vinod1

-

Posts

1,667 -

Joined

-

Last visited

-

Days Won

4

Content Type

Profiles

Forums

Events

Posts posted by vinod1

-

-

5 minutes ago, sholland said:

As mentioned above, P/E multiples are a shortcut for DCF.

If you have a steady business (no growth, but no decline) it should be worth roughly 10x owner earnings.

Throw in some growth and you might justify a P/E multiple of 15.

Some extreme high growth companies like Google & Facebook in their heyday justified very high P/E multiples.

I believe that every beginner should verify what I said above with DCF models and get a feel for the process. Once you get a feel then you will not need DCF.

You say it so much better that I do!

-

18 hours ago, KCLarkin said:

This is all true, in a way. But the problem with DCF is that if you actually knew FCF1....FCFN, the proper discount rate is... maybe 5%....the 30yr treasury rate?

The whole point of the risk premium is that you don't know FCF1...FCFN. And if you don't know FCF1...FCFN, you can't do DCF. And intrinsic value is only apparent in retrospect. So the U.S. stock market, over the past 100 years was almost always ridiculously undervalued. And one of Buffett's main insights was that, if you were an insurer, if you bought stocks with reasonably predictable coupons ("equity bonds") with your float instead of bonds you would clean up.

And so this gets to the main problem with DCF. If you use a "discount rate", you will almost certainly decide that Costco at 40x earnings is "expensive". And VSCO at 5x earnings is "cheap". But this neglects the fact that Costco is closer to a bond with a growing coupon. And VSCO is closer to an out-of-the-money call option. And Costco probably deserves a 6% discount rate. And VSCO probably deserves a 20% discount rate. And which is "cheaper"? Who knows.

---

And so what happens is that price drives sentiment. And the "DCF" shadows price action. And it becomes useless in actually picking investments.

---

In the past year, Meta has traded at $89 and at $330. Intrinsic value has probably not changed a single dollar in that time. What is the IV of Meta? Probably somewhere in the range of $50 to $1000. So obviously, you should buy below $50 and sell above $1000. But what the hell do you do in between?

---

You mentioned Damodaran, who I admire. I looked up a few of his valuations of Meta:

2018 - $181 (stock at $155)

2022 - $346 (stock at $220)

2022 - ~$100 in a "doomsday scenario" (stock at ~110)

And to be fair, he was correct that Meta was undervalued all three times. So I guess DCF does work... if you are as skilled as, perhaps, the most famous "valuation" expert. But it is devilishly imprecise and definitely an art form. Doesn't mean you can't admire and learn from the fundamental truth of Intrinsic Value.

There seems to be 3 main points of contention

1. One cannot know FCF that are going to be generated in future

2. One does not know what discount rate to use

3. If you use a conservative FCF and discount rate, you find many stocks expensive

Points 1 & 2

1 & 2 are closely related and general argument by some is that they are too uncertain. As one person put it, discount rate is like using the Hubble telescope, a small change and you are in a different galaxy. All true. But every single valuation method other than relative valuation suffers from the same thing. All the shortcut valuation methods you use have the same problem. Let us take the example of using 10x earnings for valuation. Here you are making assumptions about FCF and discount rate (a) all of earnings are FCF (b) a discount rate of 10% and since no reinvestment, you are assuming 0% growth. This is DCF model in disguise, but here you have implicitly assumed things which you are deathly afraid of explicitly putting into the model.

When I use to play basketball with my daughter when she was 5 or 6 years old, she used to close her eyes whenever is ball looked like hitting her. To her it seemed just the fact of closing her eyes, seemed to sweep away the risk of the ball hitting her.

Saying, you are not using DCF is the same exact thing. You are sweeping away the assumptions.

Future is uncertain. Cash flows are uncertain. World is unpredictable. DCF valuation reflects that uncertainty. Embrace it.

Point 3

It is like saying, I dont want to risk any money in stock market but want 15% returns. There is no point in valuing something conservatively and saying it looks expensive. Value what you think cash flows are going to be. Project it out several years. It is not DCF that is stopping you from buying. 50x earnings does not make something expensive. It looks expensive. You already know that so I would not belabor that point.

To you point about Damodaran, DCF calculation is not really the tough part. He is a good teacher. The mechanics are very simple. The tough part is understanding the business enough to know as he puts it "the story" or as Buffett says the moat and how sustainable that is.

Vinod

-

Like I said, he does not need to put FCF for year 1 this much, FCF for year 2 this much and so on to build out a DCF model. But DCF is essentially the only only way to actually calculate IV. The model laid out by Alice is based off DCF with assumptions plugged in. He does not do DCF is something both Alice and Munger mention, but it does not mean what you think it means.

If you look at How Inflation Swindles the Equity Investor, he lays out exactly the behavior of how the inputs to DCF behave and how it impacts IV. That is the essence of using DCF.

I know a lot of value investors take pride in saying "I dont do DCF". Once you do understand how earnings, FCF, reinvestment are working, you dont have to actually lay out FCF1, FCF2.... FCF in perpetuity to actually calculate value. Then you take a short cut to DCF valuation, but underlying it is essentially DCF.

The mistake I made when starting out and for several years, is look down upon DCF and missed a lot of the insight it provides. I spend several months reading up Damodaran's Investment Valuation and it really opened my eyes. Assuming you are at the same level as Buffett and hence does not need to do some of the things just because he does not do it, is not wise.

Vinod

-

Reminds me of this joke.

There are these two young fish swimming along, and they happen to meet an older fish swimming the other way, who nods at them and says, “Morning, boys. How’s the water?” And the two young fish swim on for a bit, and then eventually one of them looks over at the other and goes, “What the hell is water?”

You are using DCF if you are valuing a company with any method other than comparative valuation.

What you really mean is that you dont actually lay out the FCF and actually discount it back. You might be using a short cut like 15x Earnings. But underneath that you are making assumptions about required return, expected growth, etc. Only you are doing it implicitly. All valuation ends up being some form of DCF.

Buffett does DCF, he is just able to do the basic math in his head. His short cut method is pretty well covered by his biographer.

For most investors, until they become very good at it and understand the impacts, actually laying out a DCF is an extremely useful way to pick up nuances in valuation that are easy to miss.

As another old dude is fond to say not learning this, "you go through a long life like a one-legged man in an ass-kicking contest. You're giving a huge advantage to everybody else."

Vinod

-

17 hours ago, changegonnacome said:

Your sending me research papers....and factor quant models...and the Dean of Valuation.....and I'm simply telling you & saying that if say Uncle Sam offered me a 10yr treasury bill today with a 10% coupon....and Apple was being offered to me at the same time with TTM FCF earnings yield of 3% & IMO poor prospective earnings growth....that somehow those two instruments can't be compared somehow...cause they are apple & oranges ...nonsense....if thats my investment choices.....in my humble opinion you take the 10yr T-bill @ 10% and run, run fast....if you offer me Hostelworld equity then I tell Uncle Sam to go to hell with his t-bill.

Now if your also saying that the ERP hasn't been a great predictor of prospective stock returns..that the ERP as a factor is useless..thats its use is limited.....I just agreed with that in my post above.....I never said it was gospel or live your life by the ERP....the ERP in 2021 flashed a very generous 2-3% over bonds...signalling stocks were cheap and one should buy them up.....it was wrong, very wrong....stocks were actually expensive.....bonds were in a 3000yr bubble...making stocks look relatively cheap under the ERP or 'fed model'...Cliff Asness is right.....but if you are trying to tell me that an investor can't think in opportunity cost across both bonds and equities in a holistic way, forecasting & estimating prospective returns relative to risk in both and coming to a conclusion on where best to put their incremental marginal dollar cause somehow it's impossible to compare the two . Then we have fundamental disagreement. As @thepupil says above.....equities arent always the 'right' answer....and to not consider them while thinking about where your next incremental dollar gets invested....is to be a one trick pony.........and thats before we get in to your or anyones relative or historical ability @vinod1 to accurately forecast the equity coupon or future prospects for a company.....lots of investors I know..... lack a demonstrable ability as fundamental business analysts.....and their returns would greatly benefit from loading up on bonds for all their nominal limitations....simply because they provide a lower probability of impairment of capital.....whereas poorly chosen equities offer limitless opportunities to do so.

"but if you are trying to tell me that an investor can't think in opportunity cost across both bonds and equities in a holistic way, forecasting & estimating prospective returns relative to risk in both and coming to a conclusion on where best to put their incremental marginal dollar cause somehow it's impossible to compare the two ."

Ah ha! The discussion started when the WSJ article you referred to did not do what you just said you are doing. What WSJ article did is this: bond yield x%, stock yield y%. Vola stocks bad deal.

There is a little bit more than that, as you now point it out clearly.

Vinod

-

18 hours ago, thepupil said:

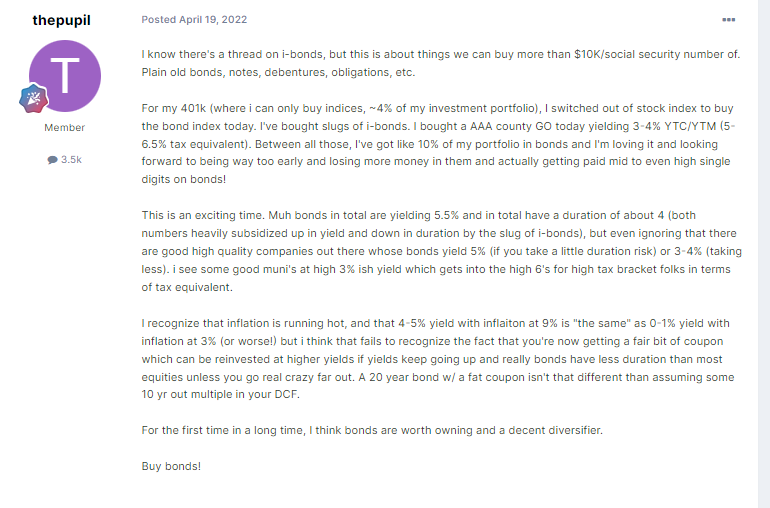

So about a year ago, I started a thread arguing that bonds were starting to look like a real alternative to equities and were beginning to become more relatively attractive to equity indices. By alternative, I do not mean "you should sell all your stocks and buy bonds". By alternative, I meant that holding bondsas part of a diversified investment portfolio would cost less in opportunity cost than in the past because yields were perking up and becoming more competitive with yields on stocks. If you think stock indices will do 6-8% / year for 10 years or whatever, whether bonds yield 0%, 2%, or 4% determines the opportunity cost of holding bonds.

an aside:

I think I'm an outlier amongst folks here and probably my peers, but I think that the traditional 60/40 or 70/30 portfolio works well in growing and preserving purchasing power and is a reasonable approach; VWENX can work just fine for a lot of people (a relatively smooth 8.2%/yr since 1929 as the world's oldest balanced fund). Financial repression and ZIRP though forced people to either buy bonds are really really low yields or take on more risk to earn the same return and I view the reversal of that as a positive. TIPS offer real yields. bonds pay a withdrawal rate and arguably have less opportunity cost.I think Powell is mostly doing a good thing by returning to a normal cost of capital. there will be some adjustment, he may go too far, some shit may blow up, but I don't think we should be at ZIRP forever.

back to bonds/stock:

Since that thread, bonds have made about 0% in total return. Stocks are down 5-6%. The market PE (using S&P 500/trailing PE on bloomberg) has de-rated from 21x to 18x, margins have come down and the index composition has changed such that EV/Sales has gone from 3.1x to 2.6x.

On a very short term, 1 year basis, I'd say the idea of bonds becoming "reasonable" as part of a portfolio was correct. I personally went from 0% to like 25% ish in bonds/cash/CLO AAA etc, but am now more like 85%/15% as found some opportunities.

Looking at today, I still maintain it's not entirely crazy to have some bonds. What's interesting is that the nominal yield on S&P 500 was about 4.7% 1 year ago and is now 5.5% (so it increased by about 80 bps), but bonds also increased in yield from 3.2% to 4.4% YTW on Barclays agg index. So both asset classes saw a de-rating, it's just that reinvestment of coupon and lower duration is the reason that bonds OP'd stocks. that's what i like about bonds, in a rising rate/rising cost of capital environment you don't really lose much and aren't takin on general economic risks. the reinvestment of safe coupon keeps you in the game.

I hope rates continue to rise (though I don't think they really can). I love having safe bonds/cash/whatever as a tool in the toolkit. stocks will (hopefully) destroy bonds over next 10-30 years, but nothing wrong with having some diversifitcation / other ways to preserve and grow purchasing power.

@Gregmalwill say the indices don't matter. For many they do. they matter in terms of how I deploy $60K/yr where indices are my only option.

I do not disagree one bit with what you wrote. It makes perfect sense.

The question of how much you want to hold in stocks vs. bonds is a separate and in 99 out of 100 cases the key determinant of overall portfolio returns.

The issue I am arguing about is this: predicting what inflation is going to do, then predicting how the economy is going to react, then predicting how the Fed is going to react and then predicting how the stock market is going to behave, then positioning the portfolio to take advantage of that prediction.

Been there. Done that. Lesson learned having needlessly ignored Buffett's advice.

I think stocks are reasonably priced. My estimate for S&P 500 is around 3600 +/- 15%-20%. It looks like the estimates from more bearish investors are something in the 3000 - 3200 range at which they would look to buy - because that is their prediction of market likely behavior.

To me market can fall 25%-50% anytime for any number of reasons. Most of which we have no idea. So why bother. If market does fall 50% to say 2000, I would see that as an indication that there is a God. And he loves me and wants me to get rich.

Otherwise just ignore the needless macro forecasts and get on with it. If you are willing to put in the effort you would find opportunities. If not, just put it in the index and wait for opportunities to show up. No need to wait for it in cash.

Vinod

-

6 hours ago, mattee2264 said:

I think some of the market strength is because ROW is holding up a lot better than expected and so far is avoiding recession. And of course US employment is still very strong.

And the Fed has expanded its balance sheet to deal with the fallout of the banking crisis which has created additional liquidity in the system.

But again it is what lies in the future once interest rates hikes fully transmit to the real economy and we see the impact of tightening lending and so on.

This is the argument I see again and again over the last 10 years. "I would have been right if not for the Fed".

-

6 hours ago, changegonnacome said:

"So comparing a static earnings yield to a bond (or inflation) isn't valid."

Its the most valid thing in the world....investing is the practise of comparing things..... prospective returns relative to risk and opportunity costs........if you aren't thinking about the pricing of your next equity investment relative to other things you could also invest in (investment property's, bonds, private credit, yourself etc.) you are doing it wrong. Do these investments have different characteristics....YES.......does that mean you can't compare them......NO.......End of.

Holy molly!

This is precisely the stuff of naive CNBC investors way back in early 2000's. It used to be called "The Fed Model". It has been debunked. Quite a few times. Separately and independently by people on different sides of the investment spectrum. I read this when the article first came out.

Here is one paper that lay bare the argument. Follow the link and download the PDF report in the Journal of Portfolio Management.

Fight the Fed Model, September 1, 2003 - Cliff Asness

https://www.aqr.com/Insights/Research/Journal-Article/Fight-the-Fed-Model

Conclusion: The very popular Fed model has the appearance but not the reality of common sense. Its lure has captured many a Wall Street strategist and media pundit. However, the common sense is largely misguided, most likely due to a confusion of real and nominal (money illusion).

Vinod -

30 minutes ago, TwoCitiesCapital said:

So yes, I believe elevated corporate margins were, in part, in response to stable and low inflation.

Why is it hard to see how these might be related? Maybe corporations can spend excess profits consolidating industries, eliminating overlapping jobs, and keeping the supply of labor high to keep inflation/labor pay low? Maybe they can spend excess profits lobbying for lower taxes and less burdensome regulation? Maybe they can spend excess profits doing things that support further excess profits instead of not having those profits by being behind the ball on inflation?

And what else did we see over that period? Multiples applied to profits that have previously only been seen at the top of cycles to persisted for years! They're still persisting! Everyone talks about how this is the most predicted recession in history and yet we trade at 19-20x earnings that are already shrinking going into it! Those aren't recessionary prices!

So yes, I think it's clear that the recent history inflation is very related to profit margins and multiples - just as it has been historically.

In the stable and low inflation 2000-2010 period, profit margins averaged 5.8%!!

Stable and low inflation is well and good for stocks, but there are some very significant changes going on. Even Grantham finally agreed and confessed to his sins and repented in 2017/18. He agreed profit margins are not going back. I have that GMO article lying somewhere on my PC.

Tax rates are one clue. Changes in the structure of the companies is another. Shifting of labor expenses to lower cost countries is another and so on. Inflation? Not so much.

Vinod

-

26 minutes ago, TwoCitiesCapital said:

Corporate margins have been rising for the last 15 years. They've spent most of that time at 9-12% which is elevated relative to history and has never persisted before. So the 13.3% was the end of what has otherwise been a consistent trend in corporate profits that has been exceptionally elevated and doesn't seem terribly out of place compared to the ~12.5% that was accomplished ~2019 without the assistance of trillions of stimulus and 0% rates.

What did inflation average over that period? Something in the ballpark of like 1.5%.

So yes, I believe elevated corporate margins were, in part, in response to stable and low inflation.

Why is it hard to see how these might be related? Maybe corporations can spend excess profits consolidating industries, eliminating overlapping jobs, and keeping the supply of labor high to keep inflation/labor pay low? Maybe they can spend excess profits lobbying for lower taxes and less burdensome regulation? Maybe they can spend excess profits doing things that support further excess profits instead of not having those profits by being behind the ball on inflation?

And what else did we see over that period? Multiples applied to profits that have previously only been seen at the top of cycles to persisted for years! They're still persisting! Everyone talks about how this is the most predicted recession in history and yet we trade at 19-20x earnings that are already shrinking going into it! Those aren't recessionary prices!

So yes, I think it's clear that the recent history inflation is very related to profit margins and multiples - just as it has been historically.

Margins averaged 8.5% from 2010 to 2020. They were 12.6% in 2021. I made a mistake, they were not 13.3%.

Look at the table of profit margins. Do you really think they are spectacularly on the outlier side? Would you think those were sustainable margins in the next few years? Or would you make an adjustment for them to fall down a little?

Vinod

-

54 minutes ago, TwoCitiesCapital said:

Real returns in equities in the from 1970-1974 was nearly -30%! How?!?! How does an inflation hedge underperform inflation by 30% points over 4-years?!?! About 1/3 of that from negative price performance and the remainder was from failing to keep up with high inflation. Even by the end of the decade, stocks had a negative real return of -0.5%/annum for the entire decade. Did NOT keep up with inflation over 10-years let alone produce real returns.

This is cherry picking! A very specific time period that coincides with end of a historic bear market!

What you are saying is stocks lose during bear markets! Yes they do. Stocks lose even over 10 years sometimes.

The best example you can pick is a negative 0.5% annual return. That is just about keeping up with inflation, roughly. Cash and bonds did pretty much similarly to stocks at that time if I recall not much difference.

For stocks to perform badly (not just compared to bonds) you need one of three conditions (1) war that devastates the economy (2) high and continuing inflation (3) financial crisis. Outside of these 3, stocks perform well. Which of these are you betting on?

Vinod

-

2 minutes ago, Santayana said:

Thanks, that makes sense. However, I looked at them a bit more and found that while they can't add new stocks, they can re-weight existing holdings, and they can sell. They sold C in 2009. I'm not saying survivorship bias will have a huge effect on what you're saying, but I do think it's wrong to discount it entirely, especially when discussing periods of high inflation which is when the weakest companies will the most likely to struggle.

This specific example of Lexington Corporate Leaders is no doubt survivorship bias. We do not know how other funds with a similar mandate would have performed. This is just such an interesting example, I threw it out there. But I accept survivorship bias is a very valid argument. I dont disagree at all.

I did not follow the fund since a long time and dont know what might have changed after it was bought out by Voya.

Vinod

-

37 minutes ago, TwoCitiesCapital said:

As pointed out, margins tend to contract because prices/wages/inputs rose faster than can be passed onto consumers. This is EXACTLY what we've seen over the last 18 months as as inflation has averaged ~8% over that time. Earnings didn't just not keep up - they contracted! This is a shorter term phenomenon that stops as soon as inflation stabilizes, but is valid as long as it keeps rising - profits will contract trying to keep up.

To answer this specific point. I say correlation is not causation.

In 2021 profit margins were at 13.3% - a historic outlier. A number that is vastly higher than any in the entire corporate history of US. Many reasons - stimulus, opening up, pent up demand, etc against a supply constrained economy. Those margins are not going to hold - inflation or deflation or disinflation. Margins went down as they normally do.

You are pinning this all on "look this is all due to inflation". If we had deflation instead, profit margins would still have contracted. Or do you genuinely believe that deflation or heck even stable 1-2% inflation, would have kept profit margins high even now?

Vinod

-

21 minutes ago, thepupil said:

Berkshire has issued stock for a few acquisitions, Dexter Shoe (the dramatically named biggest mistake) and BNSF. I suspect the trust owned a BNSF predecessor which became Berkshire Hathaway

+1

BRK -> BNSF Railway Company -> Atchison, Topeka and Santa Fe Railway

-

Almost by definition nominal GDP growth has to translate to nominal revenue growth to corporate sector. Nominal revenue growth to corporate sector implies nominal GDP growth. You cannot have one growing and one falling. A little bit of leakage happens to make it not exactly 1.0000 to 1.0000 correspondence. You just need to believe in addition and multiplication.

If you agree, then earnings have to grow in line with revenues - adjusted for profit margin changes. If over 30 years inflation is 5x and profit margin gets cut to half, real GDP growth is say 2%, you still end up with about maintaining earnings in line with inflation despite the margin compression. No real surprise.

That is why bonds lose, again and again and again over the long term.

Vinod

-

3 minutes ago, KCLarkin said:

Change, Vinod is simply pointing out that stocks tend to have a growing "coupon". So comparing a static earnings yield to a bond (or inflation) isn't valid.

--

In your simple example.

Earnings(t0) = 100

Cost of Living (t0) = 100

Earnings (t1) = 105

Cost of Living (t1) = 105

The earnings are "real" in that they keep up with inflation (in this example). There are complicated reasons why this isn't the real world experience (for example, inflation causes maintenance capex > depreciation).

Thank you for making my point clearer than I was every able to make!

I would add just one more point. They might not keep up with inflation exactly in the short term. Margins change, tax rates change, etc. But roughly and over the long term, it is just as near a certainty as you can get in investing field.

In fact I would challange anyone to find a single country where stocks were not confiscated or wiped out by war, where earnings did not keep up with inflation. One single country for any 30 year period.

Vinod

-

2 hours ago, Santayana said:

Not really, they generally get dropped from the index when they start to underperform or have their market cap drop below a certain level, they don't stay in the index all the way to the point of going out of business. By their very nature the indexes are subject to survivorship bias. Now if you buy an index fund and let the index rebalance your holding for you, then yes you will generally see earning growth over time that outpaces inflation. I didn't realize that's what you meant in your original statement,

Quick comment. I went through these calculations in detail while completing CFA exams. It does not work like what you are thinking. There are all sorts of adjustments made to account for this.

I passed the exams in 2008-2009 period (right in time for GFC) and I forgot all about them until you brought this up.

Take the Total Stock Market Index for example, it invests in just about every single available stock investment. That is close to 4000 stocks. Some go bankrupt and drop to zero. Index value reflects that. A new company is IPO'ed and TotStockIndex buys it with some of the funds. The process is dynamic. Winners get big, losers get wiped out. There is not survivorship bias in the sense that you are using the term. Look at the long history of S&P 500 and it matches the performance of total stock market very closely. Heck if you pick a 100 stocks at random out of the 4000 with some limitations given to picking say at least 50 of them from the top 100 stocks by weight, you get pretty much close to index performance. Take a look at Lexington Corporate Leaders fund which is formed in 1935 I think to invest in the leaders of the stocks of that time with the mandate that no new stocks can be bought or sold ever. It now survives as Voya something fund. It matches the overall stock market performance roughly.

Vinod

-

7 minutes ago, Santayana said:

Right, but market returns are very much affected by survivorship bias. Lots of companies fail, get dropped from indexes, and then we don't see their poor results in the historical record. Look at a list of Dow Jones components from 50-60 years ago, many of those companies clearly didn't have earnings that have outpaced inflation or they would still be with us today.

We are not talking about individual stocks. I am talking about the broad market. Every company goes bankrupt at some point but the overall corporate profits go up. When you invest in a broad index, you own pretty much the overall economy.

DOW returns incorporate the effect of companies going bankrupt. As is the total stock market or S&P 500. The methodology specifically accounts for this.

Last I read about it, only 57 companies in the original S&P 500 still survive today. The S&P 500 return during this period accounts for this fact.

So if you are talking about that specific survivorship bias, it is 0%.

When Buffett put 90% of his wife's portfolio is in S&P 500, it would be worthwhile for every investor to spend a few months pondering over this fact.

Vinod

-

6 minutes ago, TwoCitiesCapital said:

Stocks are better than bonds in hyperinflation. They're still worse off than most real assets.

In more moderate inflationary environments, like the 1970s, bills and notes did better than stocks (precisely because stocks are long duration assets). I'd imagine many real assets did as well but am only certain of energy.

Most bills/notes/bonds outperformed most stocks last year too. Jury is still out this year, but looks increasingly in favor of bills/notes/bonds if we are headed into an recession at 18x falling earnings while bills/notes pay 4.5-6.5% pending spread and credit quality.

Stocks are ONLY good in modest inflationary environments. There are better asset classes to own in just about any inflationary environment where inflation consistently exceeds 4%. If it's between 0-4%, stocks are what you want to own.

Literally a sample size of one, from which you are drawing a very broad conclusion. You might as well make a similar statement "When a Chinese spy balloon crosses continental US, stocks do xxx".

There are many things going on in the 70s and cherry picking time periods does not make for drawing much of any conclusions. Small value too did very well in the 70s.

Except during massive deflation, which means falling revenues across the corporate sector, when bonds are going to be far superior to stocks, in all other cases, stocks are always going to do much better compared to bonds. If PE's go above 40, then it might take a reeeeeelly long time, but even then they are going to beat bonds at 3 or 4%.

Vinod

-

5 hours ago, Santayana said:

How much does survivorship bias affect that statement?

Not much. Unless you are talking about world ending events not happening. In which case it does not matter, what the stock returns were.

Look at every single country in the world with stock markets and look at the returns. Well, we have that. Read 101 years of stock returns but Dimon, et all.

Say inflation is 10,000% or prices increase 100 fold.

What happens?

Corporate revenues increase roughly 100 fold. It has to, otherwise there would be no inflation. We are looking at the two sides of the same coin.

Lets say profit margins get cut in half and PE multiples get cut in half. You end up with some fraction of your wealth. Stocks would benefit from some real growth that is occurring and the debts they take gets wiped out (thanks to bond investors).

Bond investors get wiped out.

This is what happened in other hyper inflation episodes which are an extreme case.

So there you have it. In the next to worst case scenario (worst case being economy totally destroyed as in total nuclear holocaust or a meteor wiping out earth, communist takeover), stocks are still the best investment compared to bonds. Equity premium is actually pretty high in this case!

Vinod

-

A good paper that deals with some of this is, Equity Risk Premiums (ERP): Determinants, Estimation and Implications - The 2023 Edition

-

3 hours ago, changegonnacome said:

You’ll need to be a bit clearer on that one cause it makes no sense - are you saying stock ‘yields’ live in a universe where they aren’t subject to inflation pressures/adjustment…..or somehow they are guaranteed by dictate to adjust upwards always to provide a guaranteed real return for the purchaser like TIPS are over inflation……that’s big leap & it assumes perfect pricing power…..and ignores why its called equity RISK premium (ERP)…..I mean SPY usually grows its earnings….……but not always….thats the risk..….we are about to enter a period IMO where we will be/are printing nominal falls in earnings…..and very large REAL falls in earnings……ask SPY owners who bought at 4800 with say bottom up earnings now for SPY sitting at around 210 about it….they have a 4.375% earnings yield on that purchase price….in a ~5% inflation economy…not good…...& where 3 month treasury’s have a 4.9% yield with NO risk….and where the direction of travel for earnings is likely not good….yes time will make the math work…but no guarantees…..what are corporate tax rates & earnings going to be in five years with AOC as President?

I’ve seen people talk about how historical ERP figures…….are dumb, cause they’re a point in time and static and compare apples (fixed coupon) to oranges (equity ‘coupon’)….as companies grow their earnings / ‘yield’..….and bonds don’t……my rebuttal to that thesis…..is exactly what market participants don’t know that?……..the historical ERP is very valid measure of valuation as EVERYBODY understands one is a fixed coupon and the other is not….the variable-ness of the equity coupon above the bond coupon….is the RISK…most of the time the E goes up…but not always….how much investors historically wanted in compensation to take that risk is a very valid benchmark across time……it is in some respect a measure of optimism and pessimism…..exuberance & fear….its the only thing that matters but it does matter.

You are slaying a strawman that no one is arguing about.

Over the long term earnings of companies in the economy as a whole do better than keep up with inflation. Please do note the two points I bolded and underlined.

Nothing is guaranteed. Earnings do not increase in lockstep with inflation. Profit margins go up and down. Inflation or deflation happens. But over the long run, corporate earnings as a whole keep up with inflation and then some. PE multiples go up and down. That is a separate factor.

The point I am making is, you don't compare corporate earnings (which go up) and its yield with bond market yield which is fixed. This is exactly the error made by the investment community as a whole until the 1950s when they used to compare dividend yield of the market with bonds. You can read more about this if interested.

When someone says "earnings yield" of stocks as an approximate return, they mean real return not nominal return. For bonds, the yield you get is the expected nominal return. Both assuming no changes in valuation. Now you do not go about comparing these two as if they are similar, they are not. This is so widely understood and utterly uncontroversial, I am surprised that I need to highlight this.

Vinod

-

21 hours ago, changegonnacome said:

Stocks Haven’t Looked This Unattractive Since 2007 -

It's tough out there for stocks.....with bonds giving so much competition.......the bearish amongst you will even notice how the above is using trailing earnings......there's a kind of optimism built in to the thought that SPY earnings can be maintained at even these nominal levels (never mind keeping up with inflation in real terms).....my thoughts are that earnings come down in nominal terms quite a bit but in real terms quite a lot (already have).....but I think the 10yr rallies too such that its yield drops.....the Fed will get what it wants (a slowdown/reccession).

Anecdotally I'm in the process of buying a house and about 50% of the loan origination officers I spoke to about a month ago in the Tri-state area have lost their jobs

The author is making an elementary mistake - comparing a stock earnings yield with a nominal government bond yield. Comparing a real number with a nominal one. If you are going to compare use TIPS.

-

On 4/7/2023 at 7:02 AM, mattee2264 said:

e are also in unfamiliar territory. We are heading for a policy-induced recession that is following a policy-induced boom. And they will be asymmetrical.

On 4/7/2023 at 7:02 AM, mattee2264 said:There is a lot of talk about negative sentiment in the markets and most professional fund managers are privately or publicly expressing bearish views. But ultimately it is not what investors think but what they do that matters. And based on the current level of stock prices it seems most investors are holding on to their stocks and in many cases buying more.

And we are seeing the familiar pattern of people seeming to think that during times of economic weakness that Big Tech is a good safe haven and I think that is why the banking crisis has been seen as bullish as it is seen as discouraging further rate hikes by Central Banks and bringing the inevitable pivot forward and that is bullish for growth stocks whose valuations are very sensitive to the discount rate used.

And with most money managed by institutions there is a career risk to selling before everyone else. Much better to go off the cliff with everyone else than risk selling too early and losing AUM if the bull market gets extended a few more quarters.

We are also in unfamiliar territory. We are heading for a policy-induced recession that is following a policy-induced boom. And they will be asymmetrical. Because you can very quickly inflate the economy by printing a lot of money and giving it to people to spend. But releasing the air takes a little longer as interest rate rises take time to feed through the system and until they start to cause real pain businesses have no reason to cut employment and high levels of employment can sustain spending and with most people on fixed rate mortgages and under no pressure to sell their houses we aren't seeing much in the way of pressure on consumer spending from higher mortgage costs or negative wealth effects. And while we are sitting on huge amounts of public debt politically it is very difficult to raise taxes or cut welfare even though it would have a much quicker effect in terms of inducing a recession and bringing inflation back down to trend.

And a lot of the correction has been in real terms. In cumulative terms prices have gone up 20-30% since the pandemic. So in real terms the stock market is probably back to pre-pandemic levels. And while nominal interest rates are a lot higher since the pre-pandemic average real interest rates are similar at around -2%..

A lot of wisdom packed into this paragraph. Agree 100%.

There had been a 25% correction in stock prices due to inflation beyond what you see on the nominal S&P 500 index value.

People talk about now getting 4% on cash while waiting for the stock market to correct and are happy to be getting "paid" whereas in the past they have to settle for 0% returns. If one is thinking in real inflation adjusted terms, now they are worse off actually - getting paid 4% on which you pay taxes while inflation is 5% is worse than losing 1% on inflation while earning 0%.

I was in London and Paris the past week and restaurant prices seemed about same or slightly cheaper to me than in the DC metro area. I can eat out at a restaurant overlooking Notre Dame for the same price as at a mainstream chain in a US suburb. This seems crazy to me. US did experience very significant inflation in the past couple of years.

Vinod

How often do you use DCF (or something like it)?

in General Discussion

Posted

10 Myths about the DCF Model

https://pages.stern.nyu.edu/~adamodar/pdfiles/country/DCFmythsTemasek.pdf