-

Posts

312 -

Joined

-

Last visited

longterminvestor's Achievements

-

.thumb.jpeg.b0384a4135d041bebd0e39ae144d51f4.jpeg)

Insurance Brokers (MMC, AON, AJG, WTW, BRO)

longterminvestor replied to tnathan's topic in General Discussion

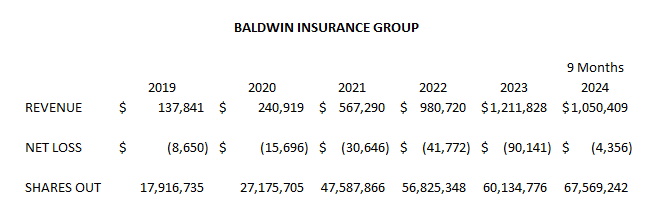

Baldwin Insurance Group still boggles my mind but I guess there is some learning in there for me. Insurance brokers can lose money for a long...long time and market is still forgiving. $191M net loss since 2019 through 9 months 2024. The learning I guess is its just a topline revenue money grab and bottom line will take care of itself. VERY hard for me to get there tho. Good for them, sincerely. The dilution is staggering as well. in 000's, except shares out -

.thumb.jpeg.b0384a4135d041bebd0e39ae144d51f4.jpeg)

Insurance Brokers (MMC, AON, AJG, WTW, BRO)

longterminvestor replied to tnathan's topic in General Discussion

Not an accountant either. However, they are calling if a deferred tax asset - to the tune of $1B - roughly 7.4% of the purchase price. Solid edge when you an extra Billion to spend others do not. See below. CFO of AJG gets a gold star! -

.thumb.jpeg.b0384a4135d041bebd0e39ae144d51f4.jpeg)

Insurance Brokers (MMC, AON, AJG, WTW, BRO)

longterminvestor replied to tnathan's topic in General Discussion

dealraker......I knew you would be on the informational edge. Brief dive into transaction. Transaction based on "Proforma Revenues & EBITDAC".....how does one proforma-lize top line revenues? Love LOVE Jim Henderson's negotiating skills (Old School insurance guy who was gracefully pushed out of Brown & Brown and started AP) - "we want USD paper- cash only, we don't want your AJG paper". So AJG says, "that's fine Jim. We will write you a check and dilute our shareholders by raising the cash in the market by selling shares". Happy for the guys at AP, what a testament to business model of insurance distribution. AP was seeded by PE, sold/re-capped multiple times. Quote from PE Fund who owned AP press release: "Over the past 13 years, the Company has acquired and successfully integrated over 500 businesses, building a national leader in insurance brokerage. GTCR originally sold the Company to Apax Fund VIII in 2015, and GTCR reacquired a majority stake in partnership with Apax Fund IX in 2019. Today, the business is led by Mr. Henderson and CEO Randy Larsen." I may dive deeper into the numbers but these sky high valuations are incredible. -

The reddit board I saw referred to Mr. Buffett as the "Whoracle of Omaha". Message boards can be a race to the bottom on the comments section. Sincerely, The guy who enjoys posting anonymous comments on a message board.

-

What Mr. Buffett tells us/shows us is interesting, what he doesn't tell us/show us is what keeps me fascinated. The simplicity is just incredible. Not too long ago, I was spending nights pouring over the 10-Q's anticipating what is gonna happen, taking detailed notes, share counts, spreadsheets, and just bathing in the numbers. Now I find myself just skimming and its amazing what has been built, I am proud to be a shareholder of this great company. Something I was considering was, How does Berkshire pay that tax? The method of payment. Do they just upload the Billions into the IRS website like the rest of us? Or do they just send it by check via USPS - in a standard envelope with no cover letter? Would enjoy knowing the mechanics to tax payment on the Apple sale...just for fun.

-

mananainvesting started following longterminvestor

-

-- there is $500B-$1T in real estate value on the FL coastline ACCURATE, however that's MARKET VALUE, NOT INSURABLE VALUE -- avg FL homeowner pays ~1% of home value in insurance this is an unintelligent way to think from an insurance perspective -- that 1% is based on a disaster event happening once every 100-200 years speculation and unintelligent way to describe situation -- however, due to a bunch of factors, hurricanes are becoming more frequent and more severe hhhmmmm, now you are a meteorologist? Thought you were a financial alchemist? -- so the insurance math has changed dramatically: disaster events could happen every 20-30 years instead of 100-200 Good news for insurance market, they get to re-price every year vs a mortgage priced once every 30 yrs -- because of this, flood insurance costs are skyrocketing, making it untenable for most people Flood pricing is set by FEDERAL GOVERNMENT AND NEEDS CONGRESSIONAL APPROVAL -- so, the state of FL has stepped to subsidize flood insurance FLORIDA GOV SUBSIDIZES WINDSTORM, NOT FLOOD. ABOVE IS FALSE. ALSO SEE BELOW HOW COMMENTS ARE NOW A RACE TO BOTTOM IN SPREADING FEAR / MISINFORMATION -- however, due to the damage from helene and milton, this program is effectively bankrupt without subsidized flood insurance, we could see major economic and social issues, which @friedberg describes: "So if the value of your home dips by 25%, because everyone starts selling their homes, leaving Florida, or they can't get insurance..." "... the people that live in Florida, most of them have their net worth tied up in their home, are going to see their personal net worth wiped out or cut in half." "... there are so many people that have put their entire net worth into their home, the value of their home is written to a point that it no longer makes sense, given the frequency at which homes are going to get destroyed." FREE MARKET, MOVE TO IOWA

-

I have lived in Florida my whole life. I am a 4th generation insurance agent in Florida. These rubes above are unintelligently discussing a topic they "seem to be knowledgeable" just because they have a mic and video pointed in their general direction. The "Winter is Coming" narrative is nice and I personally welcome it - allows for volatility in markets - which I enjoy. The stats, loss estimate numbers are directionally correct. Even still the basic understanding of the CAT Fund shows one of them does know how to operate chatGPT however the dystopian society inside the insurance market is far from correct and the lack of understanding regarding the topic discussed is laughable. The term "value" is thrown around a few times with reckless abandon - and incorrectly used with reference to how insurance and mortgages cooperate post loss. A 30 year Fixed Mortgage, contrary to popular belief, is not an "American Entitlement" - neither is the kissing cousin to a fixed rate mortgage - a low priced super easy to procure insurance policy containing a giant red lever when pulled - money falls out of the bottom of the insurance machine endlessly to bail out those who don't really know what they actually own. Both mortgages and insurance are financial marketplaces where government entities (both State & Federal) exist to facilitate risk transfer for the benefit of the mortgagor / policyholder. ATTENTION FINANCE BROS: When both the mortgage market and insurance market become "illiquid", the value of all assets which depend upon mortgage and insurance markets being super liquid, WILL GO DOWN. Which is just fine with me.....actually I prefer it.

-

.thumb.jpeg.b0384a4135d041bebd0e39ae144d51f4.jpeg)

3G background-why Buffett likes them

longterminvestor replied to netnet's topic in Berkshire Hathaway

I think I understand what you are saying here. But again, I think the framework of your thinking needs adjustment. GEICO/BNSF does not take money from headquarters. To my knowledge, it never has taken money from headquarters. IF GEICO needed money from headquarters, then it would not be a wonderful business. GEICO humms along doing what it does from internally generate capital at the subsidiary GEICO level. Can not remember officially if BNSF took money at first to do the capex projects or if it was just debt at BNSF level. maybe someone knows that one. Now confusing the situation is fact GEICO is/has been getting smoked by competition. I chose to think Mr. Buffett totally understands the issue and is solving to leap frog competition - not just make adjustments and "get back to par". This is a FOREVER GAME and there is unlimited capital chasing a growing pie of customers/premium. Insurance, specifically admitted personal auto, is kinda annoying because you can sit there and watch how everyone else does it (quarterly filings, each state has their own filing system, you can basically watch your competition grow/shrink in front of your eyes (there are games with in the game). and remember the lessons..."when you do dumb things in insurance, people will find you". So I chose to think Berkshire is the smart one and everyone else is dumb but my incentive is to think that way so well aware of my bias. Premium growth alone is not the yardstick GEICO cares about, its growth + profitable business. Ajit is working on it, Todd C is working on it. If it was easy, it would have been fixed already. This is a tough game. Specifically to BNSF, its a duopoly in trains with trucking as the kissing cousin. Precision rail roading is "a way" to do it but rail roading is also a complex game and maybe there are other reasons why they haven't done it. We have to trust that Mr. Buffett, Mr. Abel are capable managers and put the decision to CEO of BNSF weighing the pros and cons. Just cause the low hanging fruit has been discovered "why don't we do precision rail roading?" - there could be other reasons THEY ARE NOT SAYING so the competition doesnt figure it out. they know what is going on, they have looked at it 100000 times. they have employees who have left competition to come to BNSF and explain it and then the CEO make decision. Easy for us to own the stock certificate and lob in the suggestions from the cheap seats. Its much harder to be in the arena. The bet is they will figure it out. -

.thumb.jpeg.b0384a4135d041bebd0e39ae144d51f4.jpeg)

3G background-why Buffett likes them

longterminvestor replied to netnet's topic in Berkshire Hathaway

I dont see it that way. I see it more as the "wonderful" business needs zero capital to grow. and a "decent" business needs capital to maintain and grow. All the "wonderful" businesses are too expensive for him to own so he has "accepted" the decent business as a good place to store BRK's capital. There are tax implications to Mr. Buffett stuffing capital into wholly owned businesses as well. My preferred method of understanding is "needs capital/capital light" rather than "underinvest". If GEICO needed capital, it is a click away and capital would fall from the sky from headquarters. The issue Mr. Buffett and future successors face is "is this capital we are re-investing into ______(name the subsidiary) gonna be a good allocation of Parent Co BRK funds over the long haul or is this a waste of $$$, time, effort, energy to save this dying business? - and then what does BRK do with dying businesses inside of the BRK system?". In the next generation of BRK, we will face questions on what to do with businesses that DO NOT earn their cost of capital. -

.thumb.jpeg.b0384a4135d041bebd0e39ae144d51f4.jpeg)

Insurance Brokers (MMC, AON, AJG, WTW, BRO)

longterminvestor replied to tnathan's topic in General Discussion

Headline: Marsh Buys McGriff (ACTUAL STORY-MIDDLE MARKET IS WHERE THE MONEY IS) FACTS ON WHAT IS HAPPENED: Stonepoint Investment Group purchased Truist Insurance Holdings (TIH) with an implied value at $15.5B – deal was closed May 7th 2024 – it was an ALL CASH transaction which McGriff was the “retail facing brand” inside TIH who is a “middle market agency”. Stonepoint Investor Group players to include: United Arab Emirates’ Sovereign Wealth Fund named “Mubadala Investment Company” & other PE name Clayton Dubilier & Rice. Enter Big Daddy Marsh using their middle market brand Marsh McLennan Agency (MMA) to buy McGriff for $7.75B IN CASH 6 MONTHS LATER?!? – EXACTLY 50% of the value of Truist Holdings deal previously closed. This takes 50% of the implied value out of the Truist Holdings deal. I mean, imagine being a producer at McGriff right now, their heads must be spinning. Marsh needed a big uppercut to AON after their purchase of NFP, which was AON’s entrance into true middle market. MY OPINION: If ultimate goal of Stonepoint Investor Group is to IPO this thing, why sell off the retail facing piece? If the deals are all cash, there are no issues with debt, why not just keep the retail facing business inside? 2 ideas I have: #1 Gotta be transactional fees/fees/fees for the funds incentivized to “do deals” and #2 – Stonepoint may have gotten VERY expensive debt on the backend and needed to pay it off fast….only 2 conclusions I have at this time. This transaction cements my feelings towards the short/medium/long term outlook for Middle Market Brokers (BRO is the best of the lot). For many years they have stayed under the radar in middle market allowing the big 5 to chase after each other for the Fortune 500. The secret of middle market is no longer a secret. Everyone figured it out, PE backed brokers, Big 5, and others know the institutional accounts are a race to the bottom comp wise so now the big broker cohort has turned their cannons to the “middle market” which BRO/other middle market specialists have been feasting on for years. Short term BRO and other middle market brokers are fine, medium/long term they will face increased competition for accounts as the big brokers deploy sales force to take their biz/future biz. Marsh McLennan to acquire McGriff Insurance Services _ MMA.pdf -

.thumb.jpeg.b0384a4135d041bebd0e39ae144d51f4.jpeg)

Insurance Brokers (MMC, AON, AJG, WTW, BRO)

longterminvestor replied to tnathan's topic in General Discussion

TWFG (The Woodlands Financial Group) – it’s a Personal Lines outfit I have built this mental model in my head for competitors in a certain class of business, I am always looking for the dual monopoly, for example there is “a Coke” and “a Pepsi” and then everyone else. If Goosehead is Coke, then TWFG is Pepsi. The metaphor is for when a business model works, there will be a competitor. The metaphor is not to compare financial staying power/market dominance of a Coke/Pepsi debate. TWFG does do commercial insurance where Goosehead is strictly Personal Lines. TWFG is based in Texas, so is Goosehead. TWFG, founded by Richard “Gordy” Bunch, III. $180M topline revenue in 2023. The revenue comes from “Agencies in a Box” Captive Agencies, MGA’s (captive to TWFG and sell to non-TWFG agents), “independent branches”, and corporate branches. With over 400 Agencies in a box representing 77% of revenue and 14 Corporate Branches representing 4% of revenue and 2 MGA’s representing roughly 18% of revenue (over 2000 appointed agencies with TWFG’s owned MGA facility). Average commission for TWFG on a deal is 12% - fine/solid – could be cut or could grow. TWFG has pre-set calculation to buy agency in a box and become a corp branch. Has done this in the past. Branches over $1M revenue and geographically desired could be a target. TWFG does not bear expense of running the branches but sends the revenue to them. Seems like each branch has a direct split bases on (taken from S-1):“Unlike some other insurance distribution models, the operating costs incurred by our Branches do not transfer to TWFG. Instead, we receive all commission revenue and subsequently pay and record a commission expense to each Branch based on the relevant exclusive Branch agreement”. The Parent company retains 20% of revenue and cedes 80% to branch. Found this language interesting in S-1: Exclusive Branch agreements We enter into exclusive Branch agreements with our Branches under which the Branch operates as an independent contractor. TWFG receives 100% of the commission revenue on the Branch’s Book of Business that is paid by the insurance carriers and typically remits 80% of the commission revenue to the Branch, while typically retaining 20%of the commission revenue and 100% of all contingency commission revenue. The Branches are responsible for all of their operating costs, including fees for technology, E&O premiums and other services charged by us. The exclusive Branch agreement requires the Branch to exclusively sell insurance products through TWFG’s insurance carrier relationships. Our exclusive Branch agreements are straight-forward and written in plain English. When the Branch reaches a minimum term and threshold of commission revenue, the Branch is granted the right to require TWFG to purchase the Branch’s Book of Business upon termination of the Branch agreement at a negotiated price. The Branch agreement remains in force indefinitely, unless earlier terminated by either party with 30 days advance notice or immediately by TWFG in the case of fraud, bankruptcy, death and other events. Upon termination of the Branch agreement, the Branch must sell its Book of Business related to P&C products to TWFG or another TWFG-approved Branch at an agreed upon valuation, or if the parties cannot agree, at a valuation determined by independent appraisal. TWFG also has a right of first refusal on any proposed sale of the Branch to a third party. Our Branch agreements require confidentiality of all Client information and include Client non-solicitation clauses that generally stay in effect for two years following termination of the Branch agreement and our purchase of the Branch’s Book of Business. Within TWFG’s product offerings, each Branch may utilize the products that best serve its Clients. Branch principals also have a high degree of autonomy in which to operate their business and expand their footprint. Branches use our comprehensive technology and agency management system, benefiting from enterprise group rates that we believe are typically lower than agents would receive on their own or from leading agency management system vendors. Branches also participate in TWFG’s group professional liability E&O insurance policy, benefiting from a reduced group rate, as TWFG passes these savings on to our Branches. TWFG is jumping on the dislocation of insurance agencies in the small business/personal lines marketplace. TWFG has GREATLY benefited from the hard market and wondering if the growth they have had in the past is sustainable. People shop when they get non-renewed, canceled, price increases significantly, ect. That’s been happening a lot in the past 3 years, if the insurance market stabilizes, wonder if TWFG (or Goosehead as well) will get the looks on accounts like they have over the past 3 years. TWFG has scale now so total destruction is not what I am talking about, its just can it grow in the same manner it has for the previous few years. A bet on TWFG is a bet on Gordy – he controls the business with 3 classes of shareholder stock. It is profitable (I’m shocked). Same Up-C, Tax Receivable Agreement as Baldwin. I guess TRA’s are socially acceptable now. At 40X earnings, its pricey for me – however people like Goosehead at 49X earnings. I will be watching it. -

.thumb.jpeg.b0384a4135d041bebd0e39ae144d51f4.jpeg)

Insurance Brokers (MMC, AON, AJG, WTW, BRO)

longterminvestor replied to tnathan's topic in General Discussion

little chatter on AJG. vid starts there. its not that long but wanted to keep the thread alive. -

.thumb.jpeg.b0384a4135d041bebd0e39ae144d51f4.jpeg)

Insurance Brokers (MMC, AON, AJG, WTW, BRO)

longterminvestor replied to tnathan's topic in General Discussion

@dwy000 - "why the brokers are worth so much of the industry vs the companies actually providing the underlying product?" I asked this same question in previous posts with "what other business models are like this?" - Closest thing I can find is mutual fund sales but now have been obliterated with indexes/ETF's, I guess now that I am thinking about it 2 & 20 as a hedge fund seems pretty close if not exactly what I am asking for! I still search for other PUBLIC business models where these super interesting market dynamics are in play. (Help! - want to find!!!). Here is my answer knowing my incentives as a broker are highly aligned to brokers staying at the top of the insurance food chain: Simple, better business model with reduced volatility. No capital required to run the broker business. Brokers own the client relationship. Look at attached 2013 McKinsey write up where "smart money" explains the carriers want to kill off the brokers and now 11 years later, the brokers have only grown their businesses. If insurance is the toll road of the American economy, brokers take their percentage of the tolls collected and do not have to put down any capital to build the roads. In the office we have been talking about relating to selling an account as an act of magic. It really is magic, your phone rings, you take some notes, call some underwriters, fill out some paper work, get quotes, present your deal, get the order to bind, and boom - you get a check for $100 or $1,000 or $10,000 or $100,000 or more! and the only risk is losing the client (they could sue you, and clients do, but lets say they just leave and go buy elsewhere). The insurance marketplace system is set up so carriers pay brokers for market access to take risk such that carriers get an upfront premium today in exchange for a promise to pay a claim tomorrow. The buyer is reducing/eliminating balance sheet risk with a 1 time, fixed premium expense - and they have to re-up in a year - incredible! Its the carriers who want access to the market of broker represented buyers (insureds) where high commissions/low premiums drive flow into particular markets. The extra pleasures of the model are the contingents, bonus payouts on loss ratios, guaranteed supplemental commissions, and more. If insurance companies decided tomorrow to kill off all broker relationships and said "we will only talk to clients, no brokers allowed", the buyers (smart buyers, not all buyers are smart) would pay an insurance expert for negotiation/terms/conditions/fees/language to advise the buyers on the trade and would gladly pay a fee for service directly to the broker, separate and apart from any premium paid to a carrier. The premiums (and ensuing commissions) on the small, middle market, large commercial transactions (where the money is) are paid with corporate, untaxed dollars. Its monopoly money. Buyers want rock solid contracts transferring balance sheet risk to insurance market while demanding excellence from their insurance broker to curate such contracts. The dynamics are awesome. Mr. Buffett has told us, "If you are willing to do dumb things in insurance, the world will find you. You can be in a rowboat in the middle of the Atlantic and just whisper out, “I’m willing to write this,” and then name a dumb price, and you will have brokers swimming to you, with their fins showing, incidentally. It is brutal. I mean, if you are willing to do dumb things, there are people out there, and it’s understandable. But they will find you, and you will get the cash up front. You will see a lot of cash and you won’t see any losses, and you’ll keep doing it because you won’t see any losses for a little while. So you’ll keep taking on more and more of this, you know, and then the roof will fall in." That should tell you all you need to know what brokers are willing to do, (Mr. Buffett started with "the world will find you" along the lines of "Praise by name, criticize by category", there's almost a slip of the tongue when Mr. Buffett names brokers later). The insurance companies seem pretty sure about what they are doing (they hope anyway, gulp) and they also know brokers are grease that make the wheels of risk turn. INSURANCE NERD ALERT, if a retail carrier has a fixed deductible on a reinsurance deal with unlimited ceded risk, then its the reinsurer thats stupid, not the retail insurer. People will do dumb things in all businesses, its the brokers job to find the dumb insurance company who whispers a stupid price and bind it for the brokers client. Here is the video with quote (incidentally BILL ACKMAN asked the question): agents_of_the_future_the_evolution_of_property_and_casualty_insurance_distribution.pdf -

.thumb.jpeg.b0384a4135d041bebd0e39ae144d51f4.jpeg)

Insurance Brokers (MMC, AON, AJG, WTW, BRO)

longterminvestor replied to tnathan's topic in General Discussion

Market cap is market cap so would not include mutuals (which really only have value if they are de-mutualized and converted to stock). State Farm and Liberty are mutuals, Axa and Allianz are publicly traded in Europe. Lloyds is tough to value. Just saw the chart and thought I would share. and my math was right, I guess the rounding or something didn't work on the chart. makes me want to distrust the chart more.