Leaderboard

Popular Content

Showing content with the highest reputation on 01/04/2024 in all areas

-

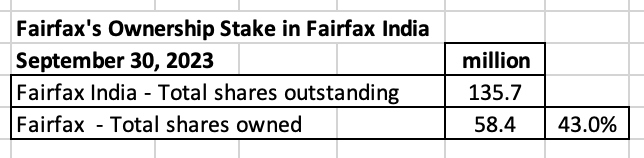

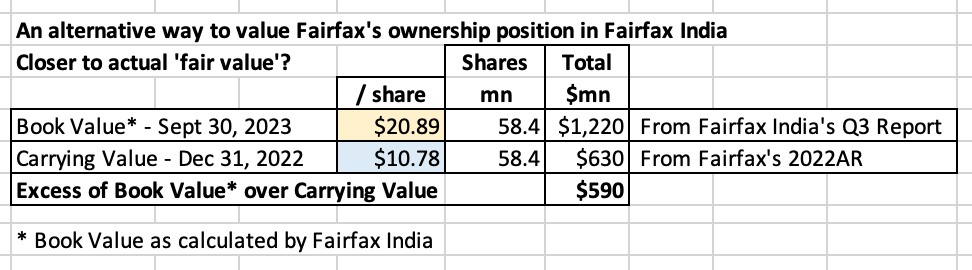

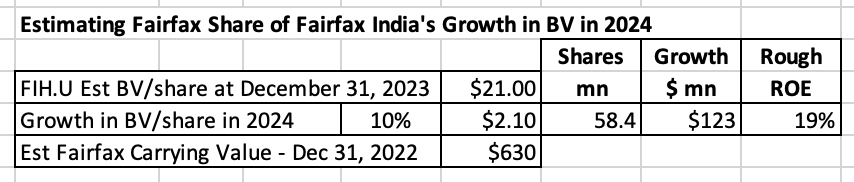

Fairfax India was launched in 2015. It has grown into a wonderful business for Fairfax. Solid collection of assets. Very well managed. Very good track record. Well positioned for the future. In this post we are going to get into the weeds of how Fairfax India is valued by its parent, Fairfax. Let me know if you think i have messed up with my math/logic/assumptions… that is how we all learn. How much of Fairfax India does Fairfax own? When Fairfax India was launched in 2015, Fairfax owned 28.1%. My math says Fairfax now owns 43.0% of Fairfax India, which is an increase of more than 50% over the past 8 years. Fairfax India is also now a much larger company - common shareholders equity has increased from $1 billion at inception in 2015, to $2.8 billion at Sept 30, 2023, which is an increase of 180%. So today, Fairfax owns 50% more of a company that has increased in size by 180%. That sounds great. But what does the math look like? How many shares of Fairfax India does Fairfax actually own? It can be a little confusing to understand exactly how many shares of Fairfax India that Fairfax actually owns. This is because some shares are held in an ‘asset value note’ that was put on when Fairfax sold RiverStone Barbados a couple of years ago. On Feb 16, 2022, when they added to their position, Fairfax confirmed they ‘beneficially owned, and/or exercised control or direction over’ a total of 58.4 million shares of Fairfax India. I am assuming that is the number of shares they ‘own’ today. A short history of the growth of Fairfax’s ownership of Fairfax India (total shares and %) can be found at the bottom of this post. Market value and carrying value What is the market value that Fairfax uses to value its stake in Fairfax India? To determine market value, Fairfax uses Fairfax India’s stock price, which at Dec 31, 2023, was $15.20/share. This gives a total market value to Fairfax’s position of $888 million. What is the carrying value that Fairfax uses to value its stake in Fairfax India? Carrying value is important. This is the value that finds its way into book value. And, as we know, book value is the ‘holy grail’ use by investors to value P/C insurance companies. In the 2022AR, Fairfax said the carrying value for their investment in Fairfax India was $10.78/share, or $630 million (using my share count of 58.4 million). What is the excess of market value over carrying value? It appears Fairfax’s book value is understating the market value of its stake in Fairfax India by about $250 million. (Yes, i know my dates are messed up… directionally, it appears Fairfax India’s carrying value at Fairfax is low). OK. Are we done? No. There is a wrinkle. Fairfax India’s stock price is a terrible measure to use to value Fairfax’s stake in Fairfax India. And that is because Fairfax India’s stock price trades at a severe discount to the fair value of the collection of companies that it owns. My guess is accounting standards require Fairfax to report carrying value and market/fair value the way they do. What should we do? Fairfax India has very good disclosures. We should simply use Fairfax India’s book value - that is the best measure of what the collection of assets they own are actually worth. What is the value of Fairfax’s stake if we use Fairfax India’s book value? Fairfax India has a book value of $20.89/share (at Sept 30, 2023), which puts the value of Fairfax’s stake at $1.22 billion (using my share count of 58.4 million). It appears Fairfax’s book value is understating the value of its stake in Fairfax India by about $590 million. That is much larger than our previous estimate of $250 million. If we use a fair value of $1.22 billion, this suggests Fairfax India is Fairfax’s 4th largest holding, along with Eurobank, Poseidon and FFH-TRS. These 4 holdings represent about 40% of Fairfax’s total equity exposure. What does Prem think about Fairfax India’s reported book value? Prem thinks that Fairfax India’s intrinsic value is ‘much higher’ than its reported book value. If Prem is right, then the value of Fairfax’s stake in Fairfax India is worth even more than $1.22 billion. Below are Prem’s comment from Fairfax’s 2022AR: Growth prospects Fairfax India reported a book value of $20.89/share at Sept 30, 2023. My guess is it will be well over $21 at Dec 30, 2023. Let’s assume Fairfax India grows BV/share at 10% in 2024, which would be $2.10/share. This would put Fairfax’s share of growth in BV at $123 million ($2.10/share x 58.4 million shares). This would also deliver a (very rough) high teens ROE. Is 10% growth in BV/share an aggressive assumption? No, I actually think it will prove to be conservative. Why? BIAL is now 47% of total investments at Fairfax India. Its value has gone sideways for the past 3 years - as a result of Covid. However, the airport is beginning its next significant growth phase (as second runway and recently completed Terminal 2 ramp up). An Anchorage IPO in 2024 could unlock significant value that has been building at BIAL. Two other private holdings in Fairfax India also might see IPO’s in 2024: NSE and SIS, which would likely unlock more value for Fairfax India. The remaining holdings of Fairfax India are well run companies and should continue to increase in value. If my rough math is accurate, Fairfax’s stake in Fairfax India is poised to grow in value by about $123 million in 2024. Some of this value will show up in the ‘share of profit of associates’ bucket. However, like the past 8 years, a large part of the value will likely not show up in Fairfax’s reported results. As a result, the gap between fair value and carrying value will continue to widen. Conclusion Since being launched in 2015, Fairfax India has quietly been growing like a weed. It is a great example of exceptional long term value creation by the team at Fairfax/Fairfax India/Fairbridge. However, the value creation has largely not been reflected/captured in Fairfax’s accounting results - especially book value. Fairfax India is a great example of how book value at Fairfax is understated. There are likely more examples. —————- Warren Buffett on book value Warren Buffett in 2018 decided to no longer publish the book value for Berkshire Hathaway as he felt it was no longer a useful tool for investors to use to value Berkshire Hathaway’s share price. I wonder how much longer book value will serve as a useful tool for investors to value Fairfax’s share price. “Second, while our equity holdings are valued at market prices, accounting rules require our collection of operating companies to be included in book value at an amount far below their current value, a mis-mark that has grown in recent years.” —————- Fairfax India: Summary of ‘total existing Indian investments’ At Sept 30, 2023, Fairfax India held total investments with a fair value of $3.376 billion. If we adjust for Q4 transactions (increase in BIAL and decrease in IIFL Finance): BIAL (manages BLR Airport) = 47% All other holdings = 53% Fairfax India Shareholders equity = $2.833 billion Debt = $500 million —————- A short history of Fairfax’s investment in Fairfax India Fairfax India was launched in 2015. At inception, Fairfax invested a total of $300 million ($10/share) for a 28.1% ownership position. Fairfax India did a second capital raise in January 2017 (at $11.75/share) and Fairfax participated to keep its ownership position of similar size (it was 30.2% at the end of 2017. Fairfax has also received two performance fees in shares of Fairfax India (2018 and 2021). Today Fairfax owns 58.4 million shares of Fairfax India. My rough math says they paid a total of $539 million or an average of $9.23/share. Share count at Fairfax India peaked at 152.9 million at December 31, 2018. Since that time, the share count has come down 11.2% to 135.7 million. With the stock trading well below book value, Fairfax India has been taking out shares on the cheap. Smart. With Fairfax’s share count going up and Fairfax India’s share count coming down, Fairfax has increased its ownership interest in Fairfax India from 28.1% in late 2015 to 43.0 at Sept 30, 2023. That is an increase of more than 50% over the past 8 years. That is a meaningful increase. ————— Summary of Fairfax India’s exceptional track record (at Sept 30, 2023) CAGR of ‘Total existing Indian Investments’ = 13.0% CAGR of ‘Total monetized Indian Investments’ = 17.5% From Fairfax India's Q3 Interim Report - Page 32 - https://www.fairfaxindia.ca/wp-content/uploads/FIH-2023-Q3-Interim-Report-Final.pdf ————— Summary of key metrics for Fairfax India (from 2022AR)1 point

-

Went on a 5 day Christmas market trip basel=ok Starsburg=not good Cologne=amazing and good party Berlin=good and amazing city München=good salzburg=ok Vienna=amazing for couples and family’s Budapest=poor but best food by a mile. so if you ever want to go to a Christmas market in Europe that’s my score. Will travel like crazy this year every two weeks somewhere in the world :d excited1 point