-

Posts

2,294 -

Joined

-

Last visited

-

Days Won

1

Content Type

Profiles

Forums

Events

Everything posted by james22

-

Exactly. No one makes a more convincing argument than Hussman, but ...

-

It's starting to look like China regrets its private-enterprise crackdown China held its annual Central Economic Work Conference, or CEWC, on Monday and Tuesday. It was attended by all of the country’s top leaders, including President Xi Jinping and Premier Li Qiang. A document released after the conference sets the agenda for China’s economy — the second-largest economy in the world — for the next year. And strikingly, this year’s readout acknowledges that China needs to prioritize economic development. “Next year, we must persist in seeking progress while maintaining stability, promote stability through growth, and establish the new before breaking the old,” states the meeting’s official readout. The wording in this document suggests “hints of remorse at overzealous growth-negative policy implementation,” Rory Green, the chief China economist at GlobalData.TS Lombard, wrote in a note on Wednesday. https://www.businessinsider.com/china-crackdown-regret-central-economic-work-conference-readout-analysis-economy-2023-12

-

What Is the Best Investment That You've Ever Made?

james22 replied to Blake Hampton's topic in General Discussion

^ That's great. -

... there’s a school of thought where the central bank and fiscal policymakers ought to err on the side of doing less - in both directions - so that we can allow the economy to heal itself against minor scrapes and bruises. We forget sometimes that there are 325 million Americans who mostly wake up each day seeking to better their situation, ease their troubles, fill their bellies, support their family members, enjoy experiences and acquire higher status. This is hardwired into the culture, into our DNA. So when an economic shock occurs, it will temporarily impact these pursuits, but not for long. Eventually, we want the things that we want again. Someone is going to make money selling them to us. This is how the economy can stumble and then heal. https://www.downtownjoshbrown.com/p/economy-like-human-body-let-heal

-

The "risk" few ever see are those that result from compounding (Housel's chapters Overnight Tragedies and Long-Term Miracles, Tiny and Magnificent, and The Wonders of the Future).

-

I'm guessing we won't hit the top this year until Dec 29th.

-

China’s economic plan is bankrupt The model that created a superpower is failing https://unherd.com/2023/12/chinas-economic-plan-is-bankrupt/

-

-

-

-

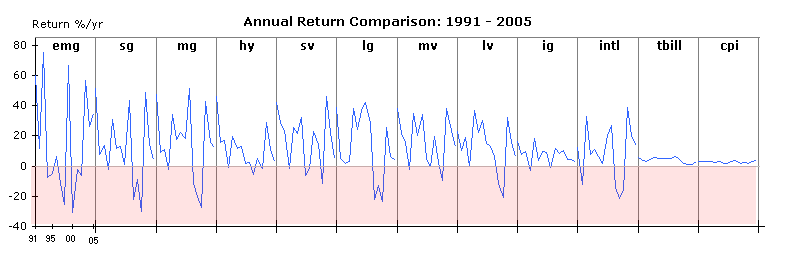

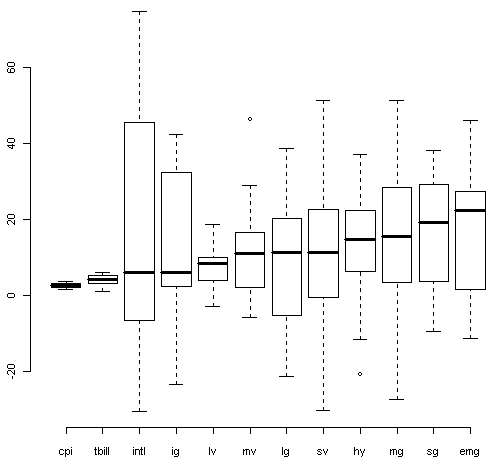

No disrespect, but I've always hated that chart. If the purpose is to confuse customers, i.e. to claim that fund class does not matter, then this chart succeeds. However, on closer look, one might observe that three of the 12 classes showed up disproportionately at the top rank so the chart is somewhat misleading. Directional evidence is buried in the palette of colors; but how to separate the noise from the signal? The "best" graphic is one where form matches function. If my goal is to help customers understand their expected return and risk for different fund classes over the last 15 years, then the side-by-side boxplot works wonders. https://junkcharts.typepad.com/junk_charts/2006/05/boxplots_to_the.html The idea, I guess, is to be able to see which asset classes have done relatively well or poorly over time: within each year, the best-performing asset class is at the top and the worst is at the bottom. If you pick out a single color, it’s barely possible to follow how it has performed (relatively) by seeing where it sits in each year … sort of mentally connecting the boxes into a line graph. ... This is a very bad graphic. Although the actual performance for each class in each year is given numerically, the graph itself gives no information about this, which is after all the most important characteristic of an investment. https://statmodeling.stat.columbia.edu/2006/05/23/post_8/#more https://statmodeling.stat.columbia.edu/2006/06/06/displaying_fina/

-

What Is the Best Investment That You've Ever Made?

james22 replied to Blake Hampton's topic in General Discussion

Good. The psychology is the difficult thing - can't be too sensitive to risks or the stress will create another problem. -

What Is the Best Investment That You've Ever Made?

james22 replied to Blake Hampton's topic in General Discussion

Smart. Doctor recommended? Reminded me of this: In 2013 Harold Varmus, then director of the National Cancer Institute, gave a speech describing how difficult the war on cancer had become. Eradicating cancer – the National Cancer Act’s goal when it was signed in 1971 – seems perpetually distant. Varmus said: "There’s a paradox that we must now honestly confront. Despite the extraordinary progress we’ve made in understanding the underlying defects in cancer cells, we have not succeeded in controlling cancer as a human disease to the extent that I believe is possible." One of the missing pieces, he said, is that we focus too much on cancer treatment and not enough on cancer prevention. If you wanted to make the next big leg up in the war on cancer, you had to make prevention the top priority. But prevention is boring, especially compared to the science and prestige of cancer treatments. So even if we know how important it is, it’s hard for smart people to take it seriously. MIT cancer researcher Robert Weinberg once described it: "If you don’t get cancer, you’re not going to die from it. That’s a simple truth that we sometimes overlook because it’s intellectually not very stimulating and exciting. Persuading somebody to quit smoking is a psychological exercise. It has nothing to do with molecules and genes and cells, and so people like me are essentially uninterested in it – in spite of the fact that stopping people from smoking will have vastly more effect on cancer mortality than anything I could hope to do in my own lifetime." Breakthrough drugs are amazing, and we should cheer them. But few things are as effective at fighting lung cancer as the boring advice of telling people to quit smoking. https://collabfund.com/blog/investing-the-greatest-show-on-earth/ -

What Is the Best Investment That You've Ever Made?

james22 replied to Blake Hampton's topic in General Discussion

Vacationing and visiting my parents, I just happened to ask what their plans were for the rest of the day as I was leaving. They mentioned my father was seeing his dermatologist and my mother insisted I stay and take the appointment when they learned I'd never seen one. Turns out I had Stage 3 melanoma. Whoops. Surgery two days later and no remission since. I try to remember how lucky I am before I'm too envious of other's good fortune. -

What Is the Best Investment That You've Ever Made?

james22 replied to Blake Hampton's topic in General Discussion

~$40 co-pay for a dermatologist visit. -

Dear Partners and Friends, Charlie Munger of Berkshire Hathaway fame passed away on Tuesday November 28th at the age of 99, just shy of his 100th birthday on January 1st. Charlie was our role model and the main inspiration behind creating Brotchie Capital. He was a generous teacher, exemplar, a brilliant renaissance man, and phenomenal human being who will be sorely missed. I was fortunate to have met Charlie early in my investing career. I first ran in to him many years ago in the basement of the Ak-Sar-Ben Coliseum in Omaha at the Berkshire Annual Meeting. At that time, there was a much smaller crowd at the meetings than the 45,000+ that attend now. Regardless, I was stunned to see Charlie was just sitting alone at a table signing a book about Berkshire. A few years later, a group of us started traveling to Pasadena CA directly after the Berkshire meeting in Omaha to listen to Charlie take questions as Chairman of Wesco Financial. He affectionately called us “the really hard-core nut cases” for making this second leg of the trip and joked that he was like the assistant headmaster of a cult. It was totally worth the trip. Charlie intentionally played the part of Warren’s side kick at the Berkshire Meeting, in part because I believe he was happy to let Warren have the spotlight. At Wesco, it was all Charlie, and he was completely unfiltered, candid and often hilarious. He and Warren could also be very funny together, but Warren is very sensitive to insulting anyone. Praise by name and criticize by category is his mantra. Charlie on the other hand, is widely known for his candor. We’ve included some of our favorite “Mungerisms” further down the page. It was at one of these Wesco meetings that his friend Peter Kaufman introduced me to Charlie once again and we had a nice chat. Charlie was extremely well read, super intelligent and he did not suffer fools with kid gloves. This made having a personal conversation with him or asking him a question publicly from a microphone at a meeting an exercise in one’s own self-confidence. A few years later, a close friend of my wife who worked for the corporate offices of Marriott got us bumped up to the Concierge level on the 6th floor at the Omaha Marriot. A close friend and I were sitting in the 6th floor lounge having breakfast one Friday when in walked Charlie, who preceded to sit right next to us. We were invited over to join the conversation by Charlie’s son-in law and a new annual tradition had begun which would continue for several years. The last time we were able to get together there was 2019, just before the pandemic would change so many things. I knew he was an avid fisherman so during that conversation I asked him if he had ever caught a giant tuna fish. He kind of downplayed the idea of giant tuna fishing and said that sort of thing was for big, strongman types. Blue Fin Tuna fishing had become a hobby of mine and I thought of writing him with pictures of all the gear we use to explain how you really didn't have to be Arnold Schwarzenegger to do it...but I didn't want to bother him with that sort of thing if he wasn't really interested. Charlie got lots of fan mail and more books sent to him from admirers than he could read. When I saw this clip from CNBC of his last interview just a few weeks ago, I was shocked to hear him say that catching a 200 lb tuna was the main unmet item on his bucket list. https://www.cnbc.com/video/2023/11/28/charlie-mung... In a final lesson from Charlie for me, this just goes to show that you shouldn't ever hold back reaching out to someone you really admire, even if you’re trying to be considerate. Of course, I would have offered to take him out with us and would have loved to have shown him our fishing banks. Ironically, the first letter I ever wrote for our partnership focused on Charlie’s idea that the economy and market was very much like an Eco-system, and I used the tuna fishery to highlight that idea. One of Charlie’s more famous lectures focuses on The Psychology of Human Misjudgment with a list of 25 items he identified as commonly recurring errors we make in our life’s decisions. It would have been fascinating to have a discussion with him about the psychology of tuna fishing, as it can be a swamp of obsession and mimetic rivalry, to borrow a term from Rene Girad. Much has been and will continue to be written about the contributions Charlie made to humankind, as it should be. For us, his most outstanding achievement will always be his discussions and writings on what it took to become “passionately rational”. The first book I read about Warren Buffett was Lowenstein’s ‘The Making on an American Capitalist’, where he described both Buffett and Charlie as embodying ‘Emersonian Independence’. Charlie was quoted as saying he desperately wanted to get rich fast when he was young, but not so he could buy Ferrari’s. He craved independence so much that he even found sending out invoices to his law clients somehow demeaning. Having a stubbornly irrepressible independent streak myself, I was drawn like a moth to the flame to Buffett and Munger. I would listen to Charlie reference this craving for independence repeatedly through the years; from the poetry of Scottish poet Robert Burns to his own self-deprecating jokes about needing to get rich because he was so opinionated and outspoken. Charlie was famous for making friends with and quoting the “eminent dead” as he called them. From Ben Franklin to Cicero, the Stoics and beyond, he was always teaching with stories and humor. I was surprised that I never really heard him mention Emerson in that light, so I asked him why that was. He explained that he was raised on Emerson through the New England Style Unitarian Church in Omaha growing up and it just became so deeply rooted in who he was that it wouldn’t have occurred to him to reference it. Warren has told the crowds that his father was always quoting Emerson to him: “The power that resides within you is new in nature…” he would remember. Charlie was famous for thinking through the second and third order effects of any action or policy. “And then what?” he would say. In keeping with that idea, it’s only natural to ask that question of this Emersonian Independence. What happens once you’re free from the shackles of corporate over lords or from clients who can cancel you? How will you live out your life getting the most horsepower out of your own unique personal engine and avoiding the pitfalls that snare so many of your fellow humans? Charlie considered it a moral duty to continue to improve one’s own rationality and ability to spot cognitive biases throughout your lifetime. I think the events of the pandemic years we’ve just lived through have made this all so obvious that Charlie often took to shortening his discussion of this topic. More recently, when a questioner would bring up a topic Charlie felt belonged in his “Too Hard Pile”, he would close with “Its hard enough to just stay sane”. A full discussion or examination of what Charlie meant by becoming ‘passionately rational’ is beyond the scope of this note, but here’s just one quote from him that may shed some further light: “Man’s imperfect, limited-capacity brain easily drifts into working with what’s easily available to it. And the brain can’t use what it can’t remember or when it’s blocked from recognizing because it’s heavily influenced by one or more psychological tendencies bearing strongly on it … the deep structure of the human mind requires that the way to full scope competency of virtually any kind is to learn it all to fluency—like it or not.” We would urge everyone who doesn’t already own a copy of ‘Poor Charlies Almanac: The Essential Wit and Wisdom of Charles T Munger’ to buy a copy of a new edition available December 5th. You may even consider buying one for every member of your family, as we have. What’s the most passionately rational thing we can do as individuals with our limited time on this earth? Learning to keep from wasting time by getting sucked into our phones, apps and other technology designed to monetize our attention has to be high on the list. We were about to send Charlie a book we had just read on this very subject and the gamification of technology. Charlie was not a fan of legalizing gambling and more and more of today’s apps have a lot in common with the behavioral psychology of slot machines! We would highly recommend Scarcity Brain, by Michael Easter. *** No discussion of Charlie Munger would be complete without an examination of his investment track record. Prior to joining Berkshire Hathaway, Munger and Buffett each ran independent investment partnerships, even though they worked together on ideas as intellectual partners. The understated record of Charlie’s partnership is below: ( Unfortunately I can't get the table to format) The reason we use the term understated to describe the record above is that when the partnership was liquidated, individual limited partners were distributed stock in Blue Chip Stamps and Diversified Retailing, which were positions the partnership held. Both entities were eventually folded into Berkshire Hathaway in exchange for its stock. If we use Berkshire’s closing price of $38 in 1975 as a proxy for the continuing compounding effect, each share is now worth $542,900. Otis Booth was one of Charlie’s partners that ended up owning 1.4% of Berkshire because of this stock swap. Charlie had another limited partner whom he could not persuade to stick with the partnership during a steep market drawdown in the 1973-74 period. The partner’s $350,000 investment would now be worth $7.3 BILLION if it had remained invested throughout the years. For those of you keeping score, that’s a compounded annual return of approximately 22.5% per annum for 47 years. A few of our favorite Mungerisms: “I think the reason why we got into such idiocy in investment management is best illustrated by a story that I tell about the guy who sold fishing tackle. I asked him, “My God, they’re purple and green. Do fish really take these lures?” And he said, “Mister, I don’t sell to fish.” “If you want to understand science, you have to understand math. In business, if you’re enumerate, you’re going to be a klutz. The good thing about business is that you don’t have to know any higher math…. Without basic numerical fluency though, you are like a one-legged man in an ass-kicking contest.” “Invert, always invert.” “Just think of it as heavy odds against a game full of bullshit and craziness with an occasional mispriced something or other. And you are not going to be smart enough to find thousands in a lifetime. And when you get a few, you really load up. It is just that simple.” “Capitalism without failure is like religion without hell.” "What we do in investing is simple, but not easy." “The idea of caring that someone is making money faster [than you are] is one of the deadly sins. Envy is a really stupid sin because it’s the only one you could never possibly have any fun at. There’s a lot of pain and no fun. Why would you want to get on that trolley? At least with gluttony or coveting thy neighbor’s ass, there’s something in it for the sinner” "If I can be optimistic when I'm nearly dead, surely the rest of you can handle a little inflation." “You’re smart and I’m right…and because you’re clever you’ll soon see that.” Around 2016, an acquaintance asked which person, in a long life, he felt most grateful to, “My second wife’s first husband,” Munger said instantly. “I had the ungrudging love of this magnificent woman for 60 years simply by being a somewhat less awful husband than he was.” "The best thing a human being can do is to help another human being know more." “Warren once said to me, “I’m probably misjudging academia generally [in thinking so poorly of it] because the people that interact with me have bonkers theories.” … We’re trying to buy businesses with sustainable competitive advantages at a low – or even a fair price. The reason the professors teach such nonsense is that if they didn’t], what would they teach the rest of the semester? [Laughter] Teaching people formulas that don’t really work in real life is a disaster for the world.” “There’s a lot wrong [with American universities]. I’d remove 3/4 of the faculty — everything but the hard sciences. But nobody’s going to do that, so we’ll have to live with the defects. It’s amazing how wrongheaded [the teaching is]. There is fatal disconnectedness. You have these squirrelly people in each department who don’t see the big picture.” “…a different set of incentives from rising in an economic establishment where the rewards system, again, the reinforcement, comes from being a truffle hound. That’s what Jacob Viner, the great economist called it: the truffle hound — an animal so bred and trained for one narrow purpose that he wasn’t much good at anything else, and that is the reward system in a lot of academic departments.” “I think liberal art faculties at major universities have views that are not very sound, at least on public policy issues — they may know a lot of French [however].” “Proper accounting is like engineering. You need a margin of safety. Thank God we don’t design bridges and airplanes the way we do accounting.” “ ‘F.A.S.B’ … ‘Financial Accounts Still Bogus.’ ” “Creative accounting is an absolute curse to a civilization. One could argue that double-entry bookkeeping was one of history’s great advances. Using accounting for fraud and folly is a disgrace. In a democracy, it often takes a scandal to trigger reform. Enron was the most obvious example of a business culture gone wrong in a long, long time.” “I also want to raise the possibility that there are, in the very long term, “virtue effects” in economics— for instance that widespread corrupt accounting will eventually create bad long term consequences as a sort of obverse effect from the virtue-based boost double-entry book-keeping gave to the heyday of Venice. I suggest that when the financial scene starts reminding you of Sodom and Gomorrah, you should fear practical consequences even if you like to participate in what is going on.” Two thirds of acquisitions don’t work. Ours work because we don’t try to do acquisitions — we wait for no-brainers.” “We tend to buy things — a lot of things — where we don’t know exactly what will happen, but the outcome will be decent.” https://shrewdm.com/MB?pid=213411239

-

Occidental + CrownRock + Endeavor = $80B? That'd put some cash to work.

-

LOL Under capitalism, rich people become powerful. But under socialism, powerful people become rich. ... But at least in America, becoming powerful isn’t the only way to become rich. Under socialism, you’re either powerful, or you’re poor. https://www.usatoday.com/story/opinion/2016/05/16/socialism-venezuela-ussr-cuba-sanders-clinton-elections-2016-column/32613393/

-

Any chance BRK is interested in Endeavor Energy?

-

Saudi Arabia could 'flush' the oil market with a flood of supply to regain control over prices in the face of rising US production, crude expert says https://markets.businessinsider.com/news/commodities/oil-market-opec-us-production-saudi-arabia-supply-flood-2023-12

-

I like the description of him as the Jim Cramer of geopolitical analysis.

-

Entertaining.

-

Yeah, I'd like a citation. Costs have come down by a lot, however: ... drilling costs have been reduced by about 42 percent ... https://www.pheasantenergy.com/the-numbers-the-permian-excels/ And ME costs only increase.