-

Posts

2,598 -

Joined

-

Last visited

Content Type

Profiles

Forums

Events

Posts posted by Dalal.Holdings

-

-

Speaking of the 1970s, Joe Biden more and more looking like Jimmy Carter 2.0

-

Looks more and more like the ‘70s to me

And sorry, FAANMG more and more

like Nifty 50

-

36 minutes ago, stahleyp said:

This should be a bipartisan issue. Unfit to serve if you aren't willing to hold yourself to the same standard as the public.

The problem is the rulemakers have to create rules for themselves...

-

80 something year old Pelosi wants to get all she can with her time left in this world

Meanwhile we’ll imprison IB interns who trade on material nonpublic info…

-

22 hours ago, Spekulatius said:

Bought a starter on LEVI again. Maybe not the cheapest consumer stock, but one of the most durable brands. I also like management. They have done an excellent job to during the epidemic etc.

I like the returns on capital, I don't like SBC being ~10% of FCF and repurchasing of shares "to offset dilution".

-

18 hours ago, crs223 said:

I would like to know what pct of iPhone sales are to people who already have a “completely functional” iPhone already.

If that number is high, than i can see a hit. But iPhones are going to be the last thing people give up.

If you don’t have enough money to pay the bills, do you go without iPhone or Cellular service? I don't think so, not nowadays. My guess: people will stop paying rent (change their living situation) or give up their cars before they go sans-iphone. At least for people under 35.

Obviously some iPhones will be purchased by those who drop it in the pool or lose it. Kids getting their first cell phones too. The question is all the "discretionary" iPhone purchases...upgrading because "the camera has more pixels", etc.

If you have a 13 or 12, is upgrading to the new 14 as compelling as it used to be? If you need a new phone, can you get away buying a cheaper 13?

Furthermore, my point (which I've made in the META thread about Oculus/etc) was that the technology sector might learn a hard lesson here: that technology is often a discretionary purchase and that if you are worried about being able to afford food or heat your home, it's going to be cut back.

That includes all the advertising for discretionary purchases that GOOG and META provide (boner pills or crypto wallets) as well.

-

2 hours ago, mattee2264 said:

Earnings season could be pretty brutal. Nike already warning on a hit to margins as a result of a strong dollar and excess inventories. That follows on from Fed Ex earlier this month. It will be a death by cuts as each blue chip (and smaller peers) are taken out and shot as markets realize estimates were overly rosy. And of course if there are enough negative earnings surprises or disappointing guidance then investors will want to get out before results and that will accelerate the pace of declines.

We ended 2021 with SPY earnings estimates of around $230 for 2022 and $250 for 2023 and bond yields of 1.5%. Peak SPY was around 4800 so that was about a 20x multiple on 2023 earnings.

We will probably close the year with bond yields of 4.5% and 2023 SPY earnings estimates will probably fall below $200.

We are at 3600 at the moment so that is around a 15x multiple on 2023 earnings (as originally estimated) which seems appropriate given the change in bond yields. But if 2023 earnings fall below $200 and there is no immediate prospect of recovery (seems likely given there will be a hit to margins as well as to demand) difficult not to see the SPY falling below 3000.

Depends on whose E you are talking about. Large global source of revenue in the face of strong dollar? Sorry to those who thought AAPL was the impervious FAANG stock...

I also have a hard time envisioning iPhone upgrades in the near future for Europeans who are worried about their utility bills.

S&P might go down due to its overweighting in tech stocks, but who is here to buy the S&P? My view is don't buy the blue chips and be heavily underweight in tech given the plethora of other opportunities available.

Perhaps once you stop hearing from everybody "how screamingly cheap" Google and Meta are is when that might change...

-

6 minutes ago, Spekulatius said:

One thing that is increasing clear is that the Russia Ukraine war is a nothingburger for the crude oil market. It does have an obvious impact for the NG market , even worldwide, because now the russian gas that went to Europe is stranded. So this is a shortfall that is going to last for a while and pushing prices world wide higher.

People are going to be looking for NG and the most likely source is going to be shale gas. The US is not the only country with large shale gas resources - Argentina and Europe and many other places most likely have reserves that hadn't been explored yet.

The UK already rescinded their ban on fracking and I think countries like Poland are likely to follow. Discussions in Germany have started as well. In Europe, I think it's almost inevitable that shale goes comes into play. The Ukraine has huge NG reserves too, so once this war is over, that's another source that could come into play.

That’s my current working hypothesis:That if we are living in some form of the 1970s, NG today rhymes with Oil in the ‘70s. Back then you had Arab countries with embargo of oil and now you have Russia doing embargo of NG …

We’ll see how it plays out but it’s inflationary esp for Europeans. Developing the infrastructure for shale will not happen overnight. USA had lots of preexisting infrastructure and waterways (and low rates) to make shale a reality.

-

Russia looking to cut off the final gas flows with its announcements of “annexation”.

-

1 hour ago, james22 said:

Ok, the Nord pipeline incidents.

Sigh. I shouldn’t do this, but …

I call them “incidents” for a reason. I grew up in overseas oilfields. I try to, by training, observe everything from as objectively neutral a viewpoint as possible.

In my experience when anything involving energy-industry hydrocarbons explodes … well, sabotage isn’t the first thing that comes to mind. And honestly, when it comes to a pipeline running natural gas under Russian (non)maintenance, an explosion means that it’s Tuesday. Or Friday. Or another day of the week ending in “y”.

...

Am I saying that there is no way that these incidents could possibly be the result of deliberate direct action? No. That area is too full of idiots — HOWEVER:

It’s hundreds of millions of cubic metres of extremely flammable — nay, explosive — gaseous hydrocarbons being transported by Russians, and subject to Russian maintenance. And I’m here to tell you — Russian maintenance under the current oligarchy system isn’t any better than it was under the Soviet system.

It blew up. Until I see evidence of bad actions, I’m going to shrug and say, “Damn. Must have been a day ending in “y”.

Seeing lots of conspiracy theories that USA behind these or this is not Russia.Always pleases me that there are many people in this world not equipped with the most basic of analytical tools (Occam’s Razor). Shrug.

-

5 hours ago, LearningMachine said:

Given OPEC+ controls 74% of oil exports, what do folks think are risks to OPEC+'s ability to control supply/demand dynamics and oil prices?

- Canada currently exports 7.3% of world oil exports. If Canadian production goes up by 300 basis points, could OPEC+ easily absorb cutting its supply if needed?

- Any risk of U.S. producing much more?

- If another country starts producing much more, could OPEC+ still absorb the cut?

- Any risk of an OPEC+ member wanting lower oil price than $90 like Saudis did earlier this decade?

- Any other risks?

The capital markets today are markedly different from when folks were handing out capitall to wildcatters, oil sanders, etc to drill baby drill...

Not only do you have ESG and liberal heads of state in these nations putting a ding in capital available for fossil fuel generation in Western nations, you have shareholders demanding return of capital over reserve growth. And then you have surging interest rates and high yield paper these firms would have to issue to drill making leverage untenable...

I think there is a strong bias in West to not drill and develop fossil fuels & related infrastructure and I think that may lead to an environment that keeps prices higher for longer (esp nat gas).

The wild card is demand from China which seems like it will not be in the same league as prior decades; however I think that the world's thirst for this stuff is still strong.

-

9 minutes ago, Viking said:

My portfolio is up nicely this year. It is pretty much all due to two large energy trades. Yesterday i was happy to load up again. The volatility is crazy (driven by sentiment). It is such a bizarre set up (who in their right mind wants to own energy stocks when the global economy is rolling over). It is also pretty clear to me that oil stocks are uninvestable for the majority of investors in the Western world. Where energy investments get really interesting is when companies start hitting their net debt targets.

As an example, CVE might hit their net debt target at year end. That is 13 weeks away. The important part is they are very close. Once they have hit their net debt target they will start returning 100% of their free cash flow to investors: regular dividend, stock buybacks and special dividends. At US$80 oil the returns to investors will be significant. Their stock price is at C$20. When they start buying back shares in volume the stock price will increase meaningfully. This will be a company with next to no debt (so minimal interest cost). No exploration risk. Profitable at US$45 oil. In other words, a $20 bill laying on the ground for those willing to pick it up.

The fact that many investors are hamstrung by their own doing ("ESG") making energy "un-investable" (for them) is a benefit for anyone who does not have such restrictions. It's easy to bash fossil fuels when they are abundant. Not when they are scarce and the winter is cold.

"When the Well's Dry, we know the worth of Water" --Ben Franklin

I think many are drawing parallels to recent downturns like '08 and March 2020 when energy dived with everything else. I think that today we face a far different beast...perhaps not unlike the one in the 1970's...

My own favorite here is $AR Antero Resources which is virtually unhedged to nat gas prices in 2023 and has retired debt maturities thru 2026 with immediate plans to return capital to shareholders...nat gas however has not been friendly to investors for a long time so be wary...

-

This is a pretty significant escalation and sign that Russia has no intention of resuming gas flows to EU any time soon...

QuoteGermany suspects the Nord Stream gas pipeline system was damaged by an act of sabotage, in what would amount to a major escalation in the standoff between Russia and Europe.

According to a German security official, the evidence points to a violent act rather than a technical issue. Swedish seismologists detected two explosions in the area on Monday, when leaks appeared almost simultaneously in the Baltic Sea.

It’s the clearest signal yet that Europe will have to survive this winter without any significant Russian gas flows, and potentially marks a major escalation in the broader conflict between Moscow and Ukraine’s allies.

-

There are long stretches (decades plus) where energy dominates. Remember, XOM was among the largest market cap stocks for decade plus...

I think the past decade or so makes energy seem un-investable for the long haul. It's often periods like that (underinvestment in new exploration, downfall of many players, etc) which are followed by long periods of outperformance.

We shall see.

-

1 hour ago, CorpRaider said:

Would be interesting. Instead of everyone buying Japanese cars like the 70's everyone would switch their 90's+ huge off road vehicles to hybrids and EVs. I've been thinking 70's for a while with the rise/return of populism and the wall/labor trade constraints all of that pre-regan/pre-clinton stuff coming back bigly. Took a long time to maybe play out.

That's the thing. I think this time it's Nat Gas and not Oil that becomes the bigger issue as opposed to the '70s when it was Oil due to Arab Embargo. Now we have a Russian embargo of nat gas which is a big deal (not so much oil).

Oil is still available from major producers (Opec and USA) and readily transferrable over wide geographical distances compared to NG which takes a lot more effort to liquefy, transport at -160C on specialized ships, and then regasification on import. Then you need the pipes to get it to end users...

-

There are several parallels to the 1970s occurring today that I think are driving inflationary winds:

-- Geopolitical conflict leading to energy supply shock (Arab Oil Embargo then, Russia-Ukraine now)

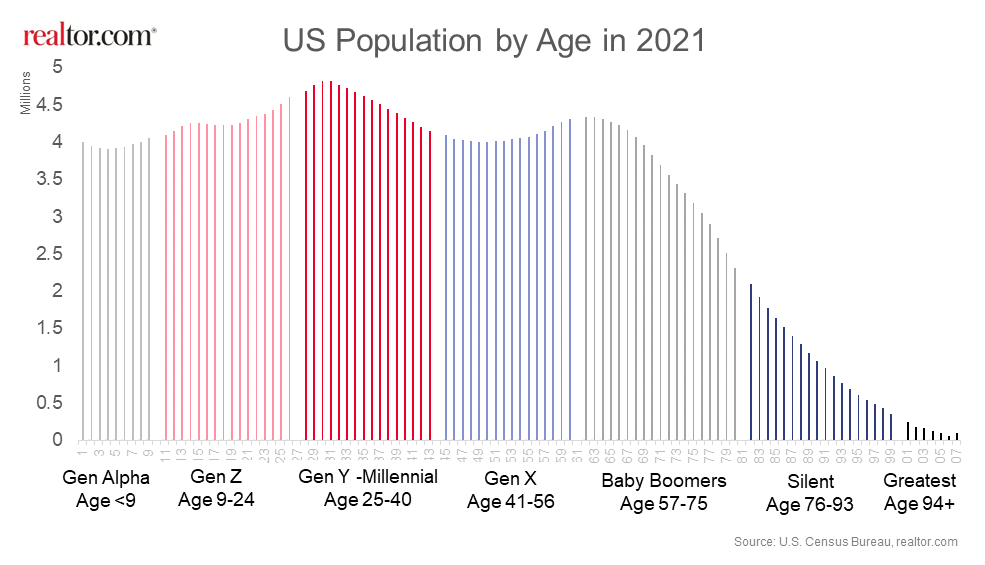

-- Large bulge population entering home buying/child rearing age (Baby Boomers then, Millennials now)

-- Devaluation of Currencies (Nixon Gold Shock then, Covid Fiscal Stimmies/negative sovereign yields now)

I'm not ruling out the possibility that we are living through some form of the 1970s.

I think the Fed will be more aggressive now due to lessons learned that decade (no one wants to be Arthur Burns), but I wonder if the above 3 things continue to pressure prices how the Fed can mitigate inflation barring demand destruction.

-

On 9/23/2022 at 12:02 PM, Spekulatius said:

I am tempted to dumpster dive into some SU if this continues. Problem is that superspikes in energy like we had this year are followed by a recession EVERY SINGLE TIME.

We also know what recessions do to oil and energy prices.

The 1970's beg to differ.

I think inflation is the wildcard here and makes comparisons to more recent downturns (like '08) less relevant. Hard to see how consumers cut back on NG consumption.

Heating and electricity use seem highly inelastic to me.

-

Add U.S. Rail Strikes as another potential positive for Nat Gas...

U.S. Storage levels are ~10% below 5 yr avg. While EU storage is slightly above their avg, not having gas flowing from Russian pipes this winter will lead to decline in storage and possible shortage.

Russia also escalating on Ukraine conflict today.

Nat gas is only not hard to produce in the USA. Seems like it's not so easy to produce in Europe and Asia (outside Russia) and yet Europe/Asia relies on it pretty significantly.

Fat tails all around.

-

18 minutes ago, changegonnacome said:

For sure - non-farm payrolls though are MoM and relatively contemporaneous…this is the data I watch most closely to see ‘where we are’…..its a good indicator of labors leverage/bargaining power to secure pay increases….it speaks to both the labor shortage AND aggregate demand. This will be the first data to turn IMO….IF….inflation is being brought under control via a reduction in aggregate demand.

But unemployment figures yes will be lagging…….but getting inflation under control does fundamentally require unemployment to tick up and reach at LEAST the non-accelerating inflation rate of unemployment (NAIRU)…..and the sad reality is most inflationary cycles require a period of time where the economy sits for a time below its equilibrium output levels….i.e slack is re-introduced….and this allows for a period of re-anchoring expectations. In practice what it means is that employees are happy to HAVE a job versus demanding wage bumps at every performance review and threatening to leave.

My other contemporaneous anecdotal indicator is from Howard Hughes corporation which just tried to open a food hall near me here in NYC down near the Seaport - Tin Building by Jean-Georges……they’ve been desperately trying to recruit staff for this expensive piece of infrastructure since March/April 2022…….and have failed to get a full complement…..the Tin Building opens Thursday to Sunday only (11am - 7pm). Trust me the business plan for this thing didnt have it operating a measly 40hr a week……they literally cant hire the people…..cause aggregate demand is exceeding aggregate supply in the economy…..when the Tin Building opens up 7-days a week I’ll know the Fed has started to get a handle on things.

Just because a piece of data is reported MoM does not make it a coincident or leading indicator...

QuoteThis will be the first data to turn IMO….IF….inflation is being brought under control via a reduction in aggregate demand.

Please feel free to defend this statement with evidence that NFP is the "first data to turn" in economic cycles/inflationary times. I remain unconvinced.

As to the Tin Building, sounds like anecdata to me...

-

$BABA is a lesson in that which many folks continue to refuse to learn...

We are moving into a new geopolitical regime vastly different than that of the past few decades (post Soviet dissolution). I think a lot of folks will be surprised by how much of an impact it has on their investments.

-

On 9/17/2022 at 8:10 AM, changegonnacome said:

The fact the labor market hasnt really been hit yet is not good news and shows how we are no where near the end of this rate hiking cycle.......unfortunately we are still at the beginning....which is a function of what I've been saying for a few months now......the Fed, even now, remains accommodative when you inflation adjust to get real interest rates. There is STILL a major labor shortage. Aggregate demand CONTINUES to exceed aggregate supply in the United States.

This is not even close to being over yet.

I'd be careful using the labor market as an indicator of where we are. Employment is a well known LAGGING indicator.

-

Quote

Russian oil major Rosneft PJSC said this week’s seizure of its German unit was illegal and that it will consider all measures to protect ownership of the assets.

Germany’s government took control of Rosneft’s assets, including three oil refineries, as Berlin moved to take sweeping control of its energy industry to secure supplies and sever decades of deep dependence on Moscow.

An obvious escalation in this energy conflict between EU and Russia. Who knows where it ends.

If there is any geopolitical lesson of the past few decades, it's that economic sanctions & wars are fat tailed and tend to go on a lot longer than most folks expect...

-

I'm not sure if I see a blowup or just endless Euro printing to "cap" energy prices.

Meanwhile they'll find ways to tax "windfalls" of energy companies. Europe is a bad place for business owners (most especially energy sector) in many ways.

None of these moves really matter if you invest in U.S. energy as Europeans will have to pay up (in U.S. Dollars) to import their energy--they'll be forced to do it--even with devalued Euros and Pounds.

Europeans have underinvested in their energy and defense for a long time (outsourcing former to Russia and latter to USA) and unfortunately will bear some consequences now. I think this is one area where Trump gets credit.

-

I agree that European prices are too high to be sustained in the long term; however I also think <$4 per mcf henry hub price of the last decade was way too low, so I'm betting more on U.S. nat gas producers than anything ($AR, for instance).

The issue is that pipeline gas (Nord Stream) will always be cheaper than LNG which requires extremely expensive infrastructure and processes (cooling something to negative 160 celsius and storing it there and transporting it across the world will never be cheap like a pipeline). Not to mention if LNG supply is low relative to demand (due to lack of adequate LNG export terminals around the world), it will further increase the price.

The other issue is that nat gas is no longer mainly used for heating, but also widely used for power generation year round thanks to the conversion of coal plants. So I think the long term picture for nat gas is highly supportive and it is unlikely we see the U.S. nat gas prices of the last decade (barring deep recession/depression).

Energy Sector

in General Discussion

Posted

I think a Reagan (Likely DeSantis) will follow this one term Jimmy