beerbaron

Member-

Posts

1,486 -

Joined

-

Last visited

Recent Profile Visitors

The recent visitors block is disabled and is not being shown to other users.

beerbaron's Achievements

-

Totally for dynamic pricing. Works well for concerts or Uber/Lyft because its a quasy Monopoly. Not sure its feasible in restaurant without your neighbour doing something similar. We shall see. Would not bet on this one working out. Beerbaron

-

Yeah i have been scratching part about the energy side. Any ideas to play this, datacenters use fixed price energy contracts so can go with select few utilities.

-

After I asked Gemini to read BRK's letters I gave it the below prompt and that is what I got as an answer. Pretty good IMO, not 100% WEB style but close. Scary good considering it would have taken me 1 day to try to do as good. Please make a letter Warren Buffett style giving the following advices to a 15 year old girl learning about the stock market. About 1 page: -I have learned that you were given a school stock picking contest and that it ends in june of this year. -Stock pickign is hard. Short term is a voting machine and long term is a weighting machine. -Picking stock winners overs the next few months is a fool's errand. -Explain what metrics one should be focused on to be a successfull long term investor. -Explain fear and how it's important to be risk averse but bet accordingly when the opportunity presents itself. Give some catching examples from Warren's past, and make sure to use a down to earth language similar to what Warren uses. To a Future Investor: A Few Words on the Market Dear [Girl's Name], Word on the street is you're diving headfirst into the world of stocks, thanks to a school contest. That's fantastic! It's never too early to start learning the ropes, and what better time than when you've got the whole game laid out in front of you? Now, before you get swept away in the frenzy of picking winners and losers, let me offer a word of seasoned advice: the market is a tricky beast. In the short term, it can be like a chaotic voting machine, swayed by emotions and fleeting trends. Chasing quick wins over a few months is akin to playing a game of chance, and even the most seasoned investors wouldn't recommend that. Instead, think long term. Imagine the market as a giant weighing machine, where the weight of a company's true value ultimately determines its worth. This is where the real magic happens. By focusing on strong businesses with sustainable competitive advantages, healthy financials, and honest, capable management, you're setting yourself up for success over the years, not just the next few months. Remember, fear and greed are two emotions that can cloud your judgment. It's natural to be cautious, especially when the market takes a tumble. But remember, fear can also be a valuable tool, preventing you from making impulsive decisions based on short-term fluctuations. However, there's a flip side to the coin. When the market throws a good pitch, offering stocks at undervalued prices, you need to be ready to swing the bat. Just like in 1989 when everyone was panicking about rising interest rates, and we at Berkshire Hathaway saw an opportunity to scoop up shares of Coca-Cola at a discount. We knew the company's fundamentals were rock-solid, and the temporary market jitters wouldn't change that. That investment, my dear, turned out to be a home run. So, the key takeaway? Approach the market with a healthy dose of skepticism, a long-term perspective, and the courage to act when the time is right. Don't get caught up in the short-term noise, and focus on building a foundation of knowledge and sound investment principles. Remember, slow and steady wins the race, especially in the marathon of investing. If you're ever feeling lost, don't hesitate to reach out to someone you trust, a mentor, or a financial advisor who can guide you on your journey. After all, even the Oracle of Omaha didn't get here alone. Wishing you all the best in your investing endeavors, Your fellow student of the market, [Your Name]

-

I came accross this wonderfull TV series (10 episodes from 1980) where Milton Friedman tackles subjects and then discusses with other discerning opinions. I have to admit, it's great to hear a great orator expose it's theories and debate it in a civil manner. It's also a time machine that shows forecast from that time period, and it's amusing or enlightening to see if he was right or wrong. There are subjects where Milton is weaker, or, at least less articulate, such as education but noneless a TV series that makes me wish we'd still lived in a society where debates can be civil. I hope you guys will enjoy it as much as I did. BeerBaron

-

It's likely going to be the play for both Russia and China. Here is Xi and Putin OS. Let's call it Putin95 for the fun of it... LandGrab = 100 sq km WaitTime = 5Y While Military Action < Than Direct Bomb { Land Grab = Land Grab * 2 WaitTime=WaitTime / 2 Wait(WaitTime) }

-

What Is the Best Investment That You've Ever Made?

beerbaron replied to blakehampton's topic in General Discussion

My prenuptial agreement... on so many levels. Most not financial. Beerbaron -

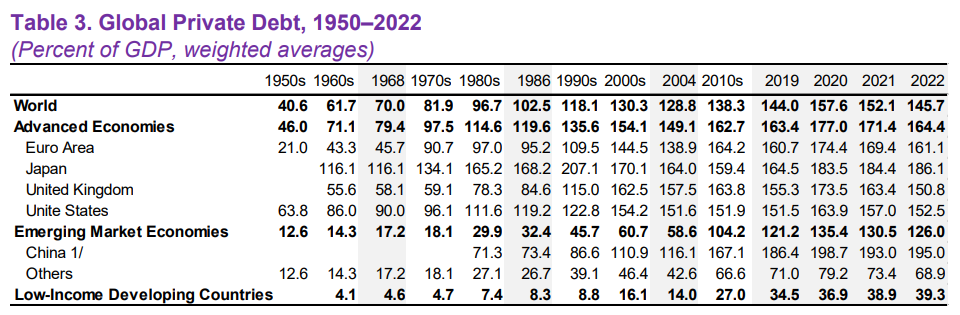

I never actually knew anything about Zeihan before yesterday, so I did not have any bias. Here is private debt to GDP figures from IMF and world bank... NOTHING like Zeihan shows. Unless someone cal tell me I'm wrong, this guy seems to molds and deform figures to make the story so simple a 5 year old would enjoy's the show. Take whatever comes out of this guy's presentation with a huge grain of salt. Beerbaron

-

Is that me or a lot of what he's saying is not substianted? For example, the number of empty housing that I heard for a university professor that specializes on India and China last week was 100 to 150M, not the billions Zeihan states. Also, the part about Jinping about not knowing about blackouts does not seem plausible China has news and even under a communist regime, those kind of things pop-out. Very articulate dude but I somewhat feel like he's not being truthfull. BeerBaron

-

Slowly increasing crying it out from 3 to 10 minutes worked for both of our kids. I remember a few times where I had to take our kid with me downstairs so my wife would not freak out over a crying baby for 10 minutes. I just visited a village that reproduced the living conditions of 1880s. A household would have 14 kids, the kids would sleep 4 per single sized bed, the smaller twos at each end and the taller ones in the middle. Anybody that tells you letting a kid cry out is bad for their mental health needs to take a step back trough evolution, birds throw their babies out of the nest and, for thousands of years, human kids were neglected based on today's standard. There will be plenty of time to reinforce their self esteem later, but, it will be pointless if their parents lose their mind. It might be worthwhile to rent a hotel for the night so that the wife sleeps without hearing the baby. Being a parent is a scam, everybody tells you how wonderful it is, but as soon as the first one pops-up they are laughing at your lack of preparedness. To sum up what one of my relative told me. "Do your best and f*** the rest". I love my kids, it gets easier but the road is long and painfull. Be prepared for 20+ years and make sure you don't screw it up at the end, this is when it pays dividends. BeerBaron

-

The below is a much more accurate picture. Russia does not have infinite supply and they have not ramped up their manufacturing 10X like some commentor would like us to believe.

-

This paper suggests that China's GDP could be more than half of it's reported size. I would be interested to hear what you guys think and how to see if peer reviews agree with this paper. https://bfi.uchicago.edu/wp-content/uploads/2021/07/BFI_WP_2021-78.pdf Here is a quick youtube video for those too lazy to read: BeerBaron

-

Hi, I have to buy half of my house from my ex-wife and instead of getting a fixed 5Y mortgage at 5.5% I tough it might be better to margin stocks (about 15% LTV) and use the cash proceed to buy the house. As additional insurance I would probably want to do interest rate swap so that I "convert" my variable to Fixed (4 to 5Y). I'm Canadian so this would have the advantage that the interest and hedges would be tax deductible. What are the retail instruments that I could use to do a dirty interest rate swap? Thanks BeerBaron

-

TFSA Transfers and Contributions (Canada)

beerbaron replied to beerbaron's topic in General Discussion

Thanks for everybody, who needs the Canadian Revenue Agency when you have thecobf.com! Thanks BeerBaron