ScottHall

Member-

Posts

774 -

Joined

-

Last visited

Content Type

Profiles

Forums

Events

Everything posted by ScottHall

-

I wouldn't read any of these books. This sort of thinking is toxic and distracts you from how the world really presents opportunities.

-

You need to build some character and I don't mean that in the usual way. Stories run the world and you can make money rain from the heavens with them. The best hedge fund managers know how to market themselves as characters to stand out from the crowd. Vanilla Value Version V doesn't do anything to get people excited. Even returns matter only so much in a way; there's seemingly hundreds of minor league hedge fund managers out there with great track records, with way less AUM than they "should have." Way I see it there's two kinds of fund managers. The ones who try to make a buck through portfolio returns and the ones who try to make a buck from attracting more assets. I think too many of the smaller hedge funds don't understand enough about storytelling. Copying Buffett's letter only means something to the in-group, and there is a market there. But for the wider world you might need something that is more of a spectacle. Bill Ackman has been great at that. A lot of little league fund managers think he is a laughingstock now because his AUM is shrinking. But even with the bad returns, he's still collecting fees on HOW MANY BILLIONS? Oh.

-

Is Warren Buffett or Charlie Munger Smarter?

ScottHall replied to nickenumbers's topic in Berkshire Hathaway

There's no need to be modest, Cardboard. Everybody knows you are one of the greats I was talking about. Your track record of calling out FRAUDULENT companies early in their hype cycles is truly unparalleled and ensures nobody will ever forget your contributions to our field. You've been a big inspiration to me as an investor, and are one of my most valuable resources on this entire website. Thank you for being you, Cardboard. And please keep posting the ideas. <3 -

Is Warren Buffett or Charlie Munger Smarter?

ScottHall replied to nickenumbers's topic in Berkshire Hathaway

So smart to spend three pages arguing which geezer is smarter and why. They were good for their day but they are both hopelessly outclassed by modern investors. -

So Musk, Trump and Bezos were all frauds who eventually turned the corner? Musk and Trump are not out of the woods yet but Bezos has reached escape velocity and has for a long time. Musk needs to continue to tap capital markets to finance his operating losses until he can get where he needs to be. Tesla consistently and wildly overestimates its unit production and has been getting investor financing while doing so. People need to believe in Musk for him to overcome the obstacles ahead of him, because he will require their money to do so. So long as people believe in Musk enough to continue to finance him, Tesla can afford to lose as much money as it wants. When belief in Musk is no longer high enough for people to finance him, that is when current year economics would matter. Tesla's biggest asset is Musk's ability to raise capital. If he can raise enough of it, he may be able to "cross the rubicon" into the world he wants to see. That's a world where his companies could be worth a lot. But it's reflexive... if people don't believe in him, he won't get there. So is it fraud to use your marketing skills to highlight the amazing stuff you've been able to accomplish, so that people will want to continue to finance you despite ongoing operating losses? A lot of people are jumping ship at Tesla. That's usually not a great sign. Maybe Google will buy Tesla if public perception falters and finance Musk. It'd be more sensible than any other project. Or maybe the public will continue to finance him so long as he continues performing technological marvels, operating performance issues be damned, and one day the infrastructure will really come together. Who knows? Trump is Trump and we'll leave it at that, so this doesn't become a political thread.

-

You guys are missing the point as usual. Sometimes founders have to create grand stories to raise the money to finance the work to get to the point that they aren't stories anymore. So many great companies have been built this way that it's very typical of a value investor to jump all over the leaders who fail to make the transition. Reflexivity is real and Holmes did not prove as skilled at mastering this art as Musk, Trump or Bezos. Classic case of value investors missing the point, again.

-

The current price doesn't seem to be much of a premium if they can keep up results like this for a while.

-

Preston Pysh [TIP- The investors Podcast] Genius or Salesman

ScottHall replied to nickenumbers's topic in General Discussion

Salesmanship is life. The value investing community is a babe in the woods in regards to what actually moves the needle in this world. -

I agree, and think the value of Musk's understanding of human psychology to the viability of his businesses might be underappreciated. The stock looks at least superficially expensive to me but that's a different question entirely.

-

I wrote some far OTM puts at a $60 strike. $1 per contract for 60 days of exposure. Defined loss acceptable. Annualized return acceptable.

-

Ability to invest in early stage startups?

ScottHall replied to sleepydragon's topic in General Discussion

I get deals based on my social network from time to time. -

Morgan is a great writer and even better guy.

-

If the debt is what matters, 100%. Otherwise, close to zero.

-

It's not as much of a given as you might think... :/

-

I like several of these (haven't read all), but wanted to underline Tested Advertising Methods. That book took me from zero to winning a copywriting tournament, and the knowledge continues to pay some very pretty dividends even now... In a very literal sense. :)

-

I think Nate is so right. I've made a ton of money on stocks others hated because I knew their marketing was working wonders. As I am beginning with some angel investments now, it's pretty much how I evaluate the outlook for each potential investment. I had an investment recently in software start-up. I know very little about software. But it has access to a unique method of customer acquisition that, although software is the product, turns it into a direct response marketing company. Something I know very well. It'll probably fail but I think by understanding marketing, you can rig the deck more in your favor than you'd expect, in some circumstances.

-

This is such a great point and something SO MANY minor league hedge fund managers simply don't understand! Which is quite amusing, when you consider that they analyze opportunity cost for a living. It's not that people don't understand it. It's that people don't want to do it. It's likely a lost opportunity, but you can't force people to do it. To pick on oddball ;), he doesn't do it either... where is his $10B fund? 8) ;D He is running a software co. and has more knowledge about marketing than most on the board. From what little understanding I have of his software business, it seems like he utilizes his marketing skills regularly while trying to sell his product. A little different than a MINOR LEAGUER sitting in a dusty library hoping that their returns will bring the big bucks in.

-

This is such a great point and something SO MANY minor league hedge fund managers simply don't understand! Which is quite amusing, when you consider that they analyze opportunity cost for a living.

-

Stock market is forward looking, supposedly.

-

Seems like a smart buy.

-

I've thought of buying some Fairfax at around current prices. Already own Markel.

-

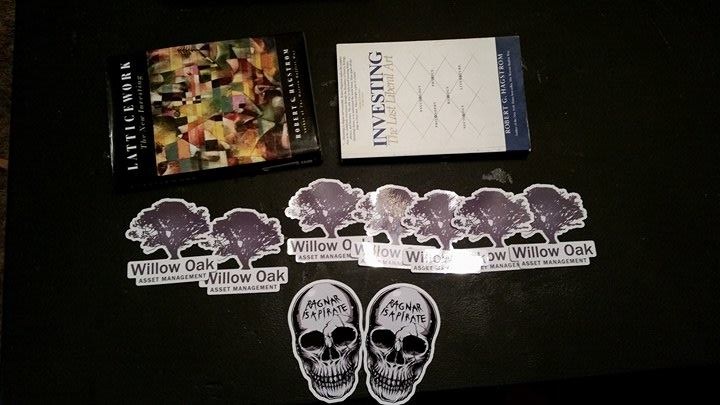

F.A.N.M.A.I.L. Well guys, now that I'm back in action it's time to share some fan mail I received on sabbatical. I have the best fans, but this time the mail came from none other than The Chairman, Jeff Moore of Sitestar. On top of getting two cool looking investing book, there were also hidden goodies packed away inside... Stickers! Two Ragnar stickers and a heaping helping of Willow Oak Asset Management stickers. What great Sitestar swag. So a huge shout out to Ragnar for the shareholder swag, considering I was forced to miss the Sitestar shareholder meeting this year. Will these stickers become a lucrative opportunity down the line? As Steve and team grow the business, these could become collector's items someday. I'm not selling a single sticker. If YOU want to do your duty of sending me fan mail and appearing on this thread, please PM me here or on Twitter to see how you can get involved in the Scotty community.

-

This is publicly available on my Twitter stream. I've publicly disclosed my returns so far this year (now dated), last year, the year before that, and XIRR since 2008 (when I turned 18 and opened an account in my own name). I can give you an update of this year's returns, because what I posted on my Twitter is now dated. I'm too lazy to dig the rest up ATM but you can find it easily enough. My return YTD is: 21.52% on a total of 31 positions. These are some great stories, Flesh. I like how your out of the box thinking helped create better economics for your business. I've worked in various roles in different marketing organizations. I've done copywriting, helped determine returns on various promotions and in aggregate, aimed at justifying more resources for growth. The biggest companies in my industry are not small, though some seem to think that's the case from my discussions with others here. Most of that sort of IRR analysis is only useful if you're not the agent in charge of the wallet, so to speak. If you know a piece of copy is good and have agency you don't have to justify the expense to anyone... I've sort of been gradually shifting myself in that direction. More towards owner-operator, less of a cog in the machine. I've been focusing on honing my skills for that. I recently wrote a piece of copy on royalty that ended up being the biggest of the year so far for that particular client. My cut for 20 days of writing ended up approximating my salary from my old gig. Persuasion is an incredibly useful skill. I'd love to chat with you about your war stories in the future, if you're game. I don't really need a copywriter, but I love to talk with others about their experiences in the industry. I could tell you some interesting refund ideas I've used in the past... I bet we could compare a lot of notes on that! I can't really discuss all of this publicly... but feel free to e-mail or PM me.

-

Interview with Doug Mohn, NoCalledStrikes.com

ScottHall replied to EricSchleien's topic in General Discussion

Fun to listen to. I did skim but a lot of it was quite interesting.