indythinker85

Member-

Posts

296 -

Joined

-

Last visited

Content Type

Profiles

Forums

Events

Everything posted by indythinker85

-

First Explanation I Have Seen On Klarman And Biotech

indythinker85 replied to indythinker85's topic in General Discussion

More from Baupost (although not on biotech) http://www.valuewalk.com/2014/09/seth-klarman-cautions-against-the-bubble-in-complacency/ -

First Explanation I Have Seen On Klarman And Biotech

indythinker85 replied to indythinker85's topic in General Discussion

Right not fully explained but I think he is saying its mostly analysts well versed in area which he did not have in the past. Its not much but its first I have seen Klarman discuss the topic at all - he usually discusses macro, investment process and on rare occasions some distressed and real estate. -

Fund managers who blew up their performance over the years

indythinker85 replied to opihiman2's topic in General Discussion

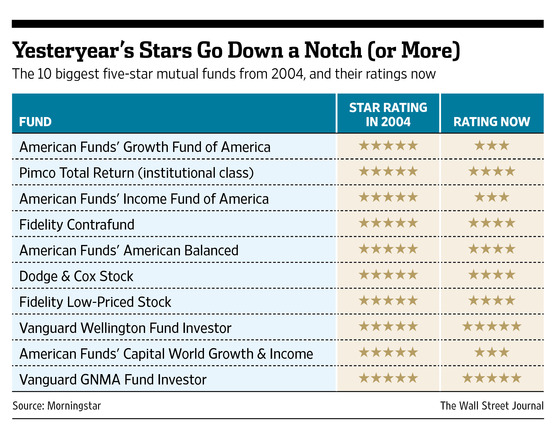

Nice recent WSJ article on this topic http://online.wsj.com/articles/how-funds-with-5-star-morningstar-ratings-10-years-ago-have-fared-1410120116 Take a list of the top-rated mutual funds from years ago—those with five-star ratings from Morningstar Inc. MORN -0.06% —and look at them now. The sobering fact: You'll see many once-proud, five-star funds have dropped to four stars, three stars or worse. And there are lessons to be learned from that. -

http://www.valuewalk.com/2014/09/baupost-klarman-letters/ “Our team is continually improving at knowing where to look for opportunity. Our analysts are doing some really creative work thinking about structural changes in some companies and industries, which has led to several new public equity investments. Pulling threads on existing stock investments has led to a few others.” Furthermore, Seth notes further, “I view it as a substantial positive that our team has the background, talent, and drive to source opportunity in new areas of the markets, generally with very favorable results. I am also pleased that this old dog (your Portfolio Manager) is still open (I’m always cautious but open) to learning a few new tricks.”

-

Don't know his cagr but his VIC presentations have performed very well. ;) I cant say more than this but Im 100% positive its 21% CAGR since inception in 2009 (including part of 2014)

-

Big fan of Guy looks like his presentation not up yet - im sure when it is VW or MF will have it - seems these posts are password protected http://www.valueinvestingcongress.com/congress/new-york-2014-presentations/

-

http://www.valuewalk.com/2014/09/value-investing-congress-presentations-2/

-

http://cdn1.valuewalk.com/wp-content/uploads/2014/08/geicoletter.pdf Here http://www.scribd.com/doc/237676916/buffett-1976-letter-explaining-geico-purchase http://www.valuewalk.com/2014/08/buffett-geico/

-

Whats with the stache? ;D Cheers! http://www.valuewalk.com/2014/07/mohnish-pabrai-dhandho-heads-win-tails-dont-lose-much-google/ Mohnish Pabrai, Dhandho. Heads I win; Tails I don’t lose much Published on Jul 29, 2014 The Dhandho Investor: In a straightforward and accessible manner, The Dhandho Investor lays out the powerful framework of value investing. Written with the intelligent individual investor in mind, this comprehensive guide distills the Dhandho capital allocation framework of the business savvy Patels from India and presents how they can be applied successfully to the stock market. The Dhandho method expands on the groundbreaking principles of value investing expounded by Benjamin Graham, Warren Buffett, and Charlie Munger. Readers will be introduced to important value investing concepts such as “Heads, I win! Tails, I don’t lose that much!,” “Few Bets, Big Bets, Infrequent Bets,” Abhimanyu’s dilemma, and a detailed treatise on using the Kelly Formula to invest in undervalued stocks. Using a light, entertaining style, Pabrai lays out the Dhandho framework in an easy-to-use format. Any investor who adopts the framework is bound to improve on results and soundly beat the markets and most professionals.

-

Paper and containerboard stocks are notably strong as Perry Capital comes out positive on the group, citing a PWC study regarding the potential for MLP conversion.Perry believes managements can create master limited partnerships for their paper mills to drive share upside potential of 50%-100%, the fund firm says in its Q2 letter. http://www.valuewalk.com/2014/07/perry-capitals-paper-industry/

-

Some more info going back to 2008 (no full letters, but looks like ValueWalk has them) http://www.valuewalk.com/2014/06/allan-mecham/

-

Was about to post this, very interesting profile. Agree he sounds a lot like Klarman. Can anyone find more info about him on internet? Am pretty good at searching but not finding much.

-

Great interview in new G&D with the founder of Denali, cheers! http://www8.gsb.columbia.edu/valueinvesting/sites/valueinvesting/files/Graham%20%26%20Doddsville%20-%20Issue%2021%20-%20Spring%202014.pdf

-

Elliott's Paul Singer On How It All Will End: "Badly, We Guess" http://www.zerohedge.com/news/2014-04-29/elliotts-paul-singer-how-it-all-will-end-badly-we-guess

-

Paul Singer on The Fed http://goo.gl/W5ksHA

-

This is a very good write up on CTC (I own some sberbank, CTC and RSX) http://www.valuewalk.com/2014/03/russias-ctc-media-smart-investment-of-the-week/

-

Where will they appear im guessing http://www.fairfax.ca/news/events-and-webcasts/events-and-webcasts-details/2014/Annual-Meeting/default.aspx or http://www.bengrahaminvesting.ca/Outreach/2014_Conference.htm

-

Value Investing Congress presentations

indythinker85 replied to fwallstreet's topic in General Discussion

Thanks cheers! MF also just posted some good notes http://www.marketfolly.com/2014/04/value-investing-congress-las-vegas.html -

Yes i know. My grandfather was almost a victim of a purge because of his nationality (he spent years in the Gulag). The point is that to present Ukrainians only as victims is a false narrative. Both Russia and Ukraine need to learn to confront their past as Germany did. As we see with Japan its very unhealthy and unproductive to deny gross atrocities; the least that can be done is to admit and say sorry. The Ukrainian worship of people who massacred thousands of civilians (many times totally unprovoked) because of their ethnicity is troubling and unhealthy.

-

Maybe you should have mentioned in comparison that the territory got freedom from decades of being treated as second class to the main country or that they gave up their defenses on assurances of protection from the people Invading them. That their country has been meddled with since it was formed. So imagine it from the points of view of the Ukranians like you said Invert, always Invert. Then we can mention why West Ukraine went from a region that was very ethnically diverse into one that became entirely Ukrainian. Although, for good reason the Ukrainian 'nationalists' want to avoid this very embarrassing topic.

-

Soros Bearish http://www.businessinsider.com/soros-13-billion-worth-of-spy-puts-2014-2 http://blogs.marketwatch.com/thetell/2013/08/15/soross-biggest-holding-a-bearish-call-on-the-sp-500/ http://www.zerohedge.com/news/2014-02-17/soros-put-hits-record-billionaires-downside-hedge-rises-154-q4-13-billion Or Not http://www.valuewalk.com/2014/02/soros-bearish-sp-500-put/ http://pragcap.com/13-f-period-is-the-worst?utm_source=dlvr.it&utm_medium=twitter