longterminvestor

Member-

Posts

262 -

Joined

-

Last visited

Content Type

Profiles

Forums

Events

Everything posted by longterminvestor

-

Insurance Brokers (MMC, AON, AJG, WTW, BRO)

longterminvestor replied to tnathan's topic in General Discussion

Recent writeup VIC on RYAN. RYAN SPECIALTY HOLDINGS INC.pdf -

According to Mitsui, it is not a subsidiary. Below is link and note from Mitsui. My understanding was Mitsui loaned $250M to Grace in 2010 to buy ships. https://www.mitsui.com/jp/en/topics/2024/1248961_14380.html Regarding certain media reports Mar. 28, 2024 Regarding the incident in which a large cargo vessel collided with a bridge in Baltimore, Maryland, USA, certain media reports have mentioned that the vessel owner, Grace Ocean Private Limited, is a subsidiary of Mitsui & Co., however, Grace Ocean is not our subsidiary, and these reports are not factually correct.

-

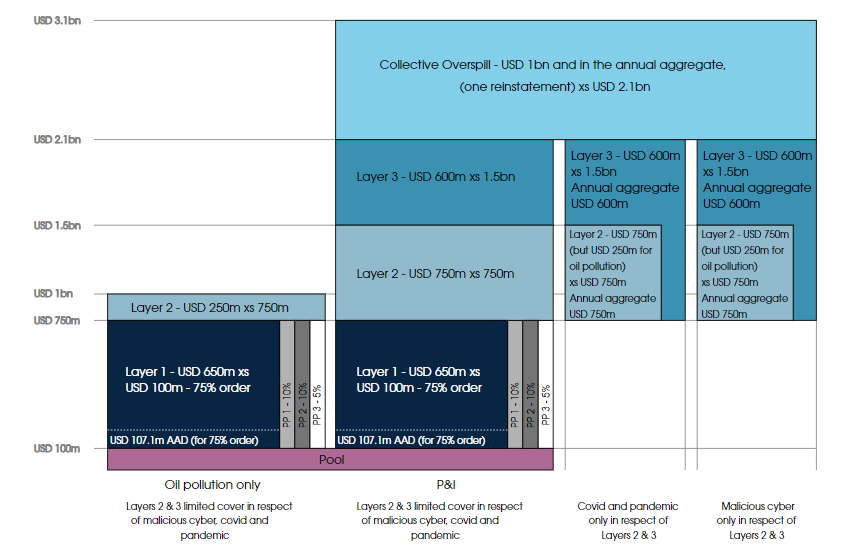

See below the layering mud map for IG P&I Club on risk for accident. Do not know carriers in the tower but there is $3B of cover - 80 reinsurance companies in tower including 20 of the worlds top 25 reinsurers.

-

Buffett/Berkshire - general news

longterminvestor replied to fareastwarriors's topic in Berkshire Hathaway

More to mechanics of risk. Surety acts like insurance but its not insurance. Its much more of a financial transaction/credit facility than insurance. Its a big dance of 3 parties saying "I trust you, but not really, so to earn my trust you gotta pay me so I trust you a little more than I want to". Surety requirements take any situation from single A ball to the Major Leagues quickly. Surety basics: 3 players and I'll name them in reference to this case. Principal (Mr. Trump), Obligee (NY Court) and Surety (easiest one to understand as insurance company, and no market stepped up). The financial incentive for a Surety to enter a transaction is extracting the most money possible from the Principal in form of premium AND to be sure the Principal is money good for collateral sum in event of payment demand from Obligee to Principal and enjoined Surety. The Principal's incentives are the inverse of Surety, wanting to pay the smallest premium and post the least amount of collateral. Principal may achieve reduction in collateral by explaining to Surety winning in appeal is fait accompli because ect ect. The Surety Company eliminates the risk of non-pay to Obligee and ultimately the Plaintiff. Important to note in Surety underwriting, there's an old saying called the 3 C's - Character, Capacity, and Capital - Principal has to embody all 3 to qualify as a good risk. So lets say we wanted to write this appeal bond or supersedeas bond. We could charge lets say 2.5% of $450M ($11.25M due at inception from Principal) and also as part of agreement we require $300M in cash to be wired immediately to us, and lastly we might add something for a margin of safety like "if the principal wins appeal, we will return collateral 2 years after last court doc is finalized" - lengthening the use of collateral float. We have use of $310M (gotta pay broker commission) for an undetermined period of time + 2 years if Principal "wins" or in event of Principal "losing" immediate payment at any point. The bet is how long will the money stay on our side of the fence - will this take years or days? Cause if its years, then maybe $310M is enough against $450M guarantee. Or if its months, in an unfavorable judicial venue for Principal, we need more premium paid/collateral posted. This is more about amount and type of accepted collateral. With the right amount of collateral and an understanding of the facts in the case - like serious legal understanding of ultimate outcome and when it will occur, there is a perfect price of risk on this deal for a surety company - similar to a discounted cash flow from judgement day backwards on the perfect price on a business, gauged against interest rates. Both are unknown so that's why the game is fun. I believe the entire reason why the 30 carriers declined, 4 brokers engaged, got put in front of the judge was court room theater to show $450M bond is an unreasonable amount and plea to reduce the bond amount to $100M. I personally believe the judge kinda knew the $450M amount was impossible to get from the beginning and the large size was done intentionally, more theater. And with that, from the vault of Mr. Buffett's lessons on this type of topic directly/indirectly: -

Buffett/Berkshire - general news

longterminvestor replied to fareastwarriors's topic in Berkshire Hathaway

Letter was forwarded to me, didn't question it because its on Chubb Letterhead, with personal Greenberg letterhead as Chairman and CEO, and signed by Greenberg. Didnt occur to me to check signature against annual report. I did just now and I'm no handwriting expert, but they match. The letter has also been quoted by multiple news sources referencing passages contained here in. Looked real to me, do you think its fake? If a reporter calls me, my source is Deep Throat. ha. -

Buffett/Berkshire - general news

longterminvestor replied to fareastwarriors's topic in Berkshire Hathaway

Mr. Trump has until March 25 to post an additional bond for $456M. The dollar amount is approaching a record size. For example in 2009, Zurich wrote a surety bond for Panama Canal for $450M - believed to be one of the largest deals ever done in surety. I would like to highlight Chubb previously issued a $91.6M bond with brokerage account as collateral allowing Mr. Trump an appeal. When the news broke of Chubb issuing the $91.6M bond, there was a ton of blow back to Chubb. CEO Evan Greenberg (son of Hank Greenberg - formerly of AIG now Starr) wrote a letter addressing the $91.6M bond (letter attached). I really liked reading the letter from Mr. Evan Greenberg - showed some leadership and belief in our system of government. One could argue the other side saying Greenberg/Chubb is favoring Mr. Trump and bring in all the politics however I want to believe Mr. Greenberg's words in his letter "we support the rule of law and our role in it". I just liked the letter a lot especially in this political climate where we need leadership. As a shareholder, I trust Berkshire made a sound decision. With a juicy premium and liquid collateral/margin of safety could be a good risk. However the political nature probably just makes it a too hard pile issue so I get it. Berkshire could have easily declined on same basis of Chubb - lack of collateral or size. As Mr. Buffett says, cash/liquidity is like oxygen. chubb-letter-on-trump-bond-3132024.pdf -

https://www.wsj.com/finance/warren-buffett-is-getting-dragged-into-the-real-estate-commissions-litigation-79696153?mod=finance_lead_pos3 More litigation at the energy business, not from wildfires, from Real Estate commissions. Litigation risk for a large conglomerate is something I haven't factored into Berkshire, will do that with more care. Article mentions the below from Annual Report disclosure: "Based on available information to date, HomeServices believes losses are likely to occur as a result of the jury verdict in the Burnett case and that such damages could be up to $5.4 billion, excluding attorneys’ fees, prejudgment interest and other costs subject to determination by the court. However, HomeServices is currently unable to reasonably estimate such loss due to, among other reasons, the joint and several nature of the liability and the early stages of the appeals process."

-

Been saying it for a while. GEICO is getting SMOKED by Progressive. Its not even close.

-

Buffett/Berkshire - general news

longterminvestor replied to fareastwarriors's topic in Berkshire Hathaway

Not at all. Shares outstanding today are less than when those shares were issued and we got the rail road. and its worth north of $150B now. -

Insurance Brokers (MMC, AON, AJG, WTW, BRO)

longterminvestor replied to tnathan's topic in General Discussion

I listened to call as well, quote: "add back for compensation expense in Q4 was $8M and expected to 7M in Q1 2024". Small potatoes in relation to comp expense overall. If you want to compare same type of measure, look to RYAN. They have similar issue and running same earn out provision thru comp expense, however RYAN's comp to rev ratio starts at 64% and is adjusted to 59% as percentage of revenue. 64% actual and 59% adjusted is still high for RYAN however starting from a lower base % helps in the long run as well as RYAN aggressively hires organically in addition to acquisition earnout passthrough which will be reduced over time. Dont know if I could call $59M full value for wholesale brokerage biz at $34M topline with these eye popping numbers we are seeing with purchases - kinda weak at $5M/15% "adjusted" EBITDA (adjusted in quotes for effect). Sounds like AmWins gifted them the $59M with a wink saying we will take this off your hands but you better send us some business. BRP obviously needs cash. My sense is they had too much turn over in that business and just needed to dump it. Color on future acquisitions was fuzzy - I pictured in my mind a fanciful CEO tap dancing for analysts. So difficult to watch when you see everyone else making money hand over fist in the space and these guys just get a pass for posting loss after loss after loss. 5 years as a public company and BRP has never made a dime posting a loss each year. Cumulatively thats $351M in total net loss for 5 years. I am looking forward to seeing how the movie plays out for sure. I'm not going anywhere. I have been pretty hard on these guys and will continue to be until there is reason otherwise. Maybe someday I could own this at a price commensurate with its value, once all the babies are thrown out with the bathwater - I guess I gotta be open to that years and years down the line from where I sit today. -

Insurance Brokers (MMC, AON, AJG, WTW, BRO)

longterminvestor replied to tnathan's topic in General Discussion

Seems like the voting machine is alive and well while the weighing machine is colleting dust with this name. Just trying to learn and be an active investor doing the work. Writing it out helps me frame in my head and challenges me to find clarity. Anonymously sharing my work is easy however I would let my mouth run with confidence on this name with management if they ever showed up on my doorstep. Just can't get my financial mind around BRP. -

Insurance Brokers (MMC, AON, AJG, WTW, BRO)

longterminvestor replied to tnathan's topic in General Discussion

BRP reported today with a net loss for the year 2X previous year. Producer comp/EE expense as percentage portion of topline commission increased to 75%. That is unbelievably HIGH. For comparison, a shrewd disciplined operator like BRO is closer to 53% (shooting for under 50%). Share count for BRP is up 5.8% YOY and up 26% since 2021. Related figure, share based comp expense, is up to $60M in 2023 from $47M in 2022 and $19M in 2021. They lose money on operations (NET operating loss is $42M) and then throw in $119M of interest expense and it boggles the mind on how this is investable. The business only paid $1.2M in taxes because of the carry forward losses and continued loss on operations. Factor in taxes on the expenses in ops and this thing can't make a profit for a long...long time. Sorry I forgot, management's metric is adjusted EBITDA and the T stands for taxes. Amortization expense seems aggressive as well (dont know this as well as I wish I did). Here are some numbers comparing to BRO (maybe someone can help). BRP Goodwill as of 2023: $1.4B BRP Amortization for 2023: $92M BRO Goodwill as of 2023: $7.3B BRO Amortization for 2023: $166M -

Buffett/Berkshire - general news

longterminvestor replied to fareastwarriors's topic in Berkshire Hathaway

Marmon's revenue is roughly 2X since the initial purchase in 2008. Anything bought in 2008 was purchased at depressed prices. so yeah, there's a bunch of intrinsic value inside Marmon that doesn't translate to the book value of Marmon and the overall BV of Berkshire. Marmon could easily be worth $18B-$20B today. However there are some dead businesses inside Marmon as well. Greg mentioned them in the 2020 annual meeting - not by name but my thought immediately was they were Marmon businesses when he discussed. -

Insurance Brokers (MMC, AON, AJG, WTW, BRO)

longterminvestor replied to tnathan's topic in General Discussion

BRO was a tough 10yr hold from high in 2006 all the way through to 2013 even further through 2016ish with no return (yeah there is a small divey in there but no price action on the biz). 2016 to today has been a rocket ride. Kudos to your conviction and that's what it takes to hit the 100X. That does deserve its due. Well done sir. Well done in deed. -

Sorry RadMan24, the Federal Government is the only entity with the balance sheet willing to pick up the flood risk in the US. And banks will not provide a mortgage on a home in a flood zone without flood insurance. Some private carriers have started to write private flood however the overwhelming majority of flood is underwritten by the US federal government - National Flood Insurance Program (NFIP). NFIP total premium is roughly $3.5B. Losses from large events Hurricane Sandy in 2012, August 2016 Louisiana flood, and 2017 Hurricanes Harvey, Maria, and Irma added up to roughly $24B in claims. Its a tough business.

-

Agree however you still gotta deal with a situation like a Precision Castparts. Also Netjets hit skids (Sokol brought that one back) and Pampered Chef needed a leader (Tracy Britt Cool). Nothing is forever. I kinda think of Mr. Able/Mr. Jain as the security guard who looks over the Mona Lisa. The security team there doesn't have to do much most of the time, but if someone rushes the painting to steal off the wall they have to act quickly and perform exactly as required and very fast.

-

Housing Developers do the same for the risk of Flooding. Low laying areas are relatively cheap land, get local officials to change law/building code/ask for variance, and build homes at/below grade to save money and the Federal Government picks up the tab for following years of flood claims.

-

Buffett/Berkshire - general news

longterminvestor replied to fareastwarriors's topic in Berkshire Hathaway

Basis is the transactions that have been done over the last 15years in the US market. -

Buffett/Berkshire - general news

longterminvestor replied to fareastwarriors's topic in Berkshire Hathaway

I have thought deeply about future of large acquisitions. There is a market for businesses in size, it does exist, maybe less in terms of "businesses inside circle of competence", however market for the type of owner/the people who control those businesses is different today than 30 years ago. The elephants are out there, just the incentives have changed for the people that own them. There are far fewer Al Ueltschi's (Flight Safety) , Mrs. B's (Nebraska Furniture Mart) , Clayton Family (Clayton Homes), and Paul Andrew's (TTI) today - to name a select few. I believe Mr. Buffett used to tell Paul Andrews that his executive comp was too low, and Andrews used to say "We can talk about that next year Warren". These people cared about their companies, their employees, and the legacy mattered. Today, the legacy is how much can I get? And the "I" is not the founding family, the "I" is the PE firm that levered the business and needs to transact for the fees and "fund performance". The sellers incentives have changed. People are scared to do "deals on a hand shake" today - the attorney wont allow it (no fees!). For the select few that still do, Berkshire is a permanent home. And Berkshire will see some deals in the future, it will happen – just gotta be patient. Similar issue has occurred in the large insurance placements (what was once called "super cat" business) where there was once ready market and now the moat has deteriorated. There was a time where large limits could only be put up by 1 or 2 players (AIG/Berkshire) - getting multiple insurance companies to take slices of risk quickly was difficult. That moat has eroded today with technology, spreadsheets, ease of transferring large amounts of PML data and getting layered deals much much faster in consortiums. Where Berkshire was once a home for big insurance and big businesses, things are changing. Berkshire rode the wave to where it is today. There was a time when Berkshire was manufacturing textiles....became a dinosaur. I have opened my eyes to the fact that Berkshire may have to pivot to new businesses/models/opportunities in a similar fashion that Berkshire left textiles for insurance. Do not know what that iteration looks like but I am open to it because of the culture inside the enterprise. I think on iteration that has occurred is Berkshire moonlights as a “Merchant Bank” franchise. Mr. Buffett can throw down billions fast with no strings and extract his terms. Regarding Pilot lawsuit, things are not always complete bliss in Omaha even with a Mrs. B for example. Mrs. B never sued, but she was disgruntled. Reports were she was unhappy with grandsons but who really knows. She left to start her own shop down the street that quickly grew to be #3 seller of carpet in Nebraska in a few short years. Mr. Buffett and Mrs. B did kiss and make up, the business was eventually purchased by Berkshire. Things happen - Mr. Abel will deal with them moving forward. -

Insurance Brokers (MMC, AON, AJG, WTW, BRO)

longterminvestor replied to tnathan's topic in General Discussion

There is also some chatter that big daddy Marsh is gonna go 100% internal for wholesale. -

Insurance Brokers (MMC, AON, AJG, WTW, BRO)

longterminvestor replied to tnathan's topic in General Discussion

https://aon.mediaroom.com/2023-12-20-Aon-to-acquire-NFP,-a-leading-middle-market-provider-of-risk,-benefits,-wealth-and-retirement-plan-advisory-solutions "Purchase price estimated to be $13.4B at the time of close, representing a ~15x multiple on seller-adjusted estimated EBITDA at closing". Incredible. -

"I can't help you with a simple solution to getting rich with soft white hands" - C. Munger

-

Insurance Brokers (MMC, AON, AJG, WTW, BRO)

longterminvestor replied to tnathan's topic in General Discussion

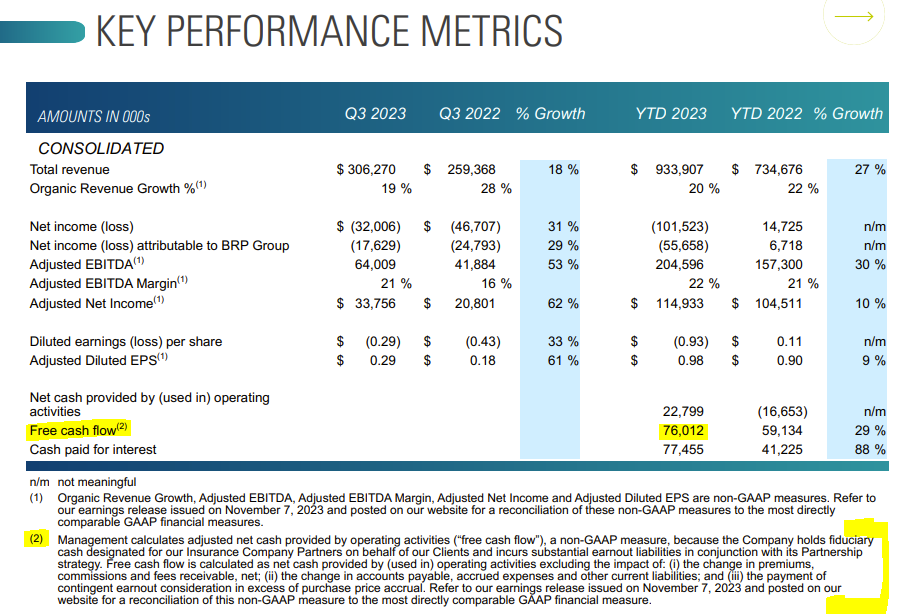

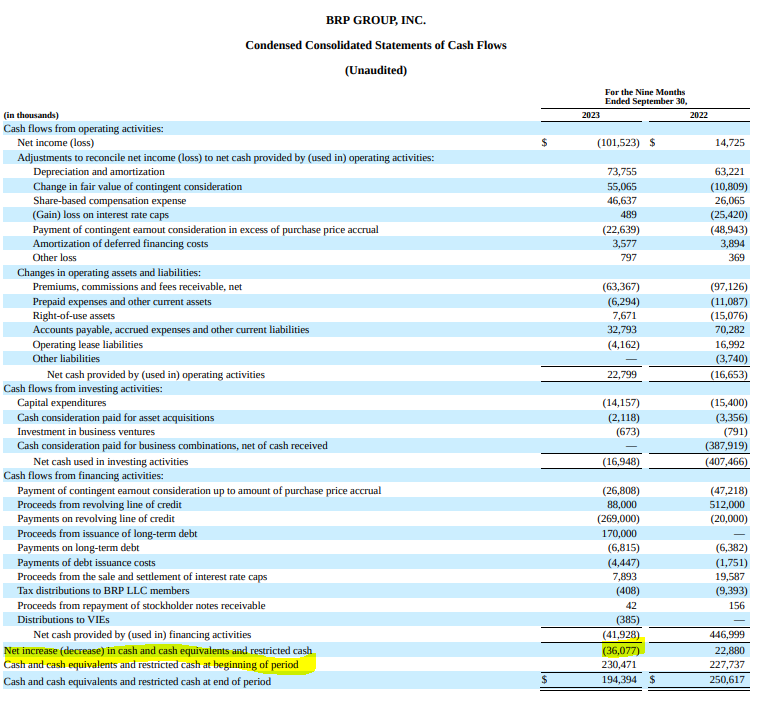

BRP's cash flow will be impaired for the near/medium term due to earn out payables and the need to pay down debt. They don't have the money to be acquisitive which is a huge part of the model. Found the disclosures on BRP's latest "investor deck" compared to actual cash flow statement to be interesting.....see below. Actual Cash Flow statement: Same goes for the other PE backed firms as the debt loaded balance sheets need to be serviced with debt and earn out payables. -

Insurance Brokers (MMC, AON, AJG, WTW, BRO)

longterminvestor replied to tnathan's topic in General Discussion