muscleman

Member-

Posts

3,764 -

Joined

-

Last visited

Content Type

Profiles

Forums

Events

Everything posted by muscleman

-

non-recourse. A broker just told me that a very large Canadian pension fund is aggressively buying all kinds of real estate in the US that they can touch. He just sold them a piece of 4 acre land for 1.7M and they plan to build a self storage on it. I think after all the central banks printed like hell in the last 18 months, and with interest rate still insanely low, we will see a massive price hike in real assets. The stock market will repeat the 2000 top and when it crashes, there will be even more money competing for a return in the real assets.

-

Up about 18% in the stocks account. Up about 60% regarding my real estate down payments. I've been aggressively moving money out of stock account to buy real estate since Biden got elected as I believe we are getting a repeat of the 1970s when the stock market would go flat and real estate would go through the roof, so I wanted to go all in on real estate but did not find that many bargains. I don't have any stocks right now and I maintain the view of the repeat of a dot com bubble top. When it crashes, I think even more money will flow to RE. Moving forward I expect housing market in the US to go up by 20% a year for the next 3 years. If this happens, my real estate down payments would go up by 80% a year for the next 3 years while collecting a small amount of cash flow.

-

With this administration throwing trillions around every year, cheap 30 yr fixed non-recourse mortgage with just 25% down, there is no doubt that the best investment idea for 2022-2024 at least is to buy rental houses. I don't think 99.9% stock pickers could beat an average real estate investor in 2022-2024. You need to understand your submarket though.

-

Got it. Thank you! I guess that's probably the case here. I am not a big player. What mtg banker do you recommend?

-

I talked to a CBRE lender who does Fannie and Freddie commercial and he said they do 30 yr fixed but the rate is like 4.5%. The 10 year fixed loan, 30 yr amortization loan has the rate of 3.75. It must be paid back or refinanced after 10 years. Are you saying that Ginnie Mae can do 40 yr fixed for 3.5%?

-

Yeah. It does seem like this administration is trying to solve the debt problem by inflation, and globally all countries are doing this.

-

Fed's keeping rate at 0 is going to cause one bubble to start brewing immediately after the collapse of the prior bubble. People are not going to sit on cash earning 0%. There seem to be a shift in investing trend every decade. The 2009-2021 era is growth. Maybe the decade of value is going to come soon.

-

By "interest rates", do you mean the 10 yr or 2 yr rates? The spread between the two are compressing lately.

-

Some are defensive stocks that trade like T-bills. Overall, it looks just like 2000. When dot com stocks crashed, BRK went up, but in the next two years of bear markets, these value stocks decline slowly until the bear market is over. I think we are right at that inflection point. The correlation of these stocks are high these days. A lot of funds will be facing massive redemptions and they just have to sell everything in the end.

-

Why do people keep saying if rates go up, housing price has to go down? Have you taken a look at historical rates vs housing prices and find any cases when both were going up?

-

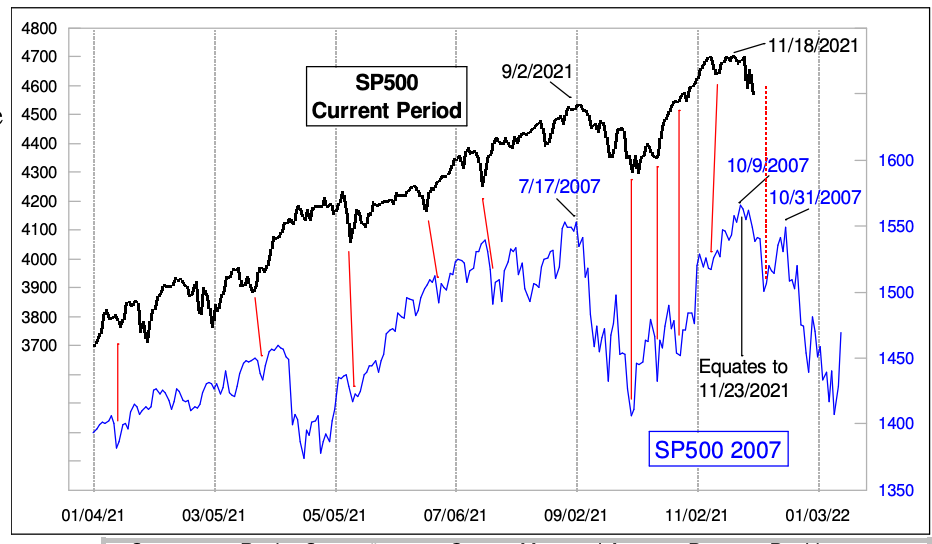

That is exactly what happened in 2000. A lot of dot com stocks were already nose diving while the stock index was making new highs as Cisco, MSFT and a few others were holding the market up. The funny thing is that this time MSFT is also one of them. The difference is that this time is an everything bubble, but in 2000, value stocks went up when dot com stocks collapsed.

-

It looks more and more like the repeat of 2000 top. Last Friday, SPY made a new high, while many stocks in it were making new lows.

-

Nothing surprising after the eviction ban is lifted. The more the socialist government tries to control the prices, the harder it bounces back. Nature forces cannot be fought by human.

-

Separately Managed Accounts at Interactive Brokers

muscleman replied to Mjs3382's topic in General Discussion

As I understand, IBKR's friend and family advisor account requirement is up to 15 accounts. You are just 5. Still a lot of wiggle room. But this requires that you don't charge management fees. If you do, then you do need to be an RIA for your state. I don't think the expense is too bad. Setting up the LLCs could be the worse part. If you are managing external accounts who may sue you, then it is worth setting it up with a two tiered LLCs. have your parent LLC in Wyomin, and have your lower tier LLC soly owned by that Wyomin LLC. In this case, your client has to sue you and win in both states to actually win, and the Wyomin LLC provides privacy. It will never tell anyone who the owner is. -

That's right. I think what happened with Zillow Offer is what is happening in the stock market right now, marked in real time. Everyone knew that RE prices will be far higher 3-5 years down the road, but ZO started paying 25% over fair market value for every property it could seen, and exploded. Everyone sees leading tech stocks being the future, so they started paying a premium. At first 50x PE. Then 100x PS. It will explode too. I think that moment is now.

-

-

I've been working extremely hard to get more real estates. I am not sitting idle on cash. I don't want to buy REITs because the managers of REITs overpay to acquire assets at crazy prices to boost AUM so they can get higher bonus. Meanwhile, I still have cash sitting on the sideline as I acquire real estates. With that said, I do think the stock market is due for a bounce to provide false security to everyone, and then fall sharply lower. Dalio is the guy who said in Feb 2020 that cash is trash. It is funny that he is bashing cash again right at another historic top here. https://www.bloomberg.com/news/articles/2021-09-15/ray-dalio-says-cash-is-trash-and-makes-the-case-for-crypto#:~:text=“First%2C know cash is trash,Bridgewater Associates%2C told CNBC Wednesday.&text=“At the end of the,'t have a place.”

-

I disagree that just because inflation is gonna run wild, anything we overpay would be justified right now. If you haven't tracked Zillow, look at how the Zillow Offer debacle played out. I think the same applies for extremely overvalued stocks. Back in 2011, we used to justify an expensive stock by saying, it is only trading at 50x PE. Now we justify an expensive stock for saying, it is only trading at 100x P/S. But S is going fast so that's ok. No that's not ok when liquidity starts to dry up, which is exactly what is going to happen now.

-

https://www.wsj.com/articles/powell-warns-omicron-variant-could-worsen-inflation-boosting-bottlenecks-11638280800 Fed's primary mandate is to battle inflation, not to pump the stock market. Right now the tide has shifted from "when to taper QE" to "if we should taper faster due to inflation out of control". Last year, covid is the cause of the start of this crazy QE program. This year, covid will be the cause for ending this crazy QE program. That's my understanding. My original post calling for a November top was also based on Fed's timeline to start tapering.

-

Yep. 1970s is not very far away from now, and I haven't seen anyone talking about a repeat of the 70s except you. Buffet lost 30% in 1973 and another 30% in 1974. I don't think that's something most people here can tolerate. At least I can't, so I choose to get out. Venezuela stock index went up 600% from 2014. But that's nothing compared to houses. What used to buy a 2 br condo there in 2014 can only buy one egg.

-

Is anyone enrolled in that? I just noticed this new feature and enrolled in it and one day later they notified me that they filed one on my behalf for WWE. I know what they can possibly recover is likely pennies but I wonder if there is any reason not to enroll for US residents?

-

i don't think it is a good idea to use margin in IBKR because they have instant liquidation rule. It only gives you a few minutes for the margin call before they liquidate your positions. There is no way anyone could deposit enough money within minutes of margin call. You have to either use margin and buy options to protect your risks, or don't use margin. I think if you want to buy and flip houses, the best way to do that is to use HELOCs. I have a HELOC with my local credit union that's free to open and the APR is 3.99%, and there is no annual fee for it.

-

I don't think we will get another lockdown this time. In the US, repulicans are anti-lockdowns. Democrats were pro-lockdowns last year, only because they want to destroy the economy and win the election. But now that they are in charge, they will have no incentive to lockdown because they have the lowest approval rating now among all administrations in the US history now. They are in desperate mode to curb inflation and make people happy so they can win 2022 mid term election. I think we will likely see fed tightening while the virus is running wild. Note that having a variant more contagious is not a bad thing. More contagious => less deadly. Eventually it will become no big deal to get infected.

-

Anyone using IBKR and know what this is?

-

Has anyone enrolled in that program? It says if a class action lawsuit results in recovery of some money, they will automatically get me to participate, and the recovered amount is subject to a contingency fee. Any risks to participate in this program?