tnp20

Member-

Posts

585 -

Joined

-

Last visited

-

Days Won

8

Content Type

Profiles

Forums

Events

Everything posted by tnp20

-

If the AI bubble like the Internet, in what year are we now?

tnp20 replied to james22's topic in General Discussion

CAUTION: Anyone that wants to get up to speed on the AI revolution must focus on the AI breakthrough of 2017 and onwards. The machine learning - the mathematical/statistical/decision tree/linear regression has been used successfully for a while by data scientsts - THIS IS NOT IT !!!! The old Neural network AI - RNNs, CNNs, LSTMs etc - THIS IS NOT IT !!!! The new AI is built on top of RNN, CNN, LSTM - its got some new features like LSTM, Attention mechanism, encoder/decoder etc - THIS IS IT !!!! This new AI is badly referred by various acronyms: At is heart its a TRANSFORMER MODEL. These TRANSFORMER MODELS are also called FOUNDATION MODELS. LLM (Large Language models) are text version of these FOUNDATION MODELS....other TRANSFORMER MODELS work with pictures, videos, voice, sound, numbers, telemetry, any kind of data really. This is what you want to learn about !!!! I am not saying machine learning is not important but thats not the new breakthrough - machine learning is awesome and you should understand it in the broader picture but its not the breakthrough that will fundamentally transform business and society that this other one will. Lot of the early stuff has wow factor like Chatgpt and Dalle-2 (try it its awesome)...and like the internet..internet took off when the porn industry got hold of it...lot of the early stuff will seem non-serious but thats because people haven't thought deeply about how to use this new tool to deeply transform their business ...this stuff does not belong in the IT department (yes its bizzare when I say this), it belongs on the front lines of business when the operations people need to figure out how to use it and what business "people, process, technology" need to be completely transformed. So when some one says they use "AI" ..one must absolutely clarify which one they mean - this is where some of the hype comes in as CEO's IT department tell him/her "yeah we use AI...been using it for a decade"...and he goes on a conference call and says "AI" 10 times. Now the picture is blurred a bit as you could combine this new AI with machine learning AI so they could be using both and together in some cases...but the Industrial Revolution 4.0 is about this new AI (2017 version). This 2017 version of Neural network AI is called Generative AI. -

If the AI bubble like the Internet, in what year are we now?

tnp20 replied to james22's topic in General Discussion

Its easy to get confused in this space so let me summarize. AI = deep learning + machine learning. Deep learning is the neural network type of AI ..simulates brain neurons. Machine learning is a statistical / mathematical model type of AI - simulates decisions trees, linear regression, optimization problems. AI has been around since the 1970s including deep learning neural network and machine learning mathematical approaches...it made progress at glacial pace and is often difficult to use. When in 2010-2020 ..Date warehouse and Date lake and massive amount of data became available - the statistical type machine learning took off and showed good results and is being used today...that sort of got incorporated into lot of applications without a lot of hype - you needed data scientists and operations reaseatch type folks to implement it using various machine learning tools..and it was done successfully ...but this is not the big break through. Neural network AI has been difficult to use. CNN used for face recognition made some progress but you had to train these models manually and using structured data to make them work which made them difficult to develop but once develped were very useful so the results were mixed - but some had good success. But then in 2017 a paper came out from google called "Attention is all you need". It was a breakthrough in approach in how Neural networks were built. Of course there were some earlier breakthroughs that led to the 2017 moment but approximation is 2017 is when the NEW AI revolution started. This new AI - you could give it the entire world corpus + internet in unstructured form and it could self learn - it trains it self over several iteration. The end result is in two parts. (i) A brain with lots of knowledge and (ii) A sponge that can learn new things very quickly. What you see with ChatGPT is (i) - it spits out things its learned. But whats most valuable is (ii). Imagine something that is easy to train with new data of any form - you no longer have to mess around with number of neurons, number layers, number of input/outputs, type of network to make it work - it just works out of the box with any kind of data - any - structrured or unstructued, text , images, sound etc ...any ...and this ability to learn fast with any kind of data is what makes it powerful. Find interviews with leaders in this space - start with the famous Bill Gates interview, interview by Geoffery Hinton...if you understand the technology like they do (and me too) its not difficult to think this is Industrial Revolution 4.0 and it will be bigger (and longer) than the internet ...it will develop in fits and starts like the internet but at some point the S curve takes off. I promise you that you wont waste time and effort if you get up to speed on this stuff....but looking from the outside at a black box , its easy to conclude its all hype. Just that this one is different. AI before 2017 (Apple newton failed because it did not have network connectivity to do useful things) AI 2017 (first iphone with network connectivity, limited apps) **BREAKTHROUGH EVENT==>IMPLICATIONS AI of the future ( iphone 13 with plethora of apps and hardware features) -

If the AI bubble like the Internet, in what year are we now?

tnp20 replied to james22's topic in General Discussion

You are both right and wrong. Hype has gotten ahead of reality where everyone is touting use of AI. The reality is moving forward with real AI applications getting implemented and used everyday - the most glaring example is not ChatGPT but something called co-pilot. Its used in coding as well as office suite of products. Others have things that are similar. Many , many other applications now being used and its using the new AI (so called transformer or foundation model, not the old AI...raw neural networks you had to configure yourself). Its coming...but S curve applies...first slowly and then all of a sudden. We are far from 2000-2001 moment. The mother of all bubbles may be coming ... There are 3 opportunities here...... (i) trade into a bubble (ii) short the heck out of the top (Jessy moment) (iii) and when babies get thrown out of the bath water, pick up the amazons and the microsofts of AI for long term hold... -

If the AI bubble like the Internet, in what year are we now?

tnp20 replied to james22's topic in General Discussion

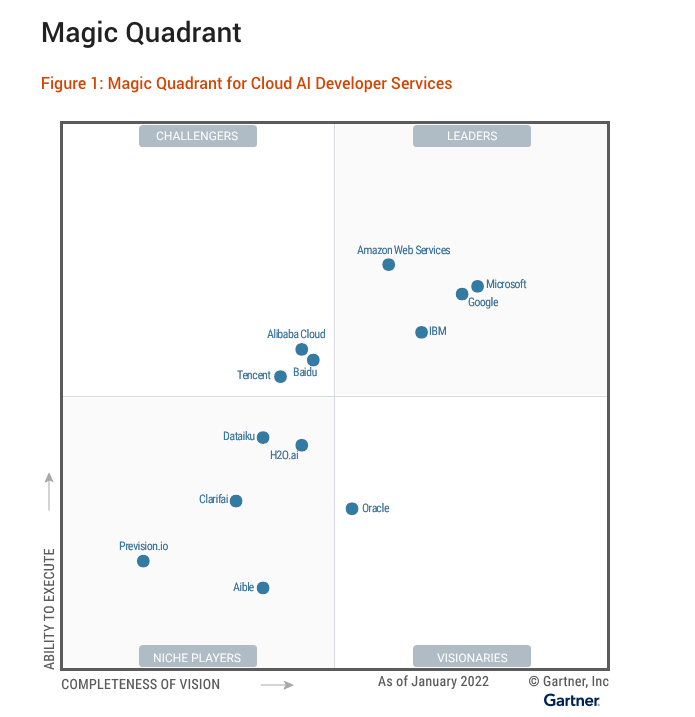

From an investment perspective here is the state of affairs in the AI space. Its still early but looks promising longer term as new developments are occurring rapidly both in breadth and depth .....this a revolution in the making....its real. There will no doubt be a 2001 moment as with dot.com....and the idea is to identify who will lift off during the inevitable bubble... Best Play: Specialized semiconductor players - huge parallel compute needed, and efficient compute needed for inferencing (i) NVIDA - this is where its at...only game in town. Grossly overvlaued but could be driven higher by momo. (ii) AMD - about 1.5-2 years behind but have everything it takes to catch up - reasonably valued/may be slightly over valued. This would be my choice on pull backs. (iii) INTC - they dropped the ball - ship is going to take a while to turn around and they are loosing ground - they need to quantum leap to catch up and not likely in next 3-5 years. (iv) SKhynix/Samsung/Micron - besides GPU chips, high bandwidth memory is needed for AI chips in huge demand .... each has issues so not compelling case by itself. not sure how to invest in SKHynix. Samsung is too diversified. Micron may be behind in High band width memory. Second Best: Hyperscalers - need huge compute to both train and then inference (run the model) (i) Microsoft - by association with OpenAi and they have an ability to imbed AI in all their products and charge more. - valuation seems a bit rich but not unreasonable. (ii) Google - Leader in AI space ...they have a lot of stuff in the lab that needs to get productized but will get there, they also make their own AI chips - good value here - this would be my choice on pull backs. (iii) Amazon - later starter but this is a marathon and with their huge customer base they have a lock on customers locked to AWS - good value here - this would be my choice on pull backs. Third tier: Data Management companies since data is what gets fed into the models (i) Snowflake - low conviction but may get there - seems over valued but Buffet or his lieutenants bought its during IPO at higher prices. (iv) Oracle - new one popped up on my radar - they bought a lot of the new high end NVDIA gpus and building a cloud with it and with DB customer lock seems a natural fit and beneficiary long term - good value here but conviction low as I havent been following Oracle story much. Unicorns: Pre-ipo companies that are coming on the radar but you cant invest in them yet (i) Data Bricks (ii) Anthropic (iii) Scale AI (iv) Hugging Face (v) Cohere (vi) Tenstorrent ...many others ...I dont follow these closely as its too early for these guys from an investment perspective... -

I see it more clearly as Xi failure. Why on "god's earth" would you try and create multiple battle grounds in the middle of gigantic covid crisis ? That is a strategic blunder of magnanimous proportions..... Multiple battles started by Xi during covid... (i) Geopolitical war (ii) Tech war (iii) Education war (iv) National security drive (v) Pop housing (vi) Consequences of covid war (that no one else in the world adopted):- - Load up local governments with huge debts fighting endless covid lockdowns - Scare foreigners - both from an investment perspective and from a tourist and resident perspective - many have left and are not coming back and few are going there now Should you not do a controlled burn in small areas one at a time making it more manageable and less severe ? Sounds like he is an hurry ...but for what and at what risk?

-

Continuation from BABA thread as I think it belongs here... You can boil the whole China investment thesis into Pragmatism versus Rigid orthodoxy of Xi (what ever crazy idea Xi has in his head ...taking on geopolitical war, tech war, education war, housing war at the same time in the middle of a freaking once in 100 year extreme economic and social event - the covid pandemic). Xi likes to create an alternate model to the West that he thinks will be better model both for China and others. He sees himself in the Moaist mold (which any smart person would tell you is utterly stupid and has nothing to offer). He begrudgingly accepts the free market capitalism because it catches mice. He fundamentally fails to understand the Western model and this has a lot to do with his key advisor Wang Huning who thinks West is failing utterly and this is their chance to come up with the "China model" as an alternative. The problem with Xi is his model based on new made up ideas is untested and lot of the factors that go into it are interlinked and not well balanced at all. Wang takes the western model's failure and adopts the opposite but the opposite is not the answer as it breaks other things in a delicate fine balance of the Western model of freedom, property rights, free market etc. Yes USA model is failing but it needs tweaking not an overhaul (and probably same with lot of other Western systems). My Chinese friends decades ago expected China to open up and become more liberal and democratic as well as capitalistic. Under Xi, the first two has been reversed and there is a question mark on the third. The chances of a new model working for China that is better than the West is low (as its untested and there is no history of it) and the odds are even lower of it being adopted by others even if it works for China simply because people are not willing to give up there freedoms for long. Rich Chinese are leaving or at least have one foot outside just in case. My recent conversations with those who know China and have lived in China and are China native falls into two camps. (i) China will get prosperous because they want to be to prove model superiority. (ii) You can't trust the CCP long term because leadership has no checks and balances.

-

https://archive.ph/SYpXj#selection-4075.154-4075.162 A prominent Chinese influencer has called on his fellow citizens to invest in the country’s stocks as property woes persist, at a time when the world’s No. 2 economy is mired in a deepening crisis of confidence. “Given low expectations for a further massive expansion in the housing market, many folks don’t know where to put their money, except for bank deposits,” Hu Xijin, former editor-in-chief of the hardline tabloid Global Times, wrote in a post on his Weibo social media account Friday. “The stock market should be a key destination for funds.” “It’s time for China to more seriously build the stock market as an investment venue that matches its economic weight,” Hu wrote. “Perhaps we need to rebuild the stock investment culture with the participation of the government, enterprises, investment institutions and ordinary citizens.” Massive money flows possible but likely starts with a trickle.... Point is China doesnt need USA or Western investors....enough domestic and middle eastern and other sovereign wealth funds to drive their markets....

-

https://www.scmp.com/news/china/politics/article/3226039/china-mounts-cultural-offensive-win-war-narratives-against-us-will-other-countries-be-swayed?utm_source=Twitter&utm_medium=share_widget&utm_campaign=3226039 "However, analysts said that while Beijing could succeed at boosting cultural pride within China, it might struggle to convince the rest of the world of its alternative to the Western-dominated global order." The top economies in 2050 will be USA, China, India, Indonesia (the exact order is debatable). No one is going to convince India and Indonesia to join "China order", let alone Europe, Japan, Korea, Anazc. China's best hope is LATAM and Africa. I think the world order will still be western led over our lifetimes.

-

Not splitting hairs but taking a pragmatic approach here ..... Long term China is screwed, why ? :- (i) Demographics issue will catch up but with delay (ii) Lack of basic freedoms and rights (property rights) that go hand in hand with a true capitalistic society (iii) World's best talent wont move there (unless we make USA a right wing white suprematist shit hole that hates foreigners) (iv) Its miltary wont be > US + alliances (v) Yuan wont be the reserve currency because XJP's policies are ultimately contradictory to true open flows of capital Short/Medium term I am bullish, why ?:- (i) China has to play the game set by the west to make progress towards their 2035 goal - ie wont rock the boat near term (ii) Urbanization is 65%, Korea and Japan is 80-90% so another decade or two of strong growth still in the tank...reforming the Hokou system and greater urbanization move frees up rural labor to mitigating aging working population (iii) They will continue to open up their markets and economy - this is what they have to do to have any chance of Yuan being the replacement for the dollar. (iv) Huge potential in domestic consumption and developing the larger middle class (v) Valuations in China are very cheap

-

There is just no demand for land right now...these are usually areas in lower tier cities. Good locations would be snapped up right away. Also depends on what the land was designated for...commercial , industrial or residential. With glut of built and in-progress housing with lack lustre new sales no one is going to bid on land except prime real estate they can sit on. This is to be expected and confirms the realities on the ground.....Housing is stuck and values for full constructed units continue to erode somewhat (but not crash). There is talk of government potentially buying some of this and converting it into low income housing ...especially for lower tier cities. Stabilizing housing is one of their top policy goals in the "fixing the balance sheet recession" plan but its all talk right now, no meaningful action has been taken other than tweaking the 3 red lines and loosening some of the restrictions around first and second homes.

-

https://www.yahoo.com/news/taiwan-presidential-front-runner-says-010428749.html I maintain my stance that there is no urgency on China's part to go after Taiwan...this issue will go from boil to simmer for the medium term.

-

This is the correct policy prescription for balance sheet recession. Everyone knows about risks of falling into a balance sheet recession. Every policy mandarin has read Richard Koo's book. Leadership listens to Liu Yuanchun - he is a highly trusted economist. The disease is known. The medicine has been prescribed. Now only the drugs need to be taken and wait for the effects. If need be the dosage needs to be increased until the disease is in remission.

-

The risk of balance sheet recession is real and their lack of serious action to date is puzzling given the rapid deceleration in economy. Not sure what they are waiting on.... They have acknowledge the issue and the remedy at the highest level.... Folks point out the high level of local government debt. Central government debt isnt too bad and its all denominated in their own currency with low inflation and $6T foreign currency reserve (mostly dollar), they have both the fiscal space (to print and spend) and monetary space (low inflation) to stimulate the economy. The issue is timing....analysts have been screening immediate action needed but so far crickets.....other than small interest rate reduction earlier last week.

-

They have some levers to fight the demographic collapse in the short term - but not long term - its part of the broader structural reforms needed. (i) Remove registration system for big cities - so people can move freely anywhere - this will attract many from the rural farming area to where the jobs are. (ii) Enable older people past retirement age to be able to come back , no forced retirement as is the current system, especially if they are mentally and physically capable to do the job still - people can still be productive past 65, move the retirement age up (iii) Automation through AI - many of the factory and even some service jobs can be automated by AI driven robots - China is pushing big into both AI and robotics (iv) Control Social safety net for the elderly so the burden of young supporting old is not too large - China already his pretty miserly pension/social benefits but as the averge middle class income rises, they can control how much of that extra income is transferred to supporting the elderly. - for a while but not long term. My investment case is not China - my investment cases is specific monopoly companies with tremendous moat and great balance sheet with large international exposure - they should so well despite the perhaps long term deteriorating macro/demographic picture long term. I think geopolitics will quite down short term so a 2-5 year horizon is reasonable. Beyond that it remains to be seen but would re-evaluate every year what steps they are taking...I think there will be a sugar rush...and valuation will normalize but the long term gravitational effects will impact valuations longer term and it remains to be seen how they cope with these multiple factors...if Xi continues to make stupid policy decisions ...its game over for China.

-

Well its several things.... (i) Xi is still primarily to blame, not his people.Xi is an ideologue going in the wrong/different direction from the original 1978 opening up intentions. The old direction's destination was what we are more used to in the west. The new Xi direction is trying to take USSR/Maoist style control and bolting it on to capitalism. He still sees value in the old system (if you gut out the failed economic model that didnt work) because he thinks (Waning Huning is his strategic advisor) the West is failing with too much freedom and too much openess, and also threats that poses to the CCP. This is like threading a needle....there arent any successful examples of what he is trying to do and he is dumb because he doesn't realize the openess/inclusivity/freedom/property rights is an integral part of capitalism that you can't pick and choose. (ii) His people are scared shitless. That top down command structure where if you fail to meet Xi's metric (what ever crazy idea he has) your career suffers. They are doing this half-hearted not to piss of Xi. They are not sure what many of his directives actually mean so they err on side of safety and caution resulting in half baked implementation. e.g. Despite crack down on the education sector, black market tuition is back with full force. XI's intention was to lower the financial pressure on average Chinese to get their kids in top schools ...so now instead of the formal education sector now its underground and there is an information black market education sector. (iii) The smart ones are probably actively sabotaging his policies to make him look bad - but I dont have examples of that and it would take a lot of damage and time to remove Xi ...coup is China has a very low probability...best one can hope for is some physical or mental incapacitation.

-

This is rather long but is an excellent and balanced piece on China opportunities but also glaring issues. This guy spent 30 years in the National Planning Commission coming up with the goals and execution for nation nth 5 year plan. https://www.pekingnology.com/p/ex-ndrc-officials-comprehensive-review The last paragraph says it all... In summary, to address the structural economic slowdown in China, it is not necessary to solely rely on expanding domestic demand. Stimulating government investment through fiscal stimulus is not sustainable, considering the increasing debt burden of local governments and the limited room for further borrowing. Instead, focusing on supply-side structural reforms, such as addressing regulations in the real estate sector and promoting long-term public rental housing, while encouraging innovation and entrepreneurship, can lead to more efficient and sustainable economic growth. These reforms can also foster the development of new industries, technologies, products, and services. Emphasizing market-oriented reforms, rule-of-law governance, property rights protection, inclusivity, openness, and innovation and entrepreneurship will contribute to overcoming the current economic challenges, aligning with the original intent of China's reform and opening-up policy initiated in 1978. We must unswervingly stick to that route. I think author is saying Xi has veered off course and thats not going to be good...we need to get back on the old track.... Three-legged stool of capitalism Chinese style is unlikely to work well because:- (i) rule-of-law governance - no CCP value destroying matras on tech/education, etc (ii) Openness - Foreigners were blocked access to CHinese equivalent from Bloomberg recently for financial/market data - Access to global uncensored internet so people can make informed decisions and foreigners can easily stay in touch with their famiies - Xi has made china more of a jail - who wants to live in a jail ? (iii) inclusivity - Xi prosecution of Uihguyr and tibetan culture , Pushing Han/Mandarin culture as the primary (iv) Entrepreneurship - stop attacking entrepreneurs , innovation comes from private enterprises, not SOE ...Xi has reversed trend favors SOEs. My point is China has potential, but they also have a lot of structural issues and the ideological Xi is not helping the situation with bad ideas.

-

Why am I bullish short medium term..... This guys is one of their top economic advisors... https://www.gingerriver.com/p/prof-liu-yuanchun-on-chinas-q1-economic They really want to repair the balance sheet of (i) lower and middle class and (ii) Large, Medium and Small enterprises......after the balance sheet damage done by covid....so that implies they will continue the policy support (both fiscal and monetary) until the trickle down effects have gone all the way down to repairing the balance sheet of all of these entities/people...so it may be a multi-year affair for the sugar rush peak so leaning towards 3+ years this bull market continues ....and it takes substantial profit recovery for these business to (a) improve balance sheet (b) raise pay/income to boost confidence further and (c) reduce youth unemployment .....so once they step on the gas pedal with the stimulus, I think they keep going (with some minor throttling) until they achieve the goal to repair the lowest balance sheets...only then they are back to normal pre-pandemic. This chart is interesting ..M2/Liquidity correlation with the SHanghai CSI 300 china stocks.....it was a screen grab from Bloomberg TV so I dont have a way to play with it... Note the peaks of the "sugar rush" and the timing from the bottom knee curve... Just eyeballing says that the peaks occur roughly 18-30 months from the bottom .... And given the disparity between M2 and the stock market and how much above M2 it goes....we can expect at least a double from here....

-

I am a china Bull short to medium term but not long term and not because of demographics in particular....well sort of.... https://themarket.ch/interview/george-magnus-china-will-not-be-able-to-de-dollarize-under-xi-ld.9180 https://themarket.ch/english/china-is-in-danger-of-growing-far-below-its-potential-ld.9068 https://www.pekingnology.com/p/tourism-industry-official-deplores After China's covid policy - many ex-pats have left never to return again. Tourists are not going to China anymore and is a crisis situation....many folks who move to China lament the fact that they can't stay in touch with family and information flows as easily as China sensors internet/social media heavily. This basic freedom or lack thereof means that the world's best minds and tech entrepreneurs will not find China and appealing destination to settle for themselves and their family. The covid experience probably fades after a while but those who stayed in china during COVID universally had a very bad experience and many left. The issue is level of freedom and lack there of. With their demographic issue, with number of people declining and number of smart capable people decline in proportion they will have ever decreasing number of people who can drive the engine of growth and innovation unless they can attract smart talent from elsewhere but who wants to go to China when you can go somewhere else thats free-er and better. Many rich Chinese themselves have a second passport - just in case. No one trusts the regime - yes there is CCP propaganda for the masses but the smart folks are all keeping an insurance policy as they are not drinking the cool aid. Xi is all about Control, Stability and Strength. Xi's thinking/policies/principles are in direct conflict with whats needed for China to be a long term success. Free markets need some level of basic openness and freedoms to succeed long term. Anyone who says XI is smart doesnt know what they are talking about!!!! I have had number of discussions with people who know and understand China intimately. There are smart Chinese in the upper echelon trying to do their best to tame Xi's worst tendencies but what Xi wants and what is truly needed for China to succeed are in direct conflict. Xi is too stupid to realize this dilemma. (as opposed to dont care what color the cat is as long as it catches mice thinking)...so the answer is China's success will be either limited/plateaued or worse fades fast after a peak in a the next decade or so. Of course another leader could take over and course corrects but thats a different matter. I had several Chinese friends who thought a decade or so ago that China would slowly liberalize/open up not just its markets but in terms of some form of semi-democracy - yes probably with chinese characteristics with CCP still playing a central role but more open/liberal political scene. Li Lu and Tianamin square student movement was crushed by the previous regime so they knew population is yearning for more freedoms. Super fast (and unscientific ) Pivot of covid policy was a affirmation that Xi's stupid policies were about to cause major unrest and to prevent that they had to pivot to maintain control. China may do well despite Xi's policies but its super power status that replaces the USA is highly unlikely because of these structural issues. Xi's failure are many but include:- (i) Highly damaging Covid policy - left many people and companies and local governments indebted (ii) Value destroying Tech/Education/private company crack down (iii) wolf warrior policy. The latter has delivered numerous countries right into US's lap and now are actively in part of some alliance against China. Many of the same countries were neutral before their wolf warrior policy. Why did they need to make so many enemies needlessly ? The countries that matter in Asia over the next 30 years are India, Indonesia and Japan - they have the population growth, economic growth or GDP weight to matter. They are direct economic and military competitors to China.

-

If your China thesis is correct, Apple is also a sell as ~20% of sales come from China and a very large part of production. Buffett owns a lot of Apple. Apple's chips are made by TSMC. As to war... China's most recent and significant land wars have been:- (i) Korean - easier to buttress North Korea - resulted in stalemate (ii) Tibet - an easy land grab. (iii) Defense against Japan - was loosing until allies helped They have no history of naval battles or invasion by naval force - which is much harder than land war especially when waters are crawling with allied subs and surface vessels are sitting ducks to barrage of missiles from Taiwan. Think Normandy losses x 100 and there is no surprise factor with satellites and alternative landing zones. As long as we don't box them in, like we did with Japan oil embargo, we leave them with rational but less than optimal options. We left Japan with no options and they acted irrationally with respect to Pearl Harbor so the chances of an irrational act on part of China are much lower but never zero. CCP wont act until it sees chances of success as 95%. Failure means a neutered China and possible end of the communist party - a risk Xi in particular will not be willing to take. Taiwan is not attacking China so what is the immediacy ? If there is no immediacy, why not aim for absolute certainty when you know time is on your side ? They will not do anything until:- (i) Technology self-reliance (ii) EV reduce reliance on oil

-

These pieces are very good:- https://www.clocktowergroup.com/research-insights/chinasthreetrapsmacrotrilemma https://andrewbatson.com/2023/05/10/xis-new-growth-synthesis/ https://www.prcleader.org/

-

Lot of our views are US/Western centric. Lets assume geopolitics go from boil to simmer back and forth and never normalize as a basic conservative assumption. Yes, it will loose western investors. US investors will be probably more averse than Europeans. But you still have Middle-east soverign funds and much of Asian that is still growing. Granted you wont get investors from India, Japan and Korea as excited but still there will be some flows. About 10-15% of Chinese own stocks. The European and US figures are 30-55%. SO if domestic investors get more excited about their own markets and economy, Chinese markets can propel themselves for decades to come and each 1% adds roughly a $1T in buying power. China is both making it easier for foreign and domestic investor to invest with various schemes (IRA, Yuan counter, etc) already implemented. Long term Chinese need foreign capital and they know it. Domestic investors are also being cajoled into directing their savings from house buying or CDs into stocks and this is likely to be slowly at first but will pick up pace. The hinderance of course is Xi himself. He hasn't quite figured out how free markets operate. His covid strategy, his attack on tech companies/entrepreneurs his poor strategy on geopolitics and optics of it are all feeding into one big CRISIS OF CONFIDENCE. Domestic investors and entrepreneurs are shell shocked. They would rather save then spend or invest. You have a perfect crisis of sorts in China stocks. Many Chinese companies have monopoly like positions with excellent balance sheet and cheap valuation metrics by any measure. You have to pick companies in CHina carefully but this is where the proverbial "fish" are. Munger may say turds and raisins but he is buying this turd with both hands via Li Lu and Daily Journal. Few other reputable fund managers are too. There are three classes of China investors:- (i) Wont touch China stocks because they dont like the system no matter what the valuation is - fair enough, your points are likely very valid but I suspect it will play out over longer term not short-medium term. (ii) Hate Xi and geopolitics but like the valuation which is incredibly cheap for select Chinese companies - add 2-5% China stocks to your portfolio . Its either a zero or multi-bagger. (iii) Go with greater conviction on China - but realize that there are gating functions that must be watched and if it fails at any of the gating function, start reducing position. What are the gating functions ? - Confidence collapse is more sustained even with pending stimulus - we have a Japan like situation after their property bubble and weak markets could last 20+ years. - Geopolitics gets worse and it looks like we are willing to suffer very painful decoupling (so far its been de-risking but not true decoupling else Apple , Nike, Starbucks etc would be down big) - Xi's style of "Capitalism with Chinese characteristics" is increasingly too Maoist for foreign and domestic investors - Republicans come to power and ban all investments in Chinese stocks...so watch the language of emerging candidates and their posture towards China - ofcourse there is rhetoric and reality but still... Notice I didn't bring Taiwan into this. Invasion of Taiwan will not happen for at least 10 years. Why ? - US and allies hold all the main choke points for oil into China so any war will not last long. - China needs time to digest the Ukrainian lesson and reformulate and retool. Chinese navy just isn't experienced enough to take on the US navy at this juncture. As long as they are making threatening noises - no war will actually happen but the minute they stop making noises - something serious has happened - some change in strategy that might include war. -

-

I think he was holding google back. There is a story that says google followed his advice to hold back until microsoft came out with ChatGPT. Then I think there was an internal disagreement as to which way to proceed. From what I am reading google is way ahead of OpenAI or Microsoft . The issue is can they leverage that from the lab to the market place to both to fend of microsoft and to capture new markets. I personally believe this space will be so big, it will be big enough for the top players to stay busy...Msft, goog, Amazon, IBM....but over time I think MSFT/GOOG duopoly will emerge ...but not for 5-10 years. IBM the old dinosaur is probably the cheapest here.

-

Lots of great points on China. The first rule of war is you need over whelming forces for a decisive win. Even then, if the enemy is tenacious (and well supplied), the situation becomes long drawn out quagmire....which means not good risk/reward. Crossing an ocean adds another complication added to the mix and raising the bar to act. Dalio's article was right to point out the very poor state of relations between the two countries...and they could get even worse. But that does not mean war automatically. No one's (new) territory has been effected by the relationship going down the drain so the immediacy of war makes no sense. China's red lines are Taiwan declaring independence ... but that is highly doubtful from a Taiwanese perspective both because why poke a dragon in the eye when you don't need to and because the Taiwanese themselves are fine with the status quo limbo situation. Even if they foolishly declare independence, it does not again automatically mean war , there are many other powerful levers that can be pulled against it (like naval blockade etc) before declaring war or invading...all points at which the situation can be potentially diffused. There is also no surprise factor (there wasn't one for Ukraine). Any invasion plans by China will be long detected by Satellites and on ground assets to give Taiwan some serious "teeth" just in time before it happens. Chinese War games will have a certain "indicators" which determine if they will turn real or not. For Russian/Ukraine situation the "indicator" was Russians building up supplies of fresh "blood" - at which point CIA knew it was for real. For China, its likely to be building up unusually large arms and fuel reserves on the coast facing Taiwan. There is also the timing factor. Chinese Navy is getting powerful but they are just now getting operational experience with their carriers and carrier aircraft - they likely need another 10-20 years for the Navy to be ready to attack and counter USA/Japan/Korean forces. Then there is the economic factor. What if China kills two birds with one stone. If they dominate the semiconductor space and are cheaper and better than Taiwan in 10-20 years - Taiwan will no longer be economic powerhouse and may be the Taiwanese will be more amenable to some accommodation that is unification "like". Then there is the nuclear factor. Taiwan has 3 nuclear power plants that have been operating for decades. They have the technical capability to produce several nuclear devices (untested) from re-processed nuclear fuel. Any hint of an invasion and they could "test" an underground device for "peaceful purposes" and China would get the hint. Interestingly enough China can't actually engage in any other war in the meantime ... for if they came out with a bloody nose - their military capability and their emerging super power status immediately comes into question...so its best to remain untested unless you are absolutely sure of a win or you have no choice. This is all rhetoric and show of force while they bide their time. They will be very very patient. Xi is no lunatic. They will act when the odds favor their decisive victory either economically or militarily.

-

This is equivalent to Texas putting 10 commandments in schools. On a totalitarian scale its much lower than Xi or Erdogan. Yes, the tweak is wrong from historical perspective but the author makes too much out of it. XI is wiping out Tibetan and Uigar culture...this is not even close. Whats with the book covered in blood ....and not mentioning Modi was cleared of any wrong doing for the Gujarat riots by India's supreme court ( its probably lot less corrupt then ours given the recent events)....take author's bias with buckets of salt. I guess the Economist must be running out of good stories, after all they have a paper to sell. I have always hated shallow stories that are easy to write (even if they are true), it means the author is too lazy to dig a more interesting but difficult story ..with well researched data that took months to write. Lets focus on the investment case (signal) and not be distracted every political act (noise) in the country. Imagine if foreigners made investment decisions in the USA based on Texas situation or national abortion ruling. As always ...pluses and minuses with each country and whats the objective and the time frames. No one who is looking long term at India going to pull their investment dollars out by reading this article.