Buckeye

Member-

Posts

334 -

Joined

-

Last visited

Content Type

Profiles

Forums

Events

Everything posted by Buckeye

-

What’s the math start to look like when you account for the 1000’s of hours you’ve spent shilling for BTC? Judging from your post frequency, it looking like a full time job.

-

If you believe this statement is true then I’m afraid you are sadly mistaken. And I can now better understand your devotion to the BTC.

-

Red never said anything about Buffett never being wrong. Where did you read that Paar? And then you compare him to Ghislaine Maxwell? WTF?

-

25% tariffs on Canadian and Mexican imports.

Buckeye replied to SharperDingaan's topic in General Discussion

It’s what Bo Burnham sings about in his song Straight White Male, when he says…“We used to have all the money and the land...and we still do but it’s not as fun now” -

25% tariffs on Canadian and Mexican imports.

Buckeye replied to SharperDingaan's topic in General Discussion

As an American, who loves Canada, and its people, I wish we could import some of that friendliness from our neighbors up north. We could use a little more of that -

25% tariffs on Canadian and Mexican imports.

Buckeye replied to SharperDingaan's topic in General Discussion

Hahahaha good point. -

25% tariffs on Canadian and Mexican imports.

Buckeye replied to SharperDingaan's topic in General Discussion

It’s sad that the sportswear company keeps getting lumped in with El Salvador and Venezuela. -

25% tariffs on Canadian and Mexican imports.

Buckeye replied to SharperDingaan's topic in General Discussion

Could this be a possibility, or should I put away the aluminum foil? Trump has said that he wants lower interest rates, correct? Maybe he’s aware that tariffs could potentially slow the economy which may force the FED to react by lowering rates? Two birds with one stone. Or one bird and one pajaro? -

25% tariffs on Canadian and Mexican imports.

Buckeye replied to SharperDingaan's topic in General Discussion

-

Wow, dude chill. I never said any of what you write in your quotations. Go easy on yourself.

-

Wow, thanks Fly. Very insightful. Can you please let me know when 1 BTC > 1 BTC? Then I’m buying! Shouldn’t be long now.

-

25% tariffs on Canadian and Mexican imports.

Buckeye replied to SharperDingaan's topic in General Discussion

The Leftist Rag WSJ had an article a few weeks back about the effects of the tariffs from Trump’s first term. They showed that capital expenditures started to turn lower about 15 months after the tariffs were first imposed. We then ran into Covid, so it’s tough to know how things would’ve worked out. I guess we’ll see if things turn out different this time (could AI spending keep growing the economy), or will things start to slow? I think tariffs act more like sand in the gears of the economic machine. -

25% tariffs on Canadian and Mexican imports.

Buckeye replied to SharperDingaan's topic in General Discussion

Literally no one on this board is saying this. What are you talking about? -

Lame answer! But I’ll give you pass:) I guess I’m currently in the camp with Josh Brown who said something to the effect of…”I’ll know when people like my wife and her friends are using Bitcoin” I thought that was funny.

-

25% tariffs on Canadian and Mexican imports.

Buckeye replied to SharperDingaan's topic in General Discussion

-

25% tariffs on Canadian and Mexican imports.

Buckeye replied to SharperDingaan's topic in General Discussion

Who said throw in the towel? Who’s saying give up? I guess you did? I didn’t post other graphs because I posted the first one I found. Sorry Cubs. Nothing convenient, just thought I’d focus on fentanyl since that seems be one of your biggest concerns. So any thoughts on why the first Trump tariff’s didn’t do shit for bringing down fentanyl deaths? -

25% tariffs on Canadian and Mexican imports.

Buckeye replied to SharperDingaan's topic in General Discussion

Damn, Cubby, you’ve got it all figured out! Must be exhausting Can you explain why President Trumps first round of tariffs in 2018 had no effect on Fentanyl deaths? Also, you spelled Colombia wrong, just like the Executive Order. Not that you care -

25% tariffs on Canadian and Mexican imports.

Buckeye replied to SharperDingaan's topic in General Discussion

The WSJ is leftist rag? Huh, that’s an interesting statement. Of course most Americans would agree with your first sentence. So tariffs are your solution to all of these issues? -

25% tariffs on Canadian and Mexican imports.

Buckeye replied to SharperDingaan's topic in General Discussion

Sean Hannity is this you? -

That’s your opinion. And my opinion is that you’re wrong. This whole exercise in tying Buffett to BTC is what BTC owners need for their confirmation bias. Just imagine how many Twitter screenshots we would see, with all of those little siren alerts “Warren Buffet buys BTC!” With all of the fans clamoring “See! See! We were right all along! Everyone should own BTC!” No naysayer has yet answered what would convince them that they are wrong, just like no BTC fan has told us what they think BTC is worth. care to give us a number? You and I both know that Buffett isn’t ever buying Bitcoin. And as a BRK shareholder I currently agree with his position.

-

Fixed it for you. Isn’t this what you are really trying to imply?

-

So are you saying that if one were to own all of the bitcoin in the world, it would then become worthless?

-

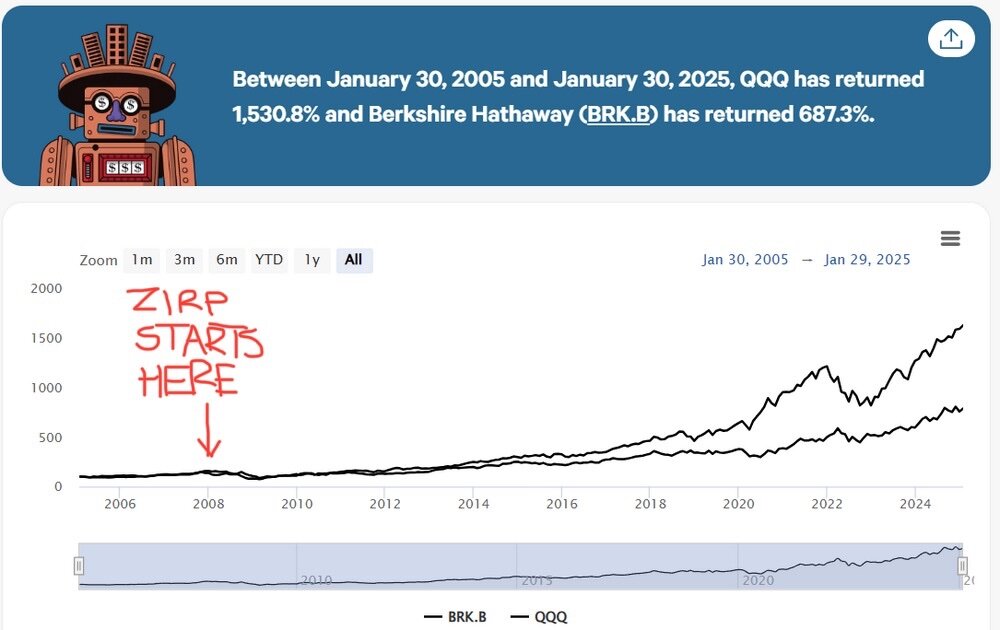

So 15 years of ZIRP haven’t been great for insurers? It’ll be interesting to see what the next 15 years bring. James, if you can find a graph of the next 15 years, please post it here!

-

To be fair, there are also 100’s (1000’s?) of investments that they both “missed” out on that most likely turned out to be complete dog shit. So you should give them some more credit there. Plus, where does the Apple position fit within your narrative of them “missing the value of tech”? Also, Warren Buffett has said time and time again that investing in Microsoft was off the table because of his close relationship with Bill Gates. So why dig him for that, with your five exclamation points?

-

Cheers to Fairfax and Viking on Fairfax Dividend Day! Thank you Fairfax and thank you Viking for all of your contributions to this board!