mcliu

-

Posts

1,161 -

Joined

-

Last visited

-

Days Won

2

Content Type

Profiles

Forums

Events

Posts posted by mcliu

-

-

6 minutes ago, Gregmal said:

Like if everything stays the way it is, if you buy today you’re getting a good price. If it changes negatively and stuff goes down you get a better price. Both situations should be acceptable to any reasonably oriented investor.

Your only job is to make sure you buy good companies or assets. Otherwise, what the fucks the problem and why the need to vastly over complicate things obsessing over all this short term shit?

-

If you follow western media, China has been heading into a meltdown every year for the last 20 years.

-

Clearly the sanctions have not worked. For the most part, Russian elites and commoners have stood behind Putin.

Ukraine's going to turn into a blackhole of money for the West, much like Iraq and Afghanistan. This money would have been better spent building domestic infrastructure, renewable energy, education and healthcare. The way democracy wins against autocracy is not through wars but to show that the system is superior.

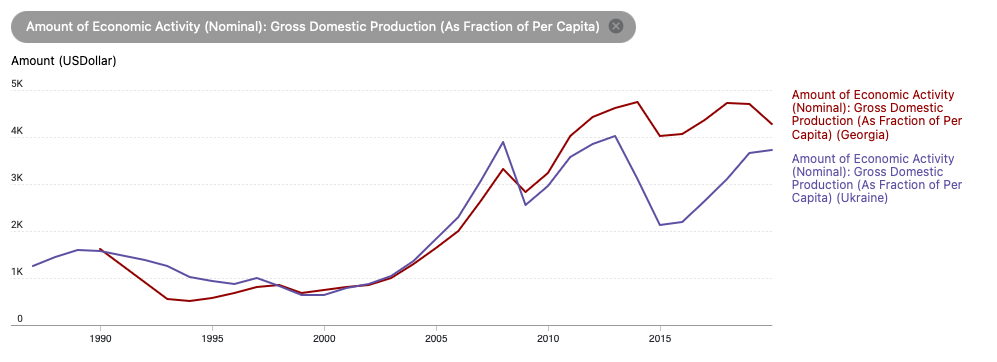

Georgia surrendered to Russia after 12 days. Georgia is still an independent country and its infrastructure is largely left intact. GDP per capita has increased >30% since that war. The longer Ukraine fights, the great probability the country will be left in ruins.

-

9 minutes ago, Gregmal said:

I mean has the raise rates/inflation argument really devolved into “the job market is the reason we can’t produce 2x4s, Ford Explorers, and PVC pipes”?

I don't think it's because we can't produce but rather that production has been flat but money supply has increased by 50%.

The price fluctuation we saw in certain commodities like lumber is probably a reflection of rapid changes in demand due to lockdowns and not so much overall price levels.

Since the US is largely a service-oriented country, availability of labour and wage growth is probably the largest driver of inflation.

I think due to the excessive COVID money printing, the Fed needs to demonstrate credibility that they will defend the value of the US$ and financial system.

The Russia war and subsequent sanctions & asset seizures is also testing the faith of USD holdings by creditors like China/Saudi.

A loss of faith in currency will make inflation worse, especially for countries with large imports (even more so with large deficits), which is what we might see in Europe as the Euro plummets.

-

46 minutes ago, Viking said:

The big problem for Canada is the EU/US will look the other way for now and take all the oil/nat gas Canada can produce because the world is in an energy crisis. But as soon as the EU solves their current problem (it will take a couple of years) of course the knives will come out and Canada will be ostracized even more for its ‘dirty’ oil. This is likely one of the many reasons why oil producers in both Canada and the US are being so disciplined with new investment… they KNOW as soon as we get through this crisis Western governments will be coming to take them out behind the woodshed. The end result is supply will increase much more slowly than past cycles.I agree with you. It seems like policy is driven by ideology and not economic rationality. It is not clear that governments will do the right thing. I think this is the biggest LT risk to the oil sands companies, but might be a ST benefit.

-

I think many US/EU companies & funds have divested their oil sands investments.

Would US/EU take it further and pressure Canada to reduce or even stop production?

-

Good topic to see psychology at work. Herd mentality, confirmation bias, etc.

May: https://ca.news.yahoo.com/putin-very-ill-blood-cancer-070511658.html

July: https://www.politico.com/news/2022/07/20/cia-putin-health-00047046

In other news, the CIA Director William Burns appeared to pour cold water on widespread rumors that Russian President Vladimir Putin could be ill, saying there was no evidence backing up such speculation. He added that Putin was “entirely too healthy.”

-

1 hour ago, Gregmal said:

I don’t even think it’s what rate, but how long. Who cares if we temporarily get 5-7% treasuries if a couple years later we re back at 2-3? Maybe the Twitterers and hedge fund guys who just wanna create their own noise to trade but as we learned during COVID, a year or two of earnings is meaningless. If you say fuck the next 2 years and after that I’m buying Costco at 15x, or Microsoft at 12xc why wouldn’t you take that opportunity and run? Cuz some doomsdayer says you might incur a 20% paper loss?

Why do you think that rates will be back to 2-3% in a few years? Because inflation will subside?

-

Andriy Melnyk,Ukraine's outspoken ambassador to Germany, drew the ire of Poland, Israel, and Jewish groups on Friday when he defended Ukrainian nationalist leader Stepan Bandera in an interview.

...

"The statement made by the Ukrainian ambassador is a distortion of the historical facts, belittles the Holocaust and is an insult to those who were murdered by Bandera and his people," the Israeli embassy said.

Polish deputy Foreign Minister Marcin Przydacz wrote on a local online platform that "such an opinion and such words are absolutely unacceptable."

The ‘Banderists’ in particular saw Jews as the “vanguard of Muscovite imperialism,” and were openly willing to commit barbarous crimes against them, as they believed it would lead to Ukraine’s independence from Russia and the Soviet Union. In 1941, under the OUN-B’s command, the Ukrainian People’s Militia spearheaded pogroms which led to the massacre of more than 6,000 Jews in Lviv.

-

-

39 minutes ago, Sweet said:

I heard this before but it’s not accurate. There is a deficit. If there was no deficit inventories would not be falling.Supply and production are different and either one can be in a deficit.

The current deficit is in oil production, not the supply of oil to the market.

There is enough supply only because there are large strategic and commercial oil inventories that are being drained.

But there is not enough oil production to keep oil inventory levels steady.

FYI:

-

The developed world became wealthy through the pervasive use of fossil fuels, which still overwhelmingly power most of its economies. Solar and wind power aren’t reliable, simply because there are nights, clouds and still days. Improving battery storage won’t help much: There are enough batteries in the world today only to power global average electricity consumption for 75 seconds. Even though the supply is being scaled up rapidly, by 2030 the world’s batteries would still cover less than 11 minutes. Every German winter, when solar output is at its minimum, there is near-zero wind energy available for at least five days—or more than 7,000 minutes.

-

31 minutes ago, Gregmal said:

Flip that around. If those fears were not existent, would the broader market have fallen to the extent it did? IMO, Nasdaq? Maybe. Everything else? No way.

It is possible that current correction is just a reversion from the artificially inflated markets of 2021 (through massive stimulus and speculative sentiment) and that markets have not priced in a prolonged economic downturn or higher interest rates. Psychologically, people are anchored to the prices of late 2021.

Valuations for some stocks are attractive at current interest rates, but fair/over-valued at higher rates. We have not seen valuations go far below fair value which tends to happen during downturns/real capitulations.

-

1 hour ago, Gregmal said:

I mean sure, most of us are good. Ive got 6 houses already with tons of 30 year fixed locked and equity over 50% in most of them and it seems half this board has cash earmarked for a pending housing crash so they can scoop up more. My main point is to highlight how ridiculous a notion it is, largely one peddled by rich folks, that raising rates is helpful to the middle and lower classes. Its like, yea...ok. Philip Morris once said cigarettes were good for you.

Inflation also harms the middle/lower classes far more than the rich.

Raising rates to reduce demand is one way of lower inflation.

Reducing fiscal spending would also help but is much less politically palatable.

Then there's also policies to increase supply.

Problem with energy-driven inflation in the current political environment is that raising rates is really the only viable option.

-

https://www.linkedin.com/pulse/reducing-inflation-come-great-cost-stagflation-ray-dalio/

Because debt assets and liabilities are now very high and because government deficits will remain high, it is virtually impossible for the Fed to push interest rates to levels that are high enough to adequately compensate holders of debt assets for inflation without them being too high to support strong debtors, strong markets, and a strong economy. If the holders of debt don’t get adequate returns they will sell them, which worsens the free market debt supply/demand picture, which either leads to a dramatic cutback in private credit (which is depressing) or the central bank creating more money and buying more debt to fill in the funding hole (which is inflationary).

In summary my main points are that 1) there isn’t anything that the Fed can do to fight inflation without creating economic weakness, 2) with debt assets and liabilities as high as they are and projected to increase due to the government deficit, and the Fed also selling government debt, it is likely that private credit growth will have to contract, weakening the economy, and 3) over the long run the Fed will most likely chart a middle course that will take the form of stagflation. -

Western elites are shooting themselves in the foot with ESG & sanctions and hoping the bullets will ricochet and hit Russia. We need to stop meddling around the world and focus on making our own country better.

-

It is good to be reminded of the basics. Sometimes people forget and get caught up by the markets.

Investing is simple but not easy!

-

Several countries starting 2030 and earlier. Most around 2035, 2040. Couple this with emerging market growth and you can see crude growth for several decades still.

$658B to maintain 99.6mbbl/d. Costs are also increasing due to inflation.

European banks cutting financing.

On a personal level, if you ran a major company like BP/Shell, you'll be less hated by the public & politicians if you diverted capex to solar/wind. Sometimes it's not a rational decision. All of these little things might compound into a major shortage somewhere down the road. As Munger calls the lollapalooza effect.

-

https://www.rollingstone.com/culture/culture-news/ukrainian-military-unit-russia-artillery-1365021/

A big part of the problem in defending this part of Donbas, Ostap believes, is that the people who have stayed behind — the people who haven’t fled — don’t really believe they are part of Ukraine. In his view, the civilians who remain are all separatist sympathizers. He says they help the Russians navigate backcountry roads that aren’t on the maps.

“Yeah, they’re all waiting for Russkiy mir,” Mace says, laughing when I ask his opinion about the locals. Russkiy mir, or “Russian world,” is the revanchist concept that Russia needs to restore its central role in the affairs of its neighbors, and its borders, to what they were at the height of the Soviet empire.

He asserts there have been instances of local collaborators getting caught providing information about Ukrainian troop movements or locations. Indeed, Slovyansk fell to Russian separatists in 2014: The retaking of the city by the Ukrainian military later that summer was the first major battle in Donbas.

“Almost everyone here is pro-Russian. But you can’t arrest people just for that,” Mace says. In any case, the police and the SBU —Ukraine’s internal security service — were doing what they could. “The SBU even arrested a couple of people in our brigade,” he says.

-

I think the fundamentals for crude has not changed. The current supply crisis is driven by lack of re-investment due to poor energy policy and the Ukraine crisis. Oil is a constantly depleting resources, you need to invest a large amount (maybe >600B annually) just to maintain production, let alone grow.

Current developed country policy is to ban ICE vehicles by 2030 and eventually kill the fossil fuel industry.

No company will want to make large long-term investments in this type of environment. Investors are also demanding quick return of capital for the same reason.

In addition, the hurdle for re-investment continues to go up with higher interest rates and just plain lack of financing as banks also pursue ESG goals.

A major recession will likely crimp demand in the short-term, but given the fragile political situation and despite the tough talk from Powell, I think countries are likely to ease far sooner and run negative real-rate policy than to suffer a major downturn.

-

Energy prices underlie everything. With the current unrealistic ESG policies, it'll be hard to get supply growth in energy. I think it'll be difficult to reduce inflation unless you have a drastic decline in demand.

-

On 6/1/2022 at 10:58 AM, Gregmal said:

I was watching a documentary the other day and it brought up a period earlier in the 2000s where the US was fighting its Iraq/Afghanistan war. There was great outrage, constant "denouncing", and a general stink made about Pakistan "aiding" some of their allies(whom happened to be fighting the US) through providing weaponry. Interesting perspective now, given todays situation. Of course it was different because whatever we are doing is right and whatever we dont like or are fighting against is evil and wrong.

It seems like most Americans cheer the start of every war/proxy war, ex. Afghanistan, Iraq, now Ukraine, etc. And then a years later that the money & lives could have been better used at home. Also disturbing is that many Americans will rightly denounce right-wing extremism in the US but will happily support neo-nazi/extremist groups abroad as long as they're fighting for the "proper" side.

16 hours ago, CGJB said:I'm no military strategist, but I always felt the end game in this would be the Donbas becoming independent, maybe joining Russia at some point, with Russia establishing a land bridge to Crimea. Now I suspect Russia will eventually take Odessa.

In the end, what's left of Ukraine will be a landlocked country. Every bit as corrupt as it has been, but much poorer as well.

I agree, no matter what, it's a sad outcome for Ukrainians either way to be dragged into this proxy war instead of negotiating peace.

Seems like the sanctions are backfiring on Europe too. Inflation hitting records. Factories shutting down due to high input costs, furthering reducing supply and increasing costs. Meanwhile, India & China are buying record amounts of Russian energy. Rouble is higher than pre-war.

-

Short Apple. COVID stimulus over. Innovation cycle slowing. Phone adoption peaking. Market still pricing in rapid growth.

-

1 hour ago, Libs said:

https://faridaily.substack.com/p/now-were-going-to-fck-them-all-whats?s=r

Fascinating article. Russian elites are angry at the west - not Putin. Forget about regime change, folks....

This is the problem with sanctions. The elites are fine and regular people suffer. When people feel under attack they rally around the govt. NK developed a nuke under sanctions/starvation for decades. Russia is far more capable and already has far more destructive weapons. What's the purpose of driving Russians into a corner?

In my opinion, the best way for the West to defend itself is to invest in its own people, infrastructure and capabilities so that it far far surpasses its rivals, instead of trying to police/invade/coup/sanction around the world.

China

in General Discussion

Posted

The US is a superpower but it's no longer the only superpower. Policy needs to adapt to reality.