giofranchi

Member-

Posts

5,510 -

Joined

-

Last visited

Content Type

Profiles

Forums

Events

Everything posted by giofranchi

-

I find the process of writing about investment ideas extremely useful to clarify my thoughts. When I write, ideas seem to come to mind that previously weren’t there… of course they were, but probably weren’t very well articulated yet and remained a little blurry. One of the reasons I like the board so much is that it gives you the chance to write about your investments and, of course, to get very competent feedback too! But, as you have said, that's just me! :) Gio

-

Hey Kraven! Be patient! You know I am in love… and it is obvious I have my head in the clouds… How could it be different?! You shouldn’t have given me such terrific advices, if you wanted a “rational Gio”!! Your fault!! ;D ;D ;D ;D Gio I do my best. Now that you are a couple, she needs to see that you are sensitive and caring. Tell her frequently that her best friend is really attractive and dresses quite stylishly. Make sure that when they are together and you come upon them that you hug the friend first and hold it a few seconds too long. When you release, say "that feels good and you smell really nice". This will show your girlfriend that you're not afraid to give compliments and are good with her friends. does that work ? wouldn't that led to arguments ? GK, You are still very young… As you grow older, you will realize you don’t have to ask!! Just do what Kraven suggests!! And you will forever be grateful!! ;D ;D ;D Gio

-

I was afraid I would have screwed something going forward… But now that I know how to be sensitive and caring, I am sure I cannot miss!! Like The Beach Boys say: “Everything is going to turn out all right”. ;D ;D ;D Cheers! Gio

-

WOW! For a moment I had thought you were his boss!! ;D ;D ;D Gio

-

Hey Kraven! Be patient! You know I am in love… and it is obvious I have my head in the clouds… How could it be different?! You shouldn’t have given me such terrific advices, if you wanted a “rational Gio”!! Your fault!! ;D ;D ;D ;D Gio

-

+1 and great post! :) Gio

-

;D ;D ;D Gio

-

Ah! Well, of course I didn’t mention that I started some years ago a company with a capital of 1 million euros. Grew it at an 18% CAGR until now, and have the goal to keep making it grow, until its capital gets to be 1 billion euros. My idea basically is to achieve a 15% CAGR for the next 45 years. Though I am almost surely bound to fail, you can easily understand that “early retirement” is not an option I have even contemplated! ;D ;D ;D Gio

-

Phcap, I am 12 years older than you… and since I started working, I don’t remember a single day in which I woke up thinking that I had to do something I didn’t like… I am serious! Not one day that I can remember! I have always concentrated on what I like the best and then seized the good opportunities that naturally presented themselves to me. If those opportunities entailed doing something I was not passionate about, I have always let them go… no matter how much rewarding they might have been in the future. Of course, I am no particular success at all, and therefore I don’t see why you should heed my advice. But I can tell you I am happy. Cheers and all the best for your future career, whatever your final choice will be! :) Gio

-

--John D. Rockefeller, Sr. Gio

-

+1 Always can count on those two for great and useful information! :) Gio

-

How has Exxon outperformed competitors for so long?

giofranchi replied to LongHaul's topic in General Discussion

My answer is always the same… SUPERIOR CAPITAL ALLOCATION I know, I am extremely boring… ;) Gio -

I have read Mr. Kahneman, Mr. Klein, Mr. Thaler, Mr. Ariely, Mr. Burnham, Mrs. Dweck, Mr. Csikszentmihalyi, and others… And I liked them very much, and I think their work is great and very helpful! Yet, to overestimate their importance would be as much an error as to overlook them… 1) Allocation of capital (or resources in general) is the single most important thing in business, 2) There is a sound way to allocate capital (or resources in general), based on the priciples of value investing, 3) As in almost any other human endeavor, there are masters at allocating capital. Gio

-

Fairfax agrees to acquire majority stake in The Keg

giofranchi replied to ourkid8's topic in Fairfax Financial

Prem, recently Kraven has given me some dating advices that worked out just wonderfully!! Maybe, after all, you should pay attention to what he is saying!! ;D ;D ;D Gio -

Wall of worry. Difficult… Wall of worry usually is about the economy… That would make sense to me… Not prices! If everyone thinks prices are extremely high, who is buying?! Would you buy, because you worry that prices are high?! I don’t understand… Gio If everyone thinks prices are high and is thus underinvested, by definition that creates buying power. Conversely.... If everyone thinks "this time is different" and is thus fully invested, by definition all of the buying power is used up. Ok, this might be true. Anyway, take a look at the poll: 36 to 38… It is clear enough to me that we just don’t know… So, make sure you are going to make money both if the market keeps advancing and if the market suffers a steep correction! ;) Gio

-

Wall of worry. Difficult… Wall of worry usually is about the economy… That would make sense to me… Not prices! If everyone thinks prices are extremely high, who is buying?! Would you buy, because you worry that prices are high?! I don’t understand… Gio

-

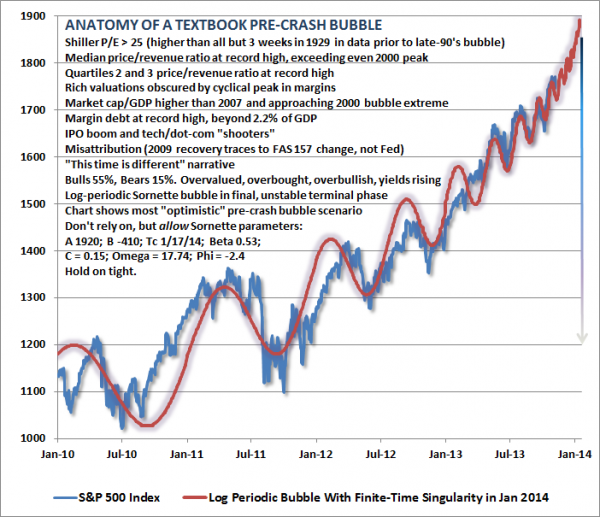

This makes little sense to me: if everyone think we are in a bubble, why do the markets keep going up? The answer might be: we might know we are in a danger zone, yet the Fed is yelling: “you must dance, until the music stops!!”. And we cannot but heed the call… Crowd psychology can go just that far… If prices keep diverging from economic values, a bubble will form, either we are aware of it or not. Gio

-

"Forget The Yield Curve, Watch The Wicksellian Spread" by Mr. Charles Gave Gio charles-gave-forget-the-yield-curve-watch-the-wicksellian-spread.pdf

-

-

-

I bought it then! Later I sold it booking substantial profits. Probably, a bad decision… but, really, what do I know about something so BIG?! Damn!! As time passes, I find my circle of competence shrinking instead of getting larger… Because I keep requiring to know more and more about a business, before accepting it inside… The net result is an “outflow” of businesses from my circle of competence, instead of an “inflow”… ??? Gio

-

"Back to German Bashing" by Charles Gave "The euro in action" graph is just terrific!! Italian IP vs. German IP experienced wild fluctuations from 1960 to 2000, but on averaged kept improving. Instead, from 2000 until today it simply cratered! And apparently with no end in sight! Our industrial base is slowly but inevitably suffocating… Difficult to see how this could end well. Gio Daily+11.14.13.pdf

-

Well, this whole discussion started with a valuation of the S&P500. Therefore, this not like buying back shares of an undervalued company in a richly priced market… Instead, this is like buying back shares of a richly priced company in a richly priced market! If the S&P500 is priced to return 3%-4% for the next 10 years, what we are talking about here is buying shares of the average company, that are priced to return 3%-4% for the next 10 years. It is nonsense to me… Would you buy the index at today’s prices?! Guess what? I’d rather short it instead! ;) Gio

-

Eric, sometimes I have an hard time to understand exactly what you mean… therefore, I do not really know if my answer is pertinent or not… But I will make a try nonetheless… Let’s say that I want to build a 30% position in LRE. And right now I have only a 20% position, and I am holding some cash, surely enough cash to buy the remaining 10%. But I also want to wait for the opportunity to average down, and don't want to build right away a 30% position at prices that might not be spectacular bargains… Yet, who knows for sure if that opportunity will ever come in the future? Not me! Neither you, I guess… So, at today’s price LRE is a wonderful investment, that I am very confident will make a lot of money for my firm, and therefore I hold it. But I also want to leave some room to get greedy, if ever the chance might be presented to me for buying more at a wonderful price. Furthermore, also Mr. Brindle seems to be thinking something similar: he used to buying back shares, when their price was closer to BVPS, while now he returns capital to shareholders through special dividends… I have no doubt that, if LRE’s share price falls enough in the future, he will start again buying back shares. Gio

-

Eric, tell me: do you really think I am the “average engineer”? Do you think the average engineer, the one interested in complying with ISO9000, behaves like I do? I you think so, I guess you don’t know many engineers! ;) Gio