way of living ? should yellen inflate it all away by endless QE letting foreginers take the hit? or should treasury forgive the debt to the fed? what about taxpayers? Simply, who will be standing left with the debt ? Rgds,

-

I used to run a covered call fund.. short calls or long puts doesnt go well hand in hand with value investing approach... if you want to long puts on ie high tech comps you need to put it into a strategy over time, otherwise you are just speculating and thats not a game I believe anybody can master successfully.. how many didnt long puts and lost a lot of money on VW during financial crises, or tried to succesfully short cisco during it bubble.. maybe you will be succesful 9/10 but its the 10th that kills the performance. So what I told my previous workplace and imo to other people is that these methods is a function of option strategy, generating maybe a yearly 5% yeild depending on vol. Its an investing strategy in itself and, if you want to couple that with ie value investing then it will likely turn into a speculation. We allocate some percentage in a trade account for special situations purposes ie shorting stocks/bonds, risk arb, stressed credit, currency play etc trying to squeeze out some extra percentage points in performance, but never mix them with the other part. My two cents,

-

Anyone buying gold miners or just me?

anders replied to original mungerville's topic in General Discussion

"A hole in the ground with a lier on top" ;) I like the mining comps at these prices.. but have great respect for the sensitivity in gold price.. I have bought some and continue adding on these prices, the stars being the royalty companies.. also like the picks & showels to mining industry.. The majors have done some aweful aquisitions in the past, then refocused cf on the balance sheet during the financial crisis, then shifted it a bit to the pnl - reducing cost basis. Imho, some come with solid balance sheets, pay a fair dividend (adjusted to gold price), and have great upside if gold stays at these levels. The gold demand clearly outstrips supply and should correlate sooner than later. Looking at history, gold price does not really correlate with higher interest rates and the great depression / HUI index scenario could very well rhyme.. yeah, im bullish ;D -

Thx guys! Well, im already running an investment business and, no doubt the passion is still there,.. Started with passive investing and now moved into passive/venture, taking a more active role.. I guess it is where the comes into the picture.. But I dont have the passion in reading 50'000 pages over the weekend as Buffett does, I dont have the passion in reading 10k on my honeymoon and therefore was hoping that it doesnt only come down to passion in reading... Frankly, Im getting tired even if exponential knowledge works like ecstasy for the brain.. maybe its just a xmas break that is needed without books and reports.. From birth I have been told that talent comes from working hard, "rise early, work hard, strike oil" kind of mentality... skip fancy words and jargon and dig in the ground until your hands bleed, then continue until you dont feel it... I love what I do, but having dinner with my family, realising that I havnt heard a word my kids said because I was which strikes me as going in the totally wrong direction.. Im being a bit abstract, but I guess you guys understand what I mean.. it maybe just comes down to this

-

“I think Buffett is a better investor than me because he has a better eye towards what makes a great business. When I find a great business, I am happy to buy it and hold it. [but] most businesses don’t look so great to me.” - Seth Klarman For a number of years I have been developing my business eye. What I do is reading; reports, reports, reports, reports, reports, reports, books, books, reports, reports.... But for the first time in my life, im starting to be tired of it.. I dont want to, but that is how it feels... It is much like you practice piano 6 hours every day, or stand at the golf ranch 5 hours per day for years... One question I think about a lot is what factor makes the difference of being really great, or world class pianist..?!? Is klarman simply saying, buffett reads reports on his honeymoon, I dont.. or is there other qualities that make up the difference ?!? I saw an intervju with a world class skier, he said its only 1% skill, gift, talent and the rest 99% is practice.. but is it then a talent to be able to have that dicipline to practice I wonder... Your thoughts in this matter would be much appreciated, Best,

-

Its an interesting topic indeed.. :) I think there are so many different dimensions in a DCF that imho one is probably better off not relying too much on the concept and just keep focus on reading reports understanding the business... Further, imo its been developed into a tool to get as much pay as possible when selling an asset.. I have backtested my data, the only ones that I have been on track, are stalwarts that has a business structure that allow them to grow at a moderate rate every year... ie structures as walmart... but they always come with a premium.. I think the conversation below kind of illustrates my point on DCF.. Munger: But you say there is some vaguely established view in economics as to what is an optimal dividend policy or an optimal investment? Bratton: I think we all know what an optimal investment is. Munger: No, I do not. At least not as these people use the term. Bratton: I don't know it when I see it... but in theory, if I knew it when I saw it this conference would be about me and not about Warren Buffett. (Laughter from the audience) Munger: What is the break point where a business becomes suboptimal in an ordinary corporation or when an investment becomes suboptimal? Bratton: When the return on the investment is lower than the cost of capital. Munger: And what is the cost of capital? Bratton: Well, that's a nice one (Laughter) and I would... Munger: Well, it's only fair, if you're going to use the cost of capital, to say what it is. Bratton: I would be interested in knowing, we're talking theoretically. Munger: No, I want to know what the cost of capital is in the model. Bratton: In the model? It will just be stated. Munger: Where? Out of the forehead of Job or something? Bratton: That is correct. (Laughter) Munger: Well, some of us don't find this too satisfactory. (Laughter) Best,

-

I would go into the business if I really enjoyed the process, not to build CV or salary.. I dont think anybody would be keen to mentor you before they can see your potential and what you can bring to the table... read as much as you can and you will most likely stumble on those that in your opinion makes sense... IMO, giving up your time for free implies that you dont bring anything of value and therefore you will end up as jawn said, running after clients with performance based salary... You are nisched towards auditing hospitals, that brings value to the firms that are working within the field of biotech and pharma.. I would continue on that path and convince them why they should hire you.. Rgds

-

Thx chai, I always enjoy reading from those that are well informed and do their homework, I very much appreciate your thoughts and agree on almost every point you bring up. I will try to illustrate my thinking in this matter. Our stance on Mongolia among other nations such as China, is that over time, these countries will be winners of 21th century in terms of prosperity and growth. Its a very long term view. So how can we best surf on the asian wave and also gain knowledge and build experience? We have taken small steps in taking exposure in those countries that we feel have a great future ahead. So we have allocated a small portion of the portfolio and in Mongolia in particular we are purchasing things that we believe will go hand in hand with that prosperity. The funny thing about mongolia is that its 1 company that dominates every sector, so we are buying into the only listed beverage company, the only listed cashmere company, the only listed financial brokerage company, the only listed cement company and so on. MGG also is an interesting way to get exposure in real estate in mongolia. A funny story when I was there a couple of years ago if you dont mind; I asked a guy where I could find the books, and got the following answer "there are´nt any books".. eh? no books I said, "no books".."you need to go to the company and knock on the door and ask to have a look in their internal books". So the way it is structured is that Mongolias financial infrastructure is still in building process and there are not any real standards and CF valuations as the ones we have in the west, as a corollary, they mark the company value to the net assets and if you want your dividend you are asked to come and pick it up at the reception. It has progressed since then but you get the point... This is longterm process and as we try to protect our ignorance of knowledge in these countries, we diversify. So it is really more of a way trying to get a healthy assymetrical exposure at an acceptable risk. The currecy risk you can take away, we have chosen not to since we are not smart enough to see where it is heading, so either you hedge or you dont, or else you are just speculating. Last time I checked, the daily turnover on MSE was about $200 000, so the kicker is when/if mongolia structure start to stabilize, FDI will enter the system and drive up asset prices. But this makes sense in our world, I would never put 10% in mongolia hoping for a quick return, we treat this more as china in the beginning of 90s and adding as it gets cheaper. Further on, we do this because we have luxory of long term view and I love traveling around the world, but it is scary sometimes. Another story is that I and a business partner went to Kenya starting a farm project up north, its a another story but it is really scary when you are sitting sipping your coffee at Westgate and two weeks later, the al-Shabaab terrorist group goes there and kill 67 people, or just yesterday, they killed 36 non-Muslim quarry workers in northern Kenya, cutting their heads off while my business partner is a couple of hours drive from there. The reason Im telling this is that I finally understand why you can generate a yearly 100% on equity on these kind of frontier structures, there is always a very good reason why people dont touch highly lucrative transactions. Best,

-

How Are You Thinking Bout The Drop In Oil Prices?

anders replied to Viking's topic in General Discussion

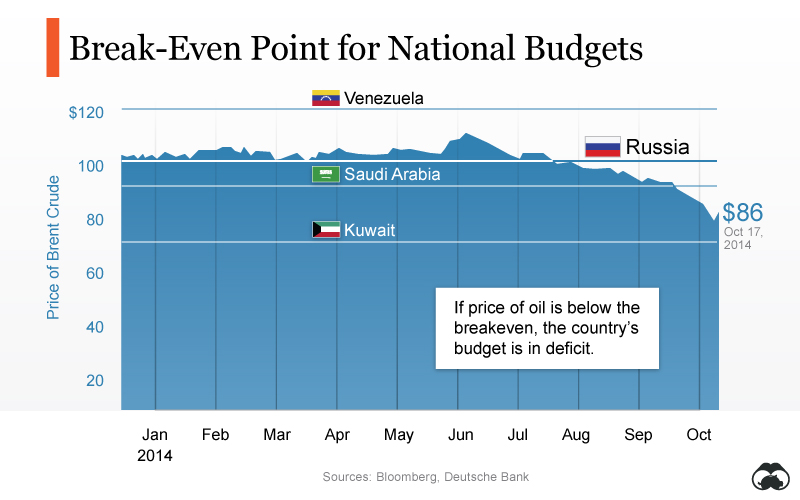

I think the price depreciation is due to political reasones, namely russia (oil exorts ~ 45% of Russias revenues) and, is why opec is not reducing production of 30m b/d. Norway also refuses to cut production. Deutche Bank has calculated the breakeven price for Russia’s fiscal situation at an oil price at $102/bbl and a cut of 1.5m b/d is needed to put a floor on price. Will price go up in future? I copy past from John Hess Fact No. 1: Eighty-five percent of the world’s energy comes from hydrocarbons. While renewable energy will be needed to meet future energy demand and contribute to reducing our carbon footprint, hydrocarbons will fuel the world’s economy for decades to come. Renewable energy does not have the scale, timeframe or economics to materially change this outcome. Fact No. 2: Once the economy recovers, oil demand is projected to increase by 1 million barrels per day each year, as world population grows from 6.8 billion today to 9 billion by 2050. The introduction of higher mileage standards in the U.S. and the gradual phasing in of electrical power into automotive drive trains will only moderate growth in automotive fuel demand. That is because nearly one billion vehicles on the road today could grow to approximately two billion vehicles in the next 30 years. Keep in mind: The U.S. has 1000 cars for every 1000 people; China has 10 cars per 1000. Fact. No. 3: Supply. We are not running out of oil. The issue is not our endowment of oil resources, it is the world’s production capacity. Additions from exploration last replaced annual production in 1987. The easiest oil has been discovered. Costs are increasing for new barrels, where wells can be drilled in water depths of over one mile to targets up to six miles deep, and discoveries can take over a decade to develop. Oil field declines are running at more than 5 percent per year. That means we have to add at least 4 million barrels per day each year just to keep production flat. Yet non-OPEC production is in the process of, if not peaking, reaching a plateau. The U.K. Energy Research Centre just published a report that there is a significant risk that worldwide production of conventional oil could peak before 2020 and enter terminal decline. If we do not act now, we will have a devastating oil crisis in the next 5-to-10 years. We will need the courage to act to prevent this crisis and make the commitment to change our behavior – not just in demand; not just in supply; but both. The United States must take a leadership role. With five percent of the world’s population but 25 percent of its oil consumption, the United States can no longer blame oil producers for rising prices. We need to have the courage to demand 50 miles per gallon as the national standard for all vehicles; gasoline hybrids and diesel could get us there. A gasoline tax of $1 gallon would boost conservation and help pay down the federal deficit by $120 billion per year. In non-OECD nations, energy subsidies that the International Energy Agency (IEA) estimates cost $310 billion per year unnecessarily inflate world oil demand and obscure the true cost of energy, resulting in wasteful energy usage. In terms of supply, the petroleum industry spends about $400 billion a year to find and produce oil, but that is not enough. With 80 percent of global reserves essentially off limits to outside investors and only 6 percent of OPEC’s oil revenues reinvested in energy infrastructure, something has got to change. The role of the national oil companies is critical; they need to invest more or allow others to partner with them. We need a balanced approach going forward. It is not a decision of “either/or” but “and.” In addition to more oil supply and energy efficiency, we need a greater role for natural gas AND cleaner coal AND nuclear energy AND renewables. Meanwhile, we must also establish realistic objectives for reducing greenhouse gas emissions that do not throw the world economy into reverse. Many governments want to limit global warming to no more than 2 degrees Centigrade. To meet this target, annual CO2 emissions would have to be reduced from today by more than 80 percent by 2050. But is this realistic? With world population growth and rising living standards, holding global CO2 emissions flat by 2050 would be a huge achievement in itself. As the global system gets increasingly stressed over competition for resources, there is more and more protectionism among consuming nations and resource nationalism among producing countries. Nations are building walls to disengage from one another when they should be building bridges to collaborate. Going forward, we need new models of collaboration. Over many decades, international oil companies and producing countries have worked together in a way that has been purely financial – through contracts that are either tax and royalty or production sharing. In the future, we need to build stronger bonds of trust. The investment model needs to be focused not only on oil resources but building the capabilities of host country’s human resources. We must redefine what it means to get a return on investment. Second, we also need a global forum dedicated to energy policy. Without a common framework on energy, sustainable economic development will be impossible. I would suggest this challenge for the G-20, which represents represent six of the seven biggest oil producers and the 14 largest oil consumers. Its mission is sustainable economic growth. Energy not only fits this objective, it is essential for its success. In conclusion, what kind of world do we want to leave to our children? If we do nothing, there will be severe consequences. Skyrocketing prices could become a way of life in a crisis-led world. In a world where we all make concessions and put global interests first, we will all win. If consuming nations led by the United States commit to conserving energy, we could save 5 million barrels per day of incremental demand over the next 10 years. If producing nations led by OPEC commit to building more oil production capacity, we would add over 5 million barrels per day of incremental supply over the next 10 years. In this world, prices would be stable and our global economy could prosper. Does this scenario sound impossible? I do not think so. The stakes have never been higher. We must build a balanced and comprehensive approach to energy security and protection of the environment to ensure sustainable development. We must unite and work together as an industry, communicating one message, having the courage to act and collaborating for the global good. In this world, there will be a bright future, not only for oil, but for many generations to come. John Hess has been Chairman and CEO of Hess Corporation since 1995. Headquartered in New York City, the Hess Corp. is an integrated oil and natural gas company with operations in 18 nations. The company explores, produces, transports, and refines crude oil as well as natural gas. -

The company is focusing on the commercial property and development which naturally comes with higher leverage with growing economy. Their focus is on creating assets before CF which they evidently believe will provide better return on equity over time. Their occupancy rate is approximately 99%, hence getting occupancy creates contracts and, if you can show consistent timelined CF on a building, will evidently raise the price on that building. Sure 4-5% yeild on assets that doesnt cover costs seems bad at first, but if you can grow the asset base, then they will at some point have a structure that allow them to grow without putting further pressure on the cost side. The company leverage ratio is at 1,08 meaning about 93% solvent which in our opinion is low for a RE company and, will enable more leverage in pace with securing occupancy rates. This to continue finance future growth and expenses until the assets cover the cost, then they slow down growth and start liquidating some assets. I think it is difficult to put a price tag on the company as the assets plays on expectation on future growth on Mongolia, future policy rates, future inflation and FDI. The ecomony has come down due to reduced coal price and some political aspects but activity is still live and well with annual gdp growth at 7%. But sure, with price trading at 85 cents on $1 tangible equity it is more interesting and we are picking up the pace in purchasing. But with a notion that it provides a part of our 1% frontier capital that we are mentally prepared to lose. I dont know how much the company will be worth in future, I talked to a guy that came to mongolia with £100 000 in 1993-94 and IPO d it in Hongkong last year at $500m and, he told me they only scratched the surface. Its risky business so best way to do this is to read everything from the company started and make a decision if one want to have it in the portfolio longterm. Rgds,

-

I have studied Mongolia a great deal and have faith in its prosperity. I dont think finding additional cash would provide a problem for them. Today almost all RE comps cannot handle big volumes such as blocks of 100m since they wont be able to deploy it succesfully. CF and value always goes hand in hand so obviously they will try to achieve both. We have found a couple of companies in mongolia that we think can provide good return over the long term period - its part of our frontier forever capital. It goes into our assymetrical positioning sacrifizing 1% every year on frontier capital, this coupled with sacrifizing 1% on macro hegdes every year (ie japan default, short JPY) So we are building on YAK buying very small volumes, and are taking a bet on Harris that he will be able to structure a company that can ride on the progress of mongolia. And if it takes 10, 20, 30 years, it doesnt matter as long as we believe he does the right things. out of experience, this things tend to take much longer than any anticipates, and then a bit longer still.. Rgds

-

I will jump back in the discussion again..lol Gio, this is what you wrote. Strategy a) I define this statement as; I believe X might happen in the market and, as a corollary I decide to do Y and Z with my portolio. Strategy b) My thinking goes, I do not act on a view on what X might be in the market, therefore Y and Z should be based on finding opportunities. Im NOT saying you might do poorly, or that you are wrong in positioning yourself into these investments. But, I truly believe "strategy b)" will provide better returns over time, so in that sense, Yes I think you are making a mistake if you make portolio strategy based on market predictions. Then to your question: Let me answer your question with a question to the extreme to further illustrate my point: If an algo went bananza tomorrow and suddenly put the BRK A share price at 25'000, wouldnt you buy for 100% regardless of CAPE or level in the market?? Rgds,

-

+1 Gio, As always, I appreciate all your thoughts and this boards ability to spin matters in different directions,

-

Today the cash level sits above 60%, due to the fact that some investments along with our "top runner" in which we were heavily concentrated in got bought out of the market this year. I dont know if this is considered as bad luck or good luck ??? since we saw a great assets depart and got cash which creates a difficult challange in this environment. Regards,

-

- I have never argued being 100% fully invested - Im not stupid ------ What im saying is that I strongly disagree with the notion of making a strategic decision on portfolio allocation based on level on CAPE, the notion that we might go into bubble territory. IMO The level of cash should be correlated on finding great ideas regardless of level of CAPE or the market, which evidently gets more difficult with higher premiums in the market. Regards,