giofranchi

Member-

Posts

5,510 -

Joined

-

Last visited

Content Type

Profiles

Forums

Events

Everything posted by giofranchi

-

Also this is not fair! He has repeatedly admitted he missed the bottom! Yet, he has also explained why he missed it, and why that has nothing to do with what historical data are suggesting right now. I am not asking for further evidence that Mr. Hussman is the worst investor in the whole wide universe… ;D ;D There is already plenty of that!! ;) Instead, I am asking of some evidence that the historical data he keeps on displaying are flawed! Gio

-

Joel, I agree with all you have said. Once again, though, I don’t think it answers the question which is the title of this thread. Let’s put it this way: ok, I agree it is not a really useful question (sorry bmichaud! ;D ;D), yet a lot of people have provided an answer… If you had to answer only to useful question, life would be somewhat boring, wouldn’t it?! ;D Therefore, I simply want to know on which basis, or on which historical evidence, people came to a different conclusion, than the one Mr. Hussman, the worst investor in the whole wide universe! ;), keeps providing us. Because, I just cannot find better historical data! For instance, Mr. Hussman shows the correlation between 3-yr chg in govt + personal savings as % of GDP and 3-yr annual growth in corporate profits. And he says from 1950 until 2013 this is what has happened. Period. Instead, you reason on why the future might be different… And this is what I’d like to know: those 50 people have based their vote on more accurate and more reliable historical data than Mr. Hussman’s, or have they based their vote on some reasoning that justifies why the future might be different from the past? Gio

-

Well, I agree. But that is not what I think the subject of this thread is all about. I haven’t started this thread, therefore I might be wrong. Maybe bmichaud could clarify what the question he has asked is truly about. What I know is that to read and comment historical data correctly, and to devise an effective investment strategy are two very different things. Therefore, you cannot judge the content of Mr. Hussman’s latest letter, simply by saying: “He is not a good investor.” Gio

-

50 to 51… Ok, I would like 50 people to read the latest letter by Mr. Hussman, and counterargument with historical data that are as precise as the ones presented by Mr. Hussman. This thread is not a discussion about the “usefulness” of what Mr. Hussman does. In other words, it is not a discussion about the usefulness of general market action. Instead, it is a discussion about whether we are in a new secular bull, or the last half cycle of the secular bear is still to be concluded. To date I have seen no argument pertaining the subject of this thread, which is more rigorous, steeped in data, and therefore convincing, than Mr. Hussman’s. Anyway, if one of those 50 people thinks he/she knows how to be more convincing than Mr. Hussman, I would very gladly listen to him/her! :) Cheers, Gio An-Open-Letter-to-the-FOMC-Rcognizing-the-Valuation-Bubble-In-Equities.pdf

-

--Cettie Rockefeller Gio Good one to remember especially on Mondays… ;D ;D ;D Gio

-

--John D. Rockefeller, Sr. Gio

-

--Cettie Rockefeller Gio

-

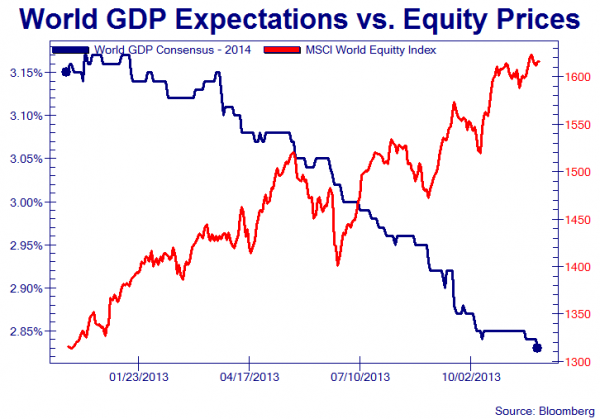

Well, this is a good question, to which I ignore the answer. Where did the capital flow from 1964 until 1981? Where did it flow from 1999 until 2009? Into bonds? Maybe from 1999 until 2009, but certainly not from 1964 until 1981! I don’t know the answer… but I do know that earnings must very much surprise on the upside, for the general market to deliver other than dismal results during the 10 years ahead… And I just don’t see how… If you are not a fan of profit margins reverse to the mean, think about sales: profits have soared since 2009, while sales have stagnated… In my businesses I have experienced many times that is not sustainable. If it is not sustainable for me, I don’t see why it should be sustainable for others. Gio

-

No, no! I still hold a basket of short positions, but that is no more than 8% my firm’s capital. FFH is around 30%, I hold no Gold, and cash is around 20%. As I have said, I possess other means to make money than the stock market, and my firm’s equity is up 20% YTD. If I may ask: how old are you? Gio

-

Good piece by Mr. David Hay. For those who don’t like CAPE, please look at Figure 17 on page 5: the stock market is probably going nowhere for the next 10 years… And I don’t see why anyone should disregard this information as useless in his/her investing decisions. Of course, if you are as good as Packer or Eric, you might very well overlook what everybody else (the market in general) is doing… The law of gravity to you clearly doesn’t apply! (And I say this with a mixture of envy and great respect!) Everyone else, first of all, must know his/her self: I guess chances are you are subject to the law of gravity. Just like I know I am!! ;) Gio EVA+11.22.2013+NA+.pdf

-

WOW! That was a fabulous article!! Packer, congratulations for you outstanding track record! ;) Cheers, Gio

-

+1 I agree 100% Gio

-

Well, he might have a point, but I guess it is not much relevant, after all… Mr. Hussman, who I think is a very reliable “observer of stock market past”, identifies a syndrome called “overvalued, overbought, overbullish, yields rising”, and he has shown many times that in the past, whenever that syndrome has occurred, steep market losses have followed. And by overvalued he says CAPE must be above 18… Therefore, if it is 25 or 20 makes little difference… Right? I am not saying the future is bound to repeat the past… What I am saying is that, particularly in a deleveraging, I don’t like an “overvalued, overbought, overbullish, yields rising” syndrome… It simply speaks of overconfidence to me… This being said, even Mr. Hugh Hendry has said the bullish trend might go on for the next 3-4 years… So, what do I know? Actually, what I know is that I am not “a man with a hammer”, I mean I don’t have to rely only on equity investing to build wealth. I have other means to make money. Therefore, if the bullish trend truly goes on for the next 4 years, I will grow my firm’s equity at a satisfactory rate, even while proceeding carefully with the stock market. :) Gio

-

-

I tend to agree… yet, 41 to 46… who really knows?! ??? What I believe is that I will make money in both cases! ;D ;D ;D Gio

-

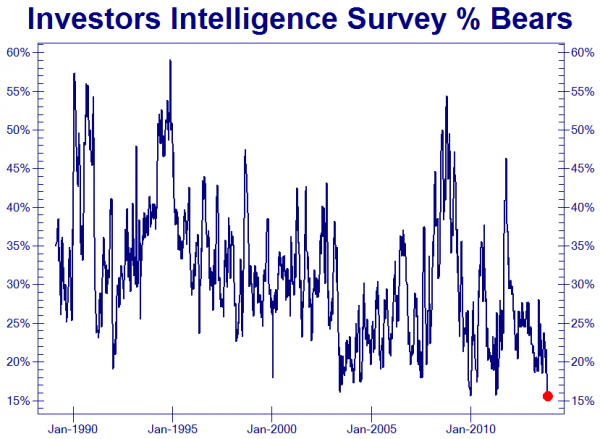

Ok, thank you! Do you have a graph by AAII that goes back to the early ‘90s? Does it tell a very different story from the one by The Investor Intelligence? If so, can you post it, please? Gio

-

Thank you, tombgrt! I have just purchased the book! :) Gio

-

Well, despite volatility, the fact remains that % of bears has never been so low since the beginning of the picture I posted: 1990. We are not talking about fluctuations in confidence… People have never been this confident in the last 23 years! Even during the internet bubble % of bears was higher than it is today… So, I don’t see how the consensus could be “we are in a bubble” and at the same time people could be so much confident… Except, of course, that consensus is not “we are in a bubble”! ;) Gio

-

Yes! But what you say is also true for the “bubble talk” bmichaud referred to, isn’t it? In other words, the “bubble talk” and the % of bears both are arguments about sentiment, aren’t they? Therefore, my question: why do they seem to point in such different directions? Gio

-

bmichaud, how does the reasoning about “bubble talk” fit with the picture in attachment? It seems to me there is not much buying power still left unused… Gio

-

"A New Kind Of Trigger Point" by Mr. Charles Gave Gio Daily+11.21.13.pdf

-

LOL!! I have never even tried to listen at 2x speed… That’s why it takes me so long to finish an audiobook!! ;D ;D ;D Gio

-

You really have backup plans?! To tell the truth, I have never thought about them… I tend to think: “If I fail, who else could be successful?!” ;D ;D ;D No, seriously, I proceed one choice at a time, and simply try to make each choice the best one possible. Then, I almost never worry about the outcome. Probably, I am just a reckless fool!! ;D Gio

-

Well, probably my view has always been the one of the entrepreneur… Actually, I have never worked for another firm… Therefore, I also understand onyx1 point of view… It’s the same one I would suggest to my employees and collaborators! ;D Gio

-

What I don’t agree is taking this decision lightly. Some posts seem to suggest: you are still very young, so grab the opportunity… You never know… Something good might happen… If not, you’d be always in time to make a change… I don’t agree. This is a strategic decision. It matters. And I have never taken a strategic decision lightly. If you want to grab the opportunity, very well then, do it! But you must think about it thoroughly. Take your time. And make sure you are at the end very confident with your choice and all the consequences it might entail. I believe this is your first duty. Cheers! Gio