BG2008

-

Posts

2,865 -

Joined

-

Last visited

-

Days Won

1

Content Type

Profiles

Forums

Events

Posts posted by BG2008

-

-

Something weird about the photo. In some, he looks legit CHADish from the front. But from the side with his whole neck on display, he looks like a skinny guy with a pencil neck.

And yes, anyone who compares themselves to Buffett raises red flag for me. There are very competent CEOs like Rick Hermann of $HQI that continues to build value but doesn't ever gets mentioned or compared to as Buffett @wabuffo

-

On 1/1/2024 at 5:26 PM, backtothebeach said:

74% in USD. Last year when I was looking at my port value, every other day I was thinking “this is insane”. Holding a large percentage of FFH and buying more on dips was the biggest driver, but I also sold tons of OTM and ITM puts on ATVI, OXY, CLF, STLC, CVE, OBE, BRKB and others, did some diagonal option spreads and some arb trades. All in all being imprudently leveraged with over 200% long if you add up long and notionally long through short puts.

That said, “you only need to win the game once“, so after 10 years of investing/trading like a madman with a 19.9% CAGR (was it worth it?), I am looking forward to being more passive.

Biggest challenge is going to be to get over my market addiction. I don’t use social media, so clicking back-and-forth between watchlists on IB and checking COBF for new posts has been my dopamine source for quite a while. I may start a new thread about this.Dude, you need to allocate to some private self storage and pay someone 2 and 20 to lock up that capital

LOL

-

Okay, I hope this would be interesting. It was buying the Peter Lynch Book One Up on Wall Street

I don't consider myself that bright. I'm a hard asset guy. People who met me in person know that I'm kind of a burly guy who's better at REITs and physical stuff.

The book was $7 or $10

But Peter Lynch talked about how rock pits are good businesses, it just kind of stood out. It was a very simple concept. Cost $10 a ton, cost $10 to truck it 30 miles etc.

In 2015, Patriot spins off the RE business which became FRP Holdings. I bought the stock at $30. Made it a 26% position and a huge position in my PA and told my family to buy it. Blackstone buys the warehouse for $359mm. The EV that I paid was $340mm but they still owned the MF and the rock pits and other cats and dogs. We made a double.

I also raised outside capital because of this idea.

Fast forward to 2020, Covid hits and FRP Holdings was trading at $40 but The Maren leased 45% of their units during Q2 of 2020. Holy Shit! They leased 45% when people were not allowed to view it? WTF? Made it an 18% position and raised some more capital.

In total, realized gains for my family and investors are likely closer to $2mm. Unrealized gains from the second investment in 2020 is around $4mm. These are gains from my own accounts and capital that I manage for others. The gains alone are double digit % of my current asset that I manage.

All of this from a book that Peter Lynch wrote about containing some little nuggets about rock pits.

Investing is funny like that. You get an insight that is timeless, i.e. rock pits are good business.

You get to know the assets, the management, the capital allocation, and the business. You can recycle the idea and come back.

-

A little bit of a market rally and now we're talking about watering flowers and cutting weeds

I thought we are value investors!

Just kidding, yes, this strategy has a lot of merit. But then some of my left for dead positions are the biggest winners

-

I guess I'm really gonna miss those 0.9% and 1.9% car loan rates.

-

What is the car lease interest these days?

-

I have a 2020 Acura MDX with tech package where the lease is set to expire this Saturday. Got a quote from Acura for $29,963. In the past, I would just send it in and get a new lease. Given the car market these days, I am thinking of getting financing and buying the car outright as we've driven it ourselves mostly and have done all the oil change. Has anyone done this recently? To get financing, should I contact the Acura dealership? Or should I do it directly via Acura financial and get a loan from a local credit union/bank? Thoughts?

-

36 minutes ago, thepupil said:

"Aligned" can mean and not mean so many things. I own CLPR in my IRA. I have no tax considerations. The Bistricers are NY residents. That's a misalignment and difference in incentives. I have 1% of my wealth and none of my reputation/status in society/etc on the line with respect to CLPR. They have a much larger % of their money and rep. That's misalignment. I am a passive shareholder. for them it's the family biz for several generations and many decades. I don't think anyone is truly "aligned" with a management team.

Do they care that the stock is at $5.50? Probably. they' would probaby rather it be $15 than $5.50. Does that mean they're perfectly aligned? Nope. they are low basis taxable multigenerational owners of RE with substantial wealth and assets outside of the CLPR entity. they're not well aligned.

To me there's a spectrum of alignment. they don't seem like crooks actively working against shareholders, but also don't jump off the page as being spectacular value creators who really care about the stock. @BG2008 thinks they're better than they appear. I struggle to see that. but he does more in depth work (to a very big degree)

I'm not going to convince anyone on this name which is why I stopped talking about it. All that Sunbelt hoorahh, now it is facing a bunch of new supply. This is how one creates value in NYC residential. Who the F gives a damn about the opinion of @Gregmal some Jersey Trash or @thepupil some know it all from the Mid Atlantic who bench mark the company against other mega REITs. If you own half of a company, you try hard to make sure you don't do something to lose it all. You keep owning more RE over time. Which they have done without diluting themselves aside from the initial IPO.

The funny thing is that everyone bitches about NYC landlords. But most multigeneration NYC landlords are wealthier than you, me, and Gregmal combined. So just keep owning more dirt in NYC and things tend to work out. People bitch and moan about NYC this and that. I'm a lifer. Leave it or take it.

Now on the decent management skill. They just built a new MF to a 7% cap according to them. Will cash out $30mm from new loan if it hits the stabilized yield. They make sure all debts are non-course with no cross collateralization.

Any of you asshats try to run this business and you'll probably get your ass handed to you.

Alignment or mis alignment, I don't know, you get a 7% yield while they lease up buildings. It's not where I want the stock to trade. But here we are. It is what it is. If you want, you can create your own share buyback.

Again, no one will believe me. So who cares. Someone of you need to try to pull off the financing they did in May 2020 with NYCB and in Feb of this year with 1010 Pacific. Those are master strokes. Probably never gets a bid, yada yada. But you get your 7% yield.

-

7 hours ago, thepupil said:

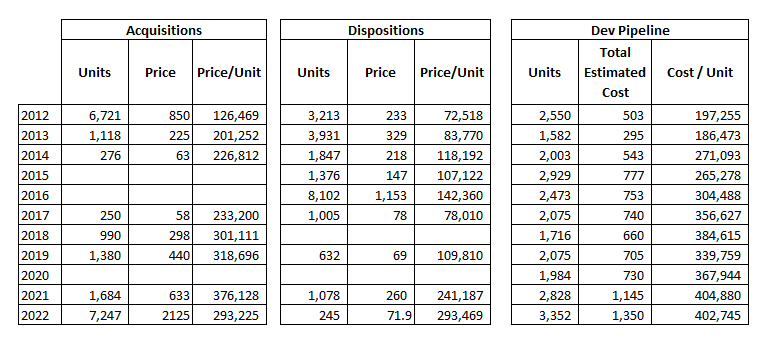

Just to continue on the CPT train. You can currently buy CPT for what looks to me to be a $240-$250K / unit (depending on how you count the development pipeline. CPT has been consistently upgrading portfolio over last decade and has been buying apartments in >$200K / unit since 2013 (and shedding lower value properties) and has been delivering new units to the market at >$250K for a decade.

The going rate for shiny CPT units that they are developing is $400K/unit.

this is why when you look at a chart like this below and see that the EV/unit has come down from $350K to $245K but also note that it was $110K/unit in 2012, you have to be careful because they've been consistently upgrading the quality of the portfolio. if you look at their acquisitions and dispositions by year, generally they've been selling old stuff and buying new stuff and obviously any development they've been doing is new stuff. In 2012, the typical CPT apartment was renting for $1000/month, now its $2,200/month. that's a combo of same stor growth, but also the massive amount of change the portfolio has undergone over that time frame.

they do the work for you and note that since 2011 they sold $3.4B of assets w/ average oge of 20+ years, developed $4B of assets w/ average age of 6 years and bvought $2.7B w/ avg age of 4 years.

CPT almost meets the "1% rule" which I associate w/ low quality, subscale non institutional real estate and has not been available for this type of asset in a long time.

What is the 1% rule? Can you expand?

-

4 minutes ago, thepupil said:

My dad retired in 2007. He got "rich" (depending on your definition) through extreme concentration. He was an exec at a company that went public and put a lot in the stock at IPO. Company got LBO'd so he crystallized his gains, company later went bankrupt after he left.

He stayed rich via bonds. Being 60% muni's w/ a typical Merrill lynch guy into the GFC saved my family's financial health as they weren't forced to make withdrawals at steeply discounted stock prices and didn't panic.. they owned a valuable unlevered home and by no means would have been destitute but a real life "sequence of returns risk" case study; if they went in 100% stocks, I'd imagine their standard of living would be lower than it is today.

Now in 2013, I took over and it was stil like 50/50 and thought that was too conservative and switched things up to more like 70-80% stocks / 20-25% cash and it's the best and most impactful financial decision i've ever made (we're now more like 70/30 with the 30 being in bonds not cash built up the bond position over last year or so.

Bonds are indeed a wealth preservation tool. and for many that's the goal.

This puts a smile on my face. When I was younger and more immature. I would criticize a lot of active managers who did not have a 15% net CAGR over their careers. As I have gotten older and dissected more investment returns. Sequences of returns is absolutely a thing. Look at a lot of the heroes from 2020 that were up 100-200%. Look at a lot of fintwits who posted 30% CAGR since 2017-2018 during a period when if you went long "unprofitable growth equity" factors, you killed it. Imagine if you had money with someone volatile but also need to take out a certain $ every year. When you're down 50%, that 4% withdrawal is now 8%. All a sudden now, you're fighting a much harder war.

Guys who was toiling and buying highly cashflow generative companies with low leverage got left behind and got called "washed out". My experience has been that if you've got wealth and you're older, you worry more about wealth preservation and beating inflation by 4-5% a year over the long run.

How does this tie into bonds? It's the view that if you're wealthy already, you should have some bonds in your portfolio.

-

3 hours ago, Spekulatius said:

Has anyone ever seen a bond investor getting rich? I haven’t , except money manager like Bill Gross, but of course they owned a business not bonds directly.

Bonds are a wealth preservation vehicle (and have their place for this purpose) not a way to build wealth.

Farifax and their long bond trades?

Anyone who bought long duration bonds in the early 80s

-

25 minutes ago, Castanza said:

@Castanzafor shit takes and money losing propositions

Far too many to name. This site is hands down the best collection of investors I have been able to find on the web. Learned a lot from others on here.

We want names!!! When are we going deer hunting or rucking on the beach here in NYC?

-

Let's have a little fun

I follow @Gregmal @thepupil @realassetsvalue for real estate related topics

I follow @wabuffo for event driven and on $HQI, dude is smart

I follow @Parsad James East for Fairfax related topics

@Packer16 for Telco, distribution themes, interesting business models etc

Just wondering who do you guys follow here on CoB, on Twitter etc and what would you say their circle of competence is?

-

I use a Aeron chair from an outlet store in Brooklyn. Bought it for about $700, the largest size. I was starting to get significant hip pain as I am a larger guy and weight a decent amount. The Aeron chair has been really helpful with getting rid of hip pain.

Side note, I started squatting this past summer. It's done wonders for my posture, back, and hips in general. I only squat once a week, but tend to go heavier as it is a stress relief for me. I highly recommend it. Also just going out for walks is great as well.

-

Bought some options that are now way out of the money. Won't expire till Mid Jan. But would rather lapse them and take the tax loss for year end. Does anyone know what the mechanism for this is?

-

Just now, Rustycage said:

I can provide some serious failure, proud owner of $ATUS from 13, have managed to sell a bit though

$ATUS has real value to me...as a tax loss harvesting candidate.

-

Down 99% for the year because I bought $ARKK calls

People who are really down probably not sharing their pain

Been hiring a couple interns/analysts for the business actually and having a good time mentoring and coaching them

-

-

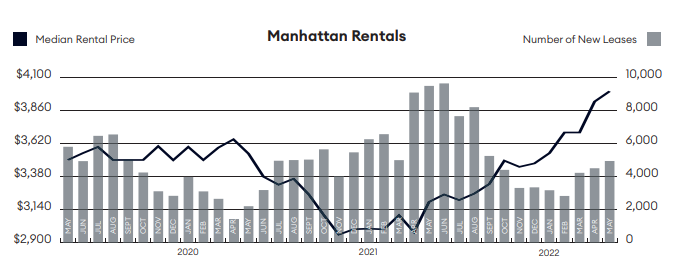

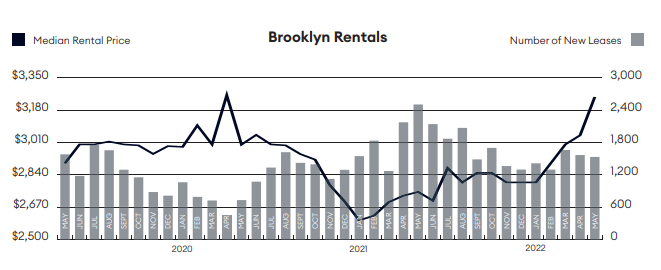

Manhattan and Brooklyn rent recovery - Nuts

We're getting back to 2019 and go higher from there

-

On 12/27/2021 at 5:40 PM, BG2008 said:

I was going to post something similar. @gregmal absolutely called the Sunbelt Multi-family trends in 2021. Holy crap. I wish I had paid more attention to it. I would love to hear what other people think 2022 key themes will be. 2020 was obviously covid beneficiaries. 2021 was a slaughter for the likes of $PTON etc. On the RE side, I think $CLPR is poised to perform as the rent increases gets passed through via quarterly new leasing and lease renewals. I think 2022 is finally the NYC recovery year. NYC office may catch a bid as well. Maybe?

$FRPH remains my biggest position and one of my favorite as it benefits from infrastructure bill passage, pricing power in the aggregate royalty, Bryant Street should be fully stabilized and they should print a decent GAAP net income number of stabilization as well. Their Greenville, SC (Sunbelt MF) should also stabilize well and print a really good GAAP net income number. It is low leverage, good management team, and a sleep well at night. Inflation will be very good for them. Recession, they will weather it well. Just solid all around.

I like $PTON in small sizes, 1%. I like $AMBP, it's boring packaging with lots of growth. Potential to double in 2-3 years. The $AMBP 5 year warrants are interesting as well.

I have shorted some TLT (20yr US Treasury) as I think inflation will eventually cause rates to go higher. It's more of a hedge due to my large RE exposure.

I think $HQI remains one of the more fascinating picks due to the jockey.

$INDT trades close to NAV. So it is not pound the table anymore. But it will be interesting to see what the CEO/Chairman combo can do.

TLT chart - Imagine buying US Treasuries and losing 16% in 3-4 months?

-

What happened to Glenn Tongue?

-

15 minutes ago, CapLab3 said:

If you are interested in ValueLine, a lot of public libraries give you access to it for free (or the cost of library card). Agree you should still cross reference with the actual filings.

Yeah, but you need to log in and it's an extra step

-

Thanks for the feedback. I am not the people building the services. I just happened to find it and it will save me $1,000 a year or whatever it cost to use ValueLine. It loads quickly (faster than NY Public library) and is meant as a quick glance. When you wind up investing, you'll have to check the actual filings anyway. So good enough for me.

-

Share your Portfolio 2024

in General Discussion

Posted

ROIC is a surprisingly large position for you. Any specific reason? @thepupil