MrB

Member-

Posts

1,182 -

Joined

-

Last visited

Content Type

Profiles

Forums

Events

Everything posted by MrB

-

I can't even find the normal PE by country. Bloomberg has some countries in the data but not many. The FT has a table for normal PEs and so does the Economist I think

-

Sarcasm...HDD is supposed to be dying because density gains are topping out. Apparently not. As you said, "Moore's Law seems to be alive and well"

-

Ouch...doubling the density? The question is at what cost, but it still is an important breakthrough. HGST Reaches 10-Nanometer Patterned-Bit Milestone, Nanotechnology Process Will Double Today's Disk Drive Data Density AN JOSE, Calif., Feb. 28, 2013 /PRNewswire/ -- HGST (formerly Hitachi Global Storage Technologies and now a Western Digital company, NASDAQ: WDC) is leading the disk drive industry to the forefront in nanolithography, long the exclusive purview of semiconductor manufacturers, by creating and replicating minute features that will allow the doubling of hard disk drive (HDD) density in future disk drives......... http://www.itnewsonline.com/showprnstory.php?storyid=259258

-

Corner of Berkshire & Fairfax Message Board - 11th Anniversary!

MrB replied to Parsad's topic in General Discussion

Well done! -

I posted this on the BAC thread, but it might be worth repeating here. Weighting in a fund is based on cost. To illustrate; for a fund of $100 I can put $10 into a stock, which with a share price of $1 means I can buy 10 shares for my fund. If the share tanks to 50 cents then I cannot add to my position. However, what I can do is sell my shares and buy back the position 30 days later, thereby establishing a new cost base, and in this case I can now buy 20 shares. So it if he is selling only in one place and not the other and his cost base is materially higher in the place he is selling then it is a safe bet to assume, that is what is happening. So, selling to buy more.

-

Interesting. In his US fund, he still owns quite a few BAC warrants. Sanj, any thoughts as to why the difference? Top Holdings As of December 31, 2012 Top 10 Holdings percentage of assets Overstock.com Inc. 30.4% Resolute Forest Products Inc. 15.8% MannKind Corp. 10.5% Sears Holdings Corp. 8.9% Bank of America warrants 8.7% UTStarcom Holdings 7.3% MBIA Inc. 5.7% JPMorgan Chase warrants 5.3% ASTA Funding Inc. 3.6% Wells Fargo warrants 1.9% different rules apply.

-

Greenlight's buying http://www.bloomberg.com/news/2013-02-14/einhorn-s-greenlight-buys-google-aetna-sells-wellpoint.html Zarley, I'm just messing with you, but how do you feel about selling your stock to Einhorn?

-

Give Ryanair some respect. It is an airline and a fantastic business! There, I said it. No I'm waiting to be kicked off the board ;D

-

Would you believe it, they actually made money. http://www.wdc.com/wdproducts/library/company/investor/Q213iis.pdf $1Bn in free cash flow for 6 months of 2013 financial year. Over 4 quarters since buying HDGT Overall headcount reduced by 12% Days inventory outstanding reduced by 30% Days sales outstanding reduced by 42% Repurchased 10% of shares over last 3 quarters. ROA 14% ROIC 21% Now who would want to own a company like that? It sells hard drives after all.

-

Western Digital Hits 15-Year Peak on Talk of Buyout http://www.bloomberg.com/news/2013-01-22/western-digital-hits-15-year-peak-on-talk-of-buyout.html

-

From 9m30 mark http://www.businessweek.com/videos/2013-01-23/dimon-weber-kostin-speak-in-davos-on-regulation

-

I think this link strings the above together http://www.bloomberg.com/video/appaloosa-s-david-tepper-on-stocks-strategy-hNEuFAUQSKORXP5UJNYUUQ.html

-

Japanese Stocks - Where to Start?

MrB replied to Ballinvarosig Investors's topic in General Discussion

Are you giving due consideration to the assumptions you are taking on board when backing out the cash? The obvious assumption would be that a. management will turn that cash into producing assets very soon or b. it will soon be returned to the investor. Well soon depends on the discount rate you are using and the price you are paying, so we could be talking 5 to 10 years in some cases. Nonetheless I would just make sure that the assumptions do not undermine the economic reality of the investment. -

Japanese Stocks - Where to Start?

MrB replied to Ballinvarosig Investors's topic in General Discussion

No that is a fair question and the following is quoted from the first draft of a letter I’m putting together now, so consider yourself a guinea pig. Firstly, in practical terms the removal of $600Bn from a $15,700Bn economy is hardly the end of the world. It is not inconsequential, but the world will not grind to a halt. Secondly, $600Bn of debt on let’s call it a $16,000Bn debt pile is insignificant when measured against roughly $46,000Bn of total US tangible assets plus $141,000Bn of financial assets sloshing around American pockets. You can question how much of those tangible and financial assets are being double counted, but against that you have to also consider off balance sheet assets such as the “recently discovered” US gas assets unlocked by fracking. By some measures the annual oil/energy saving for the US can run to $600Bn/annum. The benefits are already being felt. Consider that from 2008-2012 US GDP grew from $14,200Bn to $15,700Bn yet net oil imports for the US decreased by 3.3m barrels per day to 7.8m barrels per day for an annual saving of around $100Bn. Thirdly, you have US Fed that is clearly backing up its commitment to do what it takes with actions to the tune of $85Bn per month or $1,020Bn per annum, so I doubt they will let $600Bn spoil a good party. What should concern us is that the US is currently spending 10% of “tax” revenues on interest while interest rates are at historical lows and the majority of the debt is very short term (even lower interest rates). Stimulus will not end until inflation forces the world to demand higher interest rates, which will force the Fed’s hand and lead to higher interest rates, which means your 10% could quickly become 20% and then you very, very quickly have serious problems. So, for us Dec 2012, Jan 2013 and the foreseeable future will be business as usual, but we can hear the train coming. I have a slightly different view to most on debt to GDP, because I think it is a bit like talking about Debt/Revenue for a company. Be as it may, I also think the US and Japan are in different positions both in the size of the problem and the immediacy. Japan’s issue is very large and with inflation just about guaranteed in the next few years their hand could be forced on interest rates very soon. Moving from sub zero interest rates to 2% while spending more than 20% of revenues on servicing your debt strikes me as a slightly comprising position. I am not advocating I know exactly how it will pan out in the medium term, but I am certainly not taking any currency risk. Hence my generalized question…do you hedge the currency? In light of the above I imply it might be a good idea. So simply put: yes the US might have similar issues, but it ain’t tomorrow’s problem. Correct, but Japan’s ROEs clearly show that it comes at a huge price. In fact it is a net cost, because from what I can tell Japan’s companies have ROEs below cost of capital. You can have full employment tomorrow in the US if you are able to convince all US companies to run with sub 8% ROEs. Note that I am purposefully avoiding putting numbers out on ROE, because it varies significantly depending who you listen to. Goldman Sachs estimated it to be 3.25% in 1995 and according to them it is now as high as 7%, but I question the methodology they are now using. My research indicates that it is now closer to the 1995 number than the latter. And that is not a bad philosophy to have. However I bet you will not invest in Iraq, Pakistan or maybe Nigeria. If not, why not? Japan has real well documented problems and not thinking about them does not make them go away. In this case it really is not that complicated and on a basic level you have a “new” BOJ very clearly saying that they will inflate…it is now or never… Personally I will not bet against that, I will put in the call to my broker to hedge the currency. It is not a scenario I’m contemplating. Japan is not going away, unless they really cannot let the Spratley Islands go or whatever those islands are called they are fighting over. Please note that I did not suggest Japan is not a place to invest. I said there are hurdles, I think, you need to overcome. We’ve had a long and happy experience investing directly in Japanese stocks. However, I think a critical ingredient is that we’ve always set exactly the same bar we set for US or any other company. Well run companies of which the pocket risk is as important as the fundamental investment risk. I’m simply not prepared to invest in a low ROE company even if it has a high cash component if my partner is sitting on that money until the cows come home. Offering that company to me at a fraction of its cash does not change my mind. In conclusion: Is the JGB market in bubble territory? Is the stock market generally depressed? Will inflation cause the JGBs to deflate? If so where does the cash go? Interesting thought. -

Japanese Stocks - Where to Start?

MrB replied to Ballinvarosig Investors's topic in General Discussion

Hurdle 1 - http://www.youtube.com/watch?v=JUc8-GUC1hY&feature=youtu.be Hurdle 2 - http://ajw.asahi.com/article/economy/business/AJ201212210055 Then would higher inflation lead to higher interest rates and how does it affect its ability to service its debt load? Hurdle 3 - Flows out of 1 & 2. Do you hedge out the currency? Hurdle 4 - I'm loosely translating Chris Browne's view (from Tweedy). Japanese view a company as a trust. The main aim is to pass on the keys/assets. It is not to maximize value for shareholders. Hurdle 5 - Do you really get a marginal risk/return advantage when compared to companies like AIG/BAC/FFH/MKL/BRK/LUK/WDC etc, etc where you get P/BV from 50%-110% and PEs from 4-12 with very little currency risk, risk of a bond crisis and proven shareholder friendly managements? Worth considering. -

Sorry, I was making some big jumps there. With "inverted" I meant, airlines/railroads have a 70/30 fixed/variable cost structure and HDD has a 30/70 fixed/variable cost structure. Thereby meaning that, If you have a leveraged business with a 70% fixed cost base you have to compete . If you have an unleveraged business with a 30% fixed cost base then you don't have to compete (HDD). You can "afford to" sit back and wait for prices to improve. However, if as you suggested the economics of the industry changes permanently it only buys you more time in the case of the latter. You will still end up in the corporate graveyard.

-

Perhaps we could look at airlines versus railroads. Obviously the airplane did not kill off rail. But, it killed off a lot of railroad stocks because the small decline in their business was amplified by their high levels of debt. Sometimes a small decline in business can be a big deal. Of course, transportation is different than storage. The storage companies don't have very high levels of debt. And changes in the computer industry tend to happen a lot faster. It might be worth considering that the variable cost structure for rail/airlines v HDD is inverted. 70% variable for HDD, which if your broad thesis is correct means HDD will take much longer to die...

-

They never had a major ROC program. Recently announced for the first time and they already started the buybacks so I see no reason to doubt it. However their share dilution is significant, as mentioned before...roughly 2% per annum. So net you should a share reduction in the 8%-12% range depending on price. It is also clear from their communications that they think about price so ROC will scale between 100% divi to 100%-250m buybacks dependent on price.

-

What I find interesting is that FCF is supposedly around $3Bn and $250m of the 50% of FCF that is being returned is in the form of a divi and the rest with a buyback. That should be at least $1Bn which is roughly 10% of the company. $3Bn/$10Bn makes for an obvious bargain and the return of capital provides downside protection. The question to invest hinges on the direction of those cash flows going forward; up or down? Melting ice cube or growing business? We know what the market is saying, but it comes down to volume growth and gross margins. I think there is a more than 60% probability that volume growth will be there, but gross margins are more difficult to call. It has been steady, but for the first time you are dealing with a duopoly with a very fragmented customer base. That traditionally makes for pricing power. With an initial yield of 33% I might be over compensated to take on that risk. If you play around with the FCF numbers then there is a lot of bad news priced in.

-

http://www.computerworld.com/s/article/9234744/SSD_prices_continue_to_plunge SSD prices continue to plunge Cost-per-gigabyte is down more 66% for some models in three years For reference the new 4TB WD drive goes for about 10cents/GB

-

http://www.forbes.com/sites/ciocentral/2012/08/02/no-solid-state-drives-are-not-going-to-kill-off-hard-drives/ The comments to the article are also interesting. The problem is that the recent growth driver of volumes have been mobile not enterprise. So the cloud argument makes sense, but it is not showing in the volumes yet.

-

And that is that as the wise man said...for all my searching and data gathering it pretty much comes down to what you said.

-

I thought so to and have heard a lot of people say that. However, technology/patents, reliability (we're talking backing up your data here!), vertical integration and OEM relationships create more of a barrier to entry than people give the companies credit for. Following on that an related to your ROE question. That competitive position gives them pricing power. Maybe it is really as simple as that. Everyone seems to be looking for something more complicated than that, but maybe it is just as simple as...they have pricing power and the proof is right there infront of us.

-

I don't dismiss what you are saying, I just want to see it in the facts, because I've turned a lot of corners with these companies only to find something totally different to what I was expecting. On the point I highlighted--something that bothers me is that data production has been very strong over the last few years yet HDD growth has not been that strong. We could be at the inflection point where the slowdown in CE/PC is being picked up by enterprise, albeit slowly. Still trying to figure that one out.

-

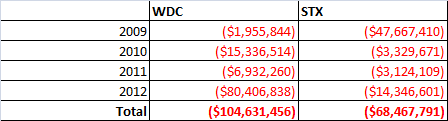

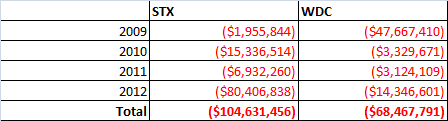

Somebody is getting rich! Insider trades for both attached. For 2009 not complete data for that year.