nafregnum

Member-

Posts

273 -

Joined

-

Last visited

Recent Profile Visitors

The recent visitors block is disabled and is not being shown to other users.

nafregnum's Achievements

-

Great podcast episode recommendation thread

nafregnum replied to Liberty's topic in General Discussion

The perfect pairing to "Scam Inc" is a longtime favorite called "The Swindled Podcast" https://swindledpodcast.com/ The guy who does the podcast lives in TX somewhere, calling himself "A Concerned Citizen", and he does deep dives into the stories of greed motivated criminals -- some are about corporations (product safety coverups, pollution disasters, etc) and some are about individuals. There's insurance fraud such as faked accidents, faked deaths, faked car wrecks ... I think he was first to thoroughly research and release an episode about the man who rigged the McDonalds Monopoly prize jackpots. Listening to this podcast is a little bit like a class in defense against the dark arts. -

Great podcast episode recommendation thread

nafregnum replied to Liberty's topic in General Discussion

The Economist put out 8 episodes about a Crypto Investing scam called "Pig Butchering" and it's excellent. https://www.economist.com/audio/podcasts/scam-inc Looks like the first three episodes of this series are available without a subscription to The Economist. I listened and enjoyed the whole 8 episodes, but just hearing the first 3 would be time well spent, and the rest of the details about this new "Pig Butchering" scam are likely to be online in other formats if you're not interested in subscribing. -

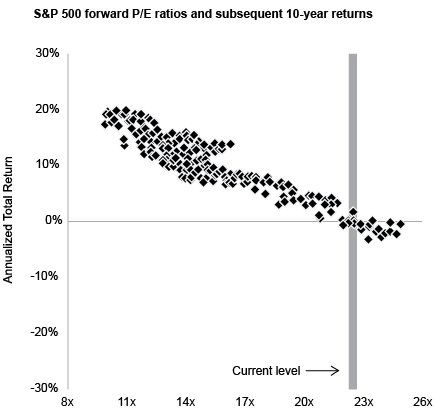

https://www.oaktreecapital.com/insights/memo/on-bubble-watch The recent memo from Howard Marks was in a browser tab, probably from when @james22 originally posted it here 12 days ago, and I finally read it today. I really appreciate how Marks takes the time to put his thoughts out there, and recommend checking it out. He's not calling a top, or saying that the market won't keep going up, or that the Mag 7 are in bubble territory, but did a fine job of describing the traits that past bubbles have shared. He included this chart that a couple people had sent to him: Here's the relevant explanation of the chart: I'm asking myself what to do with this info? I'm not heavily invested in the Mag 7, so if the top 7 falter, my guess is that a lot of that money would flee into other areas of the S&P 500, but I won't gain much from that, since my largest positions are not in the S&P. I'm only at 1% cash right now. Buffett's cash position is at a record level above $320 Billion, so it can't be the worst time for me to trim back and raise more cash. I'm only commenting about how I feel about my own portfolio and not giving advice.

-

Movies and TV shows (general recommendation thread)

nafregnum replied to Liberty's topic in General Discussion

Dostoevky's best English translators are a married couple, Richard Pevear and Larissa Volokhonsky. They're fantastic, very much worth seeking out their versions over earlier translators: https://en.wikipedia.org/wiki/Richard_Pevear_and_Larissa_Volokhonsky#Translations_credited_to_Pevear_and_Volokhonsky -

Christopher Bloomstran doubling down on DG and DLTR which are both at 5y lows. I'm waiting a little longer to see if those get even cheaper after Trump starts the tariffs. https://www.dataroma.com/m/holdings.php?m=SA

-

Thanks for this! Very interesting interview - I bought "The Prize" on Audible (it's abridged, so only 2.5 hrs) and am excited to listen to it. So, Oil was a main character in the 20th century world drama, alongside nuclear weaponry. Seems like we're looking at advanced computer chips as the current alpha resource, and maybe electrical energy like Yergin said around 55 minutes in when he said Bill Gates mentioned data centers used to be measured in CPUs "20,000 CPU data center" and now it's a "3 Megawatt data center" ...

-

Thanks for posting that video - I didn't know any of that about wastewater. I caught myself wondering what the dynamics are like up in Alberta's oilfields. I think the pressure of the injected water eases as the water is able to spread out into the geological formation until pressure is equalized. I imagine one cheapish solution might be to drill more re-injection wells and just pump slower into each one. Seems like that might reduce seismicity and also the risk of causing nearby zombie blowouts. Here's hoping they figure it out.

-

Starting a position in SNDL

-

I've enjoyed reading this thread today, mostly for all your thoughts on holding periods and concentration. Letting my winners run has usually been my best move. My big regrets have been failures to take larger positions when I feel like I've found a winner. Haven't bought anything this year, but sold off a little GLASF to sleep better. My main taxable account looks like this - I think I bought Booking, Citi, Nintendo, and Disney last year, but I didn't feel high conviction so didn't make them large positions. Looks like I sold off most of my losers to offset gains from selling some old winners last year, so the screenshot isn't a good picture of past failures such as BABA. I was lucky to follow a lot of you guys into Energy a few years back, particularly Obsidian which I had been in and out of earlier when it was PennWest -- big thanks for SharperDingaan for defending his rationale on OBE back when it was turning around and it was still unpopular. I should've listened to him about energy being something you don't hold for the long term. I wish I had sold above $10 when Russia invaded Ukraine and oil prices were surging. My best performer and my biggest position sizing regret was Enphase, bought back in 2017. It turned into a 200 bagger before I sold off most of it, and now I just keep a sliver as a memento. It was only a 0.1% position, DAMMIT! That old lesson from Enphase influenced me to build up a bigger position in GLASF a year or two ago. Buffett has said he's proud never to have lost more than 5% due to a single bad investment - I think he said Tesco was his largest mistake ... so, if I feel particularly convicted about something, I might take as high as a 6 or 7% initial position size. The way I think about it, If I were to hold a lot of 1% positions I'd probably be better off just buying the S&P. When I'm tempted to get more active, I remember this story I heard about research at Fidelity. (I asked Claude-AI to tell the story since I didn't want to type it out)

-

Watched this one last night, based on a reddit.com/r/Documentaries recommendation thread. A lot of real good philosophy on teaching/training in here that doesn't just apply to horses.

-

https://blog.gorozen.com/blog/is-us-oil-production-surging This article is suggesting shale production in the US is going to be peaking this year, that 50% has already been extracted from all major shale basins, and that the reason for recent growth has been prioritization of best performing areas, a process known in the mining industry as "high-grading", and that the actual figures are hidden behind some funny accounting using an "EIA Crude Adjustment Factor" (graph shown on the page) ... Opinions on the usefulness/accuracy of this information? Is this the kind of information people will be pointing to if Warren Buffett's big OXY bet plays out fantastically, or am I reading a conspiracy theory website?

-

Great podcast episode recommendation thread

nafregnum replied to Liberty's topic in General Discussion

Ooh, thanks, I didn't know anything about Pocket Cast before - I'm going to check it out. -

https://www.energypolicy.columbia.edu/methane-detection-just-got-a-lot-smarter/ Detecting methane leaks via a new satellite that the Environmental Defense Fund will be launching in a month or two, with support from Google and some funding from Bezos Earth Fund. https://www.bezosearthfund.org/ideas/satellites-for-climate-and-nature https://blog.google/outreach-initiatives/sustainability/how-satellites-algorithms-and-ai-can-help-map-and-trace-methane-sources/ It will have the ability to detect methane concentrations down to the resolution of 400m square pixels, and can watch 200 sites that are 200km square, so it'll be able to keep an eye on all the major O&G basins to identify where the worst leaks are so they can be remediated. The old quote comes to mind: "Only when the tide goes out do you learn who has been swimming naked." I have read that Obsidian Energy prides itself on its monitoring and leak prevention/remediation program. I'm interested to see what this kind of transparency does. I've heard that North American O&G extraction is much cleaner than in other countries, but we will all soon find out.

-

Great podcast episode recommendation thread

nafregnum replied to Liberty's topic in General Discussion

Overcast. It has "Smart Speed" (cuts out silences) and you can also pay $9.99/yr for some premium features, like ability to upload your own mp3 files to your own private 10gb of file space. I take epub books that aren't available on Audible, and convert them to mp3 file using some scripts I wrote and Amazon's Polly service, then upload the mp3s so I can listen to them. The app is great, even if you don't need to premium features. -

https://pracap.com/just-smash-the-buybacks/ Kuppy's rationale seems well reasoned for profitable-but-unpopular companies like O&G and coal. Obsidian (OBE) is doing buybacks. Who else is in this unpopular sector and doing buybacks at cheap valuations instead of dividends and mergers?