mcliu

-

Posts

1,157 -

Joined

-

Last visited

-

Days Won

2

Content Type

Profiles

Forums

Events

Posts posted by mcliu

-

-

24 minutes ago, sleepydragon said:

In Chinese history, it’s always preached “near are enemies, remote are friends”. For countries near China’ s boarder, they are always seen has long term threat. Sometime this threat is managed through gifts. My point is, China and Russia will have war again. Beijing is so close to the Russian border, it can be taken within weeks by Russian tanks. The biggest threats of CCP’s ruling is not America which is far away, but an aggressive Russia.

How will Russia take Beijing when they can’t even take Kiev?

1 hour ago, Parsad said:After visiting China in 2015 and India in 2019, what I've been saying ever since then is that the Western world better hope that China and India don't find a way of putting aside their border issues and historical disdain for each other. Because if they ever put a free-trade agreement into place and worked together with the rest of the Asian region, it would dramatically tilt global economic, political and military power!

What about BRICS?

-

-

On 4/1/2023 at 9:05 AM, formthirteen said:

Deposits are also moving into money market funds:

Does anyone know how the mechanics of this works?

If you withdraw money from a bank account and place it into a MMF, doesn't the MMF keep it in their account at some bank? And if the MMF uses the money to buy a T-Bill, wouldn't they just withdraw cash from the MMF bank account and send it to the T-Bill Seller's bank account?

So how exactly does the overall amount of deposits move from banks to MMF?

-

-

Seems like it really depends..

If you want exceptional results, you almost have to concentrate.

But you have greater risk of blowing up if a) you don't know what you're doing, or b) if you've made a mistake in your analysis or c) just bad luck/black swan.

If you're young and talented this is probably the way to go.

If you're older and less talented at investing but wealthy, you probably want to diversify and lower the odds of a bad outcome.

-

I follow Jim Cramer on Twitter so I know what not to do.

-

Agreed! Seems like banking is one of those areas where an imaginary crisis can create a real crisis though..

I think the headache here is creating the incentives for people to stay in their regional/local banks when there are TBTF banks. It's extra difficult when you have an inverted yield curve and very high short-term rates.

-

24 minutes ago, Dinar said:

They are clearly worse off than people in Singapore, as for China, I am not so sure. Something about arbitrary arrests and zero rule of law is not terribly appealing....

Yeah but I'm talking quality of life for the majority of people..

Keep in mind that many parts of Mexico are run by cartels and there's a huge violent crime problem.

As for India, it's only 1/6 the GDP per capita and you need to contend with a highly discriminatory caste system.

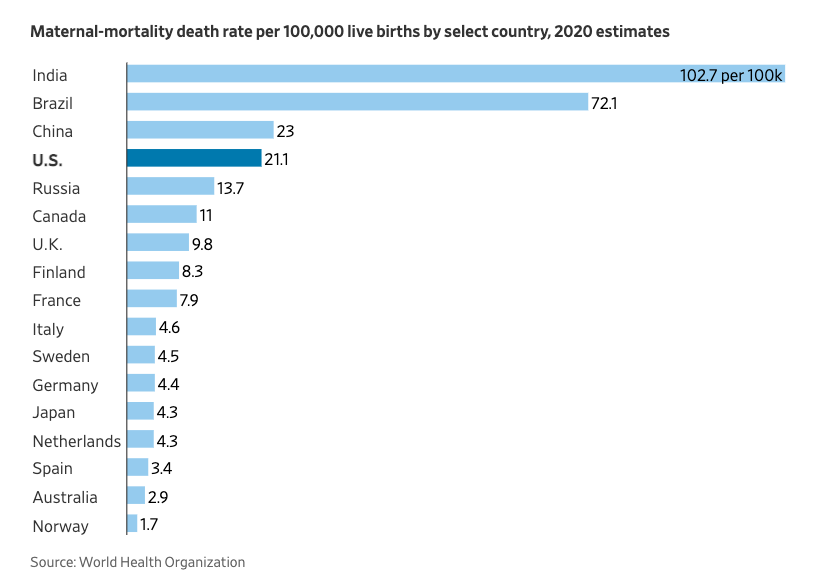

If you remove the political freedom aspect, China seems to outperform Mexico/India in every metric, safety, healthcare, infrastructure, GDP per capita, life expectancy, education, maternal outcome..

Also saw this in today's WSJ:

-

7 hours ago, Spekulatius said:

Not that great (deposits moving to MM funds) if true.

https://finance.yahoo.com/news/deposits-started-moving-money-market-145355809.html

I always think that headlines that we are having wakes up people wo tend to do nothing and often get them to do something. When you have access cash that is sitting there, then the question is why not move this to XXX where it's safe and I earn interest?

Again, stuff can be sticky until it isn't.

My understanding is that while you can withdraw deposits individually, collectively the aggregate amount of deposits do not change. ex. When you buy a treasury, someone else has to sell the treasury and deposit the cash. It almost seems like aggregate deposits depends on the amount of "money" or credit outstanding.

1 hour ago, CorpRaider said:PNC only gave a billion. I can't believe Citi gave $5 billion. I hope they sent it to the right bank this time.

LOL classic

-

On 3/4/2023 at 9:20 PM, rohitc99 said:

+1

reminds me that old quote from churchil i think - Democracy is the worst form of government, except for all the others

Are the majority of people in more democratic countries like Mexico or India really better off than people in less democratic countries like Singapore or China? -

-

1 hour ago, Sweet said:

Why this is a non-cash deferred charge I don’t understand.

Isn't this just accrual accounting?

If the EPL charge was due on Jan 1st, your financials for Dec 31 will not reflect the cash outlay (since it wasn't paid yet) but you need to accrue that expense since it was incurred in the previous period. And that's reflected on the balance sheet by a credit to deferred taxes.

-

-

Democrats

-

52 minutes ago, james22 said:

Hasn't this guy been saying China has 10 years left for the last 15 years?

https://www.businessinsider.com/stratfor-predictions-for-the-next-decade-2010-1

Lawrence DelevingneJan 22, 2010, 9:07 AMWe spoke with Peter Zeihan, Vice President of Strategic Intelligence, about STRATFOR's predictions, of which he was an author. Below are edited excerpts from our conversation.

Which predictions are most surprising?

Aside from the United States not going anywhere, I would say we expect the economic collapse of China in this coming decade. We've been talking for awhile about how the economic system there is remarkably unstable and we think that they're going to reach a break point as all of the internal inconsistencies come to light and shatter. By the end of the decade, it'll be pretty obvious to everybody that the China miracle is over. As we enter the decade, people are finally, finally starting to talk about China bubbles. If only their problem was that simple!

-

The Canadian government's specialty is to create a perception of doing something without actually doing anything.

-

-

7 hours ago, ValueArb said:

if Putin wins in Ukraine, he becomes an existential threat to Europe. He’s been moving one country at a time for a long while.

Where is the evidence for this?

-

What % of your portfolios are in crypto?

-

Plans for tons of immigrants but no plans to address housing, education, healthcare for either locals or newcomers. Canada is a mess. The system is already straining under current capacity.

-

-

-

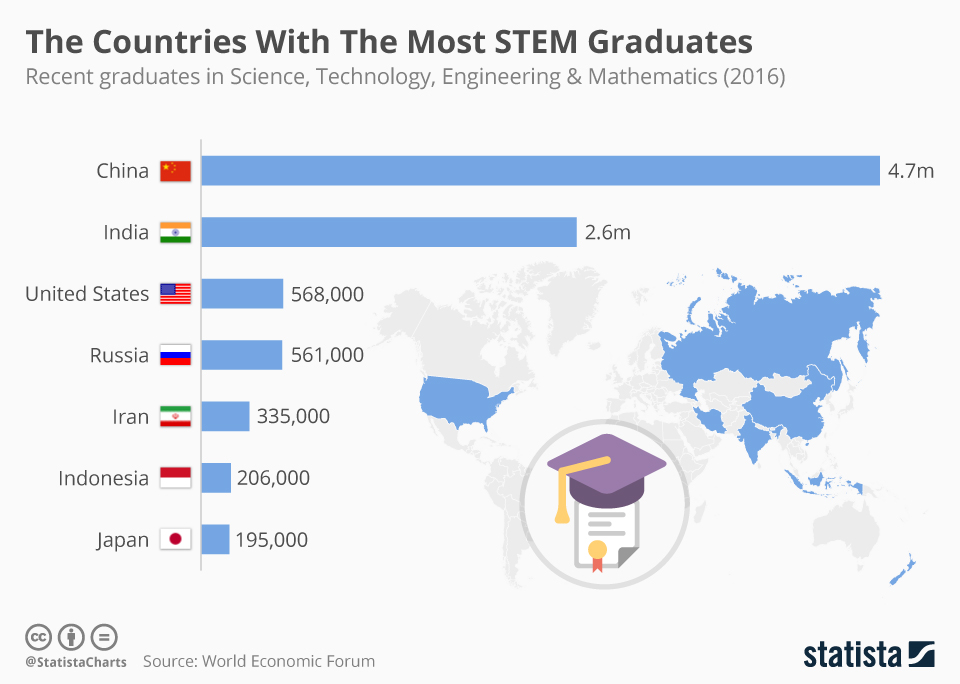

The risk to decoupling is that over time, China might surpass us in science & technology..

-

Can the market really be at a bottom when GameStop is still worth over $7B..?

Humans are greedy and short-sighted, so it's not surprising that when borrowing money was free (like the last 10 years), people will go out and borrow too much.

It's just like if alcohol was free, people will drink more than they should. Maybe now we're getting to the hangover.

Is The Bottom Almost Here?

in General Discussion

Posted

The reason I don't think 70s inflation will come back is because the the 70s has already happened and central bankers understand the implications of runaway inflation and the difficult in taming it.

I think they'll err on the side of lower inflation than let it run too hot.