-

Posts

2,256 -

Joined

-

Days Won

15

Content Type

Profiles

Forums

Events

Posts posted by UK

-

-

https://www.wsj.com/articles/evergrande-is-chinas-economy-in-a-nutshell-11632233862

"The long-term impact could be even more disruptive. China has tried repeatedly to rebalance its economy away from debt-driven construction toward consumption and service industries. It has had some success, but every time there is a slowdown, it returns to the tried-and-tested model of jacking up debt and investment to boost growth. This time might be different, as President Xi Jinping has secured all the levers of state power; perhaps he is ready to accept slower economic growth as the price of it being more sustainable. Capital flight is hard too, after a clampdown on routes previously used to get money out of the country, and with Covid-19 restricting travel.

If China really is pushing back against unsustainable debt-driven growth, it faces a series of tricky problems as it remakes its economy. It will have to wean the population off the idea that empty apartments are a good vehicle to save money, without destroying everyone’s savings. It will have to persuade people that they should save less and spend more. It will have to reallocate vast numbers of workers and capital from real estate and the broader construction industry, which together make up about one-eighth of the economy, and together with suppliers probably account for more than a quarter of gross domestic product. And it will have to raise taxes to substitute for land sales as a source of finance. Worse, it will have to do all this while adding less debt and accepting a lower growth rate. The model needs rebalancing, because it is unsustainable. China adopted the same if-you-build-it-they-will-come mantra as Kevin Costner in “Field of Dreams,” but aging demographics and slowing urbanization mean “they” no longer come in such numbers. Debt absolutely can’t keep rising at the rate of the past decade, either. China is one of only three countries to add nonfinancial debt amounting to more than 100% of GDP since 2011, according to the Bank for International Settlements (alongside Greece and Singapore, while Chinese territory Hong Kong has, too). It now has about the same level of debt-to-GDP as the U.S., despite a significantly less well developed financial system.

If China succeeds, it will mean less demand for the raw materials it has been importing, more demand for consumer goods, and, probably, a better balance of trade. For the rest of the world, that means lower prices for steel, copper and the energy that was going into cement, and less need for China to recycle dollars into Treasurys and other overseas holdings. But if China succeeds it also means less cheap Chinese labor and more Chinese consumption pushing up global demand, both of which are broadly inflationary. History suggests it is exceptionally hard to navigate such shifts without mistakes, and China is so big that the shifts will need to be global, not merely domestic. It could be a bumpy few years. China’s stop-start rebalancing hasn’t made much progress in the past few years, but it seems to me that Mr. Xi is more and more serious about it, quite apart from wanting to reassert control over the private sector. As that rebalancing filters out into the rest of the world it will matter to all of us. Evergrande is a wake-up call."

-

1 hour ago, rkbabang said:

I can't read this because I don't subscribe, but any current company is far too early. We don't even have fully autonomous electric vehicles yet. A human driven flying car is a non-starter.

This article includes very interesting part on historical transport inovations:

"Taxi companies using radical new technologies and promising to transform transportation have arisen before. In 1897, what became known as the Electric Vehicle Co. began operating battery-powered taxicabs in New York City. In the U.K., the London Electrical Cab Co. also began service that year. In 1899, the Compagnie Française des Voitures Électromobiles got underway in Paris. The electric taxis offered some great advantages over the horse-drawn cabs they sought to replace. They were clean and quiet and, because they were so innovative, they appealed to the wealthy and fashionable. In New York, the electric-taxi business boomed. In June 1898 alone, nearly 1,600 customers traveled a total of 4,400 miles, according to business historian and management professor David Kirsch of the University of Maryland. They paid 30 cents a mile, more than $9.75 in today’s money. (Horse-drawn cabs charged 50 cents a mile.). In 1899, the Electric Vehicle Co. had about 45 cabs in service, averaging 27 miles of trips per day, and a financing rush was on. A rival, the General Carriage Co., sought to raise $20 million in capital (about $650 million today). The New York Central railroad said it would launch a service with 100 electric taxis based at Grand Central Terminal. That year, estimates of demand for electric taxis quickly ratcheted up from 1,600 to 2,000 to 12,000. To shuttle passengers to New York’s booming Metropolitan Street Railway trolley system, which covered 232 miles in Manhattan, 1,500 battery-powered taxis would be needed. The Electric Vehicle Co.’s parent ordered as many as 850 “electromobiles” from its manufacturing affiliate in Hartford, Conn. In seven weeks that spring, the share price of the New York electric taxi company nearly tripled. Then the surge began to fade as overexpansion took its toll. Short battery life doomed the London and Paris firms in a year or two. In 1902, the General Carriage Co. collapsed after its stock shot from 87.5 cents to $20.50 and fell back again. Most of the electric-taxi services in smaller U.S. cities never got traction. Above all, Henry Ford supplanted the electric car by changing the idea of what automobiles were for.

Electric taxis were the natural offshoot of the 19th-century model of transportation, exemplified by steamboats and railroads: centralized services that charged fixed prices to serve fixed routes on fixed schedules. Consumers who accepted that as the status quo would rather pay others to drive them than to drive themselves. Instead, Ford got consumers to think of transportation not as a service someone else offered but as a product they could own and operate themselves. That enabled people to go anywhere they wanted whenever they wished. Transportation no longer had to be rigid; it could offer freedom. Traveling was usually still a necessity, but it could also fulfill an aspiration. Huge improvements in the power and range of gasoline engines helped, but Ford’s biggest weapon was low price: He introduced his Model T in 1908 at $850, roughly one-third of what electric cars cost at the time. Suddenly millions of people could own a product that gave them a sense of control over time and space.

Decades later, Sir Freddie Laker adopted a similar approach. Air travel had long been limited mainly to the wealthy and to business travelers when, in 1977, he launched his Skytrain, a bargain-priced, no-reservations and no-frills airline linking the U.K. to the U.S. People stood in line for hours, sometimes days, in what they called “Queue Gardens” to snag tickets at one-half to one-third of competitors’ fares. Laker’s innovation helped force governments to deregulate the airline industry, slashing airfares across the board just as the global economy was about to boom. In 1976, 137 million middle-class people world-wide had traveled by air. By 1981, that number hit 212 million; a decade later, it reached 583 million.

Technologies and industries often take leaps forward when products and services can be put to surprising new uses, enabling customers to fulfill needs—or aspirations—they didn’t even know they had. Radio, developed to assist navigation, became the indispensable musical accompaniment to people’s lives. The airplane, in its early decades, was used far more for delivering mail and shipping goods than for carrying passengers. The mobile phone, originally designed for people to talk with, has become the all-in-one wristwatch, camera, stereo, movie theater, road map and encyclopedia we all carry in our pockets and purses. Endless commutes in torturous traffic jams have made travel something millions of people dread. Perhaps—if all the technology works and every bureaucracy cooperates—air taxis can someday reinvest travel with the sense of novelty and freedom it once had. Success might depend on what the technology can deliver soon. It might depend even more on whether the technology can deliver what people don’t know they will want later."

-

-

1 hour ago, Spekulatius said:

Whatever comes out of it, I don’t think it is going to be a mega trend sort of business. Maybe Cannabis will be. I could see Cannabis competing with Alcohol as the go to social drug of choice in a few decades.

Hmm I thought cannabis is yesterdays business and not cool anymore:)?

-

8 hours ago, bathtime said:

And a part of that is psychedelics for therapeutic use. I’m on the West coast and innovators in the therapeutic scene are pivoting towards integrating psychedelic therapeutics. Anyone own CMPS?

It is interesting, do not own it, but I follow them to see how everything plays out. However I am not sure what kind of business eventually (and advantages over others) they whould have, even if beeing right/aprooved/accepted soon?

-

"Joby Aviation, which plans to begin an electric air taxi service in 2024, is worth more than Lufthansa, EasyJet or JetBlue. Does that seem right? In this market, why not? Heck, earlier this year, Tesla was worth more than the next nine car manufacturers combined, though now only the next six. Beyond Meat, made with pea protein, is worth more than the entire market for peas eaten globally—like the bumper sticker says: Imagine whirled peas. Do fundamentals even matter? I can go on. Used-car sales platform Carvana is worth more than Volvo, Honda, Ford or Hyundai. Airbnb is worth more than Marriott and Hilton combined. Crypto-exchange Coinbase is worth more than the Nasdaq. I live at the intersection of innovation and disruption, but when companies are worth more than any possible reality, watch out. How about those meme stocks still getting hyped on Reddit’s WallStreetBets? Those who bid GameStop shares into the stratosphere waved at Virgin Galactic Holdings as they soared by. A year ago, the stock was $6 and it is now $190—some dupes paid $483, game over. Short sellers Melvin Capital, Point 72 and D1 Capital focused on fundamentals and got their assets handed to them. Shorts lost more than $9 billion between January and June. New Chairman Ryan Cohen, who is driving change at GameStop, may be a retail genius for turning around Chewy, but Redditors may want to put in a call to hedge-fund manager Eddie Lampert, who bought Kmart and merged it with Sears in 2005, as a highly touted “integrated retail” play, combining stores and online sales, eerily similar to the argument for investing in GameStop today. The stock peaked at $135 in 2007. It is now at $0.30 as the company languishes in bankruptcy. A 1970s Sears Johnny Miller leisure suit is worth more. Venture capital is cuckoo. After investing $120 billion in the 2000 dot-com frenzy, and just $16 billion in 2002, U.S. venture capital invested $130 billion in 2020 and then $140 billion in the first half of 2021. Startups these days raise money as “the Uber of gardening” or “Space as a Service.” Oh wait, the latter was WeWork’s pitch, whose founder Adam Neumann declared in 2017, “our valuation and size today are much more based on our energy and spirituality than it is on a multiple of revenue.” Is “spirituality” the S in SPAC? And check this out: In June, an Italian artist auctioned an invisible statue for $18,000—in reality it was an empty box the artist claimed was a “space full of energy.” WeWork energy? Yeah, maybe fundamentals are a quaint relic of a bygone era."

https://stratechery.com/2020/the-end-of-the-beginning/

"The implication of this view should at this point be obvious, even if it feels a tad bit heretical: there may not be a significant paradigm shift on the horizon, nor the associated generational change that goes with it. And, to the extent there are evolutions, it really does seem like the incumbents have insurmountable advantages: the hyperscalers in the cloud are best placed to handle the torrent of data from the Internet of Things, while new I/O devices like augmented reality, wearables, or voice are natural extensions of the phone. In other words, today’s cloud and mobile companies — Amazon, Microsoft, Apple, and Google — may very well be the GM, Ford, and Chrysler of the 21st century. The beginning era of technology, where new challengers were started every year, has come to an end; however, that does not mean the impact of technology is somehow diminished: it in fact means the impact is only getting started. Indeed, this is exactly what we see in consumer startups in particular: few companies are pure “tech” companies seeking to disrupt the dominant cloud and mobile players; rather, they take their presence as an assumption, and seek to transform society in ways that were previously impossible when computing was a destination, not a given. That is exactly what happened with the automobile: its existence stopped being interesting in its own right, while the implications of its existence changed everything."

-

-

RE Ghost cities, yes, I remember it was quite a noise around those, but like fareastwarriors posted (this was interesting, thanks), seems that ghost cities are also worked out:

"It took a while for people to show up. A 2013 news report by 60 Minutes described the place as a ghost town: “new towers with no residents, desolate condos, and vacant subdivisions uninhabited for miles and miles and miles.” But today, Zhengdong New District is bustling with life. Waiters eagerly wave passersby into their restaurants, food delivery workers weave in and out of crowds, and professionals congregate outside office buildings for cigarette breaks. On summer evenings, families sit beside a human-made lake to watch light shows on “Big Corn Tower” or Greenland Plaza, which houses the city’s JW Marriott hotel. The area was spared most of the damage from July’s heavy flooding in Zhengzhou, which killed almost 300 people. About half of the world’s iPhones are manufactured at the 11‑year-old Zhengzhou factory of Hon Hai Precision Industry Co., better known as Foxconn. Favorable government policies for businesses also attracted large pharmaceutical and auto plants to the region, and Zhengdong New District’s economy grew at an annualized rate of 25% in the five years through 2015, according to the most recent data. The population of the district grew 27.5% from 2019 to 2020, and property prices there are up tenfold over the past decade."

“It takes time for a city to develop, and Kangbashi’s situation has improved gradually,” says Sun Bindong, an urban planning professor at East China Normal University in Shanghai, who advised the Ordos City government on urban planning and development in 2007 and 2008. City leaders in China rarely occupy their posts for more than five years, so the bureaucrat who initiates construction is usually no longer in charge when the time comes to turn buildings, roads, and rail lines into a fully functional city. Local Communist Party Secretary Xing Zheng has been in charge of Kangbashi for only a few months. Over beers at a local karaoke bar, the University of Oxford- and London School of Economics-educated lawyer says that the original plans were overly ambitious but that the area offers “a lot of potential” for sectors including education, tourism, health care, and digital industries. “The plans for the city were ahead of their time, but now you can see they were right,” he says. “In the future, Kangbashi will be small but fine.”

-

34 minutes ago, bizaro86 said:

If you wanted to lower housing prices for affordability reasons, wouldn't encouraging more residential development (aka supply) be the best way to do that?

Perhaps true, but as I understand, especially at this point in time, due to all this Huawei situation, they just happen to want things like advanced chips even more:)

From some interview:

"So tell me about Alibaba and Tencent. I think that this is a point that you’ve made as well, that Americans tend to focus on the consumer-facing companies both domestically and abroad, and that’s not necessarily the Chinese point of view. What’s your take on these companies we’ve heard of, the issues they’ve had, and how that relates to the private sector as a whole? DW: Well, I think one of the things is that the US has a defined stack. First of all, centered in Silicon Valley, which has now become bifurcated between the consumer internet in San Francisco and then the actual Silicon producers closer down in San Jose and in a normal year, I’m in California quite a bit, and I just find it remarkable that these two worlds almost never talk to each other, they’re just on completely different wavelengths. And right now today, when we think of US tech, we’re still thinking of Amazon, Facebook, Google, Microsoft and Apple. And I think that this has become a very clever marketing trick from California, which I rue. I do not think that Facebook and Tencent are the truest signs that we live in a technologically accelerating civilization. Tencent to me is mostly a video game company, Alibaba is making my life as someone living in urban China very, very convenient, but this to me does not represent the very apex of technology, and I would say the same of Facebook and Google as well. These are companies that are not creating a huge amount of IP. They’re very good at business model innovation as well as exploiting network effects but my heart is with the Industrial Silicon Valley. I’m in favor of the silicon! One of the interesting things is that, I think the Chinese government is actually moving towards this rejection of what I think are the most prestigious sectors in the US — tech, finance and real estate. And China has in my view over the last year, President Xi has really rejected each of these things. He is cracking down on finance, he is cracking down on real estate, and he is also now cracking down on tech. I think what we see now is very consistent rhetoric from the Communist Party that we cannot de-industrialize, we need to keep doing very well on manufacturing and this is consistently what the General Secretary of the Communist Party, Xi Jinping, has been saying. So you can see how this is manifesting in this antitrust crackdown that’s currently ongoing against Alibaba, also to some degree on Tencent. And I think what the party has recognized is that these are not the technology leaders that are going to drive forward our technologically accelerating civilization and we don’t need to fall for American marketing here."

-

25 minutes ago, nwoodman said:

I guess the market is implying that they have a public hanging or two and then its back to business

It will be interesting to watch, how this plays out. Also it is really strange how (including all crackdowns) much anticyclical policy they run at this point in time, especially comparing to the rest of the world:

-

https://www.wsj.com/articles/what-if-chinas-property-crackdown-goes-overboard-too-11631017035

A crackdown on runaway housing prices jibes with other recent initiatives like President Xi Jinping’s populist call for “common prosperity.” Unaffordable homes are a major cause of inequality and an obstacle to child-rearing. A huge amount of capital has also been channeled into housing that could be put to more productive uses. Previous research has linked China’s housing boom to falling productivity. The problem, of course, is that property is already so entwined with China’s economy that a sudden stop could be extraordinarily dangerous. Real estate is the biggest asset of Chinese households—who recognize that the political sensitivity of the market, and its outsize economic footprint, make sustained price falls risky for Beijing. A lack of investment options and the preference of banks for mortgage loans has exacerbated that concentration. The wealth impact from a housing crash could seriously affect already-weak consumption.

-

As part of the 2020 trade deal with the U.S., China has been opening up its financial industry. Earlier this year, JP Morgan got permission to take full control of its securities

business there. Previously, foreign brokers had been required to operate through joint ventures. If you are scratching your head wondering why Beijing is welcoming American securities firms while relations with the U.S. are plumbing new depths, the answer is simple: The move is in China’s interest, too.Beijing has long wanted capital markets to play a larger role in China. Chinese companies rely mostly on bank loans and retained profit for investment, which is quite different from many other major economies. Around 60% of outstanding total social financing, a broad measure of credit in the economy, comes from bank loans, according to data provider Wind, while corporate bonds and equity for non financial companies make up around 12%. In the U.S., equities and bonds provide 73% of funding for non financial corporations. The stranglehold of state-owned banks on the financial system makes it harder for small businesses without good connections to secure long-term funding to grow—even if they have an innovative, well-run business model. And with Beijing more wary of dependence on U.S. stock markets, the problem has become more urgent. The involvement of names like Black Rock could help gain the trust of domestic investors and redirect Chinese household savings out of real estate, which Beijing wants to shift the economy away from.

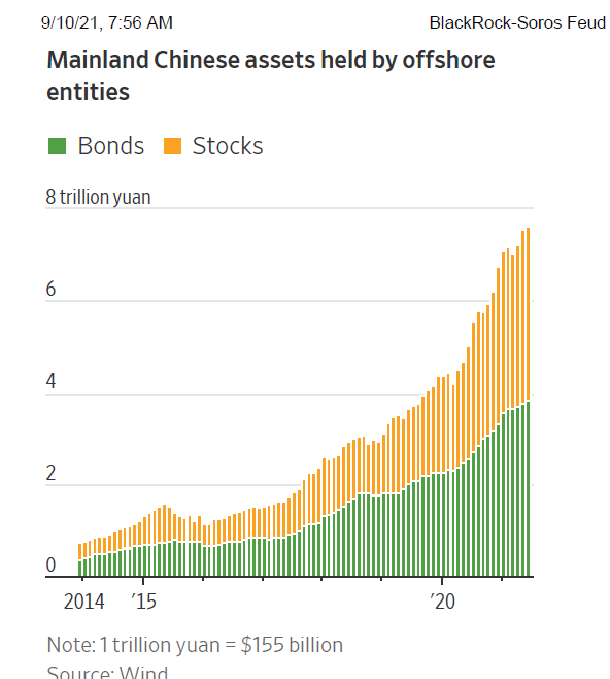

Apart from opening up finance to foreign players, China has rolled out the welcome mat for investors outside mainland China. Off shore investors, including those based in Hong Kong, now hold 7.6 trillion yuan, the equivalent of $1.2 trillion, of Chinese domestic stock sand bonds as of June, according to data from China’s central bank via Wind. That has quadrupled the amount four years ago but is still a drop in the ocean of the country’s $19 trillion bond and $13 trillion stock markets. Such inflows could also help off set capital outflows from China-based investors and bring discipline to the market.

-

from 13:30

-

"You Don't Need a CFA to Value Chinese Equities"

-

Also, again, I am biggest fan of US (and very greatfull from prospective of my countries geopolitical situation:)), majority of my portfolio is still invested there and I am rooting for its success far in the future. but, despite this all common prosperity scare in China (which is by name a socialist country), have you noticed what is going on in US (EU is far ahead already)?

"Now with merely 50 Democrats in the Senate and a five-member House majority, Democrats are planning to rush through the biggest tax and spending increase in half a century. We’ll do our best to report and dissect the details in the coming days, but here’s a taste from the text that the two House committees deigned to release:

• A universal paid leave mandate administered by Treasury that provides up to 12 weeks of family and medical leave for all workers including those self-employed at up to 85% of their weekly pay. It’s unclear how the new entitlement would interact with existing state paid leave and employer programs. The federal bureaucracy will iron out the complications later.

• A new employer 401(k) mandate—that is, a tax. Employers would be required to automatically enroll their employees in IRAs or 401(k)-type plans or pay an excise tax. Employee 401(k) payroll contributions would be set at 6% and increase to 10%. There are myriad other legal changes on employer-sponsored retirements accounts that would be land mines for businesses.

• The bill creates new civil penalties up to $50,000 per violation for unfair labor practices (ULPs), which would now include misclassifying workers as independent contractors. Business executives and directors could be held personally liable for alleged ULPs. As a gift to the plaintiff bar, employee arbitration agreements would also be effectively banned.

• Medicare would expand to cover dental, vision and hearing benefits. Health and Human Services would be charged with standing up these expansions, including setting provider payment rates. Cost estimates for this and other entitlements have yet to be announced, but they’re likely to be fictitious anyway. One credible estimate is that the Medicare increase alone would cost $360 billion over a decade.

***

There is much more spending to come, and next week come the tax increases that will also be marked up on a day or so notice. It’s important to understand how extraordinary this is. The Democratic bill would fundamentally alter the relationship between government and individual Americans. Entitlements, once created, will be all but impossible to repeal. Even if they start small, they will inexorably expand."Or all these new green regulations in US, but especially in EU? Banning ICE etc or nuclear power in Germany? Is it not some grand state planing/intervention? And who and how will pay for that?

Or what does such things tells about future: https://www.wsws.org/en/articles/2020/10/23/soci-o23.html

-

Oh, thanks for reminding these "10 baggers", though I would argue, that they have fucked themselves up well before government came, of course by wonderfully payed "stewards of capital". I was burned so much times (of course self inflicted, in pursuit of "value", usually deep:), so not any governments fault, sometimes they do what they do) by such situations, that I almost forgot some (or maybe do not want to remember?). A lot of situations with utility companies also, especially in EU, water tariffs were changed over night (to a almost no profit), one was nationalized back in my own country (price was calculated based on maybe book value or something:)), or some onerous regulations was introduced on whole sector. If I was forced to name "risk free" (not only from regulations, but also from disruption) company list today, like I said, am not sure I would even put KO in it, surely not V/MA types, but maybe Nestle, Nike and similar. But all of them today trades at least at 25x forward earnings, most more like at 30-40x.

-

4 hours ago, Spooky said:

To capitalize on the China growth opportunity I landed somewhere similar to SD - look for investment opportunities / companies in safer jurisdictions that have things China can't acquire or build at home that will benefit greatly from China's growth thus avoiding any CCP risk.

It would be very interesting to know what are those companies? Are they commodity companies or something else?

-

I agree China is not the same as US and risks related to government are higher. But not sure if it is only black and white, especially re respect to individual property rights, they still have and produces a lot of billionaires, are they not? Also, while investing, usually you still accept bigger or lesser risk. So it is different, but is the risk is really lower if you invest today in Intel instead of Tencent? Or you invest in smaller companies (or even large) and are being screwed by a management (or majority owners) instead of CCP? Is that somehow better? Destruction of value by management in perfectly fine jurisdictions in largest companies is sometimes quite amazing, just look at things like Bayer's acquisition of Monsanto or Bank of America's of Countrywide. And do you remember circumstances under which BAC acquired Countrywide? It was called shotgun wedding if I recall correctly:), was forced by the government and almost killed the company. Was it uninvestable after that?

Also I would like to ask: If Apple is good enough and safe then? Let say only 1/5 of their sales is China related, so no existential threat, but if you take that out while a company trades at like 40x earnings, I think you can go for a permanent loss of capital situation there also. And in a more nuclear scenarios, Apple is dependable on China for like 4/5 or 2/3 of its manufacturing. So is it investable or not?

Also, because it is related to regulatory risks of a very strong and moaty company in a perfect jurisdiction, I like this example so much, that I will post it perhaps third time:). So forgive me but once again:

"Archie McCardell was named president of the company in 1971. During his tenure, Xerox introduced the Xerox 6500, its first color copier. During McCardell's reign at Xerox, the company announced record revenues, earnings and profits in 1973, 1974, and 1975. John Carrol became a backer, later spreading the company throughout North America.[citation needed] In the mid-1970s, Xerox introduced the "Xerox 9200 Duplicating System". Originally designed to be sold to print shops to increase their productivity, it was twice a fast as the 3600 duplicator at two impressions per second (7200 per hour). It was followed by the 9400, which did auto-duplexing, and then by the 9500, which was which added variable zoom reduction and electronic lightness/darkness control. In a 1975 Super Bowl commercial for the 9200, Xerox debuted an advertising campaign featuring "Brother Dominic", a monk who used the 9200 system to save decades of manual copying. Before it was aired, there was some concern that the commercial would be denounced as blasphemous. However, when the commercial was screened for the Archbishop of New York, he found it amusing and gave it his blessing. Dominic, portrayed by Jack Eagle, became the face of Xerox into the 1980s. Following these years of record profits, in 1975, Xerox resolved an anti-trust suit with the United States Federal Trade Commission (FTC), which at the time was under the direction of Frederic M. Scherer. The Xerox consent decree resulted in the forced licensing of the company's entire patent portfolio, mainly to Japanese competitors. Within four years of the consent decree, Xerox's share of the U.S. copier market dropped from nearly 100% to less than 14%."

It was one of those nifty fifty companies, very expensive at that time (like most US tech companies now) and as you can see, it was killed not even by technological disruption. It was done by a democratic government. How about Xerox shareholders property rights? Are you sure that similar risks today are "virtually non-existent" while investing in some western tech/payment/etc darlings?

Also take for profit education, which is being exterminated now in China, but they were not treated much better in US:

"As for-profit colleges began to falter, for-profit online program managers gained momentum. Under the Obama administration (2009–2017), for-profit colleges received greater scrutiny and negative attention from the U.S. government. State Attorneys General, the media, and scholars also investigated these schools. For-profit school enrollment reached its peak in 2009. Corinthian Colleges and Education Management Corporation (EDMC) faced enrollment declines and major financial trouble in 2014 and 2015. In 2015, Corinthian Colleges filed for bankruptcy. Enrollment at the University of Phoenix chain fell 70% from its peak In 2016, ITT Technical Institute closed, and the US Department of Education stripped ACICS of its accreditation powers. In 2017, the advocacy group the Debt Collective created its own, unofficial "Defense to Repayment App" allowing former students of schools accused of fraud to pursue debt cancellation. In 2017, Harvard Business School professor Clayton Christensen who developed the theory of disruptive innovation, predicted that “50 percent of the 4,000 colleges and universities in the U.S. will be bankrupt in 10 to 15 years.”

So what is risk free? I would argue, that even Coca-cola is not, and its shareholders can be robbed by some kind of sugar tax in the future. But i think it is the wrong question, because the right one, as with all investments, is what risk is already priced in.

-

-

5 hours ago, beerbaron said:

I would say think what is the long term objective of China and how they will want their policies to go with that objective. There is a well documented 50 year plan that aims to put China as the premier economic power by 2048.

After you understand that ask yourself if what we hear contradicts the plan or not.

BeerBaron

https://www.theatlantic.com/international/archive/2017/05/what-china-wants/528561/

If China reaches the first goal— which it is on course to do—the IMF estimates that its economy will be 40 percent larger than that of the U.S. (measured in terms of purchasing power parity). If China meets the second target by 2049, its economy will be triple America's.

What does China’s dramatic transformation mean for the United States and the global balance of power? Singapore’s Lee Kuan Yew, who before his death in 2015 was the world’s premier China-watcher, had a pointed answer about China’s stunning trajectory over the past 40 years: “The size of China’s displacement of the world balance is such that the world must find a new balance. It is not possible to pretend that this is just another big player. This is the biggest player in the history of the world.”

Will Xi succeed in growing China sufficiently to displace the U.S. as the world’s top economy and most powerful actor in the Western Pacific? Can he make China great again? It is obvious that there are many ways things could go badly wrong, and these extraordinary ambitions engender skepticism among most observers. But, when the question was put to Lee Kuan Yew, he assessed the odds of success as four chances in five. Neither Lee nor I would bet against Xi. As Lee said, China’s “reawakened sense of destiny is an overpowering force.”

Yet many Americans are still in denial about what China’s transformation from agrarian backwater to “the biggest player in the history of the world” means for the United States.

-

14 minutes ago, Gregmal said:

I just try to stick to things that come easy to me. And if they arent easy, things that I understand or can handicap. There's like 8,000 public companies out there that dont have anything to do with China so I dont really see why the average person thinks this is their best playground.

To one his own, I agree and also do not do like zillion things:), also did not owned or even looked at China stocks in the last 20 years before this debacle, except one stock in 2010, but it was a wash:)

-

And since question is specifically re CCP, I will repost this chart. Another day read somewhere "No matter how much I disagree with Brussels, I'd sure as rather trust EU over CCP". Now, I live in EU (and am one of the biggest fan on earth of US), but gee, in the last 10 years all EU managed to produce was crisis after crisis: Euro, Brexit, migration, energy policy, etc, while nurtured zero tech champions, now losing EV battery game. China meanwhile went from strength to strength every time and I still should trust EU more? Based on what? Only because it is democracy? Thanks god US has done better and I hope still will do in the future, but only because China's system is different, that does not mean it is necessarily inferior in every way and doomed to fail. It already successfully lasted 50 years.

https://www.nytimes.com/interactive/2018/11/18/world/asia/china-rules.html

-

if you can't beat them, join them: https://www.youtube.com/watch?v=DpkCV2Hd62Y

:)))

Seriously thought, I think this is a major opportunity of one in a 10 year kind. I would also agree with Viking, that it is considerably more speculative than investing in similar US companies. But I would argue that a lot of US companies, especially smaller, are more speculative than China big tech companies.

I would answer the question "what causes the fundamental change", that nothing (except maybe for education stocks:)) has changed in big picture in the first place, only valuations, because of this temporary "regulation noise":)

-

"The rally is driven less by reflation prospects than a return to the pre-pandemic reality of low interest rates, which leaves no alternative to stocks"

But I would not pay to much attention to such things, better I think, until some real shit hits the fan, just to stay with mostly win-win situations, like BRK:))

Dont fight the CCP?

in General Discussion

Posted · Edited by UK

At least they have a decent sense of humor: https://www.bloomberg.com/news/articles/2021-09-23/xi-s-u-s-envoy-invokes-lincoln-in-declaring-china-a-democracy

Meantime: https://www.bloomberg.com/news/articles/2021-09-19/xi-s-celebrity-crackdown-no-match-for-universal-studios-in-china

"As President Xi Jinping’s government looks to tame China’s celebrities, the popularity of a new Universal Studios theme park in Beijing shows Hollywood’s enduring soft power among the nation’s 1.4 billion people. Tickets for the grand opening on Monday, priced at 638 yuan ($99), sold out within 30 minutes of going online last week -- as did rooms costing as much as 20,000 yuan at the resort’s two hotels, according to state-run media. Fliggy, an online travel site operated by Alibaba Group Holding Ltd., last week apologized for overselling the 500 yuan Universal Express Pass that lets visitor skip lines. The park became the most-searched topic on China’s Twitter-like platform Weibo on Monday morning, as hundreds of visitors queued for entrance in the rain while those inside posted videos of “Harry Potter” experiences. A grand opening ceremony was attended by top officials, including Beijing party chief Cai Qi, according to state-backed news outlet The Paper. The surging demand underscores the challenge Xi faces in dampening the appetite for celebrities among the general public, as the Communist Party looks to curtail foreign influences and promote the concept of “common prosperity.” A commentary published widely in state-run media last month warned against “fan culture” and “worshiping Western culture.” The popularity of the Universal Studios theme park shows resistance to the Communist Party’s tightening of cultural standards after decades of allowing Western influences, according to Adam Ni, co-editor of China Neican, a newsletter on Chinese public policy issues. “As powerful as the party is, it will have to contend with countless everyday decisions by the Chinese, which would together make up the moral fabric of the People’s Republic,” he said. In the lead-up to the park’s public opening, dozens of Chinese celebrities -- including “Crouching Tiger” actress Zhang Ziyi and supermodel Liu Wen -- visited attractions related to “Jurassic Park,” “Transformers” and “Harry Potter.” Photos of other guests dressed in Hogwarts cloaks, and posing with “Minions” and “Megatron” characters, became trending topics on China’s Twitter-like Weibo. “Universal Beijing Resort is popular with the Chinese because there is part of the global culture that the Chinese thirst for,” Ni added. “Beijing is trying to reinforce this dichotomy between ‘Chinese’ and ‘foreign,’ but there is still much admiration and curiosity for foreign cultures in China. So the public attitude towards Western culture is two-faced.” The project, which is expected to attract 30 million visitors a year, is a joint venture between the state-owned Beijing Shouhuan Cultural Tourism Investment Co. and Comcast NBCUniversal. It has been in the works since 2001. China’s newly appointed ambassador to the U.S. last week compared one of the attraction’s roller coasters to bumpy diplomatic ties between Washington and Beijing. “After all tumbling and shakes, the roller coaster came to a soft landing in the end,” Qin Gang, who visited the park before moving to the U.S. in July, wrote on his official Twitter account, signaling a note of optimism. "