giofranchi

Member-

Posts

5,510 -

Joined

-

Last visited

Content Type

Profiles

Forums

Events

Everything posted by giofranchi

-

Yes! Another very good movie, though a remake of a german movie starring Diane Kruger. Haven't seen the original. No need to, because "The Next 3 Days" is just fine! :) giofranchi

-

I haven't watched "This is The End" yet, but I surely agree on "Looper": excellent movie, wonderful acting! :) giofranchi

-

Well, cannot be sure what you mean... but... I DO AGREE!! ;D ;D ;D giofranchi

-

I find myself in almost the same position of twacowfca. And I am doing nothing (except watching Wimbledon and listening to the new Kanye West’s album). :) giofranchi

-

If you want to stay on the investment track, something I do during periods like the last few weeks, is I'll spend more time reading books that I need to catch up on This. If I'm not reading ideas, then I'm reading books. I never read books, even in periods of “can’t find anything that is undervalued (and low risk)”… Because I always listen to audiobooks, even in periods of “too many ideas, not enough capital”… And I listen to them in hours of the day I couldn’t be working or researching ideas anyway: while driving, while walking, while at the gym, etc. While at the office, I never read books: instead, I always read about my investments, or eventually about new ideas, otherwise I work on the businesses that I control. giofranchi

-

I try to work hard on the businesses that I control, and try to make them generate as much cash as possible. The larger the cash they generate during these periods of “can’t find anything that is undervalued (and low risk)”, the more dry powder I will have to take advantage of any market correction. :) giofranchi

-

Uncertain Times giofranchi Daily+6.19.13.pdf

-

--Charles Gave ;D ;D giofranchi

-

Well, to that I can only answer: :) giofranchi

-

Well, of course you are right! But I don’t want to make it a moral issue… too difficult and multi-faceted! My point of view is much easier: you don’t want to see a generally high stock market, after two generations have squandered their savings and lived beyond their means… just because anyway human ingenuity will save us all in the end… Instead, you want to see a generally high stock market as the result of hard working, thrift behavior, and disciplined channeling of substantial savings into productive investments. giofranchi

-

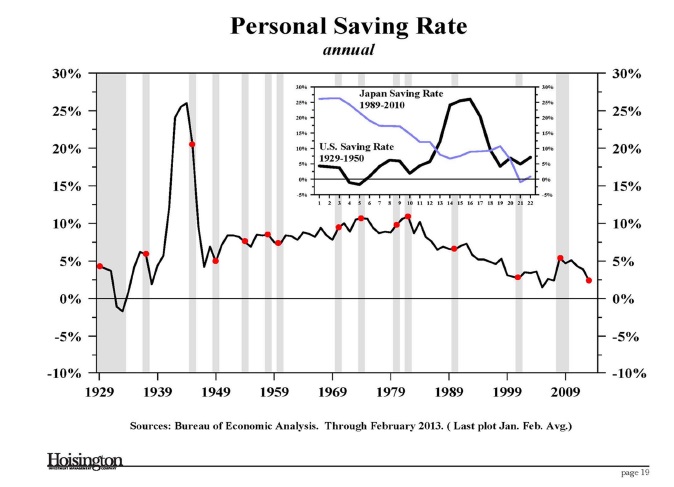

Hi shalab! The two images in attachment are from Mr. Shilling and Mr. Hunt. Look at what happened between 1939 and 1945: a personal saving rate that increased from 2% to 25%. Massive productive investments followed, that laid the foundations for the post WWII economic boom and secular bull market in equities. But, you might argue, history can be interpreted in many different ways… maybe it is so… Therefore, anyone must reach his own conclusions: if you were to save and invest just 2.6% of your yearly income, do you think you’d still be able to achieve a satisfactory CAGR for your net worth? As far as my net worth, or my firm’s net worth, are concerned, the answer is NO! giofranchi

-

David, thank you very much for posting Mr. Mark Grant's thoughts! :) giofranchi

-

Hi hyten, the fact imo is not there are people who live with a debt burden 3 times their yearly income and who save and invest just 2% of their yearly income. Of course there are! It simply is the average of the world we are living in! Given that you and I have no debt and save and invest 20% of our yearly income, it automatically follows that there must be some people who live with a debt burden HEAVIER that 3 times their yearly income and who save EVEN LESS than 2% of their yearly income! Right? The fact is: do you know people like that, who are also successful in building lasting wealth? Personally, not only I don’t know any, I wouldn’t even know how to increase my net worth, or the net worth of my firm, if I had to be burdened with such an high debt, or if I had to save and invest so little. Now, how can a nation of individuals, who stay poor, get richer?! I am surely a macro tourist… But you don’t need macro… You only need to go back to old Ben Franklin… reread his Poor Richard and his Autobiography… Imo, what a person, a family, a company, or a nation need to build lasting wealth is all in there. --Benjamin Franklin Now, what are the investing implications? I think that you must stay flexible. If you study any great investor and entrepreneur of the past, not one excluded that I know of, they never aimed for a 15% return every year, year after year. Instead, they all understood that to get a 15% average annual return, they had sometimes to be careful, and be content with a 7%-10% return, and sometimes to be aggressive, and shoot for a 20%-25% return. All of them grew moderately when times were good and opportunities were few, and grew by leaps and bounds when times were hard and opportunities were plentiful. Don’t ask me how: it is up to you! But I think we won’t regret to have learnt from them and tried to follow their example. :) giofranchi

-

PlanMaestro, I don’t think you are being fair with Mr. Kyle Bass… Anyway, if you didn’t like his presentation, please watch Mr. Lacy Hunt’s and Mr. Charles Gave’s presentations. And look at the picture in attachment: clearly, we have got a problem. How we can go on denying it is beyond me… And the problem is fairly simple, but extremely difficult to admit, because, if you admit it, you must also acknowledge there is no easy way out… Let me ask you a question: have you ever tried to live with a debt burden that is 3 times your yearly income? If the answer is yes, let me ask you another question: have you ever saved, and invested in productive enterprises, just 2% of your yearly income? If the answer is yes again, let me ask you a third question: have you ever experienced those two miserable states of being together? Put them together and no one will be able to grow wealth: not a person, not a family, not a company, not a nation. Unfortunately, there is no getting around this. And sooner or later you must bring down your debt and increase your savings and investments. You might be able to buy some time, the way Mr. Keynes has thought us, but ultimately a successful person, a successful family, a successful company, and a successful nation know how to live within their means and invest for the future. And once those things have been forgotten, sooner or later you must endure the pain of relearning… giofranchi

-

Part III giofranchi Stock-Market_Crashes_Through_the_Ages-PartIII-Early-20th-Century.pdf

-

Cheers! giofranchi Mayer-ValueInvestingCongress-050613.pdf

-

Mr. Charles Gave on The Problem With Leading Indicators. giofranchi Daily+6.17.13.pdf

-

Dan Loeb's 2nd Letter to Sony, Pushing For Spin-Off Again http://blogs.wsj.com:80/moneybeat/2013/06/17/loebs-letter-sony-entertainment-lacks-discipline-accountability/ giofranchi

-

Yes! Of course, I also watched Mr. Lacy Hunt's presentation: a great scholar in the history of finance, teacher, and money manager! Fantastic speech! :) giofranchi

-

-

Very nice plug for the Peter Cundill There's Always Something to Do book. I agree that it was a great book. I enjoyed that book too, very much! And thank you for posting the presentation: very informative indeed! :) giofranchi

-

Hi David! I have just finished watching Mr. Charles Gave's presentation at the SIC, and I have found it extremely interesting! http://www.altegris.com/7bc4a10061b00c4200bb5b769405e45c78.aspx?nr=1#bass2 Cheers! giofranchi

-

Mr. Gundlach: Don't Sell Your Bonds. giofranchi Gundlach-Dont_Sell_Your_Bonds.pdf TR-Core_Webcast_Slides.pdf

-

Deutsche Bank "Is Horribly Undercapitalized... It's Ridiculous" Says Former Fed President Hoenig. giofranchi Deutsche-Bank-Horribly-Undercapitalized.pdf

-

Stock Market Crashes Through the Ages: Part I & II. giofranchi Stock-Market-Crashes-Through-the-Ages-Part1-17th-and-18th-Centuries.pdf Stock-Market-Crashes-Through-the-Ages-PartII-19thCentury.pdf