KJP

-

Posts

2,156 -

Joined

-

Last visited

Content Type

Profiles

Forums

Events

Posts posted by KJP

-

-

Demographics appear to be another SFH tailwind: https://www.calculatedriskblog.com/2020/10/demographics-renting-vs-owning.html

-

LEVI (AH) and HII.

HII was a starter position and the defense play I had the least confidence in.

It's great move, Speculatius,

Because HII is not a business, it's a scheme [with a ticker, though] to suck up funds from the US military budget to keep people meaningless employed.

Well, I am not sure I fully agree. Should the US just outsource building these ships to Korean shipbuilders for example? it sure would be cheaper, but I don’t think it would ever happen. There is some issue with IP too, but I don’t think there is much IP in the hulls and that is actually my concern with HII in the long run.

Longer term, military power is going to be driven by technology much more so than by the number of boots on the ground. that’s why I believe the likes of LMT, NOC and LHX are better bets than HII.

I wasn't sure what the prior cryptic comment was getting at. But I agree with you that the biggest risk here is that advances in anti-ship cruise and anti-ship ballistic missiles (aided by satellite guidance) render large surface ships like aircraft carriers obsolete in combat against other advanced militaries. There are already commentators who believe that even in the open ocean US carrier battle groups would not survive the initial stages of a serious conflict with China or Russia.

As you note, the construction of aircraft carriers won't be outsourced to non-US shipyards, nor will a competing US shipyard be built. Rather, the threat to HII is that in 10 years aircraft carriers and other large surface ships won't be built at all. That being said, if you look at the free cash flow HII is likely to generate from the current order book over the next 5-10 years, what terminal value is actually being assigned to the business?

-

On PCYO, the underperformance is indeed perplexing. They own all the stuff you'd think does very well with the housing market on fire like it is.

I had the same thought. I realize PCYO is concentrated in one area and the big homebuilders are much more geographically diverse, but it's strange that PCYO hasn't really budged.

-

Yes, the people who were saying that Denmark was the best model are pretty quiet these days. Denmark is at ~500 cases per day about now, for a population of a shade under 6 million people. So, take Denmark and multiply by about 60, and that would be similar to the US. So, 500 x 60 = 30,000 (still lower than the current number of new cases in the US, but not appreciably). All of the people claiming that Sweden was misguided and that Denmark's test and traceback approach was dialed-in are pretty quiet in September.

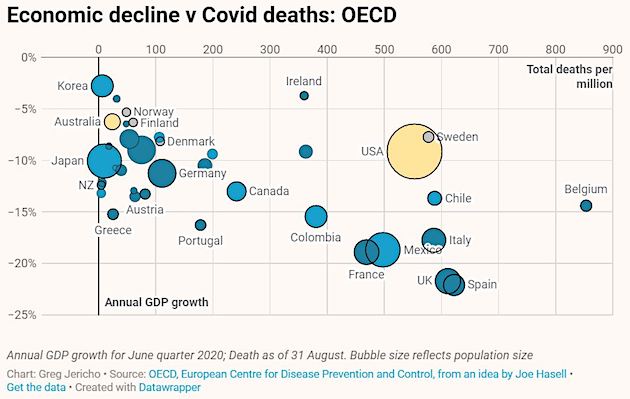

Hmm, Denmark vs Sweden. Why would anyone choose to just have Denmark's trashed economy when they can instead have Sweden's equally trashed economy and but also five times the death rate? (Note the grey dots, the Scandinavian countries that are the best comparatives for Sweden.)

Like, is it really that important to Trump fans that a bunch of extra people die without actually improving the economy? And if you're going to say, we "we should be like that country", why wouldn't you just choose South Korea? A tiny death rate and a robust economy. What's not to like?

The difference in death rates in what I assume to be roughly comparable countries is very interesting. Can anyone link to what they believe to be sound analyses of, for example, Greece v. Italy or Austria v. France? Similarly, Korea or Japan vs. United States? I apologize if these have already been posted; I haven't scrolled through the whole thread.

-

Google will try ‘hybrid’ work-from-home models, as most employees don’t want to come in every day

more WFH days, not WFH forever...Make sense.

Looks like a very balanced approach. For us as investors, I'm thinking two implications from his two statements in his interview with the Time Magazine at https://www.youtube.com/watch?v=hpn1rebBfqY:

- More employees could spread out into exurbs: Sundar wants to give employees flexibility so that they don't have to commute 2 hours, e.g. on Fridays, as those commutes prevent employees from being able to make plans with friends and families. This would mean more employees could move farther out, increasing the supply of housing they could consider for living, in turn, decreasing the price of housing within 45-min of campus.

- Company sites could shrink in size: Sundar wants to have concept of "onsites", when employees get together to meet in person. If employees are going to meet only for "onsites", this could reduce the square footage needed for company, decreasing demand for office space, decreasing office supply.

As other companies do the same, looks like this means the impact will be effective supply available will be higher for both office space and housing options. In other words, vacancy will be higher. Incremental supply can cause big swings in price as 20% vacancy did in Detroit.

What are the implications for mass transit systems? If WFH permanently cut commuting days by 50%, how do, for example, the LIRR (NYC), Metro-North (NYC), NJ Transit (north and central NJ) and SEPTA (Philly) survive? If you don't have those commuter rails, how do people get into the city on the 50% of days they want to come in?

Also, what about climate change? It is common to see companies pushing toward (at least purported) carbon neutrality. How can you do that if your HQ is inaccessible except by car, which would be the case for essentially all suburban or exurban locations?

More broadly, many cities are the hub in a local hub-and-spoke (road and rail) transport network that may be not be so easy to unwind.

- More employees could spread out into exurbs: Sundar wants to give employees flexibility so that they don't have to commute 2 hours, e.g. on Fridays, as those commutes prevent employees from being able to make plans with friends and families. This would mean more employees could move farther out, increasing the supply of housing they could consider for living, in turn, decreasing the price of housing within 45-min of campus.

-

Enterprise Products Partners

Hill International

-

I agree pipes like Williams' are cheap in a zirp world, but terminal value is a bit trickier. EIA and BP expect, I believe, natural gas demand to grow to 2035 before starting to decline. But there will obviously be major regional differences, and 15 year energy forecasts are mostly crap. Look at something like offshore wind - demand is increasing rapidly and making forecasts done 2 years ago look ridicilous. Since financing is a big part of the total cost of renewables, low rates should be a major tailwind.

Yes, terminal value is the real issue here and, as you note, projecting energy demand by source in 10-30 years is beyond probably anyone's capability. The risk is mitigated in part by the high current yields and the ability to not reinvest your dividends/distributions.

-

To me, natural gas pipelines are the most obvious value in plain sight. The easements and right of ways become more valuable overtime as it is becoming nearly impossible to build new pipelines in the face of green-washing backlash.

Bond investors seem to agree with you. Williams recently issued Holdco level 10-year debt at 3.5% (https://investor.williams.com/press-releases/press-release-details/2020/Williams-Prices-1-Billion-of-Senior-Notes/default.aspx) and OpCo (Transco) level 30-year debt at 4%: https://investor.williams.com/press-releases/press-release-details/2020/Williams-Transco-Prices-Private-Debt-Issuance/default.aspx. Meanwhile, the equity trades at a DCF yield well into the double digits.

You can find similar things with refined products pipelines. For example, Enterprise Products Partners recently issued 10-year OpCo level debt at 2.6% and 30-year debt OpCo level debt at 3.2%: https://www.enterpriseproducts.com/investors/news-releases

Meanwhile, the equity units currently have a distribution yield of ~10.5% and a DCF yield well into the double digits.

Something seems amiss in those numbers.

-

A few examples across different industries:

- Telecom: BCE.TO; dividend yield = 5.9% (T?)

- pipelines: TRP.TO; dividend yields = 5.3% (lots of other examples here)

- Energy: SU.TO; dividend yield = 4% (after being cut 55%) (XOM?)

- Financials: TD.TO; dividend yield = 4.9%

- Real Estate: KW; dividend yield = 5.9%

What are the best dividend yielding stock situations that you see today?

- The largest US natural gas transmission/gathering systems: 7.75-8% yields (Williams; Kinder Morgan) -- DCF yields likely into the double digits

- The blue chip NGL/refined products MLPs: 10-11% distribution yields (Enterprise Products Partners; Magellan Midstream)

- Oil & gas mineral (royalty) owners: ~9% to double digits (but variable) (e.g., Black Stone Minerals, Dorchester Minerals)

- Small NYC-area commercial real estate company consisting of the highest quality building on a long-term lease to a very high quality tenant and conservative balance sheet - 6.75% (Alexander's)

I own most of these. At a high level, all four have the same issue -- not only a potential absence of growth, but a potential perpetual decline into zero terminal value (oil and gas are going away; NYC will never be the same). But I think you're being fairly compensated to wait and see and I balance things out by trying to find growthier investments for other parts of the portfolio.

-

cigar, no complete country lockdown. lockdown nursing/lifecare facilities. lockdown elderly in place and within families and provide meal etc services. lockdown those who are obese/diabetes/etc. don't lockdown healthy adults or children. capiche? focus lockdown strategy on those who need it, not stupidly on everyone. we knew very early on who were really threatened by covid. common sense.

What does it mean to "lockdown" everyone who is obese, has diabetes, etc.? Do you mean pay them to stay home and not to work? Do you think that would fly politically? In any event, wouldn't your lockdown include 50% or more of the US population? [see, e.g., the 42% obesity rate asserted by the CDC: https://www.cdc.gov/obesity/data/adult.html ]

-

Huntington Ingalls

Hill International

-

Why isn't there a desire for folks to go back to the office? Part of my theory is that the ambience of NYC is what draws people in. Not a farfetched theory.

I don't think that's unique to NYC. One of the main reasons for me to go into my downtown Philadelphia office is to network/see friends for lunch, coffee, drinks, etc. Most of that is not currently available, so I've been to my office twice in the last six months and don't plan on going more frequently until more dining and drinking options are available and I'm comfortable going to them. I personally don't plan to go to any indoor restaurants/bars anytime soon, so it's still the virus that's keeping me away, but I assume there are others who would return but for the drinking/dining restrictions.

-

I was reading the book "Damn right" about Charlie Munger and on page 164 there is an excerpt from a testimony of Mr. Munger. The notes in the book say this is from: Superior Court of the State of California for the Country of Los Angeles, Metropolitan News Company v. Daily Journal Corporation and Charles T. Munger, July 1, 1999, Vol. 12, pp. 1819-20.

Beeing a German and unfamiliar with the US law system, is there a member on this board who could help me get this testimony/ give some hints how to optain this document?

Thank you for any help.

It's going to be difficult because the case is 20+ years old.

1) It's a state court, so it's not on PACER. If LA County had electronic filing back then (I suspect not) and that portion of the transcript is publicly filed somewhere on the docket (maybe yes, maybe no), then you could access it by getting a log-in to the electronic filing system.

2) If you find the case number, you can start exploring the contacts available here: http://www.lacourt.org/generalinfo/courtreporter/GI_RE001.aspx I suspect you won't get very far because the case is too old.

3) An alternative is to hire a litigation support/docket search company that regularly obtains court records in Los Angeles. They would at least know where to start looking.

4) Forget all of the above and try to contact the author or publisher of the book and ask them to provide you a copy.

-

I don't think you have a solid understanding of the virus. Probably no one has better understanding about it than me, at least in this forum. (Uh Oh, i don't want to sound like Trump..... ;))

This second wave will have far smaller death rate than the first one, and by the end of August, the US will have herd immunity and new daily cases will drop sharply and these Democratic governors will face severe pressure to reopen.

If by "death rate" you mean [confirmed cases]/deaths, you certainly seem to be right based on the data we have already. Cases also appear to be inflecting down in FL, AZ and TX. So, I'm very curious what exactly you mean by "herd immunity" and why you think we'll have it by the end of the August. Do you think the NYC already has it?

I already explained in prior posts. NYC already had 24% people antibody positive in early April, so probably 40% now. Also research shows likelihood of 40-60% of entire global population who have never been exposed to COVID but their T cell can already fight COVID. So we are easily at 80% immunity in NYC.

The proof is the 10k daily cases in March but no second spike in July. Now Texas and FL, with similar population size, have experienced what NY experienced in March, so in four weeks, the new daily cases should be sharply lower.

I don't want to keep explaining things over and over. People who believe it will find evidence that confirms their view, and people who disbelieve it will also find evidence that confirms their view. My high conviction prediction is that by the end of August, the COVID situation is dramatically better. Then the Democrats will face tremendous pressure to reopen. Then Trump wins again in November.

And to Dalal holdings, my prediction of the crash depends on many things and 6 month time line is just a tentative one. I have to revisit it later. I have high conviction that we are in the early stage of an asset bubble and I have high conviction that this bubble will burst. I have low conviction for the 6 month timeline. But as it approaches, I'll see it more clearly at that time. It is simply not a good idea to put your words into my month and say, yeah you agree with me and that the market will crash in 30 days and COVID will be gone in 30 days. I never said that.

This is the info we needed from you—I believe you are inferring from the nature article on T cell reaction in unexposed patients? While certainly possible, I would not attach a high level of certainty to those results, certainly not extrapolating to the population level as you seem to do (N = 37)

Also research shows likelihood of 40-60% of entire global population who have never been exposed to COVID but their T cell can already fight COVID.You have high certainty, but it’s a big leap...

https://www.nature.com/articles/s41586-020-2550-z

There may be a few more studies on pre-existing T-cell reactivity to SARS-COV-2. See papers discussed here: https://www.nature.com/articles/s41577-020-0389-z?s=09

-

I don't think you have a solid understanding of the virus. Probably no one has better understanding about it than me, at least in this forum. (Uh Oh, i don't want to sound like Trump..... ;))

This second wave will have far smaller death rate than the first one, and by the end of August, the US will have herd immunity and new daily cases will drop sharply and these Democratic governors will face severe pressure to reopen.

If by "death rate" you mean [confirmed cases]/deaths, you certainly seem to be right based on the data we have already. Cases also appear to be inflecting down in FL, AZ and TX. So, I'm very curious what exactly you mean by "herd immunity" and why you think we'll have it by the end of the August. Do you think the NYC already has it?

-

KJP - I know this gets a bit "chicken-or-the-egg-y..." but bear with me.

Thanks for the detailed response. I believe some of the constraints are statutory, rather than merely regulatory (not sure exactly what you meant by "rules"), but, of course, even statutes can be changed. But if we assume the current regime remains, can the Treasury's account go negative? If not, how is that Treasury account "funded"?

Stepping into hypotheticals, if the Treasury account can go negative, is that any different than the Fed buying Treasury debt directly? After all, a "negative" balance is simply a loan, even if a forced one. And if the Fed can buy Treasury debt directly, does that cross the Rubicon into pure money-printing? Put another way, a constraint under the existing rules seems to be the someone needs to first buy Treasury debt issuance. If the Treasury's Fed account can go negative, that constraint is eliminated and the Treasury may spend an infinite amount of dollars without any revenue. [i have not yet read Prof. Kelton's book, but is her thesis that this is how the monetary system actually works now, and any focus on "pre-funding" the Fed's Treasury account is a misunderstanding?]

-

I wanted to revisit this thread to outline a recent simple real-world example that illustrates how US monetary operations work.

Great post! A few questions:

Thus, debt issuance by the US Treasury is a reserve maintenance activity, and not a funding activity for the Federal government. (This fact is not well understood and tends to blow people's minds.)

How do assets (i.e., the account that's debited at Step 1 of your MetaBank example) get into the U.S. Treasury's Fed account to begin with? If I understand your point later in the post, the issuance of debt by the Treasury reverses the flow and ends up crediting that Treasury account. So why isn't that debt issuance "funding" Treasury spending?

This last point is important to remember when we think about the Fed. Currently, the Fed is talking about moving to a new program of yield curve control. This program would attempt to “pin down” long-term Treasury yields by having the Fed buy enormous amounts of US Treasury debt (possibly a majority of what's outstanding). Right now, the Fed owns on its balance sheet approximately 20% of the total amount of US Treasury debt issued to the private sector (which is a normal amount for the Fed’s history going back forty years or so).

Unless forced to do so by increases in reserve requirements, why would banks choose to sell any Treasury to the Fed that has a higher yield than the interest on its Fed reserves? So is "yield control" simply the Fed paying a high enough price to drive all Treasury rates down to the rates it pays on reserves? If that happens, what forces private market buyers to purchase Treasuries yielding essentially nothing? In other words, why don't Treasury auctions fail?

-

What is your view on heat and humidity, during what time of year would you want to use the property, and what regional amenities (mountain vs ocean vs restaurant/museum/gallery) are most important to you?

-

Thanks on the color for HII. I heard the “metal bender” characterization of HII business in a MF industry focus podcast. I do think there is a bit of truth in it.

I looked at HII too, but ultimately decided to buy the higher tech LHX and NOC instead. My portfolio is already “armed to the teeth” with holdings in RHM.DE, BAESY, NOC, GD and LHX and I simply don’t want to own them all.

I also own GD and likely will buy one or more of LHX/NOC/LMT/RTX as well if the prices are right. I don't want all of my eggs in the Navy basket.

-

I don't have any doubts that HII and GD are gonna be around building ships for a long time. The question is around is around growth. Will there be any? Will the Navy have more ships in the future? I'm leaning the less ships way (historical trend) though not many less ships. I'm certain there won't be a meaningful increase in the number of ships.

So then NII and GD are kinda working the run rate of the US navy, replacing ships as they come due. Little growth if any. In such an environment the multiple for such a business should be rather modest.

I think you're right that growth (or lack thereof) is an issue. My understanding is the overall size of the fleet has stabilized over the last 15 years and there is an ongoing push to increase the size of the fleet over the next few decades from ~290 ships to ~355 ships. See, e.g., https://www.secnav.navy.mil/fmc/fmb/Documents/20pres/PB20%2030-year%20Shipbuilding%20Plan%20Final.pdf (page 16 has a chart so the historical decline in fleet size that you mentioned and the recent stabilization I'm referring to). Of course, I would not put too much stock in multi-decade "plans," particularly those that are ultimately subject to political control. But there is a possibility of growth in fleet size or at least not a continued decline in fleet size.

In addition, HII has cyclical high and lows in capex as it periodically does major upgrades of its shipyards. It's just finishing a relatively high portion of its capex cycle, and thus capex should come down substantially beginning next year. (See slide 66: https://huntingtoningalls.gcs-web.com/static-files/cdc0dcb8-e072-4672-911a-09a854c4c851). Meanwhile, the company generated about $2 billion in FCF over the preceding four years (all returned via dividends or buybacks) despite being in relatively high portion of its cyclical capex phase. (See slide 65) Over the next five years, they project low to mid-single digit revenue growth, with most of it already booked (but again, I believe some of this is subject to appropriation) (See slides 69-70), leading to mid-single digit annual operating income growth over the next 4-5 years (slide 71), leading to roughly $3 billion in FCF over the five-year period 2020-24 (slide 72).

Now, of course, these are management projections, not gospel. But $2.5 - $3 billion in FCF returned to shareholders via dividends and buybacks over the next five years seems a reasonable outcome. And at the end of that period, I think you'll still have a company that's dominant in its industry, though the industry has uncertain growth prospects. You get that profile for a market cap of just over $7 billion and a trailing p/e of ~13 - 15 (depending how you view CAS/FAS adjustment). I also think the company will be able to pass on cost inflation to the US government to the extent it arises. So, at the end of the day, I think you're trading the high potential upside of a higher growth company for the stability of a dominant, highly free-cash flow generative business trading at a below market multiple.

Those are the reasons I own HII as part of the ballast portion of my portfolio, with other portions of the portfolio devoted to high growth/higher upside investments. If I were 15 years younger and more concerned about using all of my savings to build wealth, rather than devoting a portion of it to simply preserving purchasing power, then I probably wouldn't be interested in HII.

-

Hill International

-

Everything HII builds is either a monopoly or one half of a duopoly

Newport News

Only shipyard that can build, refuel, or decommission nuclear aircraft carriers

Duopoly with GD's Electric Boat on the building of nuclear subs

Ingalls

Duopoly with GD's Bath Iron Works for the building of Arleigh Burke class destroyers (only Large Surface Combatant (LSC) ship currently being built for US Navy)

Only builder of San Antonio-class

Only builder of America-class

Only builder of Legend class cutters for Coast Guard

Reading between the lines a little bit, shipbuilding (particularly large ships) for US Navy is so highly consolidated that the Navy is determined to (and has little choice but to) feed its remaining builders steady work to avoid having its industrial base erode away.

https://www.maritime-executive.com/article/u-s-navy-puts-industrial-base-first-fleet-size-second

HII has elsewhere been described as just a "metal bender," but I think you're correct. There is either no or one competitor for most of what they do. And I also think you're correct that the Defense Department knows HII and GD are irreplaceable and essential to national defense. So long as the US seeks to be a naval power and naval power involves large surface ships and manned submarines, HII and GD are too big and too important to fail. You can look at the US's current capacity (or lack thereof) to build nuclear reactors for energy production to see what happens when you let a specialized manufacturing and skill base erode.

BWX Technologies is another naval monopoly -- naval nuclear reactors, but the stock is significantly more expensive.

The main risk is that sometime in the next 5-10 years or so the US chooses not to continue to build traditional naval ships or to significantly shrink the Navy. Given the apparently emerging rivalry with China, the US giving up on being a naval power seems unlikely to me. But at the end of the day, that's a political question, rather than something that can be analyzed through traditional financial or economic analysis. A bigger risk, perhaps, is that large surface ships and manned submarines are rendered obsolete by unmanned drone-like ships that can fire torpedoes and missiles (think much more intelligent and capable mines).

I view HII as similar to Williams (WMB) and, in some ways, Equity Residential (EQR). They each own infrastructure/large physical assets that appear to be irreplaceable at a reasonable cost. The main question for each appears to be whether the world has moved on from the needs that infrastructures serves (or, perhaps, whether the US/cites is/are in significant terminal decline).

-

I am a 31 year old member of the yuppie scum class. My wealthiest of friends have kept their apartments in SF/NYC but are living with their parents or renting Airbnb’s in less dense places. Others have let their leases lapse or paid a contractual break fee. And the throngs of new employees that move into cities are also at home with their jobs either remote or deferred.

I agree that there may be some short-term pain here, but what you wrote is why this is still compelling to me longer-term. No need to repeat what BG has written about the unique appeal of cities for the 21-35 crowd. The suburbs or their parents' basement cannot compete.

Deals like this suggest the private market (for now at least) agrees: https://therealdeal.com/2020/07/23/record-setting-multifamily-deal-comes-together-in-brooklyn-for-1-25b/

Portfolio of Brooklyn apartments selling for ~$1 million/unit or $833/sq ft.

And as you have mentioned, what cap rate would a life insurer or pension plan pay for a high quality residential building in the very best US cities when the 30-year Treasury is yielding 1.25%?

-

Rosetta Stone

I've now sold essentially all of my Rosetta Stone. A press release saying that they're exploring alternatives has increased the enterprise value of the business by 60%. I think that says alot about both the value of the Lexia and perceptions about of current management.

Percent loss in value of residential real estate oligopolies due to hybrid work

in General Discussion

Posted

I don't think that's the demand curve Bizaro was referring to. You appear to be trying to identify the number of people currently living in cities who would move elsewhere if they believed they could. I believe he's asking about the demand from people who would like to live in cities (or different cities) but currently do not because it is not practical for them (cost, location) to do so.

Is it possible that widespread WFH actually increases demand for certain cities, because people who historically had to work in say, Omaha, Des Moines, Little Rock or Tulsa can now live in NYC, Boston or LA? Likewise, is it possible that housing in Minneapolis becomes more in demand because WFH frees people from living in, for example, Duluth?

Put another way, your comments seem to assume that people are in cities because that's traditionally where good jobs have been. But what if it's the other way around: Goods jobs are traditionally in cities because that's where people want to be? If it's primarily the latter -- and if the desire to live in cities going forward has not changed -- when how would widspread WFH affect demand for urban housing?

Applying this framework to the Detroit example, vacancies were high and housing prices low, not just because people left but also because other people did not want to move in.