-

Posts

12,967 -

Joined

-

Last visited

-

Days Won

42

Content Type

Profiles

Forums

Events

Everything posted by Parsad

-

No, you need to make clear what you are saying. You insinuated that the sale of the UK runoff was due to capital requirements and banker's debt requirements. In the December 2019 press release where they announced the 40% sale of the UK runoff to OMERS, Fairfax clearly states that: Upon completion of the transaction, Fairfax will deconsolidate the UK run-off group and apply the equity method of accounting for its remaining interest. Fairfax may further monetize its remaining interest in UK run-off in the future although the company also retains the flexibility to repurchase its interest over time. Nothing to do with Covid, statutory capital, or bankers. They've always looked for flexible financing, especially when it is advantageous to them or they are getting a premium price. So can the BS and stick to the actual facts! Cheers!

-

The stock will do over 50% regardless...just reversion to book will do that! So you're not really adding anything! 15% compounded on $595 USD book over two years gives $786 USD...was trading at $393 USD on Monday. I say 100% return or better by October 2023 at the latest...barring a massive catastrophe or market crash. Cheers!

-

+1! Cheers!

-

Yes, because you saw the pandemic coming, correct? Suddenly, some of their insurers had to book losses from the pandemic and their equity portfolios took a hit...something probably unaccounted for like 9/11 was for insurers. Fairfax had $1.7B in cash at September 30, 2019, which dropped to about $1.1B at December 31, 2019 because they paid $600M in insurance debt. That's why they had to reborrow and issue more debt in 2020 to inject capital into the subs after $400M in Covid losses and $1B in equity losses. As well as keep over $2B in cash because liquidity was drying up across the world. The UK runoff business sale was announced well before the pandemic...nothing to do with bankers or statutory capital. Get your facts straight! Cheers!

-

Haha! With all of Prem's faults, he's somehow managed to put together a $15B company from scratch and lead about 50K people, but you go ahead and tell him what a failure he's been or how he can do much better. Cheers!

-

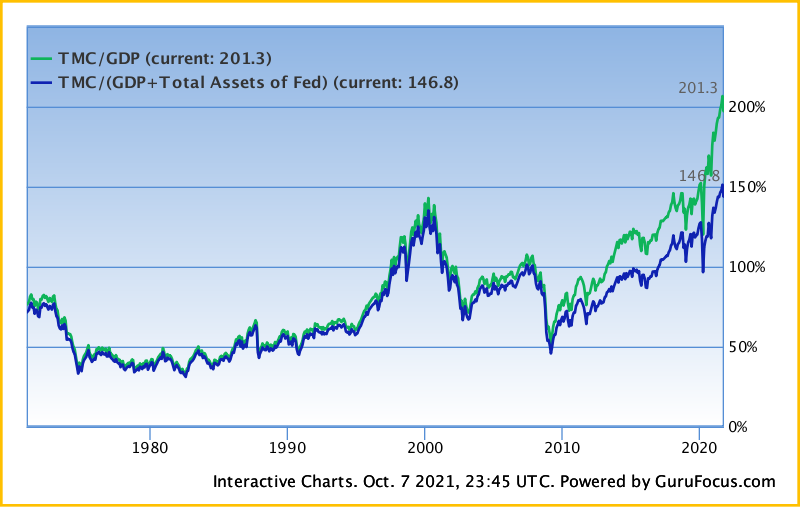

Hi Greg, you do understand the chart below, correct? You don't find it interesting that the period in which distressed value investors underperformed looks like that? And that you have massive distortions from the Fed's balance sheet. I'm not saying that Prem couldn't make money from 2009-2014 and certainly again in 2020, but you can see that the next decade cannot repeat itself. And that outcomes for equity markets are almost certainly to be well negative between now and 2031. Fairfax will have their time...which doesn't negate your argument presently. Nor does your argument presently negate the fact that Fairfax is cheap and will return to a more historical mean value over the next couple of years. Cheers!

-

Actually it wasn't Prem's problem. Balsillie and Lazaridis were on the board when Prem joined. The board pushed for Heins and his vision...so Balsillie resigned. Then the board pushed out Lazaridis, and Prem was left the lone voice in the wilderness pushing for John Chen and directing the company to focus on software. It BECAME a Fairfax problem, since they had a substantial investment in the company. Either Fairfax got involved, or BB would have disappeared a long-time ago. You can then argue...should they have cut bait and let it fail...or get involved, get Chen on board and perhaps save the company, its employees, its shareholders, the community built around BB and FFH's investment. In hindsight, which is where we all sit, including you...I'd be happy if they sold. But arbitrarily throwing around your opinions without any experience or being there...armchair quarterback at best! Cheers!

-

They had to step into managing BB because the board was killing the company under Thorsten Heins. Whatever you want to say, BB under Chen has been a relative turnaround with much work left to do. Getting out of the hardware business and focusing on the QNX software business was the right move. Should they sell BB...I agree, they should. But suggesting that Prem's ego is the only reason he's there is just plain silly! The whole reason he put Paul in as President was to remove himself from alot of these things. Cheers!

-

They've essentially bought back roughly 10% since 2017: From the fourth quarter of 2017 up to June 30, 2021, the company has purchased 1,322,303 subordinate voting shares for treasury and 1,102,998 for cancellation at an aggregate cost of $1,022.9 million. And the latest normal course issuer bid indicates they can buy up to 2.456M shares...or another 10%...and I suspect they will buy most of those fairly early as long as the price remains cooperative. In a low-interest rate environment, with little opportunity as asset prices have risen in most sectors, the natural area to allocate capital is in undervalued buybacks of his own company. This alone will be accretive to shareholders if bought under book...very accretive if bought under tangible book...eventually Mr. Market will come to his senses, and the bears on here will have to come up with excuses on how lucky Prem was or why they took the other side of this simple argument. I remember most of the same people telling me how Handler should have been removed from Jefferies two years ago, yet they couldn't see the improvements and how Handler was simplifying the business to be more like Jefferies and less like Leucadia. Same argument was made by people on why everyone should avoid Biglari Holdings during the pandemic...they thought it would go bankrupt and didn't want to invest with Sardar. You buy something because it is cheap...not because you don't like the management. You also need to have enough common sense to get out when the stock reaches your estimate of intrinsic value...again whether you like management or not. Cheers!

-

d) 25% in 1990. Cheers!

-

100%! No one is telling anyone to hold Fairfax shares forever. I don't hold any stock forever. I think the bulls are simply saying that the stock was dirt cheap last year, and remain cheap this year. And once it is revalued back closer to intrinsic value, we will sell and wait for other opportunities. The bears think that we are all Prem lemmings and that we will hold the stock for the long-term. There is a difference between admiring Prem and how we invest...yet they are convinced we are imbedded in our ways because of that admiration. Cheers!

-

Rubbish! This was said before, and it gets regurgitated whenever the company takes a hit or the stock price has not moved. Thanks for not disappointing Stephen! And again, once we get above book value, and I've sold my shares...the excuses will come pouring out of how it was different this time for this reason, and how Fairfax got lucky or Prem pulled a rabbit out of the hat...etc, etc...blah, blah, blah. And then rinse and repeat! Cheers!

-

+1! OSTK looked like dead money for most of its life...but if you had bought 10 years ago...it's a 15-bagger. Cheers!

-

You're comparing a company that has barely any data on it...I can't even find financials for it or any investor related information from its website...to Fairfax, which has a ton of information on it. Geez!

-

This is silly Greg! Should all closed end funds close then too by selling all of their assets? What about Berkshire, which perpetually trades at a discount because of Buffett's age...should we put him out to pasture and sell all of Berkshire's assets? C'mon! Cheers!

-

This is a fallacy. The market never gets "tired" of something. There can be periods of stagnation, but over time, markets always reflect intrinsic value. There are always questions of a permanent "discount" at Berkshire Hathaway, yet the value keeps going up because the company generates cash. As long as Fairfax does the same over time, Mr. Market will not give a damn about Prem's behavior or Fairfax's complexity. Markel and Berkshire are as complex...no one talks about analysts not being able to understand them. Cheers!

-

History shows that stocks will close their discount to intrinsic value, or even premiums to intrinsic value...it's as powerful as gravity. Cheers!

-

I would normally agree with this sentiment, but the way they dismantled BABA, tore a new arsehole into Didi and beat down on Macau...something is different this time. They are also not pleased with Evergrande and the unrest it could create if the malaise spreads. Beijing is cleaning house and taking names! Cheers!

-

I dunno. Bitcoin and Ethereum have the same network effects that have benefitted Facebook and other tech cos. So did AOL and MySpace. And Bitcoin has survived 12 years and multiple 70-90% crashes. Something tells me it has staying power that AOL never had. Overstock has survived 20 years and multiple 70-90% crashes. It has staying power, but is far from the dominant player that AMZN is...which started at roughly the same time. What will crypto be like 10-20 years from now and who will be the dominant player? Don't know...but BTC has less than a 10% chance of being it. Cheers!

-

You may be right! I would suggest that blockchain is the internet while Bitcoin is AOL. Coinbase may or may not be LVLT. Cheers!

-

No...never could wrap my head around what was supporting crypto prices. I believe in digital currency and blockchain technology, but not this batch of craptocurrency. They are the AOL of digital currency! No one will remember them 20 years from now, and there won't even be collectibles since they are all digital! Cheers!

-

The Federal government's efforts to crackdown on crypto or find alternatives: https://finance.yahoo.com/news/explainer-u-regulators-cracking-down-152559798.html European Union's efforts: https://www.irishtimes.com/business/economy/eu-to-ban-cryptocurrency-anonymity-in-anti-money-laundering-plan-1.4626129 UK: https://www.theguardian.com/technology/2021/jun/27/uk-financial-watchdog-cracks-down-on-cryptocurrency-exchange-binance India: https://www.coindesk.com/markets/2021/05/14/banks-are-already-cracking-down-on-crypto-indian-traders-say/ Australia: https://www.accountantsdaily.com.au/tax-compliance/15797-crypto-crackdown-underway-as-ato-locks-in-data-matching-program Mexico: https://fortune.com/2021/06/29/banxico-mexico-bank-crypto-warning-billionaire-pliego-tweet/ That list will grow. Cheers!

-

No, not written by this Parsad, but Eswar Prasad...Cornell professor. Cheers! https://qz.com/2064043/cornell-professor-prasad-says-cash-will-be-obsolete-in-a-decade/?utm_source=YPL

-

They won't be the first country to ban or at least crack down on crypto. I think the death knell for some crypto is now occurring. It will be interesting to see how the underground economy for crypto was influencing or affecting other asset prices like real estate, luxury goods, etc. This guy managed to get $58M of crypto out just before the China announcement! Cheers! https://finance.yahoo.com/news/miner-cashes-1-366-btc-102712712.html

-

I Need a Laugh. Tell me a Joke. Keep em PC.

Parsad replied to doughishere's topic in General Discussion

Very funny Sam Adams "Oktoberfest" commercial: Cheers!