muscleman

-

Posts

3,759 -

Joined

-

Last visited

Content Type

Profiles

Forums

Events

Posts posted by muscleman

-

-

3 hours ago, Gregmal said:

Because it’s the lazy academic shit they put in the textbooks.

I think once those 25% annual paper returns in tech stocks vaporize the 10% or so in real returns you can get via value stocks will appeal to people. Much more so than the 0% returns on cash and the negative ones on bonds.

Fed's keeping rate at 0 is going to cause one bubble to start brewing immediately after the collapse of the prior bubble. People are not going to sit on cash earning 0%.

There seem to be a shift in investing trend every decade. The 2009-2021 era is growth. Maybe the decade of value is going to come soon.

-

2 hours ago, Spekulatius said:

I believe if real interest rates ( net of inflation) turn positive and become significant- let's say 3% - then hard assets like real estate will fall.

Right now, we have interest rates of 1.5% (10 year treasury) and inflation of ~7%, so the real interest rate is -5.5%. that's pretty much an ideal environment for real estate.

If interest rates go to 10% while inflation is at 10%, to throw out an example, then I expect real estate to do fine.

By "interest rates", do you mean the 10 yr or 2 yr rates? The spread between the two are compressing lately.

-

11 minutes ago, ERICOPOLY said:

There are value stocks today as well. Some are rising today as the market is falling.

Some are defensive stocks that trade like T-bills. Overall, it looks just like 2000. When dot com stocks crashed, BRK went up, but in the next two years of bear markets, these value stocks decline slowly until the bear market is over. I think we are right at that inflection point.

The correlation of these stocks are high these days. A lot of funds will be facing massive redemptions and they just have to sell everything in the end.

-

23 hours ago, ValueArb said:

Why do you think RE prices will be far higher in 3-5 years? If mortgage rates go up to 5% or so, won't that lead to flat or lower RE prices?

Why do people keep saying if rates go up, housing price has to go down? Have you taken a look at historical rates vs housing prices and find any cases when both were going up?

-

1 minute ago, Kupotea said:

Rotation out of tech has been clear for a while now and only the FAAMG stocks are holding the market up.

That is exactly what happened in 2000. A lot of dot com stocks were already nose diving while the stock index was making new highs as Cisco, MSFT and a few others were holding the market up. The funny thing is that this time MSFT is also one of them.

The difference is that this time is an everything bubble, but in 2000, value stocks went up when dot com stocks collapsed.

-

It looks more and more like the repeat of 2000 top. Last Friday, SPY made a new high, while many stocks in it were making new lows.

-

On 11/24/2021 at 11:45 AM, fareastwarriors said:

just glad I'm not renting... talk about ouch!

South Florida and New York See Apartment Rents Surge More Than 30%

Nothing surprising after the eviction ban is lifted. The more the socialist government tries to control the prices, the harder it bounces back. Nature forces cannot be fought by human.

-

2 hours ago, Mjs3382 said:

I’ve been managing Separately Managed Accounts at Interactive Brokers for some friends and family. Since it is less than five people, I’ve been exempt from state registration as a Registered Investment Advisor in the state I/we are located (also I’m not currently charging fees).

As I’m close to exceeding five “clients”, I’d like to formalize the structure and form probably an LLC that will act as the Registered Investment Advisor. I’m just trying to get a sense from anyone whose managing money under this structure currently, what their start-up and ongoing expenses are/were? Just general figures. I’ll obviously hire a lawyer but would love to have some more concrete idea of expenses before starting down that route.

Any info on this would be extremely appreciated. Thanks.

As I understand, IBKR's friend and family advisor account requirement is up to 15 accounts. You are just 5. Still a lot of wiggle room.

But this requires that you don't charge management fees. If you do, then you do need to be an RIA for your state.

I don't think the expense is too bad. Setting up the LLCs could be the worse part. If you are managing external accounts who may sue you, then it is worth setting it up with a two tiered LLCs. have your parent LLC in Wyomin, and have your lower tier LLC soly owned by that Wyomin LLC. In this case, your client has to sue you and win in both states to actually win, and the Wyomin LLC provides privacy. It will never tell anyone who the owner is.

-

9 hours ago, scorpioncapital said:

I have a fondness for cash.

cash pays my bills.

cash lets me act fast.

cash lets me BUY things I need or want.

while cash may lose its purchasing power in the short to medium term, it will make up for that loss when asset prices deflate , yields increase and you actually have money left (even if worth less) to put to work at higher rate of return. That higher rate later versus now differential I feel does catch up the lost ground.

That's right. I think what happened with Zillow Offer is what is happening in the stock market right now, marked in real time.

Everyone knew that RE prices will be far higher 3-5 years down the road, but ZO started paying 25% over fair market value for every property it could seen, and exploded.

Everyone sees leading tech stocks being the future, so they started paying a premium. At first 50x PE. Then 100x PS. It will explode too. I think that moment is now.

-

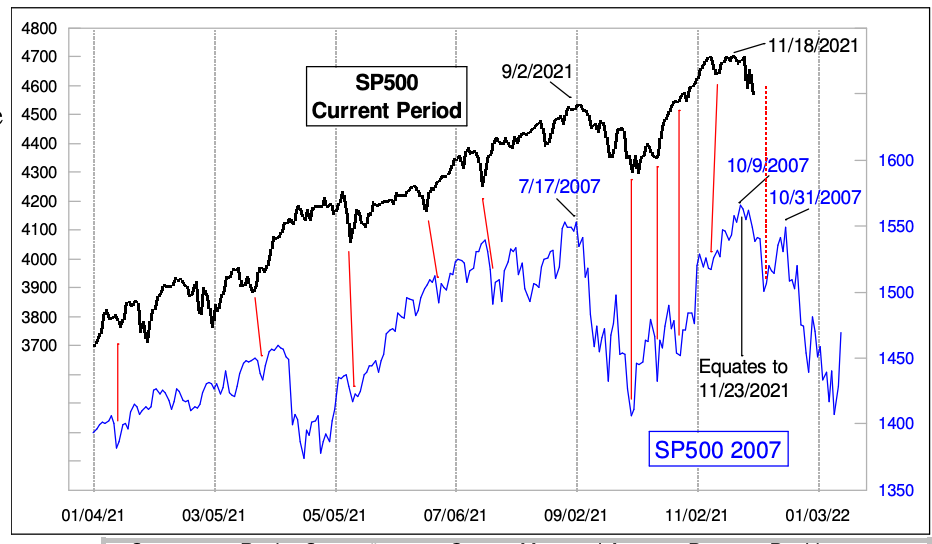

some fun comparison. No idea if it is going to repeat.

-

5 hours ago, Gregmal said:

A good summary just today from Dalio. There is this grand illusion that money in your checking account is not losing value just because the number doesnt change. Even outside that, theres literally millions of different near riskless things one can do to generate mid single digit returns in a non correlated way.

Separately, but relatedly, about this time last year I facetiously responded to a "cash" and "market top coming" topic by saying an idiot could just cover their eyes and go 80% long BRK, 30% long MSFT, and be 10% short ZM and make money while gasp! being on margin. Wouldnt you know, the idiot woulda done just fine. Same thing applies today. People just perpetually over estimate risk and probability and give too much anchor faith to "their" assessments which on a general basis, are typically off quite significantly.

I've been working extremely hard to get more real estates. I am not sitting idle on cash. I don't want to buy REITs because the managers of REITs overpay to acquire assets at crazy prices to boost AUM so they can get higher bonus.

Meanwhile, I still have cash sitting on the sideline as I acquire real estates.

With that said, I do think the stock market is due for a bounce to provide false security to everyone, and then fall sharply lower. Dalio is the guy who said in Feb 2020 that cash is trash. It is funny that he is bashing cash again right at another historic top here.

-

4 hours ago, Gregmal said:

Its like people rather lose money via the inflation monster because "the number in my checking account is still the same" and it makes them feel better than seeing a temporary red down arrow....I think its all but a certainty that the top is/was in(IMO it was Feb 2021, not now or whenever) for most of tech and high growth, high multiple stuff. But a new horizon is emerging and there's a good bit to eat there IMO.

I disagree that just because inflation is gonna run wild, anything we overpay would be justified right now. If you haven't tracked Zillow, look at how the Zillow Offer debacle played out. I think the same applies for extremely overvalued stocks.

Back in 2011, we used to justify an expensive stock by saying, it is only trading at 50x PE. Now we justify an expensive stock for saying, it is only trading at 100x P/S. But S is going fast so that's ok. No that's not ok when liquidity starts to dry up, which is exactly what is going to happen now.

-

Fed's primary mandate is to battle inflation, not to pump the stock market.

Right now the tide has shifted from "when to taper QE" to "if we should taper faster due to inflation out of control".

Last year, covid is the cause of the start of this crazy QE program. This year, covid will be the cause for ending this crazy QE program. That's my understanding. My original post calling for a November top was also based on Fed's timeline to start tapering.

-

1 hour ago, TwoCitiesCapital said:

Stocks go up is primarily only true in hyper inflationary scenarios and is only true in nominal terms.

Equity returns were very negative during the last inflation of the 70s - particularly on a real basis.

If we get +5% inflation consistently going forward, there's no way that we're not near a decade long top.

Yep. 1970s is not very far away from now, and I haven't seen anyone talking about a repeat of the 70s except you.

Buffet lost 30% in 1973 and another 30% in 1974. I don't think that's something most people here can tolerate. At least I can't, so I choose to get out.

Venezuela stock index went up 600% from 2014. But that's nothing compared to houses. What used to buy a 2 br condo there in 2014 can only buy one egg.

-

Is anyone enrolled in that? I just noticed this new feature and enrolled in it and one day later they notified me that they filed one on my behalf for WWE. I know what they can possibly recover is likely pennies but I wonder if there is any reason not to enroll for US residents?

-

2 hours ago, yesman182 said:

I moved my investments to Merrill last year because they allow you to use your margin for investments outside of your account. I wanted to have margin available for buying a house I planned to flip. After I signed up for the margin account I learned that if you use the money outside the account it is actually DEMAND Financing that can be called at anytime with no warning. I have not used this margin, because giving them the right to call your financing at any time for any reason too risky for me.

Does anyone who uses margin for purchasing homes know if IBKR/Schwab considers the margin loan a Demand loan? I want to avoid a margin/loan call at all costs, I plan to only margin ~10% of my investments.

i don't think it is a good idea to use margin in IBKR because they have instant liquidation rule. It only gives you a few minutes for the margin call before they liquidate your positions. There is no way anyone could deposit enough money within minutes of margin call. You have to either use margin and buy options to protect your risks, or don't use margin.

I think if you want to buy and flip houses, the best way to do that is to use HELOCs. I have a HELOC with my local credit union that's free to open and the APR is 3.99%, and there is no annual fee for it.

-

2 hours ago, maplevalue said:

A great point about how what the market did defied what many predicted in 2020. With that said the setup for future lockdowns is different. In 2020 we had lockdowns -> deflation -> easy monetary policy. With this go around, and CPI having gone up 6% over the past year, I suspect we would have lockdowns -> inflation -> ?. The ? could very well be monetary policy stands pat (i.e. no incremental stimulus), or potentially a tightening. I am not saying tighter policy in a lockdown scenario is the most likely scenario, but given how big of a negative it would be for markets, it's important to consider the possibility.

I don't think we will get another lockdown this time. In the US, repulicans are anti-lockdowns. Democrats were pro-lockdowns last year, only because they want to destroy the economy and win the election. But now that they are in charge, they will have no incentive to lockdown because they have the lowest approval rating now among all administrations in the US history now. They are in desperate mode to curb inflation and make people happy so they can win 2022 mid term election.

I think we will likely see fed tightening while the virus is running wild.

Note that having a variant more contagious is not a bad thing. More contagious => less deadly. Eventually it will become no big deal to get infected.

-

Anyone using IBKR and know what this is?

-

Has anyone enrolled in that program? It says if a class action lawsuit results in recovery of some money, they will automatically get me to participate, and the recovered amount is subject to a contingency fee. Any risks to participate in this program?

-

11 hours ago, formthirteen said:

I've been going through my portfolio a couple of times, trying to imagine each stock being down 50% or more, and have found nothing to sell. I'm sure I will feel differently once a stock is down 50% for real.

I sold MSFT at $27. It felt good. I don't remember if the stock was up 50% or 100%, but I remember the price. There was probably no FOMO, only bad products and leadership.

Another mental exercise I try to remember to do once in a while is to try to think about if I'm holding a stock because of wishful thinking. Are there any other exercises people here do?

Principles made me sell half of BABA. I should have sold more.

Recognizing it was all wishful thinking made me sell WISH.

I wound encourage you to do the mental exercise to not only see the prices down 50% but also when you open WSJ, you see the media bombarding you for the end of the world coming.

John Templeton said the time to sell is before the crash, not after the crash because price is already down.

The data set is getting more bearish each day, but I still do not see all stars aligning yet, so I do not have a compelling case at the moment. I am holding all cash at the moment instead of opening short positions.

Attached is an interesting comparison with 2007. I am not saying that this time it will follow just like that.

-

3 minutes ago, formthirteen said:

For some reason I didn't fear letting go of MSFT at $27. Maybe now is the time?

I don't think MSFT is going to 27. But if it goes from 290 to 100, is your gut strong enough to hold it through? You sure you won't puke it all out? If you are such a super long term holder, then it is time to start practicing mental exercises now, and see if you are really willing to hold it through. If yes then hold. If not, well you know what to do.

-

59 minutes ago, Gregmal said:

Yea....Im becoming very convinced this is happening soon. The average or worse tech stuff is straight up withering. I still fear letting go of my MSFT and GOOG but anything below that type of quality seems downright dangerous right now.

Don't forget what happened to Cisco in 2000. Even MCD and Disney had dramatic 70% drops when the nifty-fifty theme ended. They are quality stocks for sure. That doesn't mean they are immune.

Everyday, the evidence is piling up. We just had over 400 Nasdaq stocks making new 52 week lows last Friday, and that was more than March 2020 during covid crash. Liquidity is drying up too.

-

Update: We still don't have all stars aligning yet, but more and more data set points to a major top right here.

I have no stocks at the moment and just applied to open the futures trading permission as I plan to start a small trial index short position.

-

I am a little puzzled when I log onto IBKR website and saw that they have a program to invest my cash into IBKR notes that yields 0.5% for 60 day duration. I am a little confused here. If I buy the notes using cash in my account, do I still have the cash to buy stocks when I want to? I know some other brokers like Fidelity has the automatic redemption ability, so if I want to buy a stock, they will automatically withdraw from the money market fund and use that to buy stocks.

Have We Hit The Top?

in General Discussion

Posted

Yeah. It does seem like this administration is trying to solve the debt problem by inflation, and globally all countries are doing this.