-

Posts

6,772 -

Joined

-

Days Won

3

Content Type

Profiles

Forums

Events

Everything posted by rkbabang

-

If it goes up by the same percentage tomorrow you can do enhanceGoogle.com while your at it. --Eric

-

I don't know if I should admit this, so I'll just say that "someone I know" when he was a kid would dress up in his baseball uniform and sell candy bars door to door for $1 that he bought at the store for 25cents, never mentioning that it went for anything, just saying "would you like to buy a candy bar? They're $1" people would make an assumption that it was for charity. This person never corrected them.

-

Yeah, that's what Google tells me too (Yahoo as well). I prefer to believe Fidelity in this case.

-

Congratulations! Let us know when EnhanceBiglariHoldings.com goes live. As soon as I can cash out of CCLR I'll buy 100K shares of BH to help get you on the board. --Eric

-

Sure. You want to buy it? I'm not greedy, I'll sell it all to you for only $5000 per share! That's half off! You'll be buying 50¢ dollars! --Eric

-

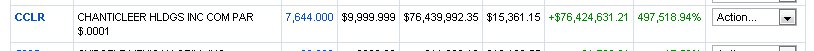

I just took a look at my fidelity account and almost had a heart attack. My investment in Chanticleer Holdings has increased 497518.94% and is now worth over $76Million! Unfortunately Fidelity seems to be the only place on the web quoting CCLR at $9999.999 per share. I of course took a snapshot of the page. It's not everyday I can look at a high 8-figure brokerage account balance with my name on it. --Eric

-

I have a son and a daughter who are 11 and 10 years old. What my wife and I did with our kids when they were younger (starting about age 4 and 5) and continue to do today is whenever the kids earn or are given money they break it up into 3 containers. My son and daughter each have their own 3 containers and they are: 1) SAVE: 60% goes into the “save cup”. 2) SPEND: The spend cup is money they can use whenever and however they wish. 30% goes into the spend cup. 3) SHARE: 10% goes into the share cup and once per year the kids get to decide how to donate this money. The last two years it’s gone to feed children in Haiti. I have UTMA investment accounts in each of their names and every time one of them has a hundred or two in their save cup I put the money into their brokerage account and let them “help me” decided what to invest it in. This has worked out really well. They get to learn the 3 basic things you can do with money (Save it, spend it, donate it) and have had a hand in making the decisions about how those things are done with their own money. They have learned how easy it is to spend the money in their spend cups versus how hard it is to earn it. As well as seeing the save money grow to become a significant amount. They frequently decide to take from their spend cups and add more to their save cups and sometimes even their share cups. They also put a lot of thought into how to use their share cup money. As far as where the money comes from in addition to birthday money that they get from relatives, they are expected to work for an allowance around the house and add more jobs if they want more. These are things like helping clean (including bathrooms), taking out trash, stacking firewood, yard work, cleaning cars, etc… Hope this helps.

-

I've put off reading this forever it seems (probably because the size of it and I always find other books that sound more interesting), but everyone who reads it seems to recommend it. Is it really a must read type of book? It is a bit of everything but specially a long novel (not a very good one though). But I tend to recommend it to people so that they realize the power of structured thinking (do you think in trees?) and technology but also on its limits. I imagine it had a big impact in the 70s and I would not be surprised that is the type of book that Steve Jobs liked to read. I think it is a pretty good novel. I was assigned it in high-school in the late 80's, I think it was the only book I was ever told I had to read that I really loved. I think a lot like the main character in the novel (yes he was insane, but that's besides the point). It's probably the engineer in me. Anyone who really loves to read books by Neal Stephenson, Corey Doctorow, etc, will love that book. And conversely, if you loved Zen and the art of motorcycle maintenance, try reading something by Stephenson. --Eric --

-

LOL, I forgot those types of books. My kids are 10 and 11 now and read their own books by themselves, but yeah, back a few years ago there are books I read to them dozens of times (if not more). "I Love You Stinky Face" was one of them. Along with "Knuffle Bunny" and "What Color Is Your Underwear?", The Giving Tree, Are You My Mother?, Plus a ton of Sesame Street books, Caillou books, Grimms' Fairy Tales, and, of course, all of the Dr. Suess books. I used to be able to recite the entire "Green eggs and ham" from memory.

-

Interesting topic. I do a lot of reading (maybe 20-30 books/year), yet there are only a few books I've read more than once. Some of these include (for various reasons and in no particular order): "How to Win Friends and Influence People", by Dale Carnegie (A duplicate from you're multi-read list) "Zen and the Art of Motorcycle Maintenance: An Inquiry into Values", by Robert M. Pirsig "Civil Disobedience", "Life Without Principle", and "Waldon", all by Henry David Thoreau "Atlas Shrugged" and "Anthem", by Ayn Rand "For a New Liberty: The Libertarian Manifesto", by Murray N. Rothbard "The Machinery of Freedom: Guide to a Radical Capitalism", by David Friedman "The Moon Is a Harsh Mistress" and "Stranger in a Strange Land", both by Robert A. Heinlein "The Illuminatus! Trilogy", by Robert Anton Wilson "Pallas", "Tom Paine Maru", and "The Probability Broach", all by L. Neil Smith "Cryptonomicon", "The Diamond Age", and "Anathem", all by Neal Stephenson "The Law" by Frederic Bastiat "No Treason, by Lysander Spooner That list may not be complete, but it is all that I can think of right now. It ended up being a longer list than I first though when starting to type this reply.

-

Thanks so much for sharing. I've just added fcbn to my list of companies I need to do further research on. Unfortunately that list is getting a little long. In the last month, I've changed jobs and moved to another state (and bought a 244 year old house that needs a bit of work). I've been too busy to focus much on this stuff. Small banks have intrigued me for a while, I can usually separate the good from the bad, but separating the good from the exceptional is a challenge. Thus far I've gotten frustrated and haven't invested in any.

-

What makes you think fcbn could one day have a market cap the size of US Bankcorp? Anything's possible, but out of all the tiny banks what is special about fcbn? --Eric

-

Hi Racemize, I’ll answer your question. I’ve been on this board about 4 years now, mostly as a lurker, but I post occasionally. I’m just an individual investor that manages my own personal money. I’m an IC design engineer by trade. Sanjeev Parsad, who started the board, is from:http://www.cornermarketcapital.com/, and many of the other frequent posters on this board do manage other people’s money and do it for a living. Although there are a ton of individual investors as well. All in all an extremely knowledgeable group of people here. I don’t mind sharing my returns as far as I know them, I just logged into Fidelity and they let you report your personal rate of return over any period up to the past 24 months. Mine is: Year to Date: 5.8% 12 Months: 6.2% 24 Months: 48.9% Of course I had a bad year in 2008, so that 48.9% was just bringing me back to where I was in 2007. I’ve learned a ton since joining this board, not just ideas, which I have found a few, but simply the knowledge I’ve gained by reading the discussions and even a few books that I never would have heard of otherwise. I was already looking into value investing when I found the board, that’s how I found it. I was looking for info on Sadar Biglari (a long story there, I made good money but no longer trust him). This board has been the best all-around resource I’ve found for info on everything value investing. If you can’t find what you’re looking for by searching the archives, just post and someone will help you. --Eric

-

Gold Price is Now Higher Than Inflation Adjusted 1980 Price

rkbabang replied to Parsad's topic in General Discussion

The lapis philosophorum method is on the verge of a breakthrough in answer to question number two. just give me some gold for testing and i will be able to do it in a few month. Its not hard all you need is a super nova. Go ahead and laugh, I've been working in my basement on a way to transmute lead into gold. I think I'm going to figure it out soon, I'll let you know. Isaac Newton did some work on this back in the day. And even today there are some bright minds working on this: Northern Ireland man tries to create gold... --Eric -

Before you click on this, beware: you just may end up spending an hour staring at it. xkcd: Money Chart

-

"The Entire System Has Been Utterly Destroyed By The MF Global Collapse" - Presenting The First MF Global Casualty

-

Biglari - A Buffett Devotee Riles His Targets (WSJ)

rkbabang replied to ExpectedValue's topic in General Discussion

I'd have no problem if Warren Buffet or Bill Gates drove one of those cars (or a fleet of them), but paragraphs like this make me steam. "In Equatorial Guinea, 35 percent of the population (average income, $1.60 a day) die before the age of 40, and 58 percent have no safe drinking water. But Teodorin Nguema, the strongman’s son, apparently makes enough as a government minister to spend $1.2 million on Champagne in just one weekend, and import no less than 26 supercars from the U.S. in 2009." These are the looters and tax farmers he's talking about, not the productive spending what they've earned. --Eric -

Lennon is someone who you can put together a video like this one http://www.youtube.com/watch?feature=player_embedded&v=lj0cCagyf_8#! where I agree with 90% of what he says, but other times he just didn't get it. Take the lyrics to Imagine for example. I'm with him 100% (No gods? Good. No governments? Excellent), until the last verse (no possessions? That's crazy).

-

Just be open to the possibility that human ingenuity will solve that problem too. There are already a lot of smart people thinking about these things and a lot of money to be made. For a few examples. No need to fight over mineral resources, says geologist True Limits for food, energy and minerals are very distant And don't forget long term, there is an almost limitless supply of every resource we could ever need (including living space) on other bodies in this solar system (the asteroid belt for example). Again, none of this is proof, but the pessimists have a long track record of being wrong. I'm not ready to short humanity just yet. --Eric

-

Of course there can be no proof now of anything that will happen in the future. But there is evidence of the same argument being made over and over again for at least the last 420 years and being wrong every time. Malthus himself wasn't the 1st "Malthusian" btw, Giovanni Botero predated him by a few hundred years, publishing his population hyperbole in the late 16th century. This nonsense has been going on a long time. There is no more reason to think that it is correct this time than there was 40 years ago, or 400 years ago. In my opinion these Malthusians are putting the cart before the horse. I think a careful study of history would show that population will tend to rise when it can in response to greater resources and economic activity and will fall when times are bad (i.e. oppression and lack of economic activity). I don't think anything at all "needs to be done". We will have 9 or 10 or 20 billion+ people or we won't. There is no central plan that can change that, and even if it could it would be the most murderous genocidal blood-ridden plan humanity has ever put into action on itself. --Eric

-

Thanks for the article Parsad. I've always been more Julian Simon than Thomas Malthus in my thinking. I view the human mind, much like Simon did, as the ultimate resource (i.e. the more the better). It always amuses me to think that Ehrlich wrote his book and then spent the next 40+ years continuing to consume the earth's precious resources. Even that guy Hutchinson who wrote the article that started this thread, I'm assuming he hasn't done himself in yet. He'd like to reduce the population by 2 Billion humans "non-coercively". That's a neat trick, I suppose he thinks people will line up by the billions for the gas chambers? Even limiting births per family to do it long term isn't non-coercive, as infants floating down rivers in certain parts of the world can demonstrate. Something tells me, like Malthus and Ehrlich before him, Hutchinson views himself as one of the people who should survive. Every breath these clowns take tells me that they are not exactly men of conviction. More "do as I say" than "do as I do". Will they ultimately be correct, I don't think so. 500 years from now when there are countless trillions of humans (or of the beings that used to be humans) inhabiting not only this planet but other bodies in our solar system and others, these people will be looked at in the same amusing way we look at Malthus today. As hysterical and short sighted buffoons. But who knows, as Yogi Berra said "It's tough to make predictions, especially about the future." --Eric

-

Thoughtful indeed. Let me summarize this neo-malthusian. Too many people are living too well. We need to either keep most people poor and starving or more preferably eliminate 2 Billion (yes that is 2 Billion) human beings from the earth. Kind of makes Hitler, Stalin and Pol Pot look like light weights. --Eric

-

Is US Manufacturing poised for a stunning comeback?

rkbabang replied to Mark Jr.'s topic in General Discussion

When I was about 10 years old I used take apart electronics (much to the chagrin of my parents), look at the chips on the board and say that I was going to design computer chips when I grow up. I ended up getting a BSEE and today at 39 I'm still an IC designer. Other people who go through life aimlessly have always amazed me, because I've never know what it was like to not know exactly what I was going to do and exactly how I was going to do it. Interestingly my son is 11 now and has been telling us for years already that he is going to be a scientist in bio-tech. I hope he sees it through. I guess it is OK not to know exactly what you are going to do and not yet have a plan or a direction, but to then aimlessly take out 6-figure loans seems crazy to me. It is making a huge investment without knowing what you are investing in. You wouldn't buy stocks that way. --Eric -

True he did say that in the last conference call. I am hoping for the $1.63 in cash, but either way, as that article above illustrates, investors have done well over the years with all the various spin-offs and dividends. --Eric

-

This stock doesn't get much mention on this board. I've been a shareholder for a while with a smallish position. I just doubled my investment in MIL today. I'm expecting the special dividend announcement soon. Smith said "by November" earlier in the year.