Luke 532

Member-

Posts

2,931 -

Joined

-

Last visited

Content Type

Profiles

Forums

Events

Everything posted by Luke 532

-

FNMA and FMCC preferreds. In search of the elusive 10 bagger.

Luke 532 replied to twacowfca's topic in General Discussion

It's becoming increasingly difficult to see how preferred shareholders get hurt when all is said and done. -

FNMA and FMCC preferreds. In search of the elusive 10 bagger.

Luke 532 replied to twacowfca's topic in General Discussion

From Peter A. Chapman... Hamish Hume, Esq., representing the Class Plaintiffs, sent the D.C. Circuit a letter yesterday advising it about the Federal Circuit's decision in Piszel v. U.S. and explaining how the Federal Circuit's decision supports the Class Plaintiffs' position. A copy of Mr. Hume's letter is attached... 14-5243-1631120.pdf -

FNMA and FMCC preferreds. In search of the elusive 10 bagger.

Luke 532 replied to twacowfca's topic in General Discussion

Good catch. -

FNMA and FMCC preferreds. In search of the elusive 10 bagger.

Luke 532 replied to twacowfca's topic in General Discussion

I'm betting before Labor Day... circa 2020. ;) -

FNMA and FMCC preferreds. In search of the elusive 10 bagger.

Luke 532 replied to twacowfca's topic in General Discussion

but that would be speculation. and we are investors. ;) Hah! -

FNMA and FMCC preferreds. In search of the elusive 10 bagger.

Luke 532 replied to twacowfca's topic in General Discussion

Me neither, but I do think it is a mistake to view price action in general as a viable method of predicting what will happen. I'm not saying anybody here is doing that. I agree. -

FNMA and FMCC preferreds. In search of the elusive 10 bagger.

Luke 532 replied to twacowfca's topic in General Discussion

I suggest ignoring price action as it's largely irrelevant. -

FNMA and FMCC preferreds. In search of the elusive 10 bagger.

Luke 532 replied to twacowfca's topic in General Discussion

Sure hope so, let's get this decision in the books in August. But if the clerk work is already done and it's currently on the desks of the judges... this is all supposition, luke. judges use clerks differently among them. some use mostly for research. some also have them draft opinions. most merits panels take some sort of vote after orals to see what the lay of the land is, and assign opinion writing responsibility. but generally once first draft of an opinion is written, other judges review the opinion and there is debate over language etc. at the end of day, there may be concurring opinions and dissenting opinions needed to be drafted and reviewed. something tells me that in perry case, you will see three opinions, since judges could agree on result but for different reasons. moreover, if there is remand for APA claim that NWS not consistent with conservatorship, you may have different standards enunciated for the district court to follow even if judges agree to remand...all the more reason for judges to debate among themselves to try to reach a single instruction for the district court. so all things being equal, this should be a longer rather than shorter judicial decision process I hear ya. Thanks for the info. -

FNMA and FMCC preferreds. In search of the elusive 10 bagger.

Luke 532 replied to twacowfca's topic in General Discussion

Sure hope so, let's get this decision in the books in August. But if the clerk work is already done and it's currently on the desks of the judges... -

FNMA and FMCC preferreds. In search of the elusive 10 bagger.

Luke 532 replied to twacowfca's topic in General Discussion

Sure hope so, let's get this decision in the books in August. -

FNMA and FMCC preferreds. In search of the elusive 10 bagger.

Luke 532 replied to twacowfca's topic in General Discussion

That would be ideal. -

FNMA and FMCC preferreds. In search of the elusive 10 bagger.

Luke 532 replied to twacowfca's topic in General Discussion

Stopping the sweep won't be a complete victory. Even the best case scenario of re-categorizing the excess funds as redemption of Sr. Shares will leave the conservatorship intact, the companies severely undercapitalized and the full Treasury commitment in place. Plus a 10% dividend on the balance of the commitment and most likely a new compensation fee on the balance that has not been drawn. It will still be a sea change for shareholders in that they will have a small seat at the table. But then, Treasury can exercise the warrants, pursue a double dip for recap and leave shareholders with less than 10% ownership while Treasury could become the controlling shareholder and name a few new Board directors. So while our situation may improve drastically, dangers will still be present. And Congress could still have a shot at dismantling the companies or HRC at merging both institutions. Many things can still happen if and even after the sweep is reversed. Good point, rros. Thank you. -

FNMA and FMCC preferreds. In search of the elusive 10 bagger.

Luke 532 replied to twacowfca's topic in General Discussion

I don't expect to be awarded anything. Only thing I'm looking for is stopping the sweep from here forward. That's it. And that will be awesome when it happens. I only own prefs (no common). -

FNMA and FMCC preferreds. In search of the elusive 10 bagger.

Luke 532 replied to twacowfca's topic in General Discussion

I'm including the entire article here (I usually don't like it when people do that, so forgive me for doing so) because it was originally posted, then removed from Forbes.com, then re-posted. http://www.forbes.com/sites/katinastefanova/2016/07/26/will-fnma-and-fmcc-bring-extraordinary-returns-to-investors-this-summer/#563ee8721b1a Will FNMA And FNCC Bring Extraordinary Returns To Investors This Summer? Katina Stefanova, Contributor The failure of legislative reform of the housing market and the potential windfall that investors stand to gain should a favorable decision be made on the plaintiffs’ case make Fannie Mae (FNMA) and Freddie Mac (FMCC) the most divisive stocks currently trading. This summer, the issue comes to a head with greater urgency and more at stake than ever before. The timing of key financial, legal and legislative factors are converging spelling volatility for the GSEs stocks in the months to come... -

FNMA and FMCC preferreds. In search of the elusive 10 bagger.

Luke 532 replied to twacowfca's topic in General Discussion

Chapman (and 2 attachments)... One factoid in Fairholme's papers unsealed this week that's new to me is: Fairholme's Motion (Doc. 1565601), at page 13, says: "Treasury’s administrative record fails to reveal that Treasury was in possession of newer projections indicating that the Net Worth Sweep was not necessary to prevent the Companies from running through the available Treasury funding commitment." Fairholme's Reply (Doc. 1572909), at page 10, says: "n adopting the Net Worth Sweep, Defendants relied on financial projections based on 11 month old data, and those projections were by then known to be inaccurate and unreliable." 14-5243-1572909.pdf 14-5243-1565601.pdf -

FNMA and FMCC preferreds. In search of the elusive 10 bagger.

Luke 532 replied to twacowfca's topic in General Discussion

From Peter Chapman today... Attached to this e-mail message are unsealed and redacted copies of: -- Fairholme's Motion filed on July 29, 2015, asking the D.C. Circuit to take judicial notice of various discovery documents; and -- Fairholme's Reply in support of that request filed on Aug. 31, 2015. I've posted copies of the two volumes of discovery documents at -- http://bankrupt.com/misc/14-5243-1565601-1.pdf and -- http://bankrupt.com/misc/14-5243-1565601-2.pdf -

FNMA and FMCC preferreds. In search of the elusive 10 bagger.

Luke 532 replied to twacowfca's topic in General Discussion

+1 -

FNMA and FMCC preferreds. In search of the elusive 10 bagger.

Luke 532 replied to twacowfca's topic in General Discussion

Sounds like Corker is nervous that Watt might release the GSE's. Things have been pretty quiet out there... wonder what, if any, material events might be taking place behind the scenes. -

FNMA and FMCC preferreds. In search of the elusive 10 bagger.

Luke 532 replied to twacowfca's topic in General Discussion

Would the court need this much time and/or information if they were to simply agree with Lamberth or remand it back to him without specific instructions? I'm probably biased at this point, but wouldn't this logically lead to remand with instructions or full overturn as the two most plausible outcomes? -

FNMA and FMCC preferreds. In search of the elusive 10 bagger.

Luke 532 replied to twacowfca's topic in General Discussion

Joe Light, author of that piece, apparently left the WSJ. -

FNMA and FMCC preferreds. In search of the elusive 10 bagger.

Luke 532 replied to twacowfca's topic in General Discussion

Nice work! -

If American - which presidential candidate will you vote for?

Luke 532 replied to LongHaul's topic in General Discussion

-

FNMA and FMCC preferreds. In search of the elusive 10 bagger.

Luke 532 replied to twacowfca's topic in General Discussion

http://www.valueplays.net/2016/06/06/the-one-thing-democrats-and-republicans-increasingly-agree-on/ -

FNMA and FMCC preferreds. In search of the elusive 10 bagger.

Luke 532 replied to twacowfca's topic in General Discussion

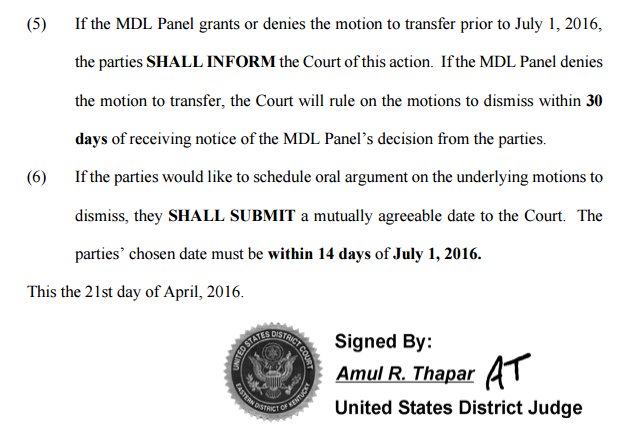

We'll have a ruling from Judge Thapar (Kentucky) the first week of July at the latest, possibly earlier. See note 5 on the image attached. "If the MDL Panel denies the motion to transfer, the Court will rule on the motions to dismiss within 30 days of receiving notice of the MDL Panel's decision from the parties." The parties gave notice to Thapar this week so the clock is ticking on the maximum 30 day wait until his decision is ordered. -

FNMA and FMCC preferreds. In search of the elusive 10 bagger.

Luke 532 replied to twacowfca's topic in General Discussion