KJP

-

Posts

2,156 -

Joined

-

Last visited

Content Type

Profiles

Forums

Events

Posts posted by KJP

-

-

We can't have wartime deficits without pretending to try to pay the bill, right?

Great question, with no obvious answers. Assuming there is some limit here, the other alternative is an effectively slow motion default via inflation. But where on whom an increased tax burden would fall is unclear.

-

No , you all just LOVE to present false dichotomies in hopes of destroying the President - and you know it.

I mean, it's not like the real choice might be between another Great Depression and millions of financially ruined lives.

You guys give 2 shits about that - you want the President destroyed and you know it.

Easy choice coming from a bunch of people with great jobs - while others in real pain side with the President

on finding workable alternatives.

It's just great to see the great minds here on COBF have it all figured out what the Presidents real motivations are.

Is this coming back to the virus is a Liberal hoax to destroy Trump?

I was actually pretty surprised about the announcement. Not the announcement itself but by the timing. And it wasn't just Trump, it was some Texas guy as well. I thought it would be at least an extra week until Republicans get to the "well the old folks are gonna have take one for the team". Which is a weird thing since they're their electorate. But maybe donors are more important than votes or maybe it just got so complicated they can't even keep it straight.

Now in practice, the way I understand it Trump can't really open up anything because he didn't really close anything. Except the border, he's probably not too keen on doing that.

I actually do care about all those people that you talk about and I think that people do need to think about opening things up. Not Trump, and the politicians, but smart people. A couple of reasons for that. I don't think you can keep it shut down for much more than 3 months and still have an economy. So as a heartless prick, at that point the old folks really have to take one for the team. But really we won't get to that point. Anyone who think you can keep Americans sequestered in their house for 3 months is out of his mind mad. At MOST you'll manage a month.

Now if you can manage a month that's actually pretty good. Cause China got things under control in a month. The problem is that the US is a lot worse than China. China didn't really have widespread infection. Most of it was in Hubei. In the US this virus made it to Shittown Alaska. You have NY, WA, IL, CA as big problems. Florida is probably a shitshow we just don't know it yet. Then you have the smaller centers popping up. So you'll have a rolling curve working its way through the country with different timings. Working on a one month time frame for max sequestration this is a nightmare!

By the way, does anyone else think that divorce lawyers are gonna make a killing off of this?

This is my biggest concern. As far as I can tell, the U.S. has no plan to address the epidemic; we seem to just be struggling everyday to try to keep our heads above water. It doesn't appear that in January we planned for March, and right now we don't appear to be planning for May. Or if we do have a plan, I don't know what it is.

That comment applies broadly to both federal and state officials, regardless of political party. But given the nature of this particular problem -- and how it spreads regardless of national or state borders -- it seems unwise to have the states lead the response with federal "support," which is the language I've heard from the daily press conferences. I don't know where that strategy came from -- a philosophical belief in federalism, an effort to avoid blame, existing bureaucratic and regulatory hurdles, or something else -- but I hope it changes.

-

Griffin Industrial Realty

-

I think the fear on here is quiet interesting since decent to good Companies are 50-75 pct. off since their most recent highs and yet it sounds like risk has increased.

Which companies do you like the best? I don't follow that many, so I'm likely missing out on potential ideas.

I agree with your general point that the amount of general posts here has swamped company-specific posts for awhile. It's been hard to get any conversation going about specific companies.

I don't even know where to begin. I think the ground is littered with bargains.

I'm not saying you're wrong. I'm genuinely interested in understanding the companies you're referring to.

Lots of mega caps and sleep well at night stocks seem cheap; Berkshire, Google, Altria.

I think ALT managers have a bright future and like KKR where apart from earnings there's some tangible value in their investments (which have taken a hit, obviously). Espescially with low rates. Unlike say BAM you don't have to have a strong opinion on malls.

Also like retailers (ugh!) like Ulta Beauty - and an asset light (but sub prime heavy!) play on retailers like Alliance Data Systems. The last one has been expensive for me, but hopefully it'll be a multibagger from here.

I also like car dealerships. Auto Nation and Ashbury Automotive are cheap and well run in the states, but they also have a bit of leverage. Their new car sales will be hurt in a recession, obviously, but they're making around 40-45 pct. of their GP on service, which is resilent. I like both, but have invested in Vertu Motors and Cambria Automobiles in UK instead - they're simply cheaper.

Vertu with around half of the market cap in net cash and coming out of a large investment cycle (thus harvesting FCF now), Cambria arguably a better business and with a fine balance sheet but bigger capex cycle ahead (perhaps some will be postphoned). I also really like Clipper Logistics in the UK (a play on retail and ecommerce), which I've written up, as well as St. James Place (money manager with sticky capital, high ROIC, asset light).

My biggest position is Berkshire, second biggest is Linamar, which is a founder-led Canadian auto parts, industrial and and agri company. 2019 was a tough year for them, and they did close to 700m in FCF vs. a market cap of 1,6b today. Guided for another 500-700m this year.

That was a couple of weeks before auto OEMS closed shop, they themselves will be shut down for some time, but I think the world will go on in 6-8 weeks, and I expect them to keep throwing off cash and diversify further (latest is into medtech - hopefully something less cyclical!). Trades around 0,3xBV and will probably do mid/high teens ROE if things start hitting on all cylinders at some point. Insiders have been buying.

All can be debated - well not really, most have gotten killed - but they're pretty simple business that are easy to understand and should be here in 5-10 years if they don't go bust before then. No idea about the upside, I'm mostly trying to figure out the downside, because if they get through to the other side, I'll much prefer to own 10 plus ROE businesses with fat dividends and half-resilent earnings and net cash should at 1,5xev/ebitda (Vertu) than hold cash - volatility be damned.

Thanks for the thoughts. To the extent it's useful, I have an eye on the following:

FRP Holdings

Griffin Industrial Realty

Williams Companies

LICT Corp.

Rosetta Stone

Comcast

Black Stone Minerals (it's hard to even type that right now)

Daily Journal

Hill International

NVR

For a few of them, I've been buying a bit here and there, but largely waiting for them to get even cheaper.

How do you decide whether they're cheap enough or not? The other day, when WMB went down 30 pct. to below 9 - apparently somewhat due to forced selling from ETF's - I think that seemed like a good time to pounce.

...

Anyway, my question is - when we've had a day like today (up 10 pct.) - how does one ever get back in if things just shoot up? Not saying that'll happen, or that it's even likely, but doesn't one risk missing all the action because one is anchored to prices just last week (with a lot of stuff since then up 50-100 pct.)? I think I would. I already find it extremely hard not to anchor to prices that aren't around 52-week lows - as arbitrary and dumb as it is.

I agree with you re: going to all cash. I didn't do that for the reasons you mentioned. But I start adding much too early, before I understood the seriousness of the likely fallout from the virus. So, I slowed my buying considerably (though I did buy a bit of WMB between 9 and 10 for the reasons you mentioned). If I missed a buying opportunity with some of my cash, I'm OK with that, but I recognize I cannot time the bottom or perhaps even recognize it until it's long since past. That's why I do have general price targets for many of the ones I mentioned.

-

I think the fear on here is quiet interesting since decent to good Companies are 50-75 pct. off since their most recent highs and yet it sounds like risk has increased.

Which companies do you like the best? I don't follow that many, so I'm likely missing out on potential ideas.

I agree with your general point that the amount of general posts here has swamped company-specific posts for awhile. It's been hard to get any conversation going about specific companies.

I don't even know where to begin. I think the ground is littered with bargains.

I'm not saying you're wrong. I'm genuinely interested in understanding the companies you're referring to.

Lots of mega caps and sleep well at night stocks seem cheap; Berkshire, Google, Altria.

I think ALT managers have a bright future and like KKR where apart from earnings there's some tangible value in their investments (which have taken a hit, obviously). Espescially with low rates. Unlike say BAM you don't have to have a strong opinion on malls.

Also like retailers (ugh!) like Ulta Beauty - and an asset light (but sub prime heavy!) play on retailers like Alliance Data Systems. The last one has been expensive for me, but hopefully it'll be a multibagger from here.

I also like car dealerships. Auto Nation and Ashbury Automotive are cheap and well run in the states, but they also have a bit of leverage. Their new car sales will be hurt in a recession, obviously, but they're making around 40-45 pct. of their GP on service, which is resilent. I like both, but have invested in Vertu Motors and Cambria Automobiles in UK instead - they're simply cheaper.

Vertu with around half of the market cap in net cash and coming out of a large investment cycle (thus harvesting FCF now), Cambria arguably a better business and with a fine balance sheet but bigger capex cycle ahead (perhaps some will be postphoned). I also really like Clipper Logistics in the UK (a play on retail and ecommerce), which I've written up, as well as St. James Place (money manager with sticky capital, high ROIC, asset light).

My biggest position is Berkshire, second biggest is Linamar, which is a founder-led Canadian auto parts, industrial and and agri company. 2019 was a tough year for them, and they did close to 700m in FCF vs. a market cap of 1,6b today. Guided for another 500-700m this year.

That was a couple of weeks before auto OEMS closed shop, they themselves will be shut down for some time, but I think the world will go on in 6-8 weeks, and I expect them to keep throwing off cash and diversify further (latest is into medtech - hopefully something less cyclical!). Trades around 0,3xBV and will probably do mid/high teens ROE if things start hitting on all cylinders at some point. Insiders have been buying.

All can be debated - well not really, most have gotten killed - but they're pretty simple business that are easy to understand and should be here in 5-10 years if they don't go bust before then. No idea about the upside, I'm mostly trying to figure out the downside, because if they get through to the other side, I'll much prefer to own 10 plus ROE businesses with fat dividends and half-resilent earnings and net cash should at 1,5xev/ebitda (Vertu) than hold cash - volatility be damned.

Thanks for the thoughts. To the extent it's useful, I have an eye on the following:

FRP Holdings

Griffin Industrial Realty

Williams Companies

LICT Corp.

Rosetta Stone

Comcast

Black Stone Minerals (it's hard to even type that right now)

Daily Journal

Hill International

NVR

For a few of them, I've been buying a bit here and there, but largely waiting for them to get even cheaper.

-

I think the fear on here is quiet interesting since decent to good Companies are 50-75 pct. off since their most recent highs and yet it sounds like risk has increased.

Which companies do you like the best? I don't follow that many, so I'm likely missing out on potential ideas.

I agree with your general point that the amount of general posts here has swamped company-specific posts for awhile. It's been hard to get any conversation going about specific companies.

I don't even know where to begin. I think the ground is littered with bargains.

I'm not saying you're wrong. I'm genuinely interested in understanding the companies you're referring to.

-

I think the fear on here is quiet interesting since decent to good Companies are 50-75 pct. off since their most recent highs and yet it sounds like risk has increased.

Which companies do you like the best? I don't follow that many, so I'm likely missing out on potential ideas.

I agree with your general point that the amount of general posts here has swamped company-specific posts for awhile. It's been hard to get any conversation going about specific companies.

KJP, I understand your partially veiled impatience but it is hard to read what the Fed just announced and to continue as if it's business as usual..

FWIW, I read what you write but I don't understand most of the companies you mention. I do find Black Stone Minerals interesting and may contribute over the next few weeks, months.

Yes, I agree it's useful to think about the macro situation too in times like these. And the Fed certainly isn't acting like it's business as usual. But I'm always curious what people are looking at when they make general statements like "there are many big bargains right now," because I don't see that in general, but I also don't look at anything close to the entire universe of companies. If nothing else, having more names to look at will keep me busy and, hopefully, more patient.

-

I think the fear on here is quiet interesting since decent to good Companies are 50-75 pct. off since their most recent highs and yet it sounds like risk has increased.

Which companies do you like the best? I don't follow that many, so I'm likely missing out on potential ideas.

I agree with your general point that the amount of general posts here has swamped company-specific posts for awhile. It's been hard to get any conversation going about specific companies.

-

People in NYC are still walking around without mask

A lot of People in grocery stores, none had mask and only some wear gloves.

Home Depot is packed with people.

Do standard (non-N95) masks aid healthy people avoid infection, prevent sick people from spreading, or both?

-

I'm also interested in orthopa's point: For those who believe the US response was "too little, too late" to avoid overloading hospitals a la Italy, by what date (or range of dates) should we start to see overloaded ICUs in the apparently most troubled areas, e.g., Seattle and NYC?

Approx every week cases double, and it takes about a week until people are hospitalized, so once you reach a large enough threshold of cases, each week gets progressively worse. Going from 1 case to 100 takes around the same amount of time as going from 100 to 100,000 (unmitigated), and the problems become much large in that 100 > 100,000 progression.

If the estimates I've seen hold, that threshold is hitting right about now with around 20,000 estimated US cases as of a few days ago. Clusters will become large enough to impact large city health systems once you have a few thousand cases in the area, and I'd expect in less than 7 days you'll start seeing a crush of patients in Seattle and NYC, and the situation will likely get worse each week from there.

NYC hospitals have started to become overwhelmed, as well as many cities in Europe.

I have now revised my expectations that the US will have much worse spread outcomes than Italy, as the US has been much less proactive, and spread is likely continuing in an exponential way further along the curve. Italy was starting to slow by 100,000 cases, however the US is still traveling on an exponential path. Millions of cases, and incredibly high CFRs are likely.

Ben F. Maier

@BenFMaier

As a disease modeler, I disagree that the US's curve looks like Italy's. It looks much worse.

Italy: sub-exponential growth due to containment measures

US: unmitigated exponential growth

The economic damage will be much larger than I previously thought as well--depression is now my base case. I am also not convinced the plans currently being written by the GOP will pass, though my confidence is much lower reading the political tea leaves. I think the struggle to pass the small $8 billion bill indicates there will be a lot of fighting once the numbers get to the trillions.

Moreover, I expect any industry bailouts to work similar to GM in 2008-2009, where within months, the bailed out company finds that it must still declare bankruptcy, as conditions will not become economic for some time, and they require re-structuring.

I was about to go back the timeline you posted and note the first rumblings from NYC that ICUs are filling up. Unfortunately, I've found reliable reporting about this specific and very important issue (current status and capacity of hospitals/ICUs) very spotty. I wish we had comprehensive data consistently published about this, which I view as a much more objective marker than testing, which we know is very flawed.

-

Let’s not forget all the stuff behind the scenes being passed.

Patriot Act signed again

DOJ just asked congress if it could suspend due process.

Never let a good crisis go to waste right?

This type of request has never been granted. Absolutely insane. The closes thing was the despicable handling of the Japanese during wwii. Katrina also had some similar stuff happen. Hundreds of law abiding citizens had their guns confiscated leaving their homes, businesses, vulnerable to looting.

What exactly is the text of the request that you're saying has never been granted before? Many district courts, on their own authority, have already suspended all civil and criminal trials and have excluded that time from counting toward the requirements of the Speedy Trial Act, with specific exceptions to be granted on a case-by-case basis. To my knowledge, however, no district court has suspended proceedings entirely, which would effectively suspend the writ of habeas corpus in that district (but query whether, in the event a federal district court was closed and thus there were no federal habeas venue, a state court could assume jurisdiction to grant a writ even to a federal prisoner, assuming Congress had not suspending the writ).

The primary qualm is the request to detain individuals without due process indefinitely without trial.

Yes, that would be disturbing, but I haven't seen the actual text. The references I have seen to such a request would authorize the Chief Judge in each district to close down. Under that scheme, it would be at the discretion of the judicial branch, not the executive. In my experience, they would be loathe to use such authority and would exhaust every other possibility first, such as phone and video conference.

-

Let’s not forget all the stuff behind the scenes being passed.

Patriot Act signed again

DOJ just asked congress if it could suspend due process.

Never let a good crisis go to waste right?

This type of request has never been granted. Absolutely insane. The closes thing was the despicable handling of the Japanese during wwii. Katrina also had some similar stuff happen. Hundreds of law abiding citizens had their guns confiscated leaving their homes, businesses, vulnerable to looting.

What exactly is the text of the request that you're saying has never been granted before? Many district courts, on their own authority, have already suspended all civil and criminal trials and have excluded that time from counting toward the requirements of the Speedy Trial Act, with specific exceptions to be granted on a case-by-case basis. To my knowledge, however, no district court has suspended proceedings entirely, which would effectively suspend the writ of habeas corpus in that district (but query whether, in the event a federal district court was closed and thus there were no federal habeas venue, a state court could assume jurisdiction to grant a writ even to a federal prisoner, assuming Congress had not suspending the writ).

-

Let's take a real world example so we can understand your proposal:

Employee A

Works at business B

Which rents space from Landlord C

Who has a mortgage with, and pays interest to, Entity D

Which pays out an income stream to Investor E

Is your suggestion that the government give B whatever money is necessary for it to pay A and to pay C, which in turn can pay D, which in turn can continue to pay out to E? Or are you suggesting that the money should stop somewhere along this chain? If so, where does it stop? If it does not stop anywhere in this chain, who ultimately will foot the bill? If no one will foot the bill, how is such a free lunch possible?

-

I hate to say it, but reading through some of the comments through this thread, I realize why the bond folks look down on the equity folks. Bond people can do equity math, but for some reason equity people can't do bond math.

It actually almost doesn't matter what date you pick for bonds since the 90's -- well, maybe not in the past year, but even then, read my final comment. I just picked anytime in the 90's, because anytime I say since the 80's, people invariably look at the double digit yields and say, "OF COURSE IT OUTPERFORMED!" I mean, yeah, in hindsight, we could have bought 30 YR treasuries and held on for 12% coupons and not even have done things like roll over duration YOY. It would have seemed like a no brainer trade in hindsight. But even then, including inflation, it was close to negative real yields. So, not exactly no brainer! But, my point is, you could have even bought 3 to 4% yielding treasuries, and rolled over duration YOY for the past 10 years all the way till when the 30 yr dipped under 1%, and you would have STOMPED the S&P on an annualized and compounded basis. It's even worse when you look at the Sharpe Ratios.

Hell, even before the 30 YR treasury rallied to the point where yields dipped under 1%, I was looking at the 30 YR a month and a half ago thinking, "SHIT, 30 YR is now 1.5%! Oh well, can't buy 30 YR zero coupon treasuries, the bonds have rallied already." WoW! Little did I know the shit was going to hit the fan since then. I had no idea 30 YR's were going to dip to nearly 0.5%. When the 30 YR hit 1% in fact, ZERO coupon 30 YR Treasuries were up nearly 30%.

I understand you're rolling duration, not holding your initial purchase for 30 years. But would you want to roll duration for the next 30 years starting from where 30-year treasuries are now?

-

US Treasuries have outperformed domestic US Stocks over the past 40 years:

On a risk adjusted basis, it's no comparison. So much for equities always >> bonds. Moreso, if you bought 30 yr Treasuries in the 90's, in fact, not even the 80's, but any point in the 90's, and rolled duration over yoy till now, you would have STOMPED the S&P on a compounded basis. It wouldn't even be close. It's something like 20+% CAGR.

Finally, more nice nuggets from Meb:

I think the next decade brings a significant amount of U.S. equity under performance.

We've had falling interest rates essentially that entire period. Can that happen again over the next 30-40 years? That would imply, what, -10% yield on the 30-year?

-

-

Griffin Industrial Realty

-

What's the board's views on which ones may be attractive and have sufficiently strong balance sheets so that even if things get worse, they will ultimately come through well?

Thanks.

If you're looking for a strong balance sheet and a resilient business model, look at NVR.

-

Interesting post: https://catalyst-insights.com/the-virus-infecting-mlps/

Here are the fact sheets for the two levered MLP funds discussed in that post:

https://cef.tortoiseadvisors.com/media/1762/tyg-fact-sheet_022920_retail.pdf

They must have been selling at any price, though I doubt they have any assets left at this point.

EDIT: They also hold shares of the publicly traded C-corps. See, e.g., this portfolio disclosure from the Tortoise Fund: https://www.sec.gov/Archives/edgar/data/1268533/000114554920004137/xslFormNPORT-P_X01/primary_doc.xml

Here's another levered midstream CEF: https://kaynefunds.com/wp-content/uploads/KYN-20-02-29-NAV-Press-Release.pdf

It's down about 80% so far in 2020.

And another: https://www.leggmason.com/en-us/products/closed-end-funds/clearbridge-energy-midstream-opportunity-fund-inc.html

It's down 90% YTD.

And why not, here's one more: https://www.leggmason.com/content/dam/legg-mason/documents/en/product-literature/fact-sheet/fact-sheet-cbi-energy-mlp.pdf

These funds are now selling at big discounts to NAV, which is no surprise given the recent performance.

-

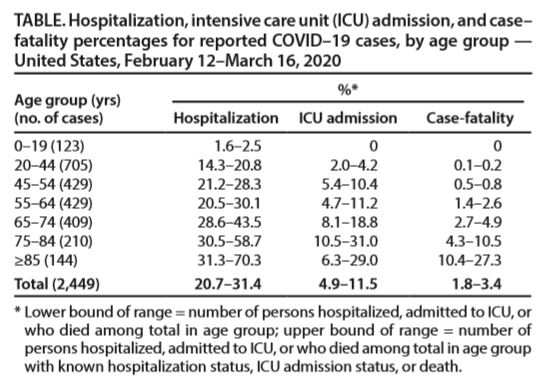

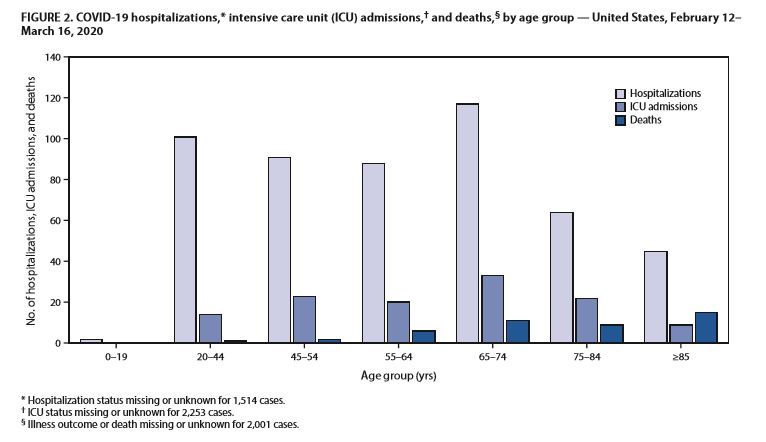

Look at the table (population adjusted), not the chart (raw numbers). Young people by and large do well. There will be younger patients who develop severe infections and unfortunately may even die, but the risk is much greater for older folks.

No disputing that. However, the hospitalization rate is much higher than I expected. I thought for me (in the 20-44 group) - it was going to be a bad flu. I didn't think i'd have a 1/5 to 1/7 chance of going to the hospital.

With n=705 for 20-44, I think you really need more information about the characteristics of the 100 that were hospitalized to know what the increased risk factors are and whether you have any. We think we know some (smoking, obesity), so assuming those don't apply to you, you're hospitalization rate ought to be lower. What it actually is though, remains unclear.

-

The data bears out that concern. In Italy, the hardest hit country in Europe, almost a quarter of the nearly 28,000 coronavirus patients are between the ages of 19 and 50, according to data website Statista.

Similar trends have been seen in the U.S. Among nearly 2,500 of the first coronavirus cases in the U.S., 705 were aged 20 to 44, according to the Centers for Disease Control and Prevention. Between 15% and 20% eventually ended up in the hospital, including as many as 4% who needed intensive care. Few died.

Thanks for sharing Kaegi.

This is really important. It shows what I was saying weeks ago regarding the data out of China. The risk to younger people is lower, but after adjusting for triage, you will see that the risks for young people have been understated and the risk for older people are overstated if you exclude periods when the health system is overwhelmed. During periods when the healthcare systems have been overwhelmed, out comes for older people became horrific. This break point needs to be understood and new data regarding the experience in the USA will really help.

Any details about potential attributes among the 20-44 group, e.g., higher percentage of smokers, etc.?

I'm not sure exactly what you're asking, but here are a couple of quick comments.

There is some very disturbing information in other sources about sudden death involving heart attacks that gives reason to be very concerned about obesity as a comorbidity in the USA. The point at which cardiac function becomes a concern seems to be primarily so late in the disease progression, that I am not sure it will end up being a major factor in the USA for younger age groups, but is likely a major factor with increasing age.

Smoking is more likely to be an issue among the 20-44 age group. The people who say that vaping and marijuana are not dangerous typically are not focused on the impact of particulates in the lungs. The cilia is responsible for removing particulate matter from the lungs, and the health of cilia will be a very important factor for survival of a severe cases of COVID-19. Anyone who has subjected their lungs to a particulate burden should try to reduce exposure immediately if they have any concerns about developing a severe case of COVID-19. This includes any type of smoking, or pollution, and particulate matter from sanding, industrial processes, construction, demolition, etc.

Yes, those are the types of things I was getting at.

Given all the other measures we've taken, when will we temporarily ban the sale of cigarettes?

-

The data bears out that concern. In Italy, the hardest hit country in Europe, almost a quarter of the nearly 28,000 coronavirus patients are between the ages of 19 and 50, according to data website Statista.

Similar trends have been seen in the U.S. Among nearly 2,500 of the first coronavirus cases in the U.S., 705 were aged 20 to 44, according to the Centers for Disease Control and Prevention. Between 15% and 20% eventually ended up in the hospital, including as many as 4% who needed intensive care. Few died.

Thanks for sharing Kaegi.

This is really important. It shows what I was saying weeks ago regarding the data out of China. The risk to younger people is lower, but after adjusting for triage, you will see that the risks for young people have been understated and the risk for older people are overstated if you exclude periods when the health system is overwhelmed. During periods when the healthcare systems have been overwhelmed, out comes for older people became horrific. This break point needs to be understood and new data regarding the experience in the USA will really help.

Any details about potential attributes among the 20-44 group, e.g., higher percentage of smokers, etc.?

-

Interesting post: https://catalyst-insights.com/the-virus-infecting-mlps/

Here are the fact sheets for the two levered MLP funds discussed in that post:

https://cef.tortoiseadvisors.com/media/1762/tyg-fact-sheet_022920_retail.pdf

They must have been selling at any price, though I doubt they have any assets left at this point.

EDIT: They also hold shares of the publicly traded C-corps. See, e.g., this portfolio disclosure from the Tortoise Fund: https://www.sec.gov/Archives/edgar/data/1268533/000114554920004137/xslFormNPORT-P_X01/primary_doc.xml

Yeah, I just saw this with mREITs today. Two UBS leveraged ETF's in mREITS were just liquidated! Most of these stocks were down 40 to 50%! HOLY SHIT! My gawd, man. I'm freaking the fuck out right now.

I'm actually encouraged by this. It provides a plausible (though not necessarily complete or correct) explanation that had previously been lacking, at least on this thread.

Also, midstream companies and mREITs are often levered up to their eyeballs. Is it wise to then lever your investment in them? I assume part of the answer is that these are retail yield vehicles whose buyers don't understand what they're getting into.

You should read this paper:

https://necsi.edu/the-stock-market-has-grown-unstable-since-february-2018

It basically says that the markets were primed for huge price swings. It didn't predict that swings would happen. It just said that if there is a crisis (like coronavirus and oil war), the markets will swing wildly like we see now. It doesn't provide an explanation, though. Although, maybe having more leveraged ETF's than before is likely causing this issue. Vehicles like 3x bull / bear ETF's weren't really around pre 2008.

I took a look at the paper. As you note, it's hard to glean anything from it, but your hypothesis about one of the potential factors makes sense: The more leveraged investors are, the more forced selling there will be.

-

Interesting post: https://catalyst-insights.com/the-virus-infecting-mlps/

Here are the fact sheets for the two levered MLP funds discussed in that post:

https://cef.tortoiseadvisors.com/media/1762/tyg-fact-sheet_022920_retail.pdf

They must have been selling at any price, though I doubt they have any assets left at this point.

EDIT: They also hold shares of the publicly traded C-corps. See, e.g., this portfolio disclosure from the Tortoise Fund: https://www.sec.gov/Archives/edgar/data/1268533/000114554920004137/xslFormNPORT-P_X01/primary_doc.xml

Yeah, I just saw this with mREITs today. Two UBS leveraged ETF's in mREITS were just liquidated! Most of these stocks were down 40 to 50%! HOLY SHIT! My gawd, man. I'm freaking the fuck out right now.

I'm actually encouraged by this. It provides a plausible (though not necessarily complete or correct) explanation that had previously been lacking, at least on this thread.

Also, midstream companies and mREITs are often levered up to their eyeballs. Is it wise to then lever your investment in them? I assume part of the answer is that these are retail yield vehicles whose buyers don't understand what they're getting into.

What are you buying today?

in General Discussion

Posted

Great list/summary. Thanks for posting. I'd add the following to the list:

HHC: See the thread

the DREAM complex in Canada:

DREAM Unlimited -- see thread -- mother ship, asset manager and real estate developer, has direct on-balance sheets office/retail assets primarily in the Toronto area, indirect ownership of the same via units in managed funds, large western Canada (e.g., Calgary, Saskatchewan metros) land holdings that are being developed into residential suburbs over time, and a grab bag of other assets

DREAM Office -- office REIT focused on Toronto with favorable management contract terms due to a transaction a couple of years ago (see thread)

DREAM Alternatives -- Over the last few years this has shifted from a yield vehicle to a development vehicle for various DREAM projects

I assume we're using "REIT" very broadly to cover companies whose primary business is owned and leading real property. In that case, FRPH probably no longer qualifies (vast majority of value is now cash/bond, aggregate royalties and DC multi-family development/land parcels, rather than NOI of existing assets).