RadMan24

Member-

Posts

845 -

Joined

-

Last visited

Content Type

Profiles

Forums

Events

Everything posted by RadMan24

-

Reuters attacking BHE's N0x emissions https://www.reuters.com/investigations/buffetts-berkshire-hathaway-operates-dirtiest-set-coal-fired-power-plants-us-2025-01-14/ Perhaps I'm biased, but it seems to whitewash all of BHE's clean energy investments and doesn't really make ends meet on a few key points. But I digress.

-

That's quite interesting thanks for sharing.

-

Thematically, sure yes, the best mitigator to the most likely result of global warming is extended heat days and any sort of sane government action will be to incentivize high efficient HVACs, especially in areas that may not have ever thought they would need HVACs (or simple ACs), like Maine.

-

Why did so many smart investors miss making a killing on BRK stock?

RadMan24 replied to Viking's topic in Berkshire Hathaway

There have been two really smart investors that bought BRK in recent years when the stock was performing poorly relative to the S&P 500 due to lingering concerns about Buffett and such: Meryl Witmer and Greg Abel. Meryl bought in May 2020 at $173 for Brk. B - now $400 Abel bought Sept 2022/March 23 - call it $400,000 for Class A, now $600k. -

https://www.ft.com/content/9619f503-6fd5-4256-8a5a-09eeebd08692 "Buffett sounds wildfire alarm as utilities industry enters new era"

-

I'll just start "dynamic ordering" -- place the order and then just drive off.

-

US DOJ threatening to sue Pacificorp is the reason for "collapse" Headlines came out 4 hours ago.

-

Thanks for sharing -- but it is clear through those documents that 1.) The rate increases will be large, but still below what other Western states/cities pay and 2.) Any major fire event in the next year or two will be catastrophic. Luckily the West has had a landslide of snow in the mountains and rain this winter, but we'll see how things play out.

-

WSJ picking up on the Japan investments: https://www.wsj.com/finance/stocks/warren-buffett-was-there-for-the-japanese-market-rally-deb6315c?mod=hp_lead_pos2

-

We'll see what differences are noted in the 2023 BHE investor presentation, whether there are any chnages to capital allocation plans or the like. Nevertheless, it is letters like these that make you realize how fortunate it is we have a whole weekend to ponder the results and outlook, without any 'trading' dynamic distractions influencing our thinking.

-

Agreed.

-

On the BHE thread, we were discussing the wildfire mitigation and impact, but I have to be honest, this letter was a sobering point of view, and one that really makes sense if this is how the regulatory bodies in certain states are going to proceed. Underground electrical wires are extensively expensive, forest management is also expensive, more and more people and property are in fire prone areas, and if "convective storms" do arise more often in the future, forest fires will simply be more intense given the growing biomass from more c02 in the atomosphere (the amount of plant biomass in most of the US is up 30% over the last 3-4 decades). It is refreshing to see however, Buffett state that he will not throw good money into bad.

-

Coal: https://www.bloomberg.com/news/articles/2024-02-09/firstenergy-scraps-2030-climate-goal-in-rare-embrace-of-coal

-

Keeping fires out of the forest -- letting dead trees and brush accumulate that - when ignitied - burns more foroscisuly and hotter than otherwise had natural fires been allowed over the past say 50+ years. So if Pacificorp's utility line falls down due to high wind, for example, and ignites a fire, in a fire suppressed area, ugly results can occur.

-

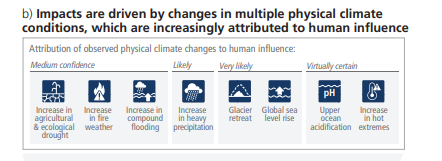

Yup, medium confidence is basically 50/50, inconclusive (behind likely, very likely and virtually certain). But, they had to put that and its a great alarm bell, there are long-term charts available it goes in waves, but hard to model out human ignition impacting natural rates (warming dries out, but atmopshere also holds more moisture, so its tough to know how it will unfold). And in some respects, i think at this point, we should just assume that climate change will be the leading rallying cry on wildfires for California on driving action. At least it has started to address some fire suppression and mitigating impacts. We truly need this across all states -- there'll be a far higher populice supporting mitigation and hardening of protections against such events, which would be a benefit to utilities and insurers in the long run. And the realities of the world aspect:

-

Exactly, and very good point raised here that often isn't talk about. If we really want to limit damage to climate change, the government should refuse to pick up the tab for flood insurance in flood areas. Nevertheless, this situation is dire in Pakistan and the Himalyas, an epic flood plane. But so is Austin, Texas. And that money would be better spent on covering low income familities energy bills during heat extremes in the US, which is the primary risk factor of climate change -- extended heat waves (not neccessairly in temperature, but perhaps in duration).

-

The IPCC provides no strong link between wildfires in the US and climate change. And as you mention, the luxury of lifestyle in the suburban forests -- because of the fire suppression -- has hidden these risks. Wildfires are a form of weather. If you want the climate impact, you have to look back over 30 year periods, at least. Perhaps a third point of which I've left out is that most, if not the vast majority of wild fires, are human ignition. Edit: To your point - the less talk about "climate change science" and more talk about mitigating risks associated with extreme weather events given the expansion of the human population and its impact on the environmnet the more likely we are to limit the impacts of climate change over time.

-

The problem is two fold : Unaffordable housing has pushed people into fire areas. Two: People have suppressed fire for decades. Those two factors create these uncharacteristic damaging events. Not climate change.

-

Nothing crazy was going on when Buffett bought Apple and made his Japan investments -- and brought Abel with him to Japan, so I see that as a potential avenue for future growth should any deals develop. Perhaps Buffett values integrity and honor much more -- if that could even be possible -- after the Pilot situation and lust the potential to do deals with the Japanese even more.

-

What a wonderful person and a life well lived. May Charlie rest in peace, but his wisdom live on forever.

-

Yea but there are times when mutual funds are out of favor that generally outperform over the longer term if an investor has patience and long-term framework.

-

If you were to bring facts to support your claims to the table that would be a good start. What was Todd's HF performance and why wasn't it impressive? What has been Todd's returns since going BRK? What stocks did Todd sell or have lost value since the SVB crisis? Who else bought Mastercard and Visa 10 years ago and still hold today that make this a uniform play that everyone did? How has charter been a bad investment if it is up 200% since original purchase in August 2014? How is being CEO of GEICO not value add? I think you get the drift...

-

To clarify: PacificCorp is a subsidiary of Berkshire Hathaway Energy, which is..as you know..owned 90% or so by Berkshire. Nothing to do with Hawaii...just Oregon wildfires from a few years ago.

-

As a few folks have mentioned and highlighted in recent months, Pacificorp is being challenged legally for causing wildfires (ignoring high wind warnings to shut down power) on Labor Day in 2020. Berkshire disclosed that the liability is approximately $7b and recent Bloomberg articles have estimated it could be as much as $11 billion, if all civil damages are paid out based on recent jury decisions. Here is pacificorp's statement: https://www.pacificorp.com/about/information-wildfire-litigation.html Example of news article: https://www.oregonlive.com/business/2023/06/wildfires-bankrupted-californias-largest-utility-what-will-happen-to-oregons-pacificorp.html Litigation website: https://www.pacificorpfirelitigation.com/ Currently, its been noted that the bond prices have taken a huge hit. The 30 year bonds issued in 2007 have a YTM of 6.3%. https://markets.businessinsider.com/bonds/5_750-pacificorp-bond-2037-us695114cd86?miRedirects=1 Similary, the 10 year bonds issued in 2019 have a 5.9% YTM. Anyone think these are interesting, or at least watching to see if those yields get even juicier? Of course, the riskfree 3 month treasury bill is 5.3%. Biggest risk Berkshire lets the subsidiary go through Ch. 11 due to liability claims.

-

Well, former engineering and construction company CB&I (of which is still around under McDermott which went bankrupt after buying CB&I) did work on LNG and Nuclear Plants during its hey-day. The Nuclear Plants of course went into overdrive on delays and costs. The bigger the LNG plants, or less experienced the E&C firm is, I'd be careful on expectations. LNG and ethylene terminals just don't seem to have as much delays or expensive overruns, partly because of size, as each of their own unique complexities and hazmat requirements.