MrB

Member-

Posts

1,182 -

Joined

-

Last visited

Content Type

Profiles

Forums

Events

Everything posted by MrB

-

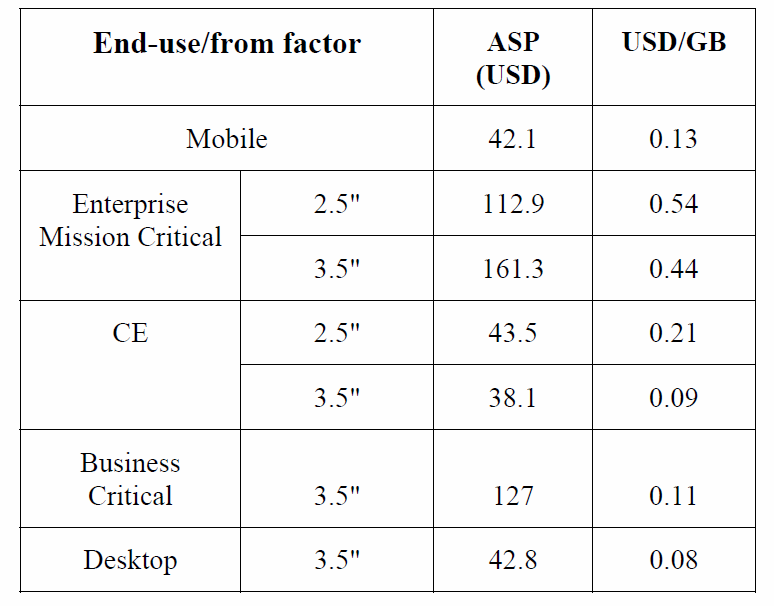

Great points. Something else. Take a look at the attached 2011 industry prices bearing in mind that drives sold for use in the cloud will fall in the BC and EMC segments. So you can lose a few Desktop HDD sales as long as you sell 1 BC or EMC drive. BC/EMC (3.5" drives) carry lower margins though, so not sure what the exact ratio is.

-

There are different segments of the storage industry. Companies like EMC and Netapp that do enterprise storage are increasingly becoming software companies. (With some services and integration... because their products are complicated.) I think that this segment of storage will be an area of a lot of value creation. Dell paid a ridiculous P/E multiple for Compellent. There are companies that make flash hard drive controllers (e.g. Sandforce). These chips will become increasingly complicated as time goes on (in the future, they will have to do a lot more error correction). There may be some unusual value creation here... though I don't know who the winner will be. There are companies that slap parts together, e.g. OCZ. I don't think that this is a great industry. There are companies that make the parts that go into a hard drive... e.g. Hutchison Technology. Not a great industry. Another way to look at it is to look at the industry structure. The suppliers to WDC/STX's numbers look horrible, which makes sense if you are supplying to a consolidating industry. The attached (pages 7-10) gives a good breakdown of the industry. Seagate-Technology-Final-Version.pptx

-

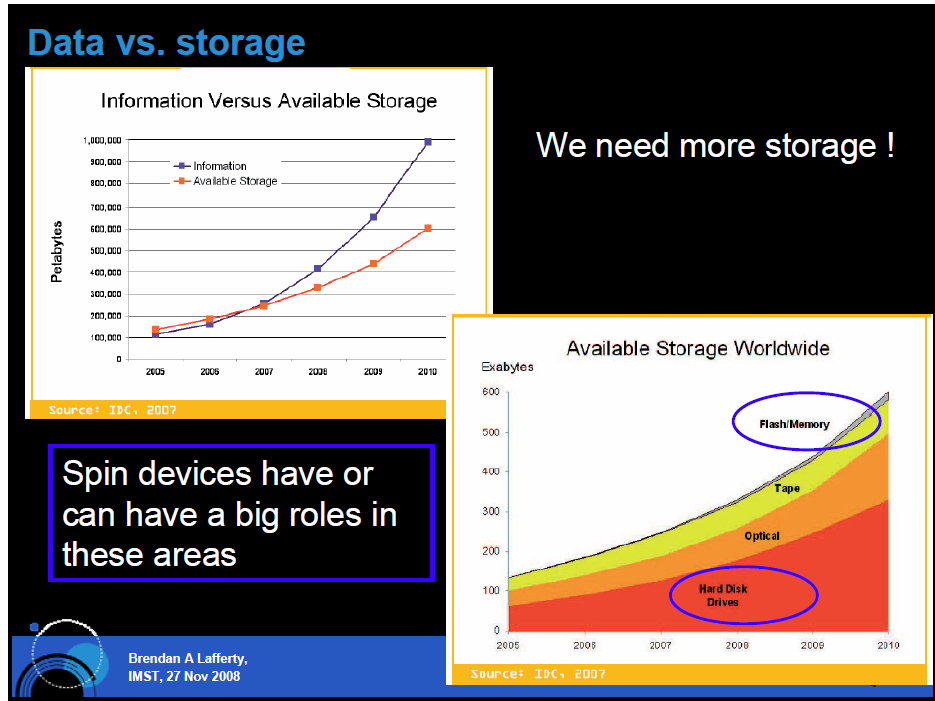

Flash is rapidly growing in datacenters. People have figured out how to overcome that problem (to some degree). It is already selling right now. Here is a great blog on the high-end storage industry: http://storagemojo.com/ Unfortunately, I couldn't figure out who the winners will be. A desktop drive at 15k rpm would be extremely uncommon. The Western Digital raptor runs at 10k rpm versus 7200rpm (and 5400rpm) of mainstream hard drives. I don't know of any products targeted at the desktop market that is faster. I think that flash will clearly kill off most demand for high-rpm hard drives. Flash is rapidly growing in datacenters.........True, but it's relative and from a low base. Datacenters itself is growing rapidly. Also, why would you put flash into a data center at 10 times the cost? Speed. However, once you dealt with the data quickly then at some point the need for the speed goes away, but the data does not. It then gets moved. Where to? HDD and maybe ultimately tape. Look at the attached. These technologies compliment each other. Say you have today's AIG Bloomberg article on ILFC being sold. There will be very high demand for that article today. Flash will do the job and it pays because today that article is worth a lot. Tomorrow? Next week, Next month? It can now be stored on HDD, because speed is not needed anymore. Next year and beyond. Put it on tape, because you are going to have very few people accessing that data. Roughly 20% of data still stored on tape today?

-

Technology changes can happen very very quickly. Software... look at ICQ and Myspace. Smartphones... look at RIMM and its stock price (or market share or free cash flow). Storage... look at the Jaz drive. USB thumb drives and mp3 players have killed a lot of demand for CDs and floppy discs. I think it's perfectly reasonable to expect the current trend of more flash to continue for the next few years. Question. Did it kill or move storage? If it moved the data, where is it being stored now?

-

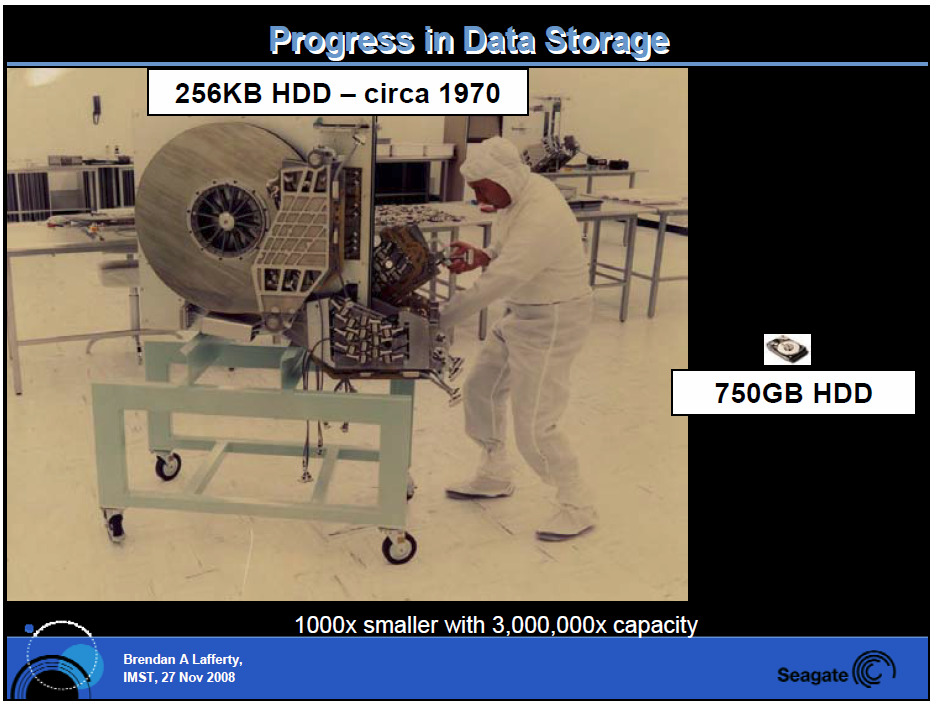

Now many years? PE of 5 with flat to increasing FCF with 50% of it being returned to shareholders via a buyback. It shrinks the time you have to think about significantly. The technology? At what point would you have given up on investing in automobile engine manufacturers back in the day? When you essentially had a duopoly and electric "engines" were introduced? With electric the cost was prohibitive and there was no clear advantage over the existing technology. How come we have not changed the basic technology of the car engine for decades? Take a look at the attached picture. The basic technology has not changed. Same thing only smaller. Also even if flash did replace HDD it will take years and you don't have to know anything about the technology to figure it out. You only have to understand data storage demand and cost of capacity. I also feel technologically challenged, but I don't think you need to figure out the technology, cost of capacity gets you there.

-

Thanks for the feedback. What do you mean by "that". I agree. This transition does not automatically spell the death of STX/WDC, because a. The adoption cycle for SSD will take a long time. Remember if we are talking a PE of less than 5 on next year's earnings then the market is essentially pricing HDD to go away in about 5 years. This ignores the fact that for SSD to be adopted 100% the factories must be built to make those SSDs. To put some numbers on it. The laptop storage market grew from 69EB (exabytes) to 95 EB from 2010-2011. Flash capacity went from 11EB to 21EB. However 90% of that capacity went towards Smartphones, tablets and SD cards. Only 2.1 EB went towards SSD. Why is that the case? I think it simply reflects the cost/utility. SSD is 10 times more expensive than HDD. That gap according to Moore's Law will decrease by 50% every 18 months, but remember with STX/WDC together spending $2Bn on R&D per annum (some towards SSD) the cost of HDD is also still rapidly going down. So the gap will probably take closer to 10 years to close. 5 years from now SSD will still be twice that of HDD. So the cost of capacity for flash. The laptop storage market will probably be about 125 EB in 2012. Samsung's Fab 16s was complected at a cost of $11Bn in 2011 with a capacity of 6 EB per annum. So a very rough/back of the envelope calculation suggests a $229Bn investment for the notebook market alone and assumes it can all be built tomorrow. It will money and time. Reading over all the jargon the basic points are that it takes time and cost a truck load to adopt SSD and at a PE of 5 (EV/NI is less) you might very well be overcompensated for taking on that risk. Technical Note: SSD or solid state drive is essentially flash in a tray. Think of a SD card, made bigger and put in a tray to use as a hard drive in your laptop. Same technology, different use. b. Both companies are in SSD already and they know how to adapt. WDC started out manufacturing semiconductors for calculators in 1970, motherboards for desktops in the 1980s and moved into HDDs in the 1990s, storage products in the 2000s and now it is a solutions business. Do yourself a favor and visit http://www.wdc.com/en/ and look at the products. Is this a HDD company or a product/solutions company? Those were my sentiments exactly. Now consider the following according to Reuters. AVG 10 year ROE (%) INTEL 12 MSFT 33 IBM 45 WDC 52 STX 42 AVG 10 year ROC INTEL 17 MSFT 17 IBM 9 WDC 15 STX 8 10 year total cash flow numbers (Bn) INTEL (Market Cap - 100 Enterprise Value 97) OCF 131 WC+Capex -54 FCF 77 Div -22 Buybacks -46 Goodwill (indicator of growth by acquisition) 10 MSFT (MC - 224 EV 170) OCF 176 WC + Capex -22 FCF 153 Div -64 Buybacks -83 Goodwill 13 IBM (MC - 214 EV 235) OCF 170 WC + Capex -52 FCF 118 Div -20 Buybacks -91 Goodwill 26 WDC (MC - 9 EV 7.6) OCF 8 WC + Capex -4 FCF 4 Div 0 Buybacks -1 (Another 1Bn this year) Goodwill 2 STX (MC - 10 EV 11) OCF 13 WC + Capex -8 FCF 5 Div -1.5 Buybacks -4 Goodwill 0.5 Bear in mind that WDC and STX is now operating in a duopoly. An interesting aside: In 2011 5% of the technology type of the storage market size sold (20 EB) was made up of magnetic tape worth about $1Bn in revenues. The companies involved? IBM, Oracle and LTO-Consortium. Thanks for the input. Keep it coming.

-

OK I APPRECIATE ALL THE FEEDBACK. HOWEVER, CAN WE PLEASE SET THE STANDARD HIGH FOR THIS THREAD. SO WHENEVER YOU SAY SOMETHING BACK IT UP WITH FACTS OR GIVE ME SOMETHING SOLID I CAN RESPOND TO. THE REASON I SAY THAT IS BECAUSE A NUMBER OF THE ISSUES YOU RAISED ARE EXACTLY THE ONES WHICH I INITIALLY THOUGHT JUSTIFY THIS IDEA NOT DESERVING FIVE MINUTES OF MY TIME. HOWEVER, THE MORE I SEARCHED OUT THE FACTS THE MORE I REALISED I MIGHT BE PLAIN WRONG AND SO MIGHT MOST PEOPLE OUT THERE WHICH MIGHT BE THROWING AWAY THE STOCK FINALLY. WHEN YOU RAISE ISSUES, WHICH I STRONGLY ENCOURAGE, PLEASE GIVE ME HANDLES TO GRIP ON SO I CAN BUILD AN ANALYSIS AROUND IT. MAKE SPECIFIC POINTS I CAN RESPOND TO, DON'T JUST DO A BRAIN DUMP

-

Myth..so how about 10 consecutive "small buy orders" please? Should get us some way to where we need the price to go ;)

-

The bears and sell side say it is because of the extraordinary contraction in HDD supply due to the Thai floods and earthquake in Japan. The latter lead to disruption in the supply chain to the HDD manufacturers. Also, due to the disruptions OEMs and just about everyone else overstocked due to the fear of not being able to get your hands on HDD. That lead to a significant spike in pricing in particular, but also more volume than would have been the case. They say the party is now over and we will return to the slide in prices. I think what the market might be missing is exactly what management of both STX and WDC have been saying all along. Things have changed and they have indeed. Over the last 18 months the industry finally consolidated into a duopoly with roughly 43% (WDC) 40% (STX) and 17% Toshiba; I'm obviously implying Toshiba is not playing a significant role. Both managements make it clear that 30% gross margins are hear to stay. WDC CFO 5 Dec "And we finished the year with $2 billion -- approximately $2 billion in free cash flow. It was an incredibly agile company that has also expanded gross margin from 15% ten years ago to approximately 30% right now....And the one that I want to point out is an increase of our gross margin model to 27% to 32%. Significant increase was at the prior model, approximately half of it was driven just by the HGST acquisition and rounding out the product portfolio. We feel comfortable that we can live in this model. It's not an aspirational model. It's something that we manage ourselves to. Many people ask us "Can you hold this model in this market where everything really speaks against you from a macro perspective?". I want to point out that we are in the third quarter of supply being greater or capacity I should say being greater than demand, and we are in the model. So, it's not an aspirational model. 27% to 32% quite frankly is what we need to earn in order to achieve our return on equity and return on capital targets" STX CFO 4 Dec "Interesting thing in the September Analyst Day -- both the large players had an Analyst Day that both their financial models were very, very similar. I think we talked about gross margins, long term, 27, 32. We talked about a range of capital deployment of anywhere from the 4% to 8% of revenue dollars of capital. We also talked about how we return our capital to shareholders' excess cash flow while we're making the appropriate investments in R&D and other technical adjacencies." STX CFO 14 Nov "Well, I think it -- the question is, why would the pricing stay at these elevated levels for post-flood? Well, one, I think there's a couple of different reasons. One, I would say they're -- they may be elevated, or you could take the position that pre-floods, they were -- had gotten too long in the tooth going too low. So I think there was a rebalancing of it to get into the supply and demand, number one. And number two, once we're up there, if we have to deploy the capital to sort of make these investments -- because our business is not about backlog. Our business is not about having someone else share the risk with us. When we open a media factory, when we decide to build or deploy that capital, that's the risk capital we take in place. And so, if you take a look at the size of the storage is still yet to come, you say you need those levels to make that investment. Because if it does go down there, you'd have to come to the thesis that, okay, who's going to deploy that capital then? And then you get back into the shortage and then you'd have price rises again. So, by keeping a flatter pricing structure, you can make those investments. So, I think the industry will -- can determine that. I mean, where there's three players now, we can determine it because we all have to deploy that risk capital. No one's getting a freebie that someone else deploys that capital for them. In order to make those investments, you need to have these -- this margin structure. I think the market is missing the fact that what you see through the windscreen is a totally different picture to what you see through the rear view mirror.

-

Anyone care to add reasons to why this stock should be shorted/bear case? 1. SSD threat 2. HDD price erosion 3. Risk from patent law suits. Case in point; $630m arbitration award that was recently vacated. More of those? 4. Taxes. Extremely low (6%-10%) tax rate is somewhat of a mirage, because those taxes need to be paid if funds are repatriated to the US. They just started paying a dividend and announced a significant buyback program. So more taxes will be paid on historical profits. 5. Share option programs are very aggressive. Current outstanding of 22m on 230m SO and recently asked and got approval for another 20m 6. Vertically integrated industry consisting of a duopoly, which makes it vulnerable to supply chain shocks. What else would you add to the bear case?

-

Probably no connection http://www.bloomberg.com/news/2012-12-06/wes-swank-of-kyle-bass-s-hayman-capital-dies-at-31-in-car-crash.html

-

He actually remembers me of Tony Stark from Iron Man. Billionaire, inventor/engineer/etc of course tony is way cooler... Oh you are really going to hate hearing this. It goes straight for the inner boy in all of us. http://www.businessweek.com/articles/2012-09-13/elon-musk-the-21st-century-industrialist "Jon Favreau, a friend and the director of the Iron Man movies, has called Musk the basis for his version of comic book hero Tony Stark, the playboy inventor who builds a flying weaponized suit." Agh! Now tell me that does not hurt ;)

-

See him squirming in his seat though when he got the question about permanent capital. "The magic sauce"

-

Some more perspective. If you rid research of the impact of survivorship bias, less than 1% of funds outperform the market by more than 3 percentage points. See page 80 of http://www-stat.wharton.upenn.edu/~steele/Courses/434/434Context/EfficientMarket/malkiel.pdf Chou Associates's investors (i.e. net of fees) outperformed the S&P (incl div reinvested) by 3.8%, 5.5% and 4% annually over 10, 15 and 20 years respectively; compounded by 10.7%, 10.3% and 12.4%. Data as of the end of Oct 2012. Awesome.

-

Any chance of scanning and posting that cover please?

-

I'm a bit behind on my homework on the fundamentals of those names, so don't have an opinion. I understand why it might be interesting though.

-

"Superinvestor Arnold Van Den Berg Delivers His Annual Client Review"

MrB replied to a topic in General Discussion

14.45% annualized since 1974 is pretty solid, though many have done much better. http://www.centman.com/investment-strategies/cm-value-i-all-cap-value/performance Many? You will struggle to come up with more than 5, maybe 10. Even if you would come up with 50 it will still make them a Superinvestor. They will certainly rank in the top 0.1% of the fund population. Great notes!! -

Anyone has the name or copy of the Goldman report referred to here, please? http://www.forbes.com/sites/ycharts/2012/10/22/goldman-sachs-creates-a-dividendbuybacks-measure-and-four-insurer-stocks-shine/

-

Calling all pink sheet/unlisted/micro/nano-cap investors

MrB replied to oddballstocks's topic in General Discussion

Oddball, 1. Where do you prefer we discuss specific stocks? 2. I'm doing a quick scan through your list. Ash Grove Cement. Have you looked at Heracles Cement in Greece? 0.3 times book and currently trading at EUR2.10 with a EUR 0.98 capital return in November? -

http://www.bloomberg.com/news/2012-10-22/albert-ueltschi-pilot-billionaire-buffett-cohort-dies-at-95.html

-

Considering the average holding period for a stock on for example the NYSE is between 3 and 4 months, the above makes total sense. Having a 3-5 year holding period alone gives you a competitive advantage.

-

55min with Jamie http://www.youtube.com/embed/TU5P5ufZQdk

-

http://farm9.staticflickr.com/8469/8076759710_9f03ba338f_m.jpg The dates at the bottom of the pic run from 1980 on the left to 2010 on the right.

-

+1 giofranchi Ah! Almost forgot! Mr. Keynes had expressed exactly the same thought in a letter to the Chairman of Provincial Insurance, dated February 6, 1942: “To suppose that safety-first consists in having a small gamble in a large number of different direction…, as compared with a substantial stake in a company where one’s information is adequate, strikes me as a travesty of investment policy.” "As time goes on I get more and more convinced that the right method in investment is to put fairly large sums into enterprises which one thinks one knows something about and in the management of which one thoroughly believes. It is a mistake to think that one limits one's risk by spreading too much between enterprises about which one knows little and has no reason for special confidence." (emphasis mine) giofranchi I agree, but your success rate/strike rate should be considered. The person that gets 10 out of 10 picks right can concentrate more than the one that gets 6 out of 10 right. Buffett and Munger is rumoured to be in the high 90s