mattee2264

Member-

Posts

703 -

Joined

-

Last visited

-

Days Won

7

Content Type

Profiles

Forums

Events

Everything posted by mattee2264

-

IF the ETF approved, will you make Bitcoin a NEW position?

mattee2264 replied to james22's topic in General Discussion

There is a funny twitter post summarizing the bull case: Millennials holding 50% of their net worth in bitcoin = $2,500 Boomers holding 5% of their net worth in bitcoin = $250,000 -

IF the ETF approved, will you make Bitcoin a NEW position?

mattee2264 replied to james22's topic in General Discussion

1st level thinking is there is a massive and self-serving incentive now for financial institutions to promote the idea that every portfolio needs a 5-10% allocation to bitcoin and that will create a huge amount of demand for the ETF. Not to mention that individual investors can now speculate in bitcoin in their retirement accounts. And if the ETF can get a bit of momentum out of the gates it will be very easy to draw in more and more money. And precisely because it is impossible to value then there is nothing fundamental such as earnings etc to tether its valuation. So it is difficult not to imagine this ETF doing very well. -

Fourteenth annual letter to owners of Fundsmith Equity Fund

mattee2264 replied to formthirteen's topic in General Discussion

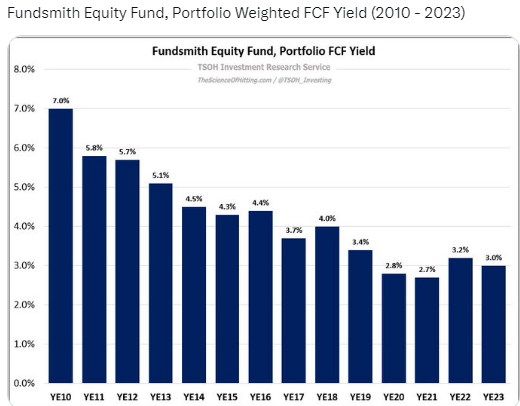

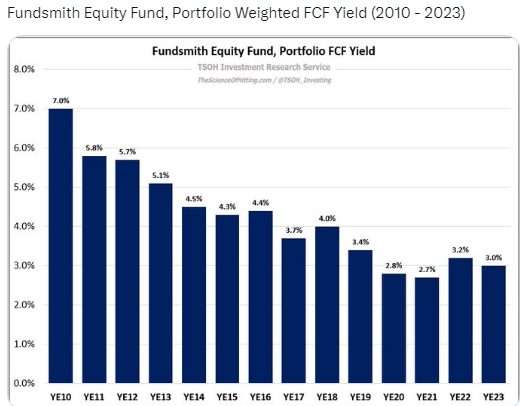

Above from TSOH Investment Research partially answers your question about valuation metrics. Although to a large extent the drift lower in FCF yields probably reflects multiple expansion in their initial investments and their buy and hold approach. It is a very popular fund so I do wonder how they deal with the issue that most funds face of the most new money coming in when market valuations generally are elevated and money tending to exit at the very time that valuations are becoming attractive again. -

Think there is a difference. With the search engines companies can gate any content they do not want freely available for search. With YouTube the content creators upload their content in the same way they do on social media sites. This seems a bit more analogous to Napster. And as GIGO applies then it only seems fair that producers of high quality informational content (OK maybe that is stretching it for journalism but at least they fact check and have highly informed sources) should consent to their content being used as training data and compensated accordingly.

-

For most of long bull markets stocks trade above 20x earnings. So long as earnings keep going up (which they will do absent a recession) and inflation and interest rates remain moderate it is sustainable. The basic idea is that if interest rates are 4-5% then that is equivalent to a PE ratio of 20-25x. So long as growth is assumed then there isn't any real requirement for an equity risk premium. It is only during times of heightened fear that investors demand a high equity risk premium because the safety of bonds is preferred to the prospect of never ending losses in stocks. Clearly that mentality does not exist at the moment. We've seen the stock market recover from the GFC, from the Euro debt crisis, from COVID, from the most aggressive Fed tightening cycle in the last 40 years and countless smaller bumps in the road. And of course there are other reasons to support higher than average PE multiples such as changing market composition (more growth/quality/defensive, less cyclicality), more interventionist monetary and fiscal policy, and perhaps even a generational change in investors as the old timers who remember the Great Depression have been replaced by Gen Z whose motto is "YOLO" and crowd into tech companies they are familiar with.

-

Consensus for 2024 seems to be: -Bonds are still a buy because rates are definitely coming down -Stocks are going up because of a combination of lower interest rates and EPS growth expectations of 10% -We are going to avoid recession (aka soft or no landing) Would not surprise me at all if markets got this very wrong as well. Bond market has already priced in a pretty optimistic picture of Fed rate cuts. And ignored the fact that the yield curve will un-invert at some point so Fed funds rate would have to fall a lot for the long bond to go much further below 4%. So IMO bonds are only a screaming buy if you think we are headed for a hard landing or the Fed completely capitulates and reinstates ZIRP to bail out the financial system or allow corporations/governments to cheaply refinance maturing debt. Stock market has already priced in interest rate cuts (which haven't happened and are even greater than the Fed is guiding) and 10% EPS growth seems pretty optimistic in a soft landing scenario. And Mag7 will have to do a lot of the heavy lifting. Which I suppose is possible but not something I would count on. As for the recession call. Obviously the bears have been wrong so far. But I think that in a myopic stock market neither bears nor bulls seem to understand policy lags which are around 1-2 years. When the first rate hike was only in early 2022 and in the previous few years we'd had ZIRP huge amounts of QE and unprecedented fiscal stimulus (which is ongoing if less effective than the pandemic handouts) it was far too premature to call for a recession and understandably bears have lost any credibility. So if a recession does arrive in 2024 and 2025 when the impact of the tightening in 2022 and 2023 is felt in full and fiscal stimulus continues to wear off then it will catch markets by surprise. The other possibility is while we avoid recession inflation takes off again and the Fed does another U-turn and long bond rates might go a lot higher than 5%. And with all the corporate and government debt maturing higher for longer is not an outcome that anyone wants. Falling inflation has given the Fed an excuse to pivot while maintaining some semblance of credibility. But if inflation takes off again they'd probably have to backtrack. Or something else entirely might happen.

-

So generative AI doesn't seem to understand the concept of copyright. And copyright infringement could become a major issue with a lot of lawsuits. NYT has already sued OpenAI/Microsoft. Disney seems also to be weighing up filing a lawsuit. Seems like it could be something that could slow the progress until it gets sorted out and perhaps pour some cold water on the Ai enthusiasm in 2024. Any thoughts?

-

What are the high growth developing markets trading at 7-8x earnings? MSCI emerging markets has a forward PE of around 12x. Still a lot better than the 20x for developed markets. But not as obviously cheap and a lot of that cheapness is coming from China which has additional risks.

-

Aswath Damodaran's investment picks and returns?

mattee2264 replied to schin's topic in General Discussion

I think the limitation of being a valuation expert is that most stocks are efficiently priced based on the general consensus as to their prospects and their track record etc. What you will be missing is the non-consensus insights that make the difference and is where the real money is made as that requires deep industry knowledge, expert judgement, predictive powers and pattern recognition that only the special few have. For fun over the years I used to read investment pitches in Outstanding Investor Digest, Value Investor Insight, Value Investors Club and so on. Most of them were well written and convincing and identified either deep undervaluation or obscene overvaluation. But if you were to see how things turned out in most cases these ideas would have done no better and often worse than just holding the S&P 500. Also the DCF framework which is orthodoxy in modern finance while theoretically correct has some serious practical limitations and the quest for false precision which is necessary for an intellectually satisfactory valuation is going to inevitably result in mistakes. To me it makes a lot more sense to just pay what looks like a fair price for a company that is fairly certain to see its earnings increase over the next 5, 10, 20 years. That doesn't really require a formal DCF and shortcuts such as PE multiples can often do just fine after adjusting earnings for any obvious distortions. Or alternatively look for situations where investors are clearly being far too pessimistic and short-sighted resulting in cheap valuations and good profit potential for a clear-minded and patient investor happy to wait for the dust to clear and sentiment to improve. It isn't textbook but it seems to be how good investors tend to do it in practice. -

What people got wrong is the type of inflation. QE policies led to asset inflation. Not consumer price inflation. It was also a bit naive to think that the Fed would ever make any serious attempt to reduce its balance sheet and do QT in a meaningful way. Higher for longer is probably wrong. The global economy is weak and now the pandemic stimulus is wearing off there goes all the demand pull inflationary pressure. The supply side inflation was always going to be transitory. Longer term probably there will be less efficient supply chains, deglobalization to some extent and resource shortages. But because they are supply side what will eventually happen I think is that central banks will just come to accept 3-4% average inflation. The slowdown this year will get inflation back to 2% and allow the central banks to declare a win. And then if inflation drifts up when the economy recovers there will be some half hearted attempts to bring it down and eventually a new inflation target will probably be adopted or the concept of "average inflation targeting" will be made more popular.

-

What is a little bizarre is that talking heads are still talking about soft landing potential when with markets close to all time highs even a soft landing will probably result in some downside as it will mean slower growth and in a market dominated by growth stocks that is going to hurt as much as lower interest rates help.

-

I think a lot of bond "investors" are just speculating on rate cuts rather than investing for income. There seems to be a presumption that we are heading back to zero interest rates. But the Fed only aggressively cuts when something breaks or the economy is heading south. If you read the Fed comments it has basically said that it feels that current rates are restrictive and they don't want to overshoot so there is a little room to cut rates next year. But if you assume that a normal term premium is around 150 basis points then for 4% long bond rates to make sense you need the Fed to slash rates by at least 200-250bp and absent a recession or something majorly going wrong in the financial system that is difficult to imagine. And locking in 1-2% real returns does not feel enticing from an income perspective. I prefer short term bonds. History shows that cash is not always trash and there are periods when Treasuries can outperform stocks. And with the CAPE at 30x a 100% equity allocation seems unnecessarily risky.

-

-Your best investments for 2024 and beyond-

mattee2264 replied to Luke's topic in General Discussion

I have a sneaking suspicion that Mag7 will once again handily beat the market especially if the Goldilocks scenario plays out (not too hot to put upwards pressure on inflation and interest rates and encourage a rotation into cyclicals not too cold to result in earnings disappointments that growth investors tend to punish severely although even in a recession scenario I suspect that they'd continue to be viewed as a safe haven ) And if AI enthusiasm persists and inflows continue into broad market index funds that will also support higher prices. Although would avoid Tesla and Nvidia as they don't have the same quality as the others and bear uncanny resemblances to go-go stocks of the dot com bubble era and do not have the same kind of provenance as the others. I still have a large holding in oil and gas stocks. While they say they are for trading not owning they are attractively priced and in inflation adjusted terms the oil price really isn't that high and demand isn't going away anytime soon while supply will eventually fall as no one is making long term investments anymore and shale while prolific in the short term doesn't have longevity. Emerging markets ex China looks like a good long term bet. Especially if you add to it some of the Chinese tech stocks which have been massively beaten down. Valuations are a lot cheaper than the USA. Growth prospects are better and you don't have the same government debt worries. Commodities are well represented and will do well if growth and inflation pick up again. There are also tailwinds from friend shoring and Western countries trying to do less business with China. Room for improvement in policies. And if inflation comes down then interest rates will come down and that will support higher valuations too. Emerging market bonds also look interesting. -

How much of a factor is Biden draining the SPR? Being cynical it was a way to try to offset energy price inflation which feeds into the headline CPI figures. And without those additions to the markets prices would have probably averaged a lot higher over the last year or two.

-

Where do people see energy stocks heading in 2024? Record US oil production and OPEC struggling to keep compliance and possibility of a global slowdown seem like negatives. On the other hand valuations are still pretty reasonable compared to rest of the market, companies are using cash flows to pay down debt and reward shareholders, and longer term outlook is still good as energy transition is going to take a long time and no one is really making long term investments anymore so supply will likely be constrained in the future.

-

Tech there do seem to be two ways to lose: 1) No landing/take off: investors gain confidence and rotate into cyclical and other more economically sensitive stocks and there is upward pressure on rates 2) Hard landing: tech giants don't exist in a vacuum and are probably more cyclical than investors realise especially when you consider their underlying businesses e.g. Google/Facebook = advertising e.g. Amazon = consumer spending e.g. Tesla = autos. e.g. Nvidia = semiconductors. Soft landing suits tech because in a low growth low inflation low interest rate world the scarcity of growth makes their secular growth prospects especially valuable and reinforces their status as one-decision stocks.

-

I think that is backwards. Market was predicting lower rates way before Fed threw in the towel.

-

Fed is political and I do not think it has any real intention of bringing inflation down to 2%. Its projections (for what little they are worth) do not see inflation returning to 2% until 2026 which they are seemingly OK with given they project rate cuts next year. That would be five years that they would have missed their target. By that point inflation expectations will be anchored at a higher level and I cannot see them being willing to go through the pain necessary to go the final mile and restore credibility in their inflation target.

-

I don't think Mag7 are so bad. Microsoft, Apple, Meta, Alphabet are all around 30-35x trailing earnings. That is only about a 50% premium to the average stock which doesn't seem unreasonable for quality growth stocks. Amazon PE ratio has always been misleading because they invest so much for growth. Tesla and Nvidia have nosebleed valuations for sure. But it is dangerous to bet against stocks that seem at the forefront of the most popular market themes i.e., green revolution and AI.

-

The yield curve has been inverted for ages as well. But are these usually good indicators still relevant in an economy where: -The US government is running multi-trillion dollar deficits every year which can offset any weakness in manufacturing (which is a far less important sector than it used to be historically) -Interest rates are incredibly manipulated as a result of money printing and forward guidance and market speculation The US economy reminds me of a gym bro juiced up on steroids. On the surface it looks strong and healthy. And will probably remain so as long as it continues to be juiced by stimulus. But eventually it will either get a heart attack or there will be some policy constraints that prevent the ongoing stimulus that it is so reliant upon. It seemed for a while as if inflation would put an end to accommodative monetary policy and the market didn't like that at all. But monetary policy hasn't really been that restrictive. There is still way more money floating around than there was pre-COVID and with the regional banking crisis the Fed has actually been expanding its balance sheet and QT has been proceeding at a fairly sluggish pace. And markets have now (probably correctly) determined that "tight" policy is transitory and pricing in much lower rates which along with stock markets approaching record highs has substantially loosened financial conditions. And any contractionary effect from monetary policy has been blown out of the water by unprecedented fiscal stimulus that is still at war time/emergency levels even though COVID is a distant memory and we are supposedly at full employment. Maybe policymakers will be able to stave off recession and eventually the economy will be able to stand on its own two feet and the excessive stimulus can be withdrawn. But more likely there will be an eventual bust even if we do have a few more boom years to go.

-

What I do find very suspect is that 2 weeks ago Powell said it was premature to speculate about rate cuts and yesterday rate cuts are now on the table for discussion. Powell is supposedly data dependent. Well over the last 2 weeks ISM Services report was a clear beat, November payrolls report was a clear beat with unemployment coming in lower than expected and average hourly earnings hotter than expected. U Michigan Consumer Sentiment report smashed expectations, CPI Inflation came in hotter than expected, and today retail sales beat expectations as well. Financial conditions have loosened massively making a mockery of Fed comments that the steepening of the yield curve meant the market could do some of the tightening for them. So data is hotter. Inflation is still double target. No evidence of recession either in the unemployment data or the retail sales data. All that has really changed for the worse is Biden's approval rating.

-

Wouldn't be so sure. Usually there is a term premium of around 100bps. So with the Fed funds rate still at 5% and the 10 year bond dipping below 4% even if the market is correct and there will be six rate cuts in 2024 that isn't going to produce much of a yield curve. And the US government has a lot of debt that needs to be refinanced as well as the likelihood of another multitrillion dollar deficit.

-

Interesting that the Bank of England have gone in a different direction and admitted that inflation isn't under control and they will have to keep rates higher for longer even as the economy plunges into recession. I suspect a lot of other central banks that are less politically motivated will take the same approach. Ironically monetary and fiscal easing is going to weaken the dollar and add to inflationary pressures in the US economy.

-

I think the risk for markets is that the S&P 500 is already trading at 20x forward earnings. The long bond is already below 4%. The S&P 500 is already at levels last achieved when the Fed Funds rate was close to zero, the Fed was printing money like crazy, the US government was doling out handouts to all and sundry, and the US economy was enjoying one of the strongest economic recoveries in the post WW2 period. And to the extent interest rates go lower it will be because growth is slowing down considerably and most Wall Street forecasts are pencilling in 10%+ EPS growth for the S&P 500 in 2024 and a lot faster growth for Mag7 and the like. Also the Fed seem to make it up as they go along. While I wouldn't discount a political motivation for promising rate cuts in an election year especially with a lot of government debt requiring refinancing, they will look very stupid if inflation increases in 2024 and they try to go ahead with rate cuts.

-

Funny that the Fed Put has morphed into the Fed Call. Markets close to ATHs and Powell comes out and congratulates himself on beating inflation and says rate cuts are now on the table and don't worry guys inflation will be back on target in 2026.