MMM20

Member-

Posts

1,950 -

Joined

-

Last visited

-

Days Won

11

MMM20 last won the day on January 23

MMM20 had the most liked content!

Recent Profile Visitors

13,757 profile views

MMM20's Achievements

-

Sure, but isn’t that why many of us are here in the first place? I think this is the anatomy of a true “long term compounder” - that it persistently trades at a discount to a growing intrinsic value for one reason or another. In this case, it’s arguably about fixation on some past bets that didn’t work out, missing the forest for the trees. But if that’s why the opportunity exists, then I’m glad for it. Eventually they’ll stop sharing details of every single line item like BRK has. Maybe we’re seeing the beginning of that with the new format of the earnings calls.

-

I’m reminded of a message from Michael Burry (then 26 years old) to sea_biscuit, on siliconinvestor.com dated 4/18/1997 at 12:25:00 AM: “Precisely why I wish to evaluate companies in the midst of proven buybacks. Small marginal companies have taken to using buyback announcements as a publicity stunt to support their stock. More often than not, the buybacks do not materialize. When they do, they end up not retiring the stock and placing it in the corporate treasury, which is of marginal use to shareholders. Everyone should be aware of this trick, as you point out. Mike“ Is that the gist of your point @Munger_Disciple? That all buybacks are not created equal? And we should add that stock comp to SG&A and adjust the share count? I’m not concerned b/c they’re not just giving away shares and that program is a probably big piece of how they’ve retained great people to produce these returns @SafetyinNumbers

-

Should this change how we think about the impact of The Big One in LA? Maybe we'd be looking at a ~$10B hit. Otherwise I'm a happy shareholder. Maybe this is the year we finally rerate to peer multiples.

-

MMM20 started following Fairfax 2025 and How Long Have you been a Continuous Shareholder of Fairfax Financial?

-

So do we get to pick up some FFH shares on the stupid cheap? Or does it not sell off as much as stuff in the indexes? Do the Canadian markets rip as people pull their money back from US and start boycotting US products? Will Canadians end up boycotting BRK and buy their homegrown FFH? Invert, always invert? Or does this end up as more sound and fury signifying nothing?

-

I don't doubt it - and governments will certainly have to step up - but I would require like a one-year payback to make any sort of investment there. I hope Fairfax has a similar mindset.

-

I didn’t have investing in Ukraine on my bingo card for this year, but I’ll take it at the right price!

-

-

Yeah to be clear I wasn’t making a one year prediction which is a fools errand. I think about it like ~50% expected return with maybe a -50% to +100% ~95% confidence interval (and a pretty flat distribution). Does that make sense? +50% return would be ~15-20% per share earnings yield and growth and the rest driven by rerating to a more reasonable multiple IMHO. Of course maybe theres a ~1% chance we hit 50% on the dot and then I’ll make sure to toot my own horn a year from now

-

Should do 50% returns again this year and that assumes we exit around 10x P/E. Of course, 1stdev around that is probably 40%. Made this a 10% position nearly 4 years ago and now a ~25% position. Posting less b/c I think the thesis is a lot more straightforward and I don’t have much to add anymore. Nowadays IMHO it’s more a question of personal asset allocation / risk management and a waiting game for ~2x rerating to a fairer multiple. I’m also somewhat burnt out b/c I’m just one guy working in my attic trying to run a little investment partnership while also raising little kids (don’t try that at home) so very happy to have found this old school oddball community (when the internet is mostly turning to shit elsewhere - but that’s another story). Happy new year everyone. Onward!

-

With real rates still positive and the yield curve so flat (and US valuations where they are), cash and short term treasuries are one way to handle it. I sleep well at night owning PM which has pricing power, is a cash cow business plus a hypergrowth startup (Zyn), and still trades at a cheap to fair valuation. PM would also benefit from a weaker dollar which is inherently diversifying for me. And I always come back to this: “The best thing you can do is to be exceptionally good at something,” the 91-year-old said Saturday. Mentioning professions like doctors and lawyers as examples, Buffett said that ”[people] are going to give you some of what they produce in exchange for what you deliver.” Buffett added that skills, unlike currency, are inflation-proof. If you have a skill that is in demand, it will remain in demand no matter what the dollar is worth. “Whatever abilities you have can’t be taken away from you. They can’t actually be inflated away from you,” he said. “The best investment by far is anything that develops yourself, and it’s not taxed at all.”

-

One of the smaller players, Vireo Growth (~3.3% of TOKE), is +170% today after announcing transformative combination at ~4-5x EBITDA https://www.globenewswire.com/news-release/2024/12/18/2998880/0/en/Vireo-Growth-Inc-Announces-75-Million-Financing-and-Acquisitions-of-Four-Single-State-Operators.html Not trying to turn this into a cannabis thread but I think it speaks to how bombed out and cheap the sector is.

-

I am buying MSOS for a bounce. I am also planning to buy and hold more TOKE longer term b/c I really like the portfolio (see below) and the manager has fully waived fees until they hit $50mm in AUM. I have my own favorites (I've owned GLASF common and series B pref/warrants for ~2.5 years and averaged up a bit in the common at ~$7 this year) but I think the group as a whole is priced to high returns right now. I also own Couche-Tard and Philip Morris on their own merits as cheap/fair compounders with misunderstood tailwinds but partly b/c I think they'll also benefit from US cannabis reform at some point. My bullishness is dampened by the fact that I know I can be contrarian to a fault - and that I'm not personally comfortable with a big position in this sector for more than a month or so given the clear and obvious left tail risks like a DOJ crackdown. I figured I'd share anyway. Now watch MSTR blow me (and old man Buffett) away.

-

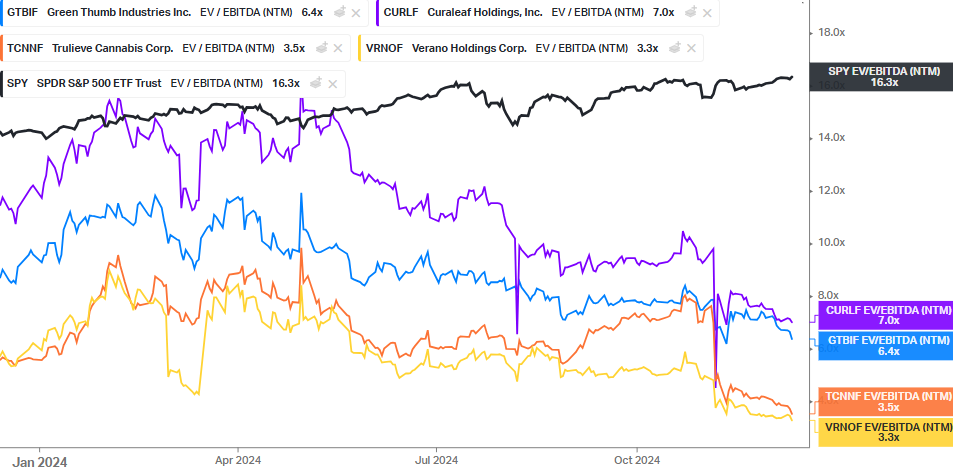

I tend to think about it on EV / (EBITDA - maintenance capex). Most of the capex has been for growth, and I think they've learned some hard lessons on that front over the past few years (though I'm not claiming every operator has found religion - some of their hands are forced by levered balance sheets and lack of access to reasonably priced capital). When I think about the bottom line, I am assuming 280E excess taxes go away in '25 or '26 at the latest. No one cares now, but that can change quickly. The obvious counterpoint is that any tax savings will be passed through to consumers. That is probably true to a certain point, but should be offset by volumes flowing to legal channels as prices get more competitive with the black market. Next, keep in mind that some of these companies are levered and interest rates are ~1.5-2x those of other businesses with similar credit profiles (aside from weed's federal status). You probably need to believe that changes with some federal reform like SAFER banking or better under the Trump admin to own the whole group longer term. But my point is to think about taxes and interest rates probabilistically along those lines and whether ~6x EBITDA-maint capex will translate to ~10-12x P/E shortly... or not. And I am mainly pointing out how oversold these are - and how much of that dynamic seems to come down to "Trump=bad", market plumbing issues, tax loss season, and multiple funds shutting down. I’m guessing we are a week away from full capitulation.

.thumb.png.e9643dd797bb6bfa93083ce1311ba74d.png)