giofranchi

Member-

Posts

5,510 -

Joined

-

Last visited

Content Type

Profiles

Forums

Events

Everything posted by giofranchi

-

Packer, I just tried to answer your question why I think the hedges will be resolved one way or the other in a matter of 2 to 3 years. The Central Banks are “all in”, first the US and England in 2009, then Europe in 2011, now Japan in 2013. And when you are “all in”, either you win or you lose, right? I think a 2 to 3 years time will be enough to finally understand if their medicine is the right one. If it is the right one, the markets will probably do more of the same. If it is a wrong medicine, I don’t know what will happen… Sincerely, I think nobody knows… We are ingesting that medicine since the bottom of 2009, so how could anyone know what will happen without it? There is just no evidence! Probably, you are right: a brief shock, soon followed by a fast recovery. For what I know, markets could go on utterly undisturbed! But I also cannot rule out a prolonged slump… That’s why imo the hedges are in place today, and why they probably will become meaningless in a 2 to 3 years time. giofranchi

-

Well, I think it is not just me! Mr. Bernanke’s stated goal is to reduce unemployment, right? And I guess we all agree on the fact that a cost of money that makes no sense has always led to misallocations of capital and bubbles… So, the question is: will the UCBOTW (United Central Banks of The World) succeed in engineering growth and in lowering unemployment with their monetary tools? Or not? If they are successful, I guess they will be able to gradually take the cost of money back to more sensible levels, without any major disruption. I know everybody is worried about interest rate hikes… But I don’t fully agree… In 2009 the UCBOTW saved us… And we have proceeded since then on the assumption they know what they are doing and will ultimately be successful… If they are successful, I don’t see confidence really broken by a rise in interest rates… Sure, there will be adjustments, but nothing dramatic… A more sensible cost of money might even be seen as a positive adjustment! On the other hand, as soon as we lose faith in the UCBOTW, chaos will ensue, no matter how low interest rates are, or how much money will be printed… Imo, it is really as simple as this: if the UCBOTW are successful, FFH’s hedges will prove to be a waste of resources; if, on the contrary, the UCBOTW ultimately fail, FFH’s hedges will prove to be very useful. giofranchi

-

1) I think we should not forget that the hedges, both if proven useful and if otherwise proven a waste of resources, are a matter of 2 more years, 3 at the maximum! If after that they should happen to be still in place, as I have already said, I will be the first to change my view on FFH. 2) At year end 2012 BRK had only 7% of its total assets in bonds. In what probably is going to be a secular bear for bonds, Mr. Watsa will shape FFH to resemble BRK structure more and more. If bonds are no longer an attractive vehicle for investments, Mr. Watsa will choose other asset classes to get a decent return on FFH’s total assets. I want to find someone who is a good strategist, who stays flexible, and doesn’t have too many investing rules. Because too many investing rules and opportunism rarely go along together well. Instead, I want someone who constantly reassesses the situation and takes decisions accordingly. At the same time, I want to see a basic “philosophy”, that provides the solid bedrock on which everything else will be built. Opportunism and Value are a philosophy, not rules. Both Mr. Watsa and Mr. Marks fit my idea of great business partners. And, as strange as it might sound, I am positive they both will ultimately do very fine, even if today they have different views and have structured very different portfolios of investments. giofranchi

-

tombgrt, probably, I didn’t express myself well enough… My idea is basically that it will take only a 7.5% annual return from their portfolio of investments, for FFH to increase BVPS at a CAGR of 15%. Given that, contrary to what happened during the last decade, I expect insurance operations to get better and better, and finally to achieve an underwriting profit, the annual return needed from their portfolio of investments might actually be only around 7%. Historically, instead, they have achieved a 9.4% annual return. If they perform 25.5% worse than they did in the past, buying at book today will assure you a 15% compounded return on your investment. To say they returned just 9% during the last 10 years clearly doesn’t make sense… it is enough to read Mr. Watsa’s 2012 AL to understand it very clearly… They thought they should be particularly careful with their portfolio of investments during the last 10 years, and probably during the next 5 years, and therefore they embarked FFH on a “defensive – aggressive – defensive again – aggressive again trip”. In 2003 – 2006: defensive, in 2007 – 2009: aggressive, in 2010 – 2013: defensive again… Well, but it should be evident to everyone it is an unfinished trip!! To judge their future possible performance, based on the last 10 years, makes no sense to me. As far as trading is concerned, to jump in and out FFH, it might be a good idea… But I don’t do that. I have two businesses to look for each single day, and don’t have the time to get comfortable with trading. As Mr. Harriman said: And I stick with it. Packer, I love Mr. Keynes and I think he has been one of the great minds of last century. And I love the way he invested his capital. Anyway, as you can see from the file in attachment, his net worth in 1936 was £506.522, while in 1945 is was just £411.238, after declining to as low as £171.090 in 1940… think of it: in just 4 years he saw his net worth declining –66.2%… According to maynardkeynes.org, also the Chest Fund suffered a –40.1% decline in 1938, then again a –15.6% in 1940, for a cumulative decline of –43% from 1937 to 1940… Sorry, but I cannot conceive investing like the world were always the same… Studying all the great “wealth accumulators” of the past, they have one thing in common: they knew when to be aggressive, and when to be defensive… ah! And, of course, they were also right! WEB, and, if you look at BRK’s balance sheet, at the end of 2012 they had 18% of Total Assets (or 41% of Equity) in Cash + Bonds, with $1.2 billion of free cash coming in every month. BRK will never suffer from a lack of cash: we better make sure we will neither! Shalab, My source of information is The Gary Shilling Insight, whose source in turn is The Bureau Of Economic Analysis. Its last point was Feb.2013 and it was 2.6%. If in the meantime it has gone up to 3.2%, it is good news. But, please consider that it is a very volatile figure, so a +0.3% in April followed by a +0.4% in May might not make a positive trend yet… PlanMaestro, You surely know better than that! When there is too much debt, everyone is on the hook. No one is spared. Too much debt basically means two things: 1) too much capital chasing too few ideas, huge misallocations of capital and bubbles follow; 2) capital spent recklessly to live beyond our means. In either case capital will be destroyed. It follows that both borrowers and lenders will suffer almost the same. And for good reasons! Because lenders behaved foolishly and acted imprudently. Now they won’t have their money back. So, it really doesn’t matter who is the lender and who is the borrower. Once there is too much debt, compared to the net worth or to the income capability of an individual, a family, a business, a nation, or the world, 1) and 2) will make sure borrowers and lenders will suffer alike. giofranchi John_Maynard_Keynes_Part2-October_2010.pdf

-

Packer, maybe it is just me that don’t get it right… but I really don’t understand how it is possible to say there is no high leverage today… Just look at the balance sheet of Deutsche Bank (see the file in attachment)! The whole world is over indebted, even China! Where corporate debt alone is almost 200% of GDP! Do you think Japan is sustainable? Then I really don’t know what sustainable means! And southern Europe?! Can you imagine what it means for a nation, like Italy for instance, to live without a currency that makes economic sense? As long as policy makers don’t admit it, the Euro will continue to be a major distortion and will continue to cause dangerous misallocations of capital. And, if you don’t like GDP, what about personal incomes in the US, which have gone back to the ‘80s level? And the personal saving rate?! At little more than 2% it is way too low, and cannot be reconciled with a nation on its way to create true and lasting wealth. In the ‘30s also, the personal saving rate fluctuated in between 0% and 5%, until it spiked to 25%… and that was what ended the depression! A renewed culture of thriftiness and accumulation of wealth on a nationwide scale. Now think about what will happen to net margins, when the personal saving rate will get back to, let’s say, 10% from 2.4% today… Yet, the stock market is at its all time high… But don’t you dare hinting at the fact the economy might be slowly improving, like Mr. Bernanke so naively did a few days ago, because that will trigger chaos… C’mon… Isn’t that ridiculous?! In the last century wars have only been the consequences of dealing with the social unrest, that sprang from misconceived economic policies. They were not the true causes. Maybe, we will find other means to deal with our own over indebtedness, not necessary new wars… at least by their classic definition, but why do you assume those new means will be painless? I don’t see any reason why they should be! giofranchi Deutsche-Bank-Horribly-Undercapitalized.pdf

-

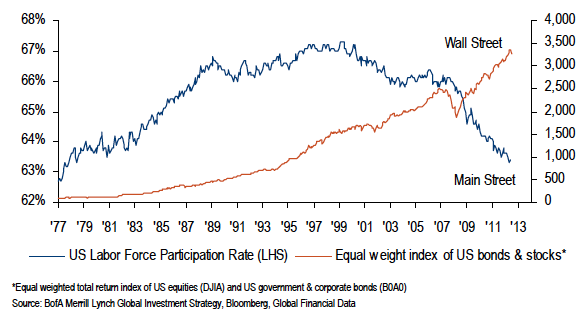

Well, as I have said a few posts ago, last decade economic growth has been the second slowest after the ‘30s in American history (1.7% y-o-y vs. 1.4% y-o-y… sorry, cannot see all that difference!), despite monetary stimulus has been the most extreme in American history, much larger than what had ever been attempted even from 1933 to 1937 by the Roosevelt administration! You must at least admit that the jury is still out… To reflate bubbles, after they have burst, is not synonymous with prosperity, it is just prosperity in disguise! But I guess in a couple of years we will have the final verdict, as “the great disconnect” of Mr. Shilling, will finally be resolved, one way or the other! Until that time, whoever reaches for yield imo is not right, but just reckless and, if finally proven right, lucky. I repeat: FFH has made no major strategic blunder that I know of till now. They are great strategic thinkers and I would have done exactly the same. No, wait, actually I have done exactly the same! If in a two years time the real economy finally does what policy-makers wish it for, then I would like to see FFH stop its hedging strategy. Vive versa, if it keeps going on even then, I will admit they are making their first serious mistake, and I will reformulate my thesis on FFH. But then, anyhow, a lot of things will be very different… think of how wonderful it would be: we will have finally find the way to live beyond our means for decades and getting away without paying the consequences! A brand new fantastic world! Hmmm… I don’t think so! giofranchi

-

Well, I guess any comparison with the past might only take you that far, right? What is really needed in investing is a strong conviction about future possible returns. There is really no substitute for due diligence and all the hours spent studying and trying to deeply comprehend a business. :) giofranchi After doing your DD, what would you say are the possibilities for FFH? Other than Prem's track record of course. In the past, BV growth was helped by an amazing bull market in bonds, extraordinary CDS gains, the first years (? first year 180% BV growth if I remember correctly) of operations, ... I'm just curious because just a few posts ago you said this: The case for Berkshire is actually very simple (even after WEB is gone) with it's decentralized group of very high ROE companies, great insurance companies underwriting at a great CR and long-term equity investments. It's likely that it remains a stable powerhouse with satisfactory returns. Considering that you said yourself that there is no alternative to doing your DD; why do you view Fairfax as more attractive? For FFH I see a very safe 15% CAGR in BVPS for the next 10 to 15 years. To know and accept what I still don’t understand, and therefore cannot judge, and therefore cannot put a valuation to, is imo an integral part of DD. I repeat what I said a few posts ago: I just don’t understand a business on autopilot. But I am sure everybody else will do just fine with BRK! :) giofranchi

-

Comstock Partners, Inc. - Market Facing Severe Headwinds giofranchi Market_Facing_Severe_Headwinds.pdf

-

Well, I guess any comparison with the past might only take you that far, right? What is really needed in investing is a strong conviction about future possible returns. There is really no substitute for due diligence and all the hours spent studying and trying to deeply comprehend a business. :) giofranchi

-

IceCap Asset Management June 2013 giofranchi IceCap_Asset_Management_Limited_Global_Markets_2013.6.pdf

-

David, thank you for posting this one! :) giofranchi

-

No… I wouldn’t put it that way… I think Mr. Watsa would neither appreciate it, nor agree with it… Instead, what I meant is that imo they are great strategic thinkers… And I like to partner with great strategists.. if I can do that at a good price!! What’s a great strategist? Well, Mr. Vanderbilt was a great strategist, long before terms like bottom-up, top-down, macro, micro, etc. had even been invented! ;) giofranchi

-

Hi muscleman, I would strongly recommend to read “The Great Depression – A Diary” by Benjamin Roth. If there is only the slight chance that the '30s in America and the '90s in Japan are similar to what we are living through today on a global scale, I really want to be aggressive, when prices are extremely cheap, while not reaching for yield (an equity portfolio that relies on the outperformance of long positions over its hedges on the indices, with ample cash reserves) the rest of the time. And I want to partner with people who behave that way. In 2005, 2006, and 2007 FFH was defensive; in 2008, 2009, and 2010 FFH became aggressive; in 2011, 2012, and 2013 it is on the defensive again. And I think we won’t have to wait a lot more to see FFH become aggressive again! What I mean is that strategically they have made no serious mistake so far, though they might have encountered some timing difficulties. Yet, timing imo is way overrated… don’t get me wrong: if your strategic view is flawed, but your timing is right, you might still end up doing very fine! Vice versa, if your strategic view is flawed and your timing is wrong, you might get killed! So, basically, if you are wrong… timing is very important! Though that sounds a lot like saying: if you are wrong, to get lucky is very important! On the other hand, if your strategic view is correct, and you possess the wherewithal to be patient and wait, even bad timing at the end won’t prevent you from achieving satisfactory results. Summing up: wrong + lucky vs. right + unlucky… guess which one I prefer? ;) I don’t follow single investments very closely, so I cannot answer your questions about BBRY or SD… giofranchi

-

Hi longinvestor! I know and agree with all those true things about BRK... Yet, still I am not convinced... I just don't understand a business on autopilot... A business without a strong person at the helm... Just one man or woman... Not a team or a board of directors... But I know that's me, and only me! Vice versa, I am not worried at all about Mr. Watsa's succession plan. When, 20 years from now, he steps down, FFH will simply be what BRK is today. And I will sell my investment. giofranchi

-

Hi ap1234, I couldn’t have said it better! Maybe, just add some very safe means those owner operators use to leverage their game, and the picture is perfect! ;) Regarding your comparison between BRK and FFH, I agree 100%. My problems with BRK are: 1) its size, 2) Mr. Buffett’s age. Tell whatever you want about growing a $250 billion company and about the succession plan, I won’t be convinced... Because those are two things I really cannot judge. And, if I don’t understand, I don’t invest. This being said, we all know a good business and a good investment are two different things: and I have no doubt BRK is a very strong ark! Maybe, as you say, much stronger than FFH. On behalf of FFH, please consider: Mr. Watsa is 20 years younger than Mr. Buffett… was BRK 20 years ago such a strong ark as it is today? Probably not… So, just give Mr. Watsa time and let’s meet again 20 years from now! ;D Furthermore, as longinvestor rightly pointed out, So, earning power will gradually build up! :) giofranchi

-

Hugh Hendry June 2013 giofranchi Hugh_Hendry_June_2013.pdf

-

Because in my previous post I used an expression I never use: “I am sure”, I want to make this much clearer. With a way over leveraged economy, mired in the second slower decade of growth since the 1790s, the stock market should not be at an all time high. Mr. Grant Williams put it very clearly a few days ago: I repeat: the declaration by the Fed Chairman that the economy is gaining sufficient strength to be allowed to stand on its own two feet sent the market into a tailspin. Absurd! Isn’t it?! In such an environment you must proceed with caution, either you are finally proven right or wrong. It doesn’t really matter. You might argue: we don’t care about macro, and WEB has said this and WEB has said that... (or Peter Lynch, or whomever!)… But let me also tell you this: I don’t think general rules are of much help to asses specific risks. I mean, just because macro is useless 99% of the times, doesn’t mean that to be “stubbornly blind to macro no matter what” is a sensible course of action. Because 1 time out of 100 you will be terribly wrong. Imo, instead, the sensible course of action is to be always aware of macro, meaning what’s going on around you and your businesses, and each single time decide if it is relevant or not. That’s exactly what Mr. Watsa and his team seem to be doing. In fact, he has stated many a time that they think we are living trough a once in a lifetime period of deleveraging, much similar to the US in the ’30, or Japan in the ’90. And in such an environment I want to proceed with caution and I want to partner with people who proceed with caution. Even if in a rally caution is thrown to the winds by everybody else! This is the reason why I think until now they have made no serious mistake. Finally, I agree with beerbaron that Mr. Watsa won’t repurchase a lot of shares anytime soon. But he has also explained why: he doesn’t want to part with cash, because he believes in the near future cash will be the scarcest and the most precious of commodities! Nothing to do with his own assessment of FFH stock price… Actually, I can almost imagine this conversation between Parsad and Mr. Watsa: Parsad: “Prem, what do you think of the stock at $380?” Mr. Watsa: “Hum…! It just makes no sense!” Cheers! :) giofranchi

-

C’mon, beerbaron! That’s exactly Mr. Market’s thesis… There is always a reason why Mr. Market gives you an opportunity! And a repricing is never easy to foresee… What you can and do know with FFH is the price you pay and the value you get! Let a repricing unfold: I will average down gladly! ;) giofranchi It's not a thesis, the actual value of FFH went down with the bond portfolio. I like to anchor myself at a specific price/BV not a dollar value. I'll gladly buy a shipload at 90% of Q2 BV tough! BeerBaron The actual value of FFH will fluctuate a lot... Will go up and down... But I don't really care. What I care about is very simple: a company, that has increased BVPS at 20% annual for 26 years, has almost gone nowhere for 3 years now. And in the meantime it has done everything right. Someone believes they have made mistakes... But I disagree. I would have done exactely the same! And I don't think we will have to wait a lot more, to see BVPS increase very fast again. That's why I have no doubt that any price below $380 is great value! giofranchi

-

C’mon, beerbaron! That’s exactly Mr. Market’s thesis… There is always a reason why Mr. Market gives you an opportunity! And a repricing is never easy to foresee… What you can and do know with FFH is the price you pay and the value you get! Let a repricing unfold: I will average down gladly! ;) giofranchi

-

US: Becoming a LNG exporter giofranchi EcoNote19_US_LNG_EN.pdf

-

"Call My Bluff" by Mr. Grant Williams. giofranchi Hmmm_Jun_24_2013.pdf

-

Find in attachment the HDGE ETF Market Commentary for June 2013. giofranchi HDGE_PMCommentary_062013.pdf