valueinvestor

-

Posts

594 -

Joined

-

Last visited

Content Type

Profiles

Forums

Events

Posts posted by valueinvestor

-

-

There's really no way of knowing because the data regarding housing is biased and lacks transparency - even the home bidding process is opaque, as @Viking alluded. There's also a real sense of FOMO and that's due to a myriad of reasons.

However the possibility of decline is real and can happen. When COVID hit, prices were down 10% off the bat. If the government didn't step in with mortgage deferrals - we would've seen a real decline. 2018 (Just four years ago) - we had months where one was down 15%. If you were a first-time home buyer, that means you had negative equity or possibly 2x your downpayment. Thankfully, there's no technical defaults or breach of covenant with most of those mortgages when your equity goes down - it needs to be replenished.

Secondly, a third of homes (again this could be wrong) is owned by investors paying cap rates that are totally reliant on capital appreciation. Consequently, if rents go lower their ability to service the debt will degrade. Historically, rents has not kept pace with capital appreciation - hence many people are reliant on refinancing and purchasing additional real estate to increase their paper returns. To give people a picture, my friend was able to rent an apartment that's only 5% higher than 2010 rent prices in Midtown Toronto.

As @SharperDingaan mentioned the banks will definitely not sell and CHMC insures all the homes, unfortunately that depends on speculator relying on bankruptcy versus selling. We should also consider that real estate prices are comped to last sold. A property on the block sold for higher? Great that raises the property value of that block, if not the entire neighbourhood. I assume the reverse is true. So it really takes one distressed seller on a block to trigger a cataclysmic decline. Especially with how the news in Canada reports on real estate, as often as the weather - it can scare speculators.

It doesn't help that I don't have great faith in the underwriting of some of these mortgages.

Again that's my simplistic analysis of the whole situation, but it doesn't mean that the entirety of Canada is overvalued. Kawartha lakes, cottage country has limited supply and even limited views - hence it's become an airbnb situation where one can get cap rates of 5-10%, even in today's real estate market.

As @SharperDingaan mention there's a benefit borrowing in an inflationary environment, as it cuts both way in terms of increasing the value of the asset while decreasing the hard liability.

P.S. It's also interesting to see that housing has become political in Canada. I really do not believe that the Government is going to artificially lower prices, as there's a lot of red tape and vested interested to keep it high. However, it is something to watch out for.

On the other hand, there's a real path that Canada could be the next Hong Kong.

-

Thanks everyone! I didn't have a chance to go through your post, as I didn't want to skim it and respond, as my usual practice. However, I really do appreciate the support! It means a lot! If I had to say what's my best investment - it's spending $25 to be a member of this board. A huge honour!

-

Feel free to let me know if this has been discussed before, but thought I could get some advice in regards to the Toronto Real Estate market or Real Estate in general. I've provided context, but if you want to skip it, feel free to answer the question below.

I live with my parents, and rent an office. Never really cared about owning a home, and performance has been pretty good, where I was able to edge out Toronto Real Estate prices with stocks even with the recent declines of some growth names. Matter of fact, my parent's stock portfolio that's less "risky" managed to also outperformed their own real estate portfolio that's on the outskirts of Toronto, where houses appreciated higher.

If you were a young person (mid-twenties) looking to compound at high rates, what would you do? Divest some of your equities for real estate? Would you dabble in Canadian real estate? Would you look abroad? I was looking at Arizona, Florida, Cleveland, Rochester (NY), Detroit (MI), and more.

I'm slightly interested because with real estate, one has access to tax (depreciation) and low-interest leverage advantages versus equities. However I have a hard time divesting, as I think there is a real opportunity to make money by just holding. As I don't think returns will be as stellar with Toronto real estate and even if I underperform slightly, I rather have that - then spend time maintaining a property or deal with tenants.

My long term goal is to compound at high sustainable rates but so far, my assets are my tiny stock portfolio and tech business. However, my business also has an opportunity to get a 100% LTV through the owner-occupied commercial real estate loan, but I'm not sure if I want to put cash-flow towards real estate versus investing in the business and monetizing sometime later. Commercial rents, as you could imagine has been really dirt cheap at one point, and I was able to lock-in a good lease agreement with very low penalty for breaking it.

My conclusion thus far is if I'm going to purchase a home, it should just be a home rather than an investment. I hear stories with mortgage brokers in Toronto, and the underwriting standards despite the higher "stress-test" for new mortgage applicants, however that's anecdotal.

TLDR. I guess my question is if you just want to compound at high-rates for the next thirty years, where would you be looking? I'm flexible. It can be bonds, currency, art, crypto, NFT, etc. I'm also happy to work with very volatile investments that can produce large mark-to-market declines, as my needs are very little at this point.

-

Happy Holidays!

-

Why CNTWW as opposed to NYSE: AMR? I was in contura before they changed the name. This is so strange, I'm sure there's a reason?

-

I recant my statement of implying it's not broken, but not accurately saying this board gets better and you're right, the freeloaders can complain about not having a free lunch, when lunch is right in front of them, well we can't do anything about that!

-

6 hours ago, Gregmal said:

And if you really need the money, get a better full time job lol.

Exactly!

5 hours ago, Spekulatius said:For me, the main benefit of this forum is not to present a full fledged research report, it is crowdsource research. I post what (little) I know and hope that other posters add to it and fill in some blanks or prove me wrong.

I found this to be a hugely beneficial. I welcome full fledged research, but don't expect it here and think this is generally found behind some sort of paywall that supresses the crowdsourcing aspect that I think is more valuable.

That said, there is nothing wrong with a tip jar, some authors that publish research have those and I occasionally tipped.

I thought so too, but a few people whine and gripe about the quality of the posts. I don't really see a decline, but an increase, especially in terms of how people think and view investments. For example, I learned a bit by reading your posts beyond idea generation. IMO, if one really wants more investable viable ideas, they should pay for it or hire an analyst.

At the same time, I also realize that some are dropping off because there's not a lot of new "ideas." I think that's not a benefit, as it's in my experience, they have businesses or are execs of businesses and can provide real insight on the topic at hand.

I'm fine either way, but I don't think we lose much by crowdfunding a monthly award and awarding it to the best idea of the month. One it may attract new users, and provide new ideas, which will bring about new discussion.

Sometimes I feel this forum is a bit insular, and I can effectively predict how particular users will respond to a specific posts. It's kind of comedic and fun in its own way haha.

Anyways, it seems that many are not passionate about this (neither am I) - I guess why fix something that's not broken right?

-

Some say they would want to buy a beer or treat people to a meal on this forum. This allows that.

-

5 minutes ago, Castanza said:

Like a tip jar?

Sure

-

I think that's different. I think this should be an open forum, and there shouldn't be a paywall. I don't think people are necessarily here to be paid for their research. It's work to develop a following - I'm saying let's remove the friction. Just as twitch streamers get paid for great streams, maybe we should start not necessarily paying but "donating" for a single post or awarding an idea from a crowdsource fund. That way great content brings great contributors, or vice versa.

-

A friend of mine, a frequenter of the forum remarks that my posts are sometimes reminiscent of a 10 year old's book report. I laugh because I agree, but I always thought it was not my "duty" to do the work, but rather provide insight on a topic that can lead one to the right direction. I never really used this forum for idea generation, probably only got one or two ideas from the forum. Also my investment research less calculative but involves more thinking and doing (such as trying out the products), hence I can't easily copy/paste my notes.

However, I seen really good posts that has a lot of research backed, but I don't necessarily agree with their conclusion. Either way, if there's a way where I can contribute to a fund, where we can award the best topic or directly "donate" to a contributor to really show my appreciation of them as a contributor, I see no reason not to do it. Hell, it may be a greater investment than some of my posts/contribution. We can even have a part of that fund or donation towards the website to subsidize the operation and if it's big enough, improve it.

I know that I spend a lot researching investments, and whenever I think of posting my entire research, it's easy 10 pages going from business to comps to unit economics. This is coming from a person who doesn't believe that they're research oriented, so it means complete research for anyone one of you could easily go passed that and I'm willing to pay for it.

This doesn't mean that I expect going forward that many posters will rush at a change to monetize on their posts, hell, I wouldn't as I have other priorities. However, I'm sure that there are other posters who has constraints from time and money, and may post more, if those constraints were loosen. If not, I'm sure it will attract more posters from varying backgrounds with hopefully wacky ideas.

So yes or no? Any reason not to do it?

-

1 hour ago, fareastwarriors said:

Criticize his performance, but criticizing an individual is just poor taste.

-

On 4/29/2021 at 9:08 PM, ValueMaven said:

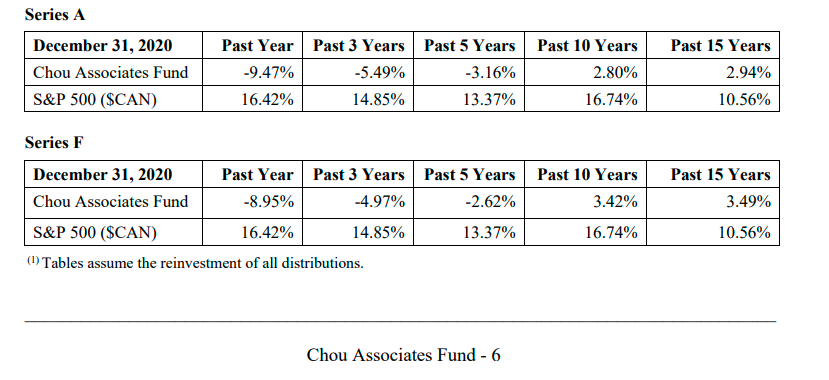

Chou is totally washed up and his performance shows it. Sorry, he has had some terrible allocations over the past decade. It isnt just his style being out of favor either.

Did it make you feel better to write that? Apology accepted but to call him washed up versus his performance is poor is... worst than being washed up. You're not the only one to say that and many others posted on the board too - hence this post is not to single you out.

I don't often or really care to come to anyone defence, unless they're truly defenceless and Francis Chou is not defenceless. There's a reason why people stick with him regardless of his multi-year underperformance and I suspect it's due to his character - not many refund fees when the world is melting and facing massive redemptions.

Do I see why he made those investments? Yes. Do I necessarily agree with it? No, in fact, I wholeheartedly disagreed relative to other opportunities. The very reason why RFP, Exco, etc. went up this year, could also be the reason why it goes down. Does that mean he's washed-up? Far from it. I think he's getting started.

Not many can double down, let alone stick with an investment after repeatedly being bitten from it. Many espouses Benjamin's and Warren's philosophies' but few practice it - myself included. Reading his letters during his underperformance was a treat and I respect his conviction. The only fault that he has in my book is his love for bargains, and as he's admitted and I paraphrase, there were stocks that were priced at 100 cents/dollar but truly were worth 150 cents/dollar and others priced 100 cents/dollar but were really worth 70 cents/dollar.

Frankly, I've seen people rave about RFP @ $28, BB @ $50, Valeant @ $200 (I bought it at $200) but many not raving it when it's at a 10th of it's all-time high price, and this would be fine if they admitted they were wrong or be sympathetic when other share the same fate. I really hope the numbers Prasad put out is true, because it probably meant he averaged down over a long period and multiple times. That's alone is what I believe 99% on this board, even the world do not have the wherewithal/fortitude to replicate.

-

Ahh.. makes sense! Thought there was a particular metric but it seems it was a confluence of them.

-

My biggest achievement in 2020 was to sell 90% of my stocks right before the COVID crash as there were many technical indicators showing the top. But I still had a 4% draw down on my account as the remaining positions dropped like a stone, which is a tragic because I had too much fundamental belief in them.

My biggest mistake was to choose not to believe in my technical analysis after the end of March when it says I should be buying aggressively. Being in an inner circle with classmates from Wuhan's CDC and Hospitals, the fundamentals clouded my view too much and scared the shit out of me to buy. I was ramping up exposure on stocks too slowly and ended the year with only a 11% gain.

What were the technical analysis that you touched upon? By the way - thanks for alerting the board at the time, wished I've seen it!

-

-

How many are sticking to the lessons that you've learned in 2020?

-

SE with my SNC Lavalin Proceeds - but I think net still same exposure still the same. I was 150% long, now just 100% long.

-

SNC Calls - Got lucky. Sold most yesterday and out of it today - hopefully.

-

I'll echo what others have said. I think it's dangerous to take too many lessons from 2020. The primary lesson I'm taking away is to make sure I think through how current events will actually impact the business I am buying. Some are more obvious than others. I was buying LUV in early March, and really didn't think enough about how hard it is to understand the long term implications the pandemic might have on air travel.

Made the same mistake with Spirit and AerCap, but promptly changed in the middle as soon as it was clear that multiples were not going to rerate and businesses were growing sporadically during the pandemic. SE for example had no issues with COVID, and yet the market was pricing as if the situation was as bad as in the US.

-

Regret: Because I thought the market was not cheap overall, I allocated more to lower risk event-driven ideas with (supposedly) uncorrelated but lower returns. Should have been at least 100% long at all times :D Nonetheless I beat the S&P500 with significant cash holdings. I had parked some cash in a SPAC and sold in the crash below my entry price and reinvested proceeds profitably, did not know how crazy the returns on the spacs would be in the future and did not re-enter later because I will not buy more than 2% above trust value :'(

Another example: I was long one genetic company in Ark's ETF. No profits, lower growth due to Covid. I sold after ~2 years with just a >10x return using mostly covered calls. Should have held and enjoyed another 100% extra 8)

I was short TSLA <1% , but read the signs (ever more funds flowing in (index inclusion possible) / reality does not matter for at least some years or catalyst event and better long TSLA than worthless bitcoin) and totally reversed to long TSLA ~2% and then sold at a small profit. Despite knowing how important flows are and seeing confirmation biased shareholders like in TSLA's case, I did not learn my lesson to not short in this market, which lead to some cost in 2021 where I am just a little ahead of the S&P500 (GME cost ~2% of portfolio, but I could have held the position through, was just angst this could go >1000$).

Overall, I will not change anything. I keep buying small caps with a value tilt and focus more on international markets like Eastern Europe 2021 instead of expensive USA (will valuation matter in the end?). Another lesson is to sell crazy spikes due to twitter pumps (stocks go up up to 100% on no news and then go down again), but I have to work on how to spot this, as I am not constantly watching stock prices. Also difficult to tell the difference: Could this be another GME? How crazy can it get? --> max 0.5% position size. But I also manged to offload some microcaps (I was long) into the spikes and rebuy later. 2020 was too crazy to derive real lessons in my opinion. Despite some experimenting with warrant/unit arbitrage, I will never buy SPACS significantly above trust value despite the return potential (expected value positive as long as market = crazy).

Congratulations - glad you're not sitting on your laurels.

-

Timely post as I was just reviewing 2020.

On an investing front, I was raising cash in my PA end of January and entered the lows holding about 40% cash and 5 positions. I was prepared for a pullback but not expecting what happened. I pitched 4 names near the lows all of which the big guy above failed to make a decision on and locked me out from buying in PA. I was able to deploy half my cash in other ideas but these 4 were on my buy list leading up and have all had great returns since. I was not expecting a rebound like we had and thought that we would chop near the lows for some time at which point I would be able to get into those names but it didn't work out that way and I rode 2020 with 20% cash.

The biggest lesson I learned - if you see value take it don't worry about getting the best price your not going to time the bottom nor the top. Second, everything happens fast the timeline to recognize value and act has become incredibly short. Idk if it has to do with the proliferation of ETFs and passive investors but it seems to me that when stocks get cheap they all get cheap at the same time. That makes it a bit overwhelming and can lead to distractions. The best solution is to know the stocks that you want to buy in a pullback and at what price there is not enough time to do your research during the downdraft.

Control what you can control. I was pounding the table but wasn't given a clear yes or no on the investment decision and didn't want to buy first. Ethically it's the right thing to do, but in the rearview, he probably had no intention of acting on my pitches in the first place. When the S&P 500 was down 35% from the highs I was told I'm too bullish. Unfortunately, this isn't the first time something like this happened but an idea here or there happens for me it just happened to be almost half my portfolio. Lesson learned - i should get a new job.

Damn! That sucks. I'm not sure how to act in that situation, I wonder how the big honcho feels taking money out of your pocket. Not sure if that's a mistake, as you acted ethically. Always good for the long run.

-

Plug Power (PLUG).

It's even cheaper since I got in a few days ago, has dropped like 15% so now it's only 87x EV/sales, and 38x book value, and the laws of physics still seem to be against the idea that hydrogen fuel cells will ever be competitive with batteries for most applications.

Oh, and what I bought was 2021 $10 Puts.

HAHAHAHAHAHAHAHA ;D ;D ;D

-

SE, SNC

Is the music still playing? I almost sold SE this week, but then I checked my notes and the revenue growth and had to postpone the decision...

I did napkin math a while ago with 60%+ downside. However they are pushing into Brazil, which gave me an idea to SOP valuation.

What’s the value of Shopee Singapore, Shopee Malaysia and so forth. Paints a different picture. With that being said. I’m ready for a 60% drawdown. Rather hoping for it. Only reason why l bought is unsophisticated - I don’t have any ideas. As soon as one comes up, I’ll exit fully and plow in there.

A House in Canada Now Costs Almost 2X A House in the US

in General Discussion

Posted

@Peregrine

You brought up a good point, I always thought it was inflation as from 1990 to 1998, where we had a decline of 37% but we've also experienced a correlation in unemployment.