MrB

Member-

Posts

1,182 -

Joined

-

Last visited

Content Type

Profiles

Forums

Events

Everything posted by MrB

-

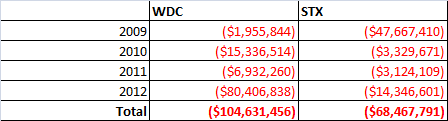

Somebody is getting rich! Insider trades for both attached. For 2009 not complete data for that year.

-

Interesting. Could people backing up to cloud backup services that use tapes turn around the seemingly secular decline in tapes? I came across this for tape info: http://www.insic.org/news/A&S%20Roadmap.pdf Nice one..thanks for sharing. I think people should be backing up to tape more. It is currently about 5% of the market and in volume market share seems to be growing about 1 percentage point per annum and to be conservative I think one should factor in that it will speed up. Growing at 1 percentage point per annum from 5% is not insignificant and the price of tape is very low. So I do think it is a threat. I looked into accessing that story before, but with less than $1Bn in revenue shared by the LTO consortium there is no way I could see to access that story from an investment point of view. Happy to get some ideas though.

-

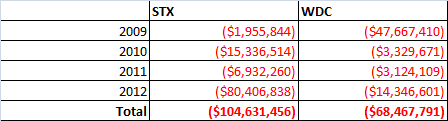

Both STX/WDC just launched or it might be that WDC is about to launch 4T drives. Although people like hoarding the whole backup story is totally nuts. I generally save a tonne of information only to revisit most of it.....well never. I think annual data volume is about 900 EB and the world is currently shipping enough EB storage (2.6) to back that up almost 3 times over. However, look at the attached digital footprint of an email. It's nuts! Correction: I read somewhere that there is enough storage capacity to back up everything on the Web, twice over. I cannot find the source though, so put a question mark over it. However, the data from IDC suggests in 2012 2,600 EB of data is being created and total storage is 1,188EB. Also, what is important, as far as I understand it, is that the 2,600 EB is production/replication this year and 1,188EB is total storage capacity this year, not new storage capacity. Anyone...please correct me if this is wrong, but that is the way I read that data. So maybe we all wake up and realize that maybe we are over doing this a bit or is it a case of...to paraphrase "nobody ever lost money by betting against the intelligence of the public"

-

Based on what? A. As previously stated and supported by facts. Even if we assume you are right, the cost of SSD is prohibitive to meet demand. B. It is not a laptop story and even if it was it still only moves data into the cloud where the majority of it is stored on HDD. See attached for a more complete picture of what the playing field looks like. It is much bigger than laptops. It is much bigger than laptops and SSD have a definite role to play…but so does HDD. SSD has its own issues on the tech front SSD has a bleak future http://www.computerworld.com/s/article/9224322/SSDs_have_a_bleak_future_researchers_say This paper from IBM explains that the runway for HDD and tape is much brighter than for SSD http://www.digitalpreservation.gov/meetings/documents/storage12/5-Fontana-StorageMediaDenstiyfoRNANDTAPE.pdf Not saying SSD is not a great technology...just suggesting it might not be all plain sailing How many users today go straight from 0 to a smart phone? They will never have a laptop or a PC. However, they bring more data to the party, which gets stored where? See attached. So you are broadly correct, but there is a tradeoff. The data still sits on HDD….and SSD….and tape. Why not? Price balances demand and supply. There are powerful forces at work suggesting demand will only grow (no guarantee) and supply? Two doors to knock on…..or more than 100 SSD doors. I appreciate your input!!

-

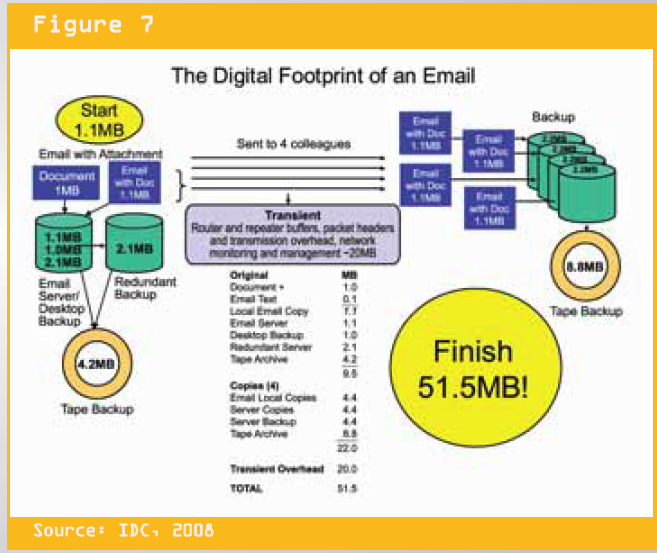

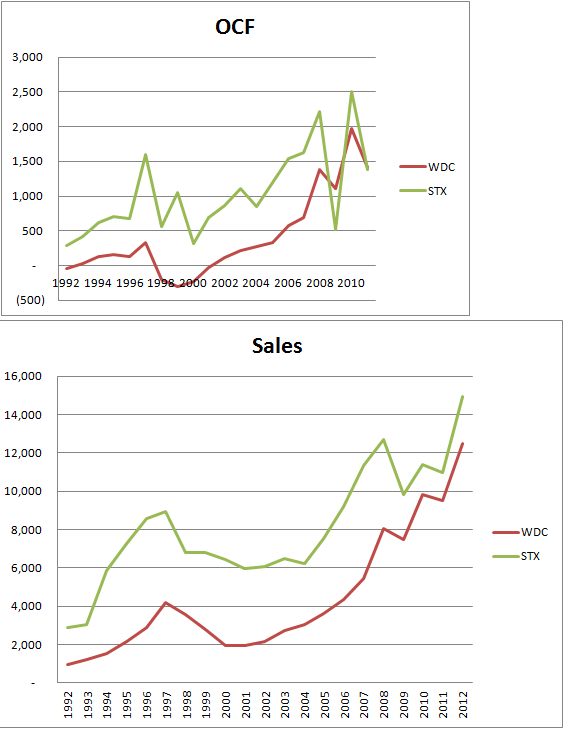

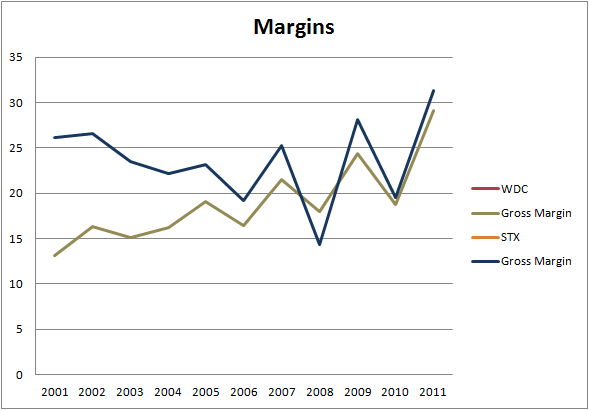

I am not sure exactly what your point is, I assume it is fundamental performance, so I’m not sure the attached data speaks to your point. Please feel free to let me know if you meant something else. I attached the gross margins, operating cash flows and sales over the long term. I think the trend is clearly still the same, more so for STX. However, WDC did experience significant weakness from 1998-2001, both operating cash flows and sales. STX stayed cash flow positive throughout the period, but both showed a significant slowdown in sales from 1997-2003/4. I had a quick look at WDC’s 10k for 2000 and it suggests those losses were related to a major product recall, production costs which resulted in them moving production from Singapore to Malaysia and diworsification/botched acquisition of Connex in particular. So not sure exactly what you are driving at and whether the above sheds light on that, but happy to explore. On another note, I suppose the trick is to figure out how the rear-view mirror gives a sense of the road ahead for all those companies. For WDC/STX another concern is how much of that gross margin/general performance was driven by consolidation, which is now over. Will they play nice or is it a case of the big dogs staring each other down? The future could therefore look very different compared to the past for these two companies. See attached. I recall seeing that specifically mentioned. Google not buying enterprise class drives. The latter carry ASP 3 to 4 times more, what I have not been able to establish is what the gross margins on those look like. Obviously I’m thinking significantly more, but until I see it in the data it is a baseless assumption. Maybe I’m just seeing what I want to see or not in this case. Lastly, I also attached the long term history of WDC's lifecycle, which shows the evolution of the company....it is a different company today compared to 10 years ago.

-

Tape "seems" to be a sideshow, but very interesting. It looks to be used mostly for "cold storage". So archive type data that does not need to accessed frequently. The growth in areal density for tape is actually significantly higher than HDD or SSD and the costs drastically lower. It underscores again that these technologies are complimentary rather than exclusive...well it's really a bit of both. Revenue from tape is only about $0.7Bn or thereabouts and make up 5% of the storage market measured in EBs

-

I find this interesting, especially considering that Apple is estimated to consume about 25% of NAND supply in 2012 Apple's new iMac a turning point for hybrid drives http://economictimes.indiatimes.com/tech/hardware/apples-new-imac-a-turning-point-for-hybrid-drives/articleshow/17603762.cms

-

The comments to that article is also well worth a read. Things I have not thought of before. The biggest cloud providers are moving further down the value chain, designing their own servers, network switches, and chips – Google is Intel’s fifth largest customer. How soon will they demand unique models of disk drives, SSDs, and tapes? More niches, but comfortable niches. Is it inconceivable that somebody buys WDC or STX. I recall from at least WDC management's incentives that they will be very well compensated for a takeover. You mentioned cloud providers are buying disk drives to hold the content that used to be stored on PCs, but it’s not a one-for-one ratio. Consider: when I create content on a PC, say for example a 200MB video clip, I store it on disk locally and (presumably) I back it up on another disk, the “multiplier” is 2X. If I put that same content in the cloud, it is replicated on MANY disks…a dozen or more on (for example) YouTube. Same goes for photos on Flikr, doc files on Google docs, Skydrive etc. The massive redundancy that underlies all Cloud architecture…the ‘cloud multiplier effect’ if you will…is truly the ‘silver lining’ for HDD makers.

-

The coming crisis in disk drives http://storagemojo.com/2012/10/16/the-coming-crisis-in-disk-drives/

-

Great point. I don't see how WDC/STX are not going to be fined in future. The European Commission's report on the Seagate/Samsung merger is well worth a read. I'm very distrustful of these Fed/AG/EC investigations/fines. Just see it as a way to fill holes that cannot be met with taxes otherwise. So I am biased. However, when I finished reading that report I could not help but think. Yeah, let's allow these suckers to merge, because we are going to fine the living daylights out of them. I'm just not able to follow the logic they applied when deciding to allow them to merge. In light of that read this Hitachi, Seagate and WD to Jointly Research Hard Drives Technology. http://www.xbitlabs.com/news/storage/display/20100818121426_Hitachi_Seagate_and_WD_to_Jointly_Research_Hard_Drives_Technology.html I will be extremely surprised if these guys do not get fined in the next 5-10 years to the point that I think it needs to be in the price. EC rule of thumb is max 10% of turnover, so potentially $3Bn for the two or 1/2 annual FCF. Agreed, but how does one explain away a clear trend of steadily increasing gross margins, since 2001? See attached.

-

For what its worth, over the last decade WDC <u>increased</u> sales, net income, assets and equity by $10Bn, 1.5, 13.5 and 5.4 respectively. 15% net margin, 11% ROC and 27% incremental return on incremental equity. That is reflected in the share price which increased 10 fold! You see this is my problem. When I read your comments, I go, yeah man, the dude's right! However, when I pull the facts I almost need to do a double take. My assumptions count for rubbish, it is the facts that count. You’re neither right nor wrong because other people agree with you. You’re right because your facts are right and your reasoning is right—and that’s the only thing that makes you right. And if your facts and reasoning are right, you don’t have to worry about anybody else (Edit:In this case, my own emotially driven misconceptions). -Benjamin Graham

-

When I read the above I am naturally inclined to agree. I am not trying to placate you, I really do think. Yes, it is correct. The problem with that argument is that at no point in history has that ever been true and the facts simply do not support the notions that a) SSD will deliver and b) that people will not need the storage. <b>a.</b> SSDs most immediate problem is not demand, it is cost to supply. It simply cannot deliver. Worse yet, the substantial upfront cost to supply must be considered against a precipitous drop in prices, driven by HDD. The problem for SSD seems to be that HDD is driving down prices in an economically profitable way, whilst SSD is not. The rough numbers on SSD fabs are currently $10Bn for 5EB, so do the math. To successfully displace HDD in 2012 SSD will have to come up with 2,600 EB (see below) of annual capacity and at $2Bn/EB ($10Bn/5EB) we’re talking…ok I’m not even going to say it, because it looks ridiculous. Let’s just say they replace HDD in the laptop market, all 280EB of it. That is $560Bn of capacity investment. What is the probability of that happening? Now if you are an OEM? Where do you go? Essentially there are two doors you can knock on, WDC/STX. However, I think it is key to understand that it is not a cost of data story, it is a price v cost per drive story. Why are people (including myself originally) so hung up on the cost per GB? Do we think about the airline industry as price per mile flown or cars as price per mile driven? No, we think about how much does it cost to produce and how much can I sell it for. <b>b.</b> Take a look a the first two charts in the attached. What is interesting is that this was pulled from a <u> March 2008</u> IDC white paper and those forecasts for the number of exabytes matched up, almost to the last kilobyte, to the way the market developed. So I think one need to be slow to dismiss the industry forecasts by people like IDC. What does that look like? The following charts in the attached illustrates the estimates of moving from the current estimate for 2012 of 2,600 EB to 8,000EB in 2015. It is noteworthy that WDC and STX work with internal forecasts for storage needs which are dramatically below that. See last charts on the attached. Yes, PC demand might be flat to negative, but the attached illustrates that PC is a small part of the story. The question, really is not about whether there is going to be a need for data storage, it is how well WDC/STX will capture the storage needs of the cloud, which is/will be massive. The industry has not been below 400m units since 2006 and analysts current estimates for 2012 is 600m, while WDC guides 560m. Once again the facts of this story paints a different picture to people’s (including mine!!) incorrect assumptions about the industry. Good points and those are important things to watch. Gross margin and return of capital is key. STX returned returned $4Bn of cash over the last three years v a market cap of $10Bn and WDC just under $1Bn v a market cap of $9Bn. However, WDC has now started paying an annual $250m dividend with 50% of FCF (ex dividend) being returned via share buyback, dependent on price. So, although the proof is in the pudding, there already is some pudding. It is not a PC story, as alluded to earlier; a common misconception. However, it still needs to be proven that WDC/STX can migrate into the cloud with the demand for storage. Bear in mind that speed of data access and value of light/mobile is not an issue in the cloud and there SSDs natural advantages are less relevant. <b>Thanks for raising some good points!</b>

-

HDD Industry Reports Bleak Results as Shipments Plunge in Q3 Weak PC demand and the rising challenge from tablets blunt sales of the storage medium November 16, 2012 FANG ZHANG Hard disk drive manufacturers had a rough third quarter when HDD shipments plunged a steep 11 percent, a loss the industry blames on a host of economic and market-related factors, such as the usurping of PCs among consumers by ever-more popular tablet devices, according to an IHS iSuppli Storage Space market brief from information and analytics provider IHS. HDD shipments in the third quarter amounted to 139.2 million units, down from 157.0 million units during the second quarter. The most recent results reversed the 8 percent gain that took place in the second quarter, and they also represent the lowest third-quarter shipment level in at least five years for the storage medium. Just last year for the same July to September period, HDD shipments had stood at a lofty 175.3 million units. ......................... A return to growth, then, for the HDD space is more than likely—even though that would transpire over the longer term, and not for what’s left of the year. Complete article- well worth reading http://www.isuppli.com/Memory-and-Storage/MarketWatch/Pages/HDD-Industry-Reports-Bleak-Results-as-Shipments-Plunge-in-Q3.aspx

-

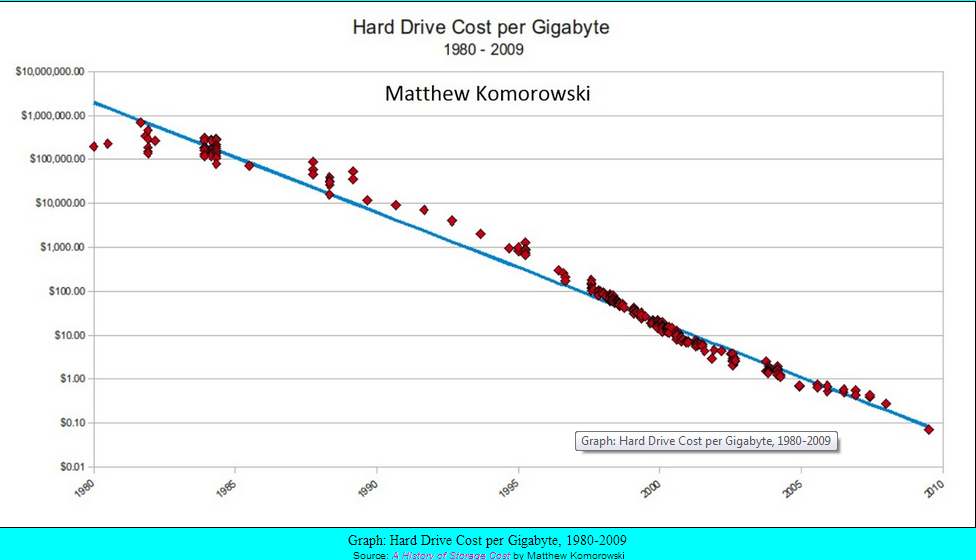

Those are fair questions, but as Hyten suggested it is nothing new. Price/Gb going down is a good thing just as Henry Ford thought it was a good idea to make cars cheaper thereby making it more affordable to more people which broadens the market. The price needs to go down to ensure it stays competitive with SSD. This fact is missed by many that say the price of SSD is going down. Correct, but so is the price of HDD. Price/Gb? This might be the wrong question to ask. Price/drive might be more appropriate. Price/Gb illustrates the speed of innovation. It is interesting to compare the drop in prices/Gb with that in drives. Take a look at this website http://www.mkomo.com/cost-per-gigabyte , which essentially demonstrates Moore's law. Price/Gb halves every 18 months. However price / drive? On average every 5 years. For the latter you have to work with data provided on that webpage, but you can just eyeball it too. It is unclear which prices they used; it seems they used top end drives whereas I tend to focus on ASP (average selling price). So assuming the logic translates then it is noteworthy that in 2003 ASP were almost exactly where they are today, bearing in mind we saw a huge jump due to the Thai floods. P/Gb is more an indicator of pace of innovation and necessary for ensuring desirability/utility of product than anything else. What counts is price per drive and cost of manufacturing/R&D. This is where WDC/STX's financials become most illuminating. How is it possible for companies in such a down and out, price destroying industry to increase all margins (gross, operating and net) over the last 10 years? If they are on their way out and being squeezed from all sides then how come their days payable tripled over the last 10 years, days receivable more or less doubled (actually today it is the same as 10 years ago, but the last year is a big change from the trend) and inventory more or less doubled. This explains cash flow margins going up about 3 times. This culminates in sky high ROE and high ROC margins. So I hear what you are saying, but even a cursory glance at the financials indicates that something does not add up and when you dig deeper there seem to be some explanation for why these companies have been doing so well. There just seem to be more than meets the eye.

-

I'm actually not..well I'm trying not too. I am just highlighting the facts, because the more I look at those the more my own reservations seem to be irrelevant. It just seems terribly misunderstood. It does deserve some respect you know ;-) "Like flying a Boeing 747 six inches above the ground" http://www.atarimagazines.com/v5n6/InsideHardDisk.html

-

a. From the links you mentioned. "The bearish cases which seem to me to be driving down the price are, in no particular order: 1 - hard drives have moving parts and consume too much power, so they are going into end-of-life soon (discussed above) 2 - tablets and SSD-only systems are replacing PCs with hard drives 3 - the business cycle is slowing so shipments are easing and earnings are moderating 4 - hardware components are all low-margin commodity businesses and competition will come in to eat their lunch because the tech isn't that hard. Of those three, I believe #2 and #3 are red herrings. The replacement is merely a displacement which isn't reducing the growth rate of aggregate storage demand, and the cycle is just a cycle. It doesn't make sense to sell your farm just because winter is coming. #4 is most prevalent among people who haven't looked at the numbers or the consolidation, as it certainly isn't true based on the empirical evidence. But it could have some merit some day. Like many businesses with mere "scare them away" moats, the continuation of the high returns relies on the rationality of potential entrants to the market being rational enough not to enter a market which will cause all participants to get low returns on capital. The numbers and the shakeout seem to give some comfort that this scare-away approach is working and/or the tech is sufficiently hard, but it's not a bullet proof moat situation. Somebody with a few billion dollars to spare could enter the market as a new competitor. The good news is that the two issues worth considering, #1 and #4, are the sorts of things that you'll see coming, they won't be overnight. That, plus the immense margin of safety in the current price, gives me the comfort to make this a large allocation. For the put writer, a flat share price is currently a 30%/year return proposition." b. Earlier in the post he also mentions the internal combustion engine and it's basic technology which have stayed the same throughout the years. Are there similarities and if so how would one go about thinking about it? c. It is a lovely irony that one of the perceived threats, the move to mobile computing and lighter, more energy efficient SSF memory, may actually have the effect of driving more memory to the cloud, where the HD technology is not impeded by weight, and where cost per TB is the predominant factor, that factor being one where the traditional technology still has a huge lead. Interesting angle.

-

Might also be the most intelligent way to approach an investment in this case.

-

Someone put a firecracker under the industry's *** today? http://biz.yahoo.com/ic/ll/813pip.html Leaders in Price Performance (Intraday) Hutchinson Technology Incorpora [htch] +8.64% SANDISK [sndk.mx] +6.21% Xyratex Ltd. [xrtx] +5.78% Quantum Corporation Common Stoc [qtm] +4.76% STEC, Inc. [stec] +4.56% Emulex Corporation Common Stock [elx] +4.43% SINGULUS TECHNOLOGI [sng.de] +3.35% Western Digital Corporation [wdc] +2.26% OCZ Technology Group Inc [ocz] +2.16% Seagate Technology. [stx] +2.01%

-

Western Digital - Presentation by Chris Mellor of The Register

-

11.29 S-8 filing New shares to be registered under 2004 Performance Incentive Plan 13.2m New shares to be registered under 2005 Employee Stock Purchase Plan 8.2m Current outstanding under both plans 22m (17m for rank and file employees) Current shares outstanding 243m So about 1.6%/annum or $150m-$300m that you can add to payroll expense; hopefully it buys more in motivation.

-

Thank you will, take a look

-

I think that it's important to note that solid state drives differ in performance mainly due to the flash controller and the type of flash used. The companies making the flash controllers may make some very good profits... an example would be LSI buying Sandforce. In some cases they compliment each other, in some cases they don't. Part of the analysis will rest on your forecast between what the mix of flash and hard drives will be in the future. Look at it from the point of view of the consumer buying a laptop. Do they go with flash: high performance, computer boots in several seconds, somewhat lighter, longer battery life? Or do they go with hard drive: more storage, lower price, etc. It also depends on whether some new feature/application will cause consumers to need a lot of storage space. Currently, really the only thing that consumers need a lot of storage space for is video. Maybe really fast Internet will cause people to do a lot of streaming and not need a lot of local storage. Or maybe not. If you look at audio, we are at the point where many people use Spotify/Grooveshark and don't even need to store music locally anymore. 10 years from now, things might look like this: If storage capacity doubles every 2 years, then storage capacity in the future will be 32X what it is today. (*It may be less because flash has problems scaling down to smaller transistors.) A 40GB flash drive today will be 1280TB in the future. A Blu-ray disc is 25GB so you can store about 51 Blu-rays (*this math is a little wrong since drives hold less after they are formatted). This could be enough for 90% of people out there. Then there are people who do need more storage... they will simply buy hard drives on top of their flash drive. Maybe people will move towards 4K resolution which will take up 4 times the amount of space, assuming no advances in compression technology. If video moves towards 60fps instead of 24/30fps and 3-D instead of 2-D, then storage requirements will be higher. But I think that almost everybody will be booting off a flash, or a flash/hard drive hybrid (the latter scenario is beneficial for Seagate/WDC). On the server side of things, the picture probably won't look as bad. Two things play in my mind when I hear the concerns about HDD in notebooks "going away" ; a) storage moves somewhere else rather than being eliminated and b) where it moves is a place where HDD costs 3-4 times as much. So there is a trade off between selling less HDDs, but much higher priced ones albeit at lower margins. Is that made up by the low valuation/duopoly? Not exactly sure what the answer is, but that pretty much drives at the heart of the investment case for me.

-

Yes that is a consideration, but what makes me lean towards WDC is what you touched on. I think WDC is much better managed and STX seems to be managed pretty darn well. Average gross margins over the last decade is 2 percentage points ahead of STX as is operating margins. Lowest cost producer....Capital turns for WDC is also markedly better and more aggressive buyback, which is preferable at these prices. Even just buying STX is also a strategy I find hard to fault.

-

Correct, but the date and page 13 of said presentation means STX management made that point after WDC/Hitachi deal

-

Points 1 & 2 is not valid anymore. See page 12 of the attached in particular. I find it rare for managements to think about price when buying back stock and these guys clearly do. Better yet; you have a competitor that think just as hard about value than you do. They already bought back just over $600m and will probably buy back about $1Bn over the next 12 months with a $250m dividend. I don't understand the industry well enough to make an intelligent comment on the last point. Capital_Allocation.pdf