indythinker85

Member-

Posts

296 -

Joined

-

Last visited

Content Type

Profiles

Forums

Events

Everything posted by indythinker85

-

Gambling in the stock market goes beyond mere speculation. One of the habits Buffett has especially spoken out against as a form of gambling is borrowing money to buy stocks. The Financial Industry Regulation Authority (FINRA) reports that investors have started to buy more and more stocks on margin, meaning they're borrowing money to buy them. In September, investors had more than $654 billion in margin debt. That's an increase from August when the number was in the $645 billion range. If this trend continues, there could be a new record for margin debt soon. The current record was set in January 2018 when investors held $665.7 billion in margin debt. Buffett has said there's no reason to buy stocks on margin unless they are "in a hurry to get rich and willing to go broke." He also advises investors to "get rich slowly." Buffett has also said in a CNBC interview in 2017 that China's stock market sometimes has casino-like characteristics because it is relatively young compared to U.S. stock markets. The Shanghai Stock Exchange opened in 1990, while the New York Stock Exchange has been in operation since the late 18th century. Warren Buffett is often referred to as the "Oracle of Omaha," so investors would do well to listen to his advice about the stock market and gambling. Many people could probably say they have gotten rich from listening to Buffett's wisdom on investing. https://www.valuewalk.com/2020/11/buffett-opposes-gambling-stock-market/

-

Buffett's advice to investors not to treat the stock market like a casino is further strengthened when you understand how he feels about actual gambling. Buffett described gambling as "a tax on ignorance" during Berkshire Hathaway's 2007 annual meeting. He once installed a slot machine in his home and tested his children on it by giving them their allowance in dimes. He said he had all of their allowance back by the evening on the day in which he gave it to them, which illustrates how easy it is to lose while gambling—whether it's on the stock market or in a casino. Buffett believes that since humans tend to enjoy thrill-seeking, it may be why so many people like to gamble. However, it's easy to get in trouble by gambling by taking on debt to buy stocks, as many investors have found when they've fallen victim to a margin call. From https://www.valuewalk.com/2020/10/buffett-warns-stock-market-casino/

-

Can anyone who has more info DM me?

-

Buffett/Berkshire - general news

indythinker85 replied to fareastwarriors's topic in Berkshire Hathaway

Many questionable labor practices at this plant of theirs https://www.valuewalk.com/2020/04/sps-technologies-precision-castparts/ - its a pretty big one it seems as well, 5000 plus employees https://www.dnb.com/business-directory/company-profiles.sps_technologies_llc.d298457fd640833efc3d80a968ab5532.html Curious if this is true, would Buffett know about stuff like this? -

Was just posting this thank you~!!!

-

Full CNBC video from today (would love whole thing in one if anyone sees it) https://www.google.com/search?q=cnbc+buffett&client=firefox-b-1-d&tbs=qdr:d&tbm=vid&sxsrf=ALeKk02X0A_qfHCa-HyT6XmgN5PkiQV7bQ:1582566122123&tbas=0&source=lnt&sa=X&ved=0ahUKEwjSsquc3urnAhWfgnIEHdZoC40QpwUIIA&biw=1920&bih=923&dpr=1 Transcript here http://www.valuewalk.com/2020/02/billionaire-investor-warren-buffett-cnbc/

-

Transcript http://www.valuewalk.com/2017/12/charlie-munger-bitcoin/

-

The Collected Wisdom of Seth Klarman

indythinker85 replied to giofranchi's topic in General Discussion

Great stuff also more here http://www.valuewalk.com/2015/11/baupost-group-q3-letter/ -

Anyone do it? http://www.valuewalk.com/2015/08/spac-investments/ http://dealbook.nytimes.com/2013/08/13/a-thriving-financial-product-despite-a-record-of-failure/?_r=0 http://www.publiclytradedprivateequity.com/portalresource/IntrotoSPACs.pdf

-

Dalio worried about China http://www.valuewalk.com/2015/07/bridgewater-china-crash/ http://www.wsj.com/articles/giant-hedge-fund-bridgewater-flips-view-on-china-no-safe-places-to-invest-1437613434

-

FL Fraud? http://www.valuewalk.com/2015/07/hedge-fund-due-diligence/

-

Whitney Tilson's Media Blitzkrieg

indythinker85 replied to innerscorecard's topic in General Discussion

Tilson is a nice guy just he never knows when to stop. After the 60 minutes interview he came out looking very good - he could have done Bloomberg and CNBC that morning and then just kept quiet. Instead, he has done CONSTANT emails, interviews, articles etc. He does not know when to stop. Tilson could really use a good PR agent who would tell him when its enough! Anyway, here is his updated track record. http://www.valuewalk.com/2015/02/whitney-tilson-letter-2014/ -

http://www.valuewalk.com/2015/02/denali-investors-returns-2014/

-

http://www.valuewalk.com/2015/02/baupost-group-q4-14-letter/ http://www.bloomberg.com/news/articles/2015-02-13/baupost-sifted-through-energy-carnage-as-bargains-rare

-

http://www.valuewalk.com/2015/02/allan-mecham-letters-2014/

-

Seth Klarman: What I've learned from Warren Buffett

indythinker85 replied to tede02's topic in Berkshire Hathaway

More from Klarman http://www.valuewalk.com/2015/02/baupost-group-q4-14-letter/ http://www.bloomberg.com/news/articles/2015-02-13/baupost-sifted-through-energy-carnage-as-bargains-rare -

Jeffrey Gundlach: "This Time It's Different" Webcast

indythinker85 replied to ni-co's topic in General Discussion

http://www.valuewalk.com/2015/01/jeff-gundlach-on-oil-prices/ Jeff Gundlach: Geopolitical Consequences Of $40 Oil “Terrifying” -

It was mostly 2011 H2 - Denali performance 2010 +10.3%, 2011 –34.4% , 2012 +15.4% - cant post the full letters but can help you if you contact me

-

More from Dalio http://www.valuewalk.com/2014/10/bridgewater-judges-sovereign-nations-success-economic-scale/ He said that it matters most in the long run. What i am missing is how in the world all the different ecnomies work together. At the moment we have a beautiful deleveragin in the US, but a deflation with austerity in europe and a debt bubble in china. Now is the US importing deflation through the currency and killing the beauty?

-

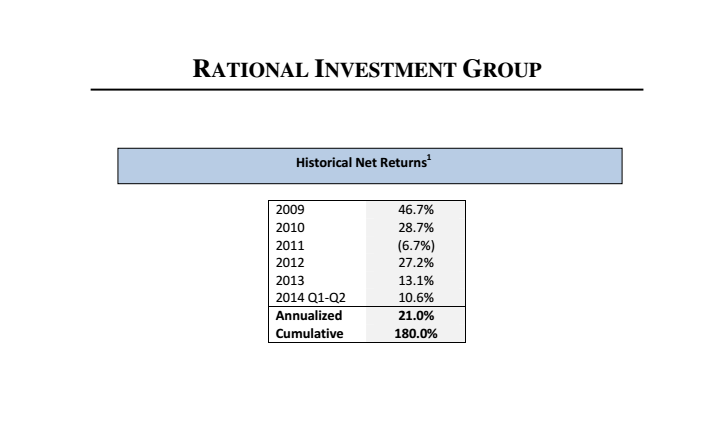

Besides the ones he mentions at VIC, I don't think so. The guy doesn't even have a website. Yes, I was very impressed with his interview. If anyone has more info on him, please share. His returns have been great as well: "Since inception, we've generated net returns of 21% a year. That compares to 13% for the TSX Composite Index in Canada, where the vast majority of our portfolio has been invested over the years. We've beaten the index by about 8% annually while averaging 24% cash." Recent VIC presentation: http://www.valuewalk.com/2014/09/guy-gottfried-radar-underfollowed-gems/ Gottfried pitched these two stocks a few days ago at capitalize for kids. http://www.marketfolly.com/2014/10/guy-gottfrieds-presentation-on-tree.html For the board here is a screenshot from his letter of returns - cant reveal more as he has a small base of ppl receiving this info and dont want anyone to get in trouble

-

Importance of ROIC Part 5: A Glance at the Last 42 Years of Wells Fargo http://basehitinvesting.com/importance-of-roic-part-5-a-glance-at-the-last-42-years-of-wells-fargo/

-

[amazonsearch]Outines and Orgies: The Life of Peter Cundill[/amazonsearch] Just a heads up since i really liked the first one, got advanced copy of this one but havent got a chance to read it yet.