nwoodman

Member-

Posts

1,478 -

Joined

-

Last visited

-

Days Won

8

Content Type

Profiles

Forums

Events

Everything posted by nwoodman

-

These are important points, and the second one is something I’ve been thinking about a lot since the CC. This deal gives a glimpse into the kind of earnings power that comes from shifting a portion of the fixed-income portfolio from safe treasuries into higher-yield corporates. They have been telegraphing this intent for a couple of years now. I’m not saying that shift has fully started yet—you probably need some real stress in credit markets for that to accelerate—and even then, it’s only ever going to be a portion (maybe 25% at most?) of the FI portfolio, given RBC constraints and regulatory capital rules. That said, it illustrates how much earnings power can change under these conditions. As you pointed out, it’s easy to be anchored to a decade of low rates, but these yields aren't necessarily outliers in an HFL (higher-for-longer) environment. I still don’t think that kind of optionality is being priced in. If Fairfax continues to lean into private credit and structured high-yield deals like this, the long-term earnings profile of the fixed-income book could look very different from what the market is currently expecting.

-

MS with a breakdown by non-life insurance sector. It looks like Digit’s speeding ticket is still intact INDIA_20250214_1507.pdf

-

MS with a positive spin (see attached) “The broad market is drawing down rapidly as the bid has faded despite improving fundamentals. While catching the bottom is difficult, we think buying Indian equities could prove rewarding.” INDIA_20250217_1001.pdf

-

Thanks @Viking. Agree with all your points. There is a degree of sophistication to the way Fairfax is going about things that I wish I had appreciated more. There is also a frankness in the CC’s that is quite refreshing “Peter Clarke Right. Yes, no, that's -- the TRS on Fairfax, that's strictly an investment for us. We put it back on in 2021 or thereabouts and it's performed extremely well and we think it will continue to perform very well. As we said, we can see strong underwriting results going forward. Our interest in dividend income is strong, our associate income is strong. But we feel we'll be able to continue to compound book value at a very high rate or acceptable rate, and our share price will follow. You know, we're not trading at a high multiple if you look at our peers and so for us, it's still an investment, we very much like.” The thing that make’s my head spin a little is their short and medium term opportunity set. $835m of timeshare financing at an aggregate >10% was not on my bingo card for January. For a while I have felt they have/perceive more opportunities than they have available cash. Just hope they don’t get over their skis but so far, so good.

-

Not sure, other than their debt raises, there aren’t too many details available on their instruments of choice, but interesting point about the FX implication. CAD would definitely help the cause . I thought you might have had a handle on who the Total Return Payer was, pretty sure you figured it was one of the Canadian Banks so I think there is a high probability it is in CAD. Anyway some notes attached, it’s definitely floating rather fixed as they have discussed a “ higher TRS expense” previously that coincided with rising rates. Fairfax Financial’s Total Return Swaps on Its Own Shares.pdf

-

While that would be awesome, surely this is at the prevailing rate, SOFR + spread. Cheap compared to IV growth, but unlikely to be locked in. I am tipping 4.75%+2%=6.75%.

-

I am a Fairfax investor, so it crossed my mind of course. Vacatia is obviously the price taker here and Fairfax didn’t have to do the deal. There needs to be enough cashflow to service the 80m of financing (unless there is a PIK provision to the note) and whatever Vacatia needs to set up their system at Berkeley to start clipping tickets. You would hope the assets were some way to this target and then Vacatia generates the rest through the overnight rental market plus some asset sprucing. In the pdf I outlined some thoughts on how it might work but it’s speculation. If it goes tits up then you hope that the Berkley assets can be sold at cost. My only other thoughts are Wade Burton’s tie ins with KW and Eurobank, he seems to like (tourism) property but as @petec said there has been a few flops or works-in-progress depending on your timing. As I said above I would love to know how this originated and whether it came via KW or an associate. Out of the blue seems unlikely but possible. Will be watching this one with great interest due to the quantum but also an insight into Wade’s deal making and risk management. In both areas I think he excels BTW. Always difficult due to the way Fairfax allocates capital to attribute a decision to one person though.

-

Indeed, as you pointed out above if it works the leverage will be pretty phenomenal albeit on $25m of equity. It will be interesting to get some color on the terms of the note, perhaps AR or at least Q1.

-

Sensex down 3,000 points in 9 days. Is it just the beginning of bear market? Quite the blow off in Indian markets. On the updside, IDBI is down 30% since its peak in July 24. At the current market capitalization of INR 775 billion, the 60.72% stake being put up for sale is worth approximately $5.42 billion USD.

-

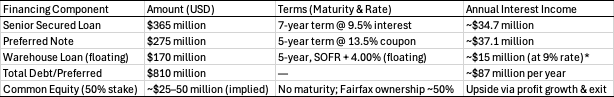

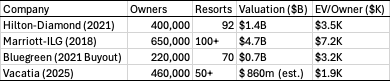

Corrected in V3 above, it should have read Vacatia contribute their business model to the Vacatia Blizzard JV. Vacatia is definitely still a stand-alone. I also corrected the EV/Owner table on the basis that Berkley got done at $835m (Fairfax) and $25m (Vacatia)=$860m. We don't know this for sure (chance of financing outside of Fairfax), but on face value it does seem like a decent margin on safety. However I know SFA about the the timeshare industry so take it with a pinch of salt. The Vacatia business model of timeshare plus overnight rentals isn't unique but might make a real difference to legacy assets like Berkley. I guess that's Vacatia's bet and if it doesn't turn out well Fairfax flips the underlying assets. Each year Fairfaxearns $80+m so the margin of safety improves. I would love to know how this deal orginated, perhaps yet another question for the AGM. Wade Burton from the CC " Second, I wanted to discuss an investment that closed just after year-end 2024. We invested in the largest independent timeshare company in America called the Berkeley Group. Caroline Shin and her team at Vacatia are Fairfax partners here. The investment is underpinned by asset value, where we directly own 4,950 full-service vacation units mostly located in Las Vegas, Orlando, and other high-traffic vacation areas in the U.S. The opportunity here is for Caroline and her team to generate overnight rental income from the huge stock of nightly vacancies. Her experience designing Hotwire online booking software and then as an executive at Starwood is perfect for what Vacatia is trying to do with Berkeley. In fact, prior to this acquisition, her group at Vacatia made investments in five smaller timeshare assets from 2019 to 2024, and in each case, they were very successful at significantly growing EBITDA in a short period of time. The total deal was $835 million, which we funded with a $275 million five-year preferred note at 13.5%, a $365 million seven-year senior secured note at 9.5%, and $170 million mortgage warehouse loan with a five-year maturity at SOFR plus 400. The $50 million equity is funded 50% by Fairfax and 50% by Caroline and her partners. We are absolutely thrilled to be her partner on this."

-

Hopefully it plays out something like this: “1. PVC Price Recovery and Demand Growth (Mid-to-Late 2025 Onward) • The PVC market is showing early signs of stabilization, with prices bottoming out in late 2023. • Industry experts predict higher global PVC demand in late 2025 and 2026, driven by a rebound in construction and infrastructure spending, particularly in India and Southeast Asia. • India’s PVC consumption is expected to grow at 8% CAGR, creating a structural demand tailwind for Sanmar’s Chemplast Sanmar unit. • Timing: Expect a gradual price recovery from mid-2025, with stronger margins by 2026. 2. Anti-Dumping Measures in India to Support Domestic Pricing (Q2 2025 Onward) • The Indian government is advancing anti-dumping duties on paste PVC and suspension PVC imports, particularly from China, South Korea, and the EU. • If finalized, these duties would reduce import pressure and improve pricing power for domestic producers like Chemplast Sanmar. • The PVC Quality Control Order (QCO), set to take effect by June 2025, will further limit low-quality imports, benefiting domestic manufacturers. • Timing: Once anti-dumping measures are officially imposed (likely Q2-Q3 2025), expect price support and margin recovery for Sanmar. 3. Full Utilization of Expanded Capacity and Operational Efficiency Gains (Q3 2025 Onward) • Sanmar has completed major capacity expansions (e.g., 41,000 TPA specialty PVC addition and full ramp-up of TCI Sanmar’s 400,000 TPA Egypt plant). • Efficiency improvements and higher utilization at TCI Sanmar (Egypt) should significantly boost profitability once PVC prices stabilize. • Timing: Efficiency-driven profitability improvement from Q3 2025, with full impact in 2026. 4. Diversification into Higher-Margin Specialty Chemicals (Late 2025–2026) • Sanmar is expanding its Custom Manufactured Chemicals Division (CMCD) to cater to high-value agrochemical and pharma markets. • Five new contracts signed for specialty chemical intermediates, with a second-phase expansion of the new plant planned in 2025. • This shifts revenue mix away from commodity PVC toward less cyclical, higher-margin products. • Timing: Specialty chemicals’ revenue contribution will increase meaningfully from late 2025. 5. Stronger Financial Position and Lower Debt Burden (Q4 2025 Onward) • After the 2021 IPO and debt repayments, Sanmar significantly reduced its financial leverage, lowering interest costs. • Fairfax India remains a long-term supportive investor, providing stability. • Recent cost control measures and cash preservation efforts position the company for profitability in the next market upturn. • Timing: Lower financial costs and improved cash flows from Q4 2025, supporting sustained profitability. Expected Timing for Sanmar’s Return to Profitability • Short-Term (H1 2025): Limited profitability improvement, awaiting pricing recovery and regulatory actions. • Mid-Term (H2 2025): Anti-dumping duties, demand recovery, and full plant utilization start boosting margins. • Long-Term (2026): Stronger profitability driven by higher PVC prices, specialty chemicals growth, and cost efficiencies.” We shall see. Fairfax seems happy to wait it out, so that’s good enough for me.

-

Love your work. Didn’t realise or had forgotten that there was a sunrise on that deal. I always figured that they would buy this in first. That color explains it.

-

Don’t disagree but the thesis is the airport. Sanmar is going to be a drag for the next year but should start working from 2026 onwards.

-

I've attached some notes on Vacatia. I sound like a broken record, but I love these structured deals. I doubt its lost on anyone here but this is such a sweet spot for Fairfax. There seems to be no shortage of deals to be done. Hopefully we hear some more color from the Fairfax team in a few hours time. Caroline Shin Bio: Caroline Shin is a seasoned tech entrepreneur and hospitality executive best known for co-founding Vacatia, a platform modernizing timeshare management. Key highlights of her career: • Built and sold Hotwire: As a founding team member, she helped scale the travel site before its $685 million sale to InterActiveCorp in 2003. • Led Starwood Hotels’ CRM strategy: Boosted market share by 20–40% for top properties through data-driven pricing and loyalty programs. • Founded Vacatia (2015): Created a tech platform serving 750+ resorts, helping owners rent/sell timeshares and manage operations digitally. • Launched Vacatia Partner Services (2023): Expanded into hands-on resort management, now overseeing 4,750+ units across the U.S.. • Co-founded Store Vantage: A SaaS tool optimizing staffing and customer relationships for small businesses. Trained as a nuclear engineer at MIT, she applies analytical rigor to solving hospitality challenges. Outside Vacatia, she runs a pet grooming business and advocates for Korean American community initiatives. Edit: Updated following Q4 24 CC, very good of Wade to break it out *Note: actual interest on the $170M warehouse will vary with SOFR. At a 5% base rate, SOFR+4% = 9% (≈$15.3M/year). If rates decline, interest expense will fall (and vice versa). The Secured Overnight Financing Rate (SOFR) is a benchmark interest rate that reflects the cost of borrowing cash overnight using U.S. Treasury securities as collateral. It is widely used in financial markets as a replacement for LIBOR (London Interbank Offered Rate) for pricing loan bonds and derivatives. Weighted Average Yield: Fairfax's weighted average cash yield is robust based on the structured notes alone (excluding equity). On $810M of combined loan investment, the annual interest of ~$87M equates to roughly a 10.7% blended yield. Including the floating portion at current rates, the overall yield is in the low double-digits, which is very attractive for a secured, asset-backed investment. This reflects the risk profile (timeshare assets are somewhat niche and less liquid), but Fairfax negotiated rich terms. Company Comps Vacatia and Blizzard Vacatia: Company Analysis V3.pdf

-

Good pick up. We have a much better idea now

-

The way I see it, it doesn’t make much different to IV but does derisk the share price or potential for larger than market type movements. I did wonder last year whether some of those corrections may have been exaggerated due to the perceived TRS implications.

-

Personally I am very happy that they have started retiring the TRS. If they can close out roughly 10%/quarter it would be a thing of beauty. It was an asymmetric but highly leveraged bet that has worked out well. In a 50% draw down Fairfax stock would not be immune and there would be a beta amplification because of them. I think any indication of IV that it signals needs to considered together with liquidity and risk/reward considerations.

-

we probably need to pin this, but the bank (counterparty) is price agnostic, Fairfax is renting their balance sheet and taking the directional risk.

-

While I usually deplore SBC, in the case of Fairfax it was one of the aspects of the comps package that really got me across the line a couple of years back when I was on the fence about purchasing more. It got me thinking about the longevity of their employees and sharing in the upside as well as downside. Perhaps I needed a little convincing back then that it wasn’t some black box scam run by charlatans, the kind of company Muddy Water SHOULD have targeted.

-

That's cool. How they unwound was a key question for me. Looks like we may be getting an answer there

-

A few articles floating around about the introduction of Aerial View Display (AVD) at KIA. Some notes attached (geeking out) https://www.indianeagle.com/traveldiary/bengaluru-international-airport-aerial-view/ This is far more than just some CCTVs strung around the place. The productivity and safety gains make it a no-brainer, but from my reading, the primary headache is dealing with an individual airport's legacy IT backbone. While there are plans, only 5% of airports globally have made the leap. The fact that BIAL has completed a successful implementation shows class on many levels. I like this asset more and more and you can't help but think it can only further their case for the second airport. From the notes AVD Primer - BIAL.pdf

-

2002 in a former investco, then 2011 in personal accounts. First company I really had confidence in buying on the way up. Prior to a large position in BRK,it was mainly industrial cigar buts, and prior to the cigar buts I really had NFI. The evolution in thinking, to buy what you know and take advantage of periods of undervaluation and be wary but not afraid of concentration, was among the best lessons I have learnt. Thanks W & C.

-

I wonder if it is also a cleaner arrangement to be out of BIAL if they intend to bid on the 2nd airport.

-

Some further notes on the proposed sites for the second airport attached. Some thumb-suck estimates on the new build cost too: 30-50m passengers Land $US1.2bn Airport Construction $2.5bn Total ~$3.7bn Perhaps I need to rethink my lower bound $4bn valuation on KIA Bengalarus second airport: Nelamangala and Kanakpura Rd emerge as top choices (Hindustani Times) "To accelerate the project, the state government is considering inviting Bangalore International Airport Limited (BIAL) to spearhead the development, the report added. This move could help navigate the non-compete clause that restricts the construction of another airport until 2033. Officials believe BIAL, which successfully operates KIA, would be well-equipped to take on the new project." Why is Karnataka racing to finalise its 2nd airport site in Bengalaru? A neighbour is in the fight (The Print) But building the second airport also has its challenges. In its concession agreement signed with the Union government on 5 July2004, BIAL ensured that it remains the sole airport in Bengaluru, at least until 2033. “No new or existing airport shall be permitted by GoI to be developed as, or improved or upgraded into, an International Airport within an aerial distance of 150 km of the airport before the 25th anniversary of the Airport Opening Date,” according to the concession agreement. The only concession is for the development of Mysuru and Hassan airport. The new proposal by Karnataka is likely to complicate matters. “We are exploring if we can give the contract to build the airport to BIAL itself. In this way, they can waive off the non-compete clause,” the official cited above said. As of January 2024, Fairfax has invested approximately $7 billion in the country. Watsa stated, “In the next five years, we are looking at doubling that. We got a few projects already that we’re working on.” Indeed! Notes on Proposed Sites for Bengaluru’s Second Airport.pdf

-

That's along the lines of what I was reading. There seems to be a political angle, with various "officials" wanting the second airport in their jurisdiction. There also appears to be a bit of confusion, as the 90 million passengers the officials are getting their knickers in a knot over are slightly less than the 100 million capacity BIAL is currently designing T2 Phase 2 and smaller T1 upgrades to accommodate by 2030. There is always a fair chance that final passenger numbers are much higher than even the 90-100m envisaged, so perhaps there is merit in a second airport. A 2008 concession agreement between Bangalore International Airport Limited (BIAL) and the government prohibits new airports within 150 km of KIA until 2033. So, it is unclear to me if this will be tested. Plans for an airport in Hosur, in Tamil Nadu (40 km from Bengaluru), face legal hurdles due to this clause. The Hosur airport would also be at Karnataka's disadvantage, which is where the upside might be that BIAL gets an inside run on developing a second airport. BIAL have certainly proven their bona fides with T2. Challenges and Next Steps (as far as I can tell) Political Consensus: Ministers lobby for sites in their constituencies (e.g., Nelamangala vs. Kanakapura), but the government insists decisions will prioritize connectivity and economic impact. Land Acquisition: Estimated cost of ₹10,000 crore for 4,400–5,000 acres. Federal Approval: After finalizing the site, Karnataka plans to submit the proposal to the AAI by mid-February 2025. Estimated Timeline: A second airport will take 7-8 years, hence the sudden flurry. If BIAL gets the gig, great; if not, I'm happy to see deliberations drag on in true Indian style.