mattee2264

Member-

Posts

643 -

Joined

-

Last visited

-

Days Won

7

Content Type

Profiles

Forums

Events

Everything posted by mattee2264

-

Fundamental indices can outperform over short periods but you aren't getting the long track record you get with a market cap weighted index. Also arguably a low interest rate environment favours cash cows because they are seen as bond proxies and they may not do as well in a somewhat higher interest rate environment and cash cows also generally are mature or declining business with their growth behind them. A basic FCF calculation also penalizes companies that are making growth investments through their P+L (e.g. marketing expenses, research expenses) or intentionally keeping prices low to increase market share (e.g. Amazon).

-

I mean we all know that "higher for longer" is another Fed fairy tale? Sooner rather than later mortgage rates will come back down and real estate markets will unfreeze. If workers manage to negotiate wage increases this year that will also improve affordability and in some markets at least there has been a correction in prices.

-

As I understand it when you index invest you free ride on the efforts of active managers to price stocks. So indexing will keep working so long as there are enough active managers who care about fundamentals and do a proper job. Whether it will continue to work when active managers are either losing their jobs or hugging the indices and most of the buying and selling is done by speculators (retail and hedge funds) remains to be seen. Market cap weighting has the best track record and understandably so because capitalism is based on survival of the fittest and the largest companies have withstood competitive challenges, dominated their markets, and become entrenched in the economy. Also by holding a market cap weighted index fund you are betting that over time the market capitalization of the S&P 500 will increase over time in line with the US and global economy. That is a pretty safe bet to make. You are also benefiting from efficiencies as there is little need to trade and rebalance and trading costs can eat away quickly at returns. With the benefit of hindsight there were times when you'd have done better switching into an equal weighted index or favouring EAFE over USA for example or switching into small caps. But that is a variant of market timing and as outperformance of every index comes in short bursts and likewise underperformance the costs of getting it wrong can be severe. Besides for most of the cycle a market cap weighted index will outperform. Concentration is also a common feature of a market cap weighted index. For the US economy it hasn't been too detrimental because the economy is sufficiently diverse that the top 10 stocks by market cap still offer a range of industries and sectors. Even the current concentration isn't as bad as it looks because Big Tech is involved in other industries e.g. retail/luxury goods/advertising etc. Other economies it can be a bit more toxic for example an FTSE 100 indices would mean owning a lot of financial companies and mining/energy stocks which over long periods tend to be bad investments. Another thing worth mentioning is that with index investing you do not need to be able to value every stock. Ben Graham used to write about how large growth companies are speculative because so much of their value depends on future prospects. Clearly for most of this market cycle investors underestimated these prospects and perhaps now they are starting to overestimate them. But an index investor would have participated in their dramatic outperformance and probably far more so than the majority of active managers. It also allows you to be valuation indifferent. Generally in the later stages of bull markets there aren't obvious bargains and even good investors can run out of good ideas and end up with too much cash or unwittingly end up taking on too much risk or lowering their standards etc. An index investor doesn't care as over long periods he knows that it isn't valuations that drive stock markets return (although there has been a helpful long run upward drift in valuations) but growth in earnings and dividends (and latterly the shrinking share count from buybacks). And maybe one of the reasons that index investing will never catch on to the extent it stops working is that it is hard for intelligent people to accept that all they need to do is hold an index fund through thick and thin with no need to read annual reports, study business economics, read Berkshire letters, follow the news, know any accounting etc. And for short periods of time at least it is possible to beat the market and think you are one of the few who can do so long term. And the few people who can beat the market over long periods of time get lionised and continue to inspire hope others can do the same. And another reason is that indexing does not work all the time. You have to suffer through the occasional 50% drop or occasional lost decade and you need a holding period of at least 10 years to reliably outperform bonds. And during those bear markets and lost decades it is a lot easier for active managers to beat the market and gain a reputation for doing so and attract money.

-

So apparently a factor in the slump of BTC post ETF approval is that the FX estate is having to liquidate bitcoins creating a lot of selling pressure. Should be coming to an end soon (although sometimes these things can continue to develop a momentum of their own).

-

POLL - Hard landing vs soft landing, how will 2024-2025 look like?

mattee2264 replied to Luca's topic in General Discussion

You aren't going to get a hard landing in the USA with the US government running a multi-trillion dollar deficit and the Fed likely to accommodate any supply-side inflation. Also even if AI is incredibly overhyped the short term impact will be an investment spending boom which will add further support to the economy. And to an extent I agree we have already had a landing. There was a corporate profits recession in 2022 and outside of Mag 7 there wasn't much profit growth and the Russell 2000 is still in a bear market. The real risk I think for markets is that investors might sour again on Mag7 when they realize that interest rates aren't going much lower than they already are and earnings growth will be harder to achieve this year as they've already taken advantage of cost cutting/restructuring opportunities and it will take time for AI to deliver meaningful benefits to the bottom line. -

If the AI bubble like the Internet, in what year are we now?

mattee2264 replied to james22's topic in General Discussion

Something that has occurred to me is that in the short term it does not really matter whether AI is any good or not or the extent to which it boosts productivity and over what timeframe. So long as enough people believe it is worthwhile it will still result in a massive investment boom that will be very supportive to the US economy in the same way that mostly unproductive US government spending is. And that combination of massive US fiscal deficits and massive AI investment spending at the least could offset the recessionary pressures in the global economy and may even result in an economic boom similar to the dot com bubble. Of course if AI doesn't fulfil its promise and the investment boom turns to bust or continued deficit spending proves unsustainable then it sets us up for a massive hangover. But in the short term at least the above seems very bullish and suggests we are closer to 1995 than 1999. -

Other thing I am wondering is whether with ETFs and so on the original thesis for BTC continues to stand up? IE only 29M coins and therefore perfectly inelastic supply so price will increase with growing demand and use. But if no one is trading coins but is instead trading ETFs and fractional trading of bitcoin is possible does that start to fall apart?

-

US grew the exact same amount Q3 (before revisions). I think economic data is pretty suspect and subject to a lot of political motivation in both countries. As a famous politician once said "It's the economy stupid".

-

Read an article in the FT suggesting that the Fed will soon start QE. https://www.ft.com/content/d4012025-28d5-40bd-b525-9594dc970569 Argument is that just as draining of reserves forced a pivot in 2019 this time it is the exhaustion of the overnight reverse repo facility (ON RRP) with Dallas Fed President Lorie Logan is already suggesting QT should taper once the ON RRP runs dry. Apparently the ON RRP is connected to a hedge fund basis trade and there are also worries about all the bonds the US Treasury will be issuing this year. Reminds me of Japan. QE seems to be like heroin. Once you start, you can never seem to get off it. Very bullish for stocks though.

-

Agree you also have to consider what was required to do to earn the wealth. A lot of wealthy people are crooks. They may have obscene amounts of material wealth but morally and spiritually they are bankrupt. People who get wealthy the honest and hard way such as partners or law firms and other big professional service firms had to sacrifice family life, hobbies, social life, health to work the punishing hours required and be at the beck and call of clients and a lot of them hate the work. And part of the reason they became so wealthy is they never had any time to spend their money and were lucky enough to avoid the expensive divorce or sugar babies. And even people who love their jobs can unwittingly become workaholics and lose the balance in life and the second they retire they drop dead because they have little else to live for. Warren has the right idea. It is about finding work you enjoy and if you do that you will naturally work hard at it and eventually keep working not because you have to but because you want to. But it is also about having people who love you and strong connections and a sense of purpose. There is a great book "The Second Mountain" by David Brooks which covers these kind of ideas and gives a playbook for the 2nd phase of your life for after you are done chasing career success and material wealth and want to find a real sense of joy in later life.

-

Reminds me a bit of the FIRE community. They work hard, save about half their income, so they can retire at 40. But it requires huge sacrifices both during the accumulation phase but also during the "retirement" phase because the only way you can retire early with $1m is if you are prepared to live of $30,000 a year. That doesn't go far and requires you to live in the middle of nowhere, never eat out, have campervan holidays, home school your kids and basically live like a pioneer. And probably at the back of your mind you are still worried that the historical returns do not hold up and you risk running out of money. It is a romantic lifestyle that appeals to some but I do not think you'd classify these guys as wealthy by any means. Then there is super-wealthy which entails yachts, gold diggers, private jets, a household of chefs, butlers, nannies and the like and other ways to burn through millions a year. But it is somewhat above your average middle class retiree so you can eat regularly at fancy restaurants, live in a big house in a nice area, go on luxury holidays staying in five star hotels, perhaps have a holiday home where you can spend the winters, and enjoy things like weekly massages and spa visits without batting an eye. Then your is your average baby-boomer retiree who through being frugal and working hard and investing sensibly has amassed a nest egg of a few million, has a home worth probably a similar amount and a defined benefit retirement plan throwing off an annual income some high percentage of their final salary. Kids have flown the nest. So if they wanted to they can eat out whenever they want at fancy restaurants, spend the winters in the Caribbean and the summers in Europe, fly business class, stay in 5 star hotels, have a weekly massage and belong to a country club, and basically never have to worry about money or sacrifice in any way. That is probably what I would think of as wealth. Then again the irony of wealth is that the people who are wealthy do not usually have the lifestyle you expect because the habits that made them wealthy are difficult to break so instead they just leave behind a huge inheritance.

-

POLL- S&P 500 2024 Return Estimates by the board

mattee2264 replied to Luca's topic in General Discussion

I think Howard Marks said something along the lines at "At Oaktree we are allowed to have macro opinions we just don't trade on them" -

The white knighting is painful to watch. The internet age equivalent of "my pen is my sword"

-

POLL- S&P 500 2024 Return Estimates by the board

mattee2264 replied to Luca's topic in General Discussion

I think it is all about Mag7 and the rest. NO-LANDING: Mag 7 will do badly and the rest will do well (except for interest rate sensitive sectors e.g. financials). S&P 500 will probably go sideways. SOFT-LANDING: everything will do well with Mag7 probably leading the pack. S&P 500 might go up 10-20% or something. HARD-LANDING: everything will do badly with Mag7 outperforming as its earnings are more resilient than more cyclical sectors and lower interest rates are very bullish for long duration stocks. And so long as AI hype continues investors will probably look through any cyclical weakness in Mag7 earnings. S&P 500 might go down 10-20% or something. Possibly more if something majorly breaks. But I think that the Fed put will limit the damage. What I have observed is that since COVID investors have been treating Mag7 as a safe haven. And because growth has been scarce and Mag7 are the only companies growing their earnings it is understandable investors are willing to pay a big premium for their earnings. The wild card is AI. If it becomes clear that a wave of lawsuits and regulation are going to stall progress then that could dampen enthusiasm for Mag7. Tech earnings expectations are pretty ambitious with AI presumably expected to contribute and if it does then we could be in for a mid 90s melt up and an even more two tiered market. -

There are a few guys out there usually keen on commodities who are talking up the idea inflation isn't dead. Clearly there is a lot of noise in the inflation data and the measures of inflation are imperfect. But I still feel the short term trend for inflation continues to be lower. Firstly, companies/landlords took the piss with price increases during the COVID period taking advantage of the extra spending power consumers had with all the COVID handouts and their excess savings and the strong economy and using the supply chain issues and material cost inflation as an excuse. Those price increases are unlikely to stick. And a focus on the rate of change ignores that compared to pre-COVID prices are up at least 20% and double that in many instances and that is going to result in a lot of price resistance and pressure for price cuts. We already saw Black Friday a ridiculous amount of discounting across the board even in sectors that have absolutely nothing to do with retail. Secondly, while rate increases are pretty weak, they do have a lagged impact so their full impact hasn't been felt which should exert some modest downward pressure on inflation this year. And even in a soft landing it implies weak economic growth. Medium term though inflation will rebound because emergency fiscal spending seems to be entrenched and once the economy recovers that is going to add far too much fuel to the fire and the Fed is bound to sacrifice inflation for financial stability and slash rates too far and commodity prices will rebound once the global economy (especially China) starts to recover.

-

I think you want blue chips stocks with legs that have survived a few cycles but do not look as though they are heading towards the decline phase of the industry life cycle. MICROSOFT seem the safest tech bet. They've navigated multiple technological transitions and they are trusted in enterprise software where companies prize reliability and familiarity. Interestingly of the top 10 companies during the dot com bubble Microsoft was the only one to replicate its former glories. History would suggest very few of the Mag 7 will be magnificent 30 years from now but Microsoft might be the exception. NIKE has always been the coolest sports brand and has seen off various competitors and the Nike swoosh is iconic. And with their money they can sponsor the best athletes and sports teams and run advertising campaigns and so on. EXXON is a blue chip oil company and should navigate the energy transition as well a anyone and return enough in dividends that you will do well even if fossil fuels eventually do get replaced. And you want some commodity exposure to balance the portfolio. Berkshire I think will fail to do as well over the next 30 years. A lot of managers in their subsidiaries work hard even though they have enough money to retire because they love working for Warren and Charlie. Capital allocation is also something Warren and Charlie did superbly. Their successors are probably good as they've been handpicked. But the successors of the successors might not be as good. And a lot of their businesses are commodity businesses so dependent on good management and capital allocation to do well. Not the kind of businesses any fool could run.

-

"The good news, however, is that in only 24 hours, Neri’s lawyers use the Wayback Machine to check MIT's plagiarism policy back when Neri wrote her thesis in 2009. It turns out that MIT's Academic Integrity Handbook did not require citations or even mention Wikipedia until 2013, four years after Neri wrote her dissertation and used Wikipedia for the definitions of 15 words and/or terms. Bear in mind that 2009 was still the early days for Wikipedia" The above is laughable. Even if copying from Wikipedia was not covered in MIT's plagiarism policy at the time it clearly goes against the spirit of the plagiarism policy and even a high school teacher would be pissed if a student copy pasted segments of his homework from Wikipedia. And this is a PhD thesis at MIT. At best you can say it is sloppiness and laziness on her part. Deserving of a retrospective slap on the wrist but clearly nothing on the scale of what Gay has been accused of.

-

Reminds me of the UK aristocracy. They have huge estates handed down the generations. But with all the upkeep not to mention death taxes they have to keep selling Old Masters just to keep the lights on and eventually hand over the keys to the National Trust. With some exceptions they certainly aren't living the high life as a result of having far too much house. My mum lives in a rich neighbourhood. Rich people buy million dollar houses. Then spend another million knocking them down and rebuilding them and making endless extensions and improvements. So the house is always full of workmen and covered in scaffolding and I do not know how much actual utility they get from it. I suppose it is "an Englishman's house is his castle" and everyone wants the biggest and fanciest castle. But it is an expensive ego trip. Something I also see is people move out to the suburbs/commuter towns for more "house". Then end up spending lots of time commuting and they miss all the entertainment and culture of a big city. And to go anywhere or do anything even if it is only grocery shopping you need to get in your car. Another thing is the "holiday house". It is a status symbol. But locks you into going to the same place every year. And then you have the hassle of renting it out when you aren't there and staying on top of maintenance and so on. And while many see it as a potential retirement home who knows the state of your health when you retire or the kind of lifestyle you want. We are very bad at predicting what our future self wants.

-

So China is a bit of a basket case and outside some of the tech companies is considered un-investable by most investors. Question is what impact will Chinese economic malaise have on the ROW and specific stock sectors? The failure of China's reopening has clearly depressed commodity prices as China drove the super cycle. Possibly some benefits for other exporters that can pick up some of the slack. But maybe some contagion to neighbouring countries such as Japan? Probably not great for Apple and Tesla which unlike the other Mag7 countries have a heavy exposure to China. Definitely not good for luxury goods companies (which we are already seeing in results of Burberry/LVMH) Any other thoughts?

-

I don't think the Fed really care about the last mile. Financial stability and getting Biden re-elected (so Powell keeps his job) are more important priorities. Although I do expect them to start QE again before they start cutting rates. Also the Fed have already covered themselves by saying that the path to 2% will be "lumpy and bumpy" so they will continue to focus on the past trend of disinflation and will only consider raising rates when the cat is out of the bag again. But I agree that 2024 is likely to see higher inflation. The economy is resilient and consumers keep spending and the fiscal impulse continues to add fuel to the fire and the Democrats will do everything they can to pump up the economy pre-election. Everyone is hoping for a big wage increase in 2024 and while there are some layoffs especially in technology they aren't on a sufficient scale that workers feel happy just to keep their job and accept whatever crappy pay increase they receive. All the conflict in the world is going to cause supply chain issues. Shipping costs already are rocketing. And if China shows any signs of recovering then commodity prices will take off. As I said Big Tech and long bonds are probably not where you want to be. Commodities, cyclicals and value and small stocks might do very well especially if you believe there will be no-landing or a take-off.

-

What I find extraordinary is that people hyper focus on the Fed's every move and uttering and completely ignore the influence of fiscal stimulus of $500bn a quarter and the expansion of government jobs which is fully offsetting the impact of any private sector weakness and job cuts. A recession requires an output gap and that isn't going to happen when you have such a massive fiscal plug. And if the private sector were to recover and the ROW (especially China) see an economic recovery then that is going to result in a lot of inflationary pressures which will result in another inflation shock. Especially as all the conflicts in the world are going to cause supply chain issues. And of course everyone is positioned in long duration assets such as Big Tech, long bonds etc. anticipating continued disinflation and rate cuts.

-

IF the ETF approved, will you make Bitcoin a NEW position?

mattee2264 replied to james22's topic in General Discussion

There is a funny twitter post summarizing the bull case: Millennials holding 50% of their net worth in bitcoin = $2,500 Boomers holding 5% of their net worth in bitcoin = $250,000 -

IF the ETF approved, will you make Bitcoin a NEW position?

mattee2264 replied to james22's topic in General Discussion

1st level thinking is there is a massive and self-serving incentive now for financial institutions to promote the idea that every portfolio needs a 5-10% allocation to bitcoin and that will create a huge amount of demand for the ETF. Not to mention that individual investors can now speculate in bitcoin in their retirement accounts. And if the ETF can get a bit of momentum out of the gates it will be very easy to draw in more and more money. And precisely because it is impossible to value then there is nothing fundamental such as earnings etc to tether its valuation. So it is difficult not to imagine this ETF doing very well. -

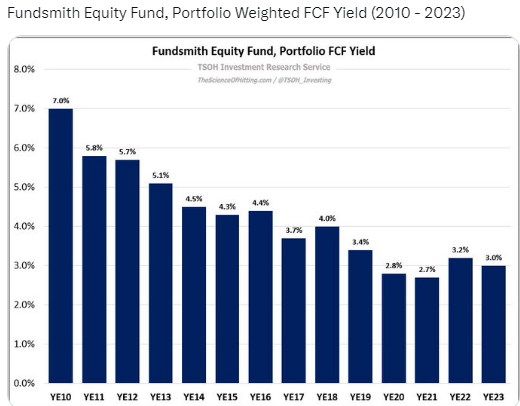

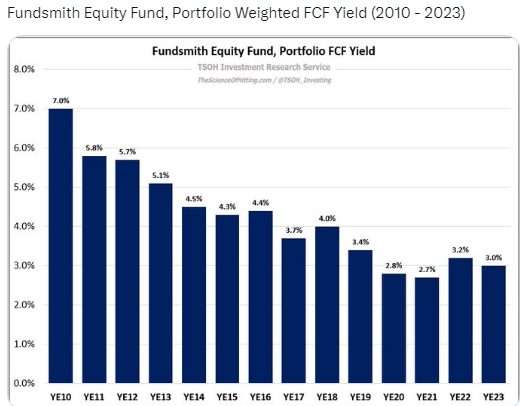

Fourteenth annual letter to owners of Fundsmith Equity Fund

mattee2264 replied to formthirteen's topic in General Discussion

Above from TSOH Investment Research partially answers your question about valuation metrics. Although to a large extent the drift lower in FCF yields probably reflects multiple expansion in their initial investments and their buy and hold approach. It is a very popular fund so I do wonder how they deal with the issue that most funds face of the most new money coming in when market valuations generally are elevated and money tending to exit at the very time that valuations are becoming attractive again. -

Think there is a difference. With the search engines companies can gate any content they do not want freely available for search. With YouTube the content creators upload their content in the same way they do on social media sites. This seems a bit more analogous to Napster. And as GIGO applies then it only seems fair that producers of high quality informational content (OK maybe that is stretching it for journalism but at least they fact check and have highly informed sources) should consent to their content being used as training data and compensated accordingly.