-

Posts

2,256 -

Joined

-

Days Won

15

Content Type

Profiles

Forums

Events

Posts posted by UK

-

-

The obscure federal regulator that threw a wrench into a $30 billion railroad merger this week could have more in store for the nation’s freight railways—with implications for both business and consumers. Like other federal agencies, the five-member Surface Transportation Board has been tasked by President Biden to root out what it considers to be corporate monopolies that hurt smaller companies and consumers. In a closely watched action, the board in coming months is expected to consider a rule to mandate so-called reciprocal switching, the practice in which railroads can be compelled to share access to their tracks with competitors. That would allow shippers to seek competitive bids for moving freight, which in theory could lower shipping costs and the prices ultimately paid by consumers.

Freight railroads oppose the plan, saying it would be detrimental to their operations and profits. Trucking already serves as a competitive counterweight, they argue. Freight railroads also warn that such a mandate could have unintended consequences, including lower capital investments in infrastructure they are forced to share with rivals.

There are also threats beyond reciprocal shipping. Martin Oberman, who was appointed chairman of the STB by Mr. Biden earlier this year, has also mused about the possibility of the STB moving to regulate storage fees at so-called intermodal railroad terminals—which handle containers across multiple modes of transport, like rails, trucks and ships—to address clogs in the supply chain. Intermodal shipping is currently exempt from STB regulation.

“This is an industry with very few entrants in it, and they tend to be very monopolistic or, at best, duopolistic,” Mr. Oberman said. ”So we just have to live with the existing limited entrants in the field, but at least build in competition where we can.” “The railroad industry is not just about maximizing profits for railroads, it’s also about the public interest in the economy, and the Congress has made that clear,” he said.

Mr. Oberman’s focus on competition and skepticism of some of the railroad industry isn’t a departure from his predecessor, Ann Begeman —but his tone is, said Tony Hatch, a veteran railroad analyst.

Mr. Oberman also established a new passenger rail working group that is preparing to begin enforcing new on-time performance standards beginning next year. Under those rules, which freights, Amtrak, and the government battled over for a decade, freight railroads could face penalties for delaying passenger trains, which run over freight-owned tracks across most of the country. Rulings favorable to passenger railroads in both matters could help make feasible Mr. Biden’s vision of vastly expanding train travel in the country.

Mr. Oberman countered that many of the mergers that consolidated the rail industry 20 years ago included contracts for reciprocal switching among railroads, which have operated without major problems since. “The railroads would prefer that we do nothing ever, except pre-empt everybody else from regulating the railroads,” Mr. Oberman said. “I think the reaction, and I’ve told them, by the way, was way overdone and exaggerated.”

-

-

https://www.wsj.com/articles/how-mixing-hurricanes-with-low-rates-impacts-insurers-11630350607

But there is some rising pressure on recent positive pricing trends for reinsurers, according to industry reviews. A report by brokerage Willis Towers Watson in July said that in the reinsurance market “there are increasing signs of capacity supply outweighing demand. Worries about inflated costs had limited impact on recent renewal pricing, the report said. But the market for alternative capital is booming, with issuance of catastrophe bonds in the second quarter of 2021 outstripping new issuance in 2019, according to Willis. This market tends to be strong when interest rates are low, leading investors to search for alternative forms of yield. Historically this has hit reinsurance pricing through ample supply of funds.

-

37 minutes ago, thepupil said:

I actually think we’re a bit fancy bunch, expected to get some shade for my life choices, some mustachians to argue for a 1995 Corolla / Schwinn bike purchased on Craigslist or something.

it’s a bull market when a bunch of value guys are buying year old bimmers and new SUV’s

I used to own old Honda or Nissan, but then changed my mind on this "cigar butt car ownership style" not least due to: https://en.m.wikipedia.org/wiki/Collision_avoidance_system

I don't need or even like any assistance in driving (can even use manual gearbox:)), but this "automatic braking" is really important and it works (have "tried" several times). At night, or if you are distracted, sometimes it just sees and acts faster. It is usual feature for newer (soon will be mandatory for all new cars), but most older-cheaper just do not have it.

-

2 hours ago, Parsad said:

The Outback and Forester are great...but we don't have alot of dealer/service support in Vancouver for the brand. Don't know enough about the Q8, but my brother bought a Q7 which is very nice for the family. Cheers!

I am sure Q7 is very nice and good car!

But what else is funny with Q8 is that it shares the same platform with Lamborghini Urus, so one could argue, that Q8 fanciest and most expensive version, which is Q8 RS, is actually cheapest:)). I think it should qualify then for value buy, with approx 50 per cent margin of safety:)))

https://www.hotcars.com/heres-why-the-audi-rs-q8-is-a-better-buy-than-the-lamborghini-urus/

-

4 hours ago, LearningMachine said:

How are the the reliability issues with Subarus, e.g. head gasket issues due to the boxer engine, transmission & oil consumption as mileage goes up?

I think, that those issues were related to a very specific engines and years, also boxer diesel, which they already discontinued, but yes I also read that some of their cars from particular years had such issues. Otherwise they are made to be very practical and resilient, dirt proof, etc. But also noisy and very light on materials/fancy/comfort stuff. Probably it is hard not to find similar reliability problem stories with different manufacturers these days, but perhaps then Honda still has very good reputation?

-

Subaru Outback or Forester for value, Audi Q8 for growth/quality:)))

-

6 hours ago, Spekulatius said:

“Little Miss Sunshine” is similar and also very watchable.

Yes, watched this one twice:)

-

-

-

10 hours ago, ValueMaven said:

Who made this?? This is awesome - I'm going to frame it!!

It was shamelessly copied (and tweaked a litttle bit) from: https://www.drwealth.com/invest-in-these-3-companies-and-you-pretty-much-own-the-world/

-

-

RE sentiment: https://www.wsj.com/articles/alibabas-u-s-shares-fall-to-lowest-since-2019-as-china-cracks-down-11629240410

Another factor pressuring U.S.-listed Chinese businesses is Afghanistan, said George Ball, chairman at the investment firm Sanders Morris Harris. He said traders worry that China’s potential growing influence might empower the Chinese government to enact even more stringent regulations. “The American inability to deal with the threats in Afghanistan is making traders think that China is going to be all the more stronger,” Mr. Ball said.

-

-

Coronavirus data suggest the U.K. is slowly emerging from the latest wave of the pandemic, even after the government pushed ahead with an almost full reopening of the economy last month. Virus reproduction numbers published on Friday indicate Covid-19 is in retreat in five of England’s seven regions and in the nation as a whole, while the national statistician’s weekly survey showed infection rates broadly stable in England, Wales and Northern Ireland and declining in Scotland.

-

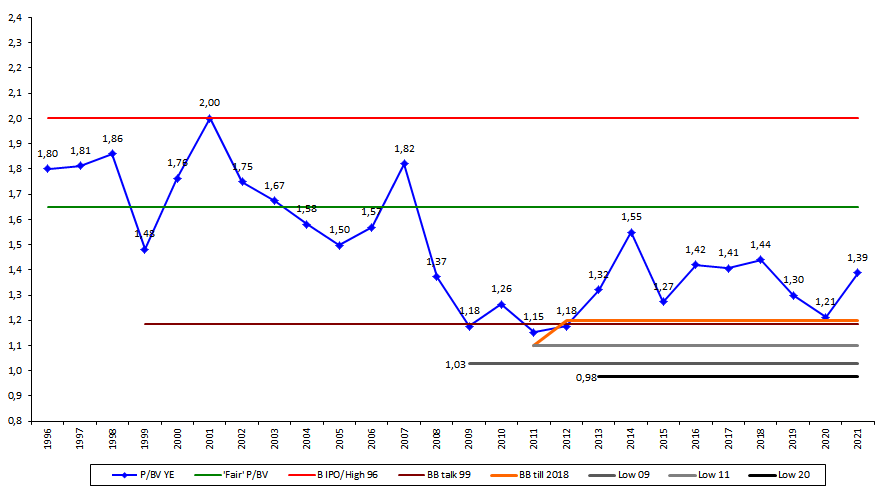

Yes, sure, BV era is ending:) and I look at BRK more via "normalised earnings" (which you can conveniently borrow and adjust as you like from say Semper Augustus) and PE, however I am to lazy yet to calculate normalised profit back to 1996:). If anybody knows, maybe such data is already available (kind of look through earnings or similar)? Because also it would be nice and possible to compare BRK to SNP in such way.

-

Look through BV:

-

I think this one can be recommended in advance:)

-

16 hours ago, nwoodman said:

The inevitable demise of one, then both of the most talented didactic business brains, we will see in our lifetimes might create some short term opportunities.

Since from this years AGM it is official, I recently reread this article from 2019:

Nobody will change Warren Buffett, but new management could have its own strengths, from more hands on operational matters, to more freer hands on divestment, or, maybe even (why not to dream a little) to going semi hostile/activist in acquisitions/larger holdings. Abel's approach and Ted/Todd's involvement with companies they invest, participating in hot tech IPO's when that makes sense, indicates that this is a possibility and why not?

-

Returns also depend on starting and ending valuation (and finaly normal BB are very encouraging for the latter), but I remember him saying, that for 10 percent IV growth they would need "somewhat more normal rate environment". Also I think, that if recesion, or more importantly, some kind of market disllocation (but esspecially due to higher rates) comes in the next 5 or 10 years, BRK would be worth more at the end, then without any turbulences. Conservatively, from current valuation, I do not expect BRK to return more than 8-10 if rates and capital deployment oportunities stays as it is, but as WB said in last interview "sometimes conditions changes very very quickly in the market". So BRK even after recent run up stays quite atractive and defensive, given alternatives. Looking longer term I am almost starting to treat it as a place, instead of cash (or above certain max level of cash), to put capital if I dont have better ideas (depending on valuation ofcourse:)).

-

Last month looks interesting.

-

Only recently I watched this one: https://www.imdb.com/title/tt6266538/

It was really entertaining and funny:)

-

...has been described as "impenetrably ambiguous: either the answer is so obvious it is right in your face, or the answer is as intangible as the wind"

-

Not an investment idea, but interesting:

State-run China Telecom is set to raise 54.2 billion yuan ($8.4 billion) in its maiden share sale in Shanghai, mere months after being forced to delist from the New York Stock Exchange. The offering by one of China's three state telecom groups will be the mainland's largest listing in a decade. China Telecom in a filing on Friday said it will issue up to 11.96 billion shares at 4.53 yuan apiece. The company's Hong Kong-listed shares ended the morning session 0.3% lower at 2.92 Hong Kong dollars (38 U.S. cents), trimming gains for the year to 40%. The offer price in Shanghai represents close to a 90% premium over the current trading price in Hong Kong. "The issue price was determined based on several factors including the fundamentals of the issuer, valuation of comparable companies [and] market conditions," the company said in the statement.

Edison Lee, a telecom analyst at Jefferies, said on Friday following the IPO pricing that China Telecom remains to be "one of our top picks." "We believe China's industrial digitization in the next five years will be first led by state-run enterprises, and the Chinese telcos in general are strongly positioned to leverage that growth," he wrote in a note to clients. He sets his target price for Hong Kong-listed shares at HK$5.12, 75% higher than current levels.

Buffett/Berkshire - general news

in Berkshire Hathaway

Posted · Edited by UK

I would ques it is related to this value-growth rotation going on back and forth, which is mostly related to rate expectations, which is mostly related to economy expectations, which is somehow related to maybe delta scare and what not else, and it is only trying to explain past:) and still perhaps nobody on earth knows what will future be:). But I think BRK is quite well positioned, but they are regarded bu market as being more on the short duration side, so lower rate expectations is not as good for BRK valuation (as say for FANGS), but lower valuation is not so bad if BB are going on, so you cannot lose here and god bless BRK BB:)