-

Posts

6,774 -

Joined

-

Days Won

3

Content Type

Profiles

Forums

Events

Everything posted by rkbabang

-

Do you think Bitcoin is a safe store of value?

rkbabang replied to mikazo's topic in General Discussion

I purchased some bitcoin for the first time last week. I bought 2 BTC at about $185 each. Speculation, of course. I'm just going to sit on them and see what happens. Maybe buy a few more if the price drops significantly from here. I used coinbase.com. My theory is that in 25 years 1 bitcoin is going to either be worth the equivalent of $1M 2015 USD with people using nanobitcoins for most transactions (people will get paid in bitcoin, buy everything in bitcoin, oil and stocks will be traded in BTC, etc)... Or it is going to be worth $0 and be long forgotten. It is either going to catch on in a huge way or die out completely. I don't see any other mid-way scenario being possible. -

Your credit union is unlikely to offer a competitive rewards program. I also do my banking at a small credit union and its cards are not worth having. True, I looked at the perks and they're not really peaks. Another question, say I bank with a credit union and decide to get a Citi CC. Do I have to open a bank account with Citi? How would I go about paying my balance every month? Thanks. You really are new at this. You certainly do not need to open an account with them. You get a bill every month. You'll have the option of having it delivered by paper mail, or email, and if your bank supports it, it can even be delivered electronically right to your banks bill pay system. Once you get your bill, in whatever form, you either write them a check and mail it in (do people still do this? I don't know, I'm sure some people still write checks.), or what most people do is pay with your credit unions online bill payment. The Fidelity cards require a Fidelity account to get your rewards in cash, but all of the other cards mentioned here allow you to either apply it to your credit card account or they will mail you a check when your rewards balance reaches a certain level ($50 or $100).

-

Your credit union is unlikely to offer a competitive rewards program. I also do my banking at a small credit union and its cards are not worth having.

-

If you use Fidelity a good two card solution with no annual fees would be to get both the Fidelity AmEx with 2% unlimited cash back on everything, and the Fidelity Visa which is 1.5% cash back on everything (for those places that don't except AmEx). The Visa is actually 1.5% for the first $15K spent every year and 2% back there after, but if you use your AmEx whenever you can you would be unlikely to reach the $15K limit, unless you spend a lot at places that do not accept AmEx. This is an especially good setup if you use Fidelity as your broker, as they will just automatically deposit the cash back into your Fidelity account. How have you lived the last 25 years without a credit card, that is unimaginable to me. I have a few cards and besides a few things I can't put on them (my mortgage, electric bill, and car insurance) I have just those bills to pay every month and I get a 2% discount on everything I buy. You can always try out a card for a few months and cancel it if you are not happy. I've applied for cards in the past just to make one big ticket purchase, pay it off, then cancel the card. I did this for example to put a $10K purchase on a card that had 0% interest for 18 months, so I could pay it off over time without interest. Payed it off then canceled the card. If you are smart and responsible you can really use these things to your advantage.

-

I don't have that problem. I've owned foreign companies which I could trade in the US, either ADR or pinksheets, but I've never made a trade on a foreign exchange.

-

I wish I could say that I have some magic formula (because that would mean that those over-sized returns are going to continue), but they are mostly from a handful of really good ideas that I had which all happened to work out. So I guess a some good ideas and a good dose of luck too. I was shadowing Biglari for a while. I put a large amount into Friendly's and made out great when it got taken private. I invested a huge amount into SNS around its low point. I owned WEST for years as well. I also made out well with the MIDD / OVEN buy-out. The market was pricing OVEN as if the deal was going to fall apart and I was confident that it wouldn't. It went through as agreed upon and I made out very well. I posted that idea to the old MSN board and I know a few people thanked me for it. That happened during the financial crises and I also happened to have a large Fairfax position at the time, so I didn't do too badly at a time when everyone else was losing their shirts. Then the last few years it was my large leveraged BAC position that made 2013 a huge year. I tend to stay 100% invested, using BRK and FFH as a place to park my money when I have no other ideas. Unfortunately after BAC plays itself out fully, I have no idea what is next. I'll just put it in BRK, FFH, and maybe PRDGF until the next big idea comes along. I've been extremely lucky that everything I've gone big into has worked out so far <knocking on wood>. I've had a lot of smaller positions that haven't over the years.

-

Nicely done. Do you find Fido to be accurate in computing the returns? I think it is fairly accurate. I figured it out myself a few years ago and got reasonably close to the Fidelity number. I take out money rarely, if ever, and only add a few times per year. My accounts are all for separate things (IRA, taxable brokerage, ROTH IRA, my wife's ROTH IRA, the kids UTMA accounts, etc, so I never move money back and forth between them, just deposit money from the outside into the appropriate account. I think the calculation is pretty straight forward.

-

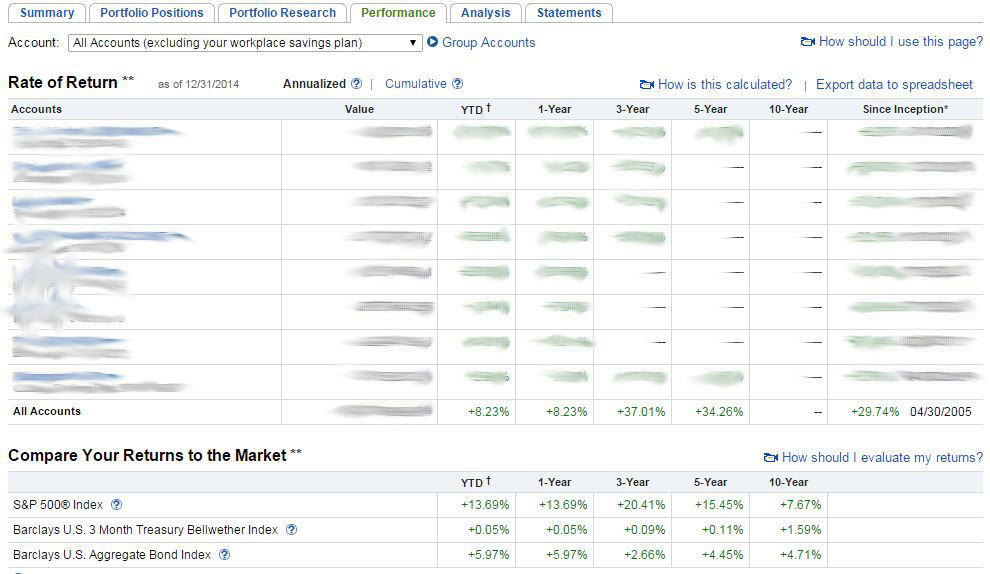

HumbleBrag! 35% compounded over 5 years is quite nice! Yes I am very happy with my 5 and 10 year performance (actually about 9 3/4 years), but I was talking about the sub-par 2014 return.

-

Fidelity finally updated the performance page with the Dec 31, 2014 numbers. I posted this last year when I had an exceptional year, so I'll post it again this year when I under-performed the market by quite a bit.

-

Exactly, when I'm 90 and I look back on my returns, I'll know whether or not I beat the market.

-

I would have convinced my parents to mortgage their house and put everything they had into Microsoft in the mid to late 80's, then to move my future inheritance over to Apple in 2002.

-

It is never too early to start. We had our son reading, writing, and doing addition and subtraction before kindergarten. My wife was a stay at home mom and my son just picked up everything she taught him. It depends on the child though, because we weren't able to do the same thing with my daughter, she even struggled in school until about middle school when she started catching up to the other kids. I think whether you send you children to school or not, how they do will largely depend on them. While my children have gone to school since kindergarten they have a few home-schooled friends who seem to be well spoken and just as bright as any other kids. We didn't home school only because of the social aspect. I still sometimes think it was a mistake not to home school my son, who could have learned at a much quicker pace than he is in school.

-

What are your average yearly household living expenses?

rkbabang replied to Liberty's topic in General Discussion

I was just in Manhattan Christmas week and this new residential tower at 432 Park Ave dominates the skyline, it wasn't there last time I was in the city. You look at NYC now and three buildings stand out above the rest: 1 World Trade Center off to one side, The Empire State Building in the middle, and 432 Park Avenue on the other side. Inside New York’s $95 Million Penthouse: 432 Park Avenue EDIT: I forgot to mention that 3 additional residential towers all also with roofs higher than the Empire State Building are already under construction and will be finished in the next few years. 225 West 57th Street, 111 West 57th Street, and 125 Greenwich Street. There are a lot of people dropping $tens of millions on condo's. -

I was just reading a story about how they cracked one version of poker and programmed a computer that will always win in the long term. They did this with an algorithm to have the computer always minimize the worst case scenario. How a computer program took the gambling out of poker "These algorithms look at situations and come up with a decision that has, to put it simply, the best worst case. Regret minimization tries to come up with answers with the smallest amount of downside."

-

What are your average yearly household living expenses?

rkbabang replied to Liberty's topic in General Discussion

Seriously? I need to start charging my friend/family when they call me with their computer/network problems.... :) My wifi router is about 3 years old and I think I needed to unplug it and plug it back in once or twice in that time, but other than that no problems. It sounds like this person you know should just buy a new router and fire his tech guy. -

What are your average yearly household living expenses?

rkbabang replied to Liberty's topic in General Discussion

I'm sure it's true for many. I know that if I made millions a year, I would have no problem spending 500k or whatever; my goal is to be independent, not to spend as little as possible. I'm not sure what I'd spend all that money on, as I don't have expensive tastes (technology has made most of the coolest things in life inexpensive... a top of the line iPhone and Mac, a fast internet connection, a good stereo, and all the books I can read.. not a very expensive proposition). I'd probably just get a really nice house in a quiet spot, get a Tesla, a cook, a helper for the kid, I'd add a few zeros to my donation to the SENS Foundation, and that's about it... But it's also true in general (maybe not on this forum) that many people who make a lot spend everything (and more) and don't have much saved. It's the old Ben Franklin line... I think about this sometimes. If I had a few million that I had to spend, but couldn't buy a house/car/boat/rv/lawyer how could I possibly spend the money? Maybe the guy churning through $10m a year can help answer, but I have no idea how I'd spend hundreds of thousands or millions a year without the big purchases. But to the guy spending $10m a year maybe a $1m house yearly isn't really big, it'd be like someone who makes $100k buying a $10k item yearly. Part of it is that I've never been wealthy and probably haven't been exposed to truly expensive things. I'm sure there are places charging outrageous prices for things that I'm unaware of. If you traveled a lot you could go through an enormous amount of money that way. 1st class flights (or even charter), top priced hotel suites, crazy expensive restaurants 3 times per day, etc... -

What are your average yearly household living expenses?

rkbabang replied to Liberty's topic in General Discussion

Sounds like another poll. One of my goals is to get my savings/spending ratio >=1 and keep it there. Right now it is just under 0.5, but I've had some unusual expenses this year, including spending more than usual on travel, car repairs and the house. It is an achievable goal if I down size the house a bit. -

What are your average yearly household living expenses?

rkbabang replied to Liberty's topic in General Discussion

My total in 2014 for 4 people (2 adults, 2 teenagers) living in the North East (NH) was about $110K total. The break down is: $37K Mortgage. Includes P&I, $10.8K Taxes, & $1.6K insurance. $4K Electricity Bills $1K Auto Insurance $68K Credit Card Payments. We put everything except what is listed above on our cards and pay the balance in full each month. This is an exact number, but I'll estimate the break down off the top of my head: About: $6K home heating oil $1.6K Firewood $2.7K Comcast (internet/cable/phone) $15K Vacations/Travel $4K car repairs (both cars needed an unusual amount this year) $4K Chimney repairs and relining $5K for 3 garage doors replaced $2K for new heating oil tank in basement About $800/month in Groceries And the rest is everything else we purchased: restaurants, gasoline, entertainment, electronics, gifts, clothing, other house repairs, etc... Obviously the house is the largest expense. It's over 3800 sqft, 247 years old, and uninsulated, so heating and A/C are major expenses. We've been here 3 years and will probably be putting it on the market in the spring. Our previous house was new construction, smaller, and much cheaper to run, we want to go back to something like that. We've discovered that we don't really need a 3800 sqft house, there are rooms in our house that we don't even use. The kids are teenagers, so in 4-5 years or so it will be just my wife and I which will make this house even more ridiculously too large. -

I get from mrholty's post that he was planning/hoping to retire at age 40 with $4M. If you are planing to live off of your investments for 30-50+ years, you need to think about inflation.

-

How much a person feels he needs to retire is totally up to him. There is no right number. And not everyone wants to live the Mr. Money Mustache lifestyle. yep, I thought $4mm was too low. I did as well. Maybe it's just because I like my day job, but I plan to work until at least 60 yrs old regardless of what level my portfolio reaches. I'd have to be up into 8 figures before I'd even consider retiring earlier.

-

This article tries to make the case that oil (and its price) simply doesn't matter as much as it used to, and will matter even less in the future. Consumption of oil per person has been shrinking for decades while at the same time that GDP/bbl of oil is rising dramatically. "energy stocks currently make up 8.9% of the total market value of the S&P 500. Back in 1980 the corresponding figure 28.8%. Oil was pretty much king in the 20th century, but today not so much." Oil Is Fading Into History

-

Music about investing/business/money/getting rich

rkbabang replied to innerscorecard's topic in General Discussion

and of course: http://www.youtube.com/watch?v=6vH3lBI5Arc -

I have a few cards I use which combined give me better cash back than even the $100K level above. Thanks to someone on this board for gas and groceries I now use the Sally Mae Mastercard which pays 5% on those categories. I use the Amazon VISA, for amazon.com purchases it pays 3%. And for everything else I use my Fidelity AmEx card which pays 2% for everything with no monthly or yearly limit on the rewards. I also have a Target RedCard for 5% off at Target, but we don't buy from Target very often.

-

Ahh, I got you. A lot of people hating on Fuddruckers, I haven't eaten there in years, but I don't remember it being bad.