Sweet

Member-

Posts

1,529 -

Joined

-

Last visited

-

Days Won

2

Content Type

Profiles

Forums

Events

Everything posted by Sweet

-

@Dinar at what price should I buy? It depends on whether the story has changed, I don’t have a rule, however for me it should be obvious. By obvious I mean you check the price, a few other metrics, and you aren’t opening an excel sheet to do DCF because the opportunity is so apparent. I sometimes feel that if you are doing a DCF analysis the opportunity might not be that compelling. As an example. In 2013 (if my memory is right) Apple dropped approx. 50%. There were some concerns about growth and the next phone cycle, and every time Tim Cook spoke the shares just kept dropping. Apple had a large amount of cash on hand, which when subtracted from market cap meant a you were paying a PE of 6-8, and all the growth was free. Not many opportunities come up like that though, which is why there is a wishing element to this list!

-

Interesting business. What’s your take on the future for it?

-

@LearningMachine I probably would add Apple. I own an iPhone, and I wouldn’t own anything else. It’s not the phone, it’s the integration and services offered. I can can see Apple going after Visa and Mastercard. The iPhone has measurably improved my life. Four months on I would make changes to the list: - Amazon - Alphbet - Apple - Visa - Mastercard - Bank of America - Well Fargo - Costco - Starbucks - Walmart - Microsoft These are definitely companies I would buy a lot of if the price was right. However it’s missing small - medium cap with large growth potential - I.e. no young compounders. It’s missing biotech too which IMO is an ever emerging field. I’m not really happy with the list.

-

Interesting article: https://www.marketwatch.com/story/selloff-puts-s-p-500-on-bear-markets-doorstep-if-history-is-a-guide-theres-more-pain-ahead-11653002466?mod=home-page

-

Agree Simba

-

On the Economy Lots of talk by Twitter commentators and market analysts that we are in for a large economic recession on parallel with 2008, driven by inflation busting rate rises. Maybe they are right, however, it has been my experience that market optimists have been on the right side of history far more often than not. The last time the Fed had to get tough with inflation was in the 70s and 80s, many are dreading a reoccurrence, but few seem to recall that GPD largely kept ticking higher even when rates were at their peak. Fed funds (blue line), GPD (red line) - 1972 to 1983 On Stocks We have a decade of low rates driving valuations higher. The average of the 10 yr US Treasury yield has historically been 4% - 5%. A return to that average yield for Treasuries is healthy, although I think valuations in stocks will compress. Some companies, are trading at very low multiples, but others are trading at sky-high valuations. Walmart, even with the recent 20% drop in price, is trading at a PE of 25 whilst recent revenue growth has averaged at about 4% per year. On the whole the market doesn't look cheap. When the Fed was raising rates in the 70s and 80s stocks did very little for nearly a decade. Dow Jones - 1970 to 1983 History is not a predictor of course. Overall I think the economy is OK, but I think we investors may be in for a period of under performance. We don't really have any other alternative than to be in the market though.

-

Over the long term those who were optimistic about stocks and the economy, who bought and held, have probably made much more money than those who were pessimistic. At the same time, I do think we are large correction, or a decade or more of underperformance. The former might best best for everyone. I posted periods of the Dow Jones from inception. It shows decades, multiple at times, of boom, and times when the market has done nothing. In 1940 the DJ was at the same price as in 1920. In 1983 the DJ was the same price as in 1964. Two 20 years period with little action. A huge amount of this is obviously just being born in the right era. But if you are born in an era where the market hits a generational top, how do you outperform?

-

Today's 52-week lows (those of interest on any given day)

Sweet replied to CafeB's topic in General Discussion

Stocks of note hitting 52 lows this week: AMZN - Amazon AIV - Apartment Investment and Management Company BCS - Barclays BNED - Barnes & Noble BIO - Bio-Rad BK - The Bank of New York Mellon BA - Boeing BAC - Bank of America CMG - Chipotle Mexican Grill C - Citi CRM - Salesforce DD - DuPont GPN - Global Payments GS - Goldman Sacs HD - Home Depot JPM - JP Morgan MS - Morgan Stanley NKE - NIKE ORCL - Oracle PLTR - Palantir SBUX - Starbucks USB - U.S. Bancorp WF - Wells Fargo -

and ARKK investors

-

COWZ - 10+% FCF/EV Yield: Please poke holes!

Sweet replied to LearningMachine's topic in General Discussion

It’s interesting but I don’t have anything useful to add. -

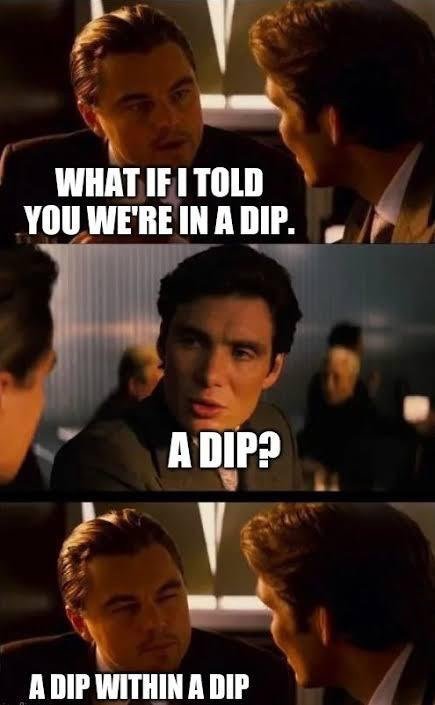

I think that’s where I have been with one of my holdings recently. If it was from anyone else, this wouldn’t be a meme:

-

^ lol, pretty much.

-

Just lucky I guess?

-

True. I want to start averaging into certain sectors which are currently getting wrecked. Technology is something I would like to own, but it’s been out of whack from fundamental for at least 5 years. Then again, maybe technology is last years decade, and this decade with higher rates the market will want returns. It does feel like a generational turning point.

-

How much more? No idea. It has proven to be very asymmetric selling, I think the tech stocks could get cut 50% or more again. No idea though, finger in the air stuff.

-

Probably still much more downside to come. The big tech stocks are still trading at large valuations.

-

Oil price is just a shade over $100 but oil products are trading as high as $275 equivalent according to this article. It argues a recession is the only way to tame prices through demand destruction. https://www.bloomberg.com/opinion/articles/2022-05-09/crude-hovers-at-110-a-barrel-but-the-refinery-margin-makes-us-pay-a-lot-more?sref=5dj0X2VO

-

Ads need some targeting. Seeing young girls in bikinis - not comfortable with that either.

-

Thanks, you know what you are doing. I agree that if interest rates rose that it is something I would consider. Not for me currently though, would rather hold cash at this moment when there is for sure more tightening.

-

I don’t know how valuable it is to own a bond index. One of the great benefits of a bond is that it redeems at par, and that’s great for controlling risk. My understanding of bond indexes (which I admit is not great) is that it doesn’t redeem. You buy and sell at whatever price the index is. In a rising interest environment, doesn’t the price of the index fall? Take AGG, yes it’s yielding more right now because rates are going up, but the price of the bond is down 15% since recent highs. If rates keep rising, as most expect they will, that index will decrease in value. .

-

There are so many good ones out there, some are funny, others are more serious. I find it helps - especially on down days. Please note, the intention is not to offend anyone.

-

FNMA and FMCC preferreds. In search of the elusive 10 bagger.

Sweet replied to twacowfca's topic in General Discussion

Is the thesis dead or alive? -

For sure. I held from joining back then because there was too much politics talk. I’m glad there is a politics forum.

.thumb.png.1d7d18c129a27683057b73c2816d4f5a.png)