valueinvesting101

Member-

Posts

285 -

Joined

-

Last visited

Content Type

Profiles

Forums

Events

Everything posted by valueinvesting101

-

Fairfax India Announces Intention to Make a Normal Course Issuer Bid period commencing September 30, 2020 and ending September 29, 2021, of up to 3,500,000 Subordinate Voting Shares. Fairfax India may purchase up to 15,429 Subordinate Voting Shares on the TSX during any trading day. It will take around 225 days to purchase close to 3.5 million shares. Repurchases could be around $21-30 million. Less than 0.3% of current market cap. Seems insignificant except to signal cheap price. https://www.fairfaxindia.ca/news/press-releases/press-release-details/2020/Fairfax-India-Announces-Intention-to-Make-a-Normal-Course-Issuer-Bid/default.aspx

-

What are the monopolies of India?

valueinvesting101 replied to wescobrk's topic in General Discussion

Companies with dominant market share are usually trading at pretty steep valuation e.g. Asian Paints, Pidilite, Gillette India etc. There are some state controlled monopolies but I guess you are not looking at those. You can be on look out for HDFC Bank below 3 P/B ratio. It's taking market share from public sector banks for last 25 years in a growing market. Likely to continue for another 2-3 decades. -

I find that private investment valuation hasn't changed much except Sanmar and NSE. Following note from the latest quarterly report is interesting: I believe BIAL gets to update user development fees (UDF) charged per passenger from AAI based on the expected equity return during the period and actual returns achieved during the period last period. If UDF is adjusted in 2022 to reflect lost of revenue/returns due to COVID then there should not be much impact for the airport valuation. This could the reason for 0.1% reduction in BIAL valuation vs. ~15% reduction in Sanmar valuation. Any more details about impact of COVID on BIAL valuation and UDF collection in the future?

-

Can WeChat ban announced by Trump lead to app getting removed from iPhone app store in China? China is important market for Apple and impact of iPhone demand will also have negative effects on other product and services demand. I wonder if Buffett can see the impact of such changes to Apple valuation. It seems to be priced for perfection and can lead to quick haircut of 30-40% if demand in China tanks or similar change can occur.

-

Two Questions about Berkshire

valueinvesting101 replied to Foreign Tuffett's topic in Berkshire Hathaway

At $35 billion purchase price, this probably tops BNSF purchase. I think that was around $34 with debt but involved around 6% of Berkshire shares too. That level of capital deployment probably indicates longer term commitment too. -

Buffett buybacks: Could Berkshire tender stock?

valueinvesting101 replied to alwaysinvert's topic in Berkshire Hathaway

Buffett's Berkshire Hathaway reduces share count, suggesting possible buybacks https://www.reuters.com/article/us-berkshire-buffett-stock-idUSKBN24B2CZ?taid=5f08a57256bb3f000175c765 -

-

Buffett buybacks: Could Berkshire tender stock?

valueinvesting101 replied to alwaysinvert's topic in Berkshire Hathaway

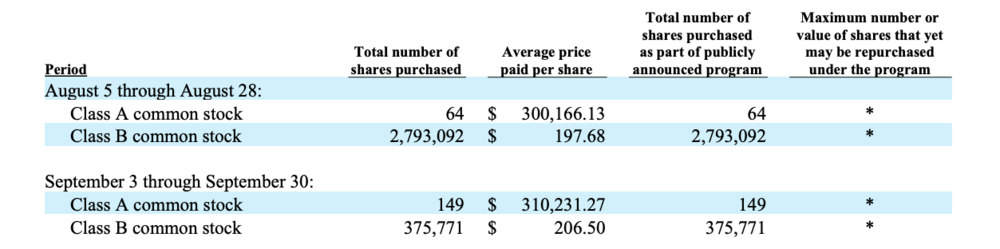

Buybacks were around 550 million in August 2019 with average price of $197.68 and $300,166.13 for B and A share. So may be it will be repeated as well. -

Some commentary about future growth at the Bangalore airport. https://www.passengerterminaltoday.com/news/expo/pte-interview-reimagining-indias-fastest-growing-gateway.html I think Mr. Watsa also referred to taking passenger capacity to 90 million in few years. 10-15 years predictions can be too rosy but given growth in the aviation sector in India it is possible if GDP continues to grow in high single digits.

-

Buffett buybacks: Could Berkshire tender stock?

valueinvesting101 replied to alwaysinvert's topic in Berkshire Hathaway

Just read this transcript from 1996 AGM: 30. Berkshire businesses worth more than book value WARREN BUFFETT: Zone 6. AUDIENCE MEMBER: Mr. Buffett, my name is Steven Tuchner. I’m a shareholder from Toronto, Canada. And my question concerns the valuation of Berkshire shares. Given the large number and dollar size of the private businesses recorded at historic cost, which Berkshire owns, shouldn’t the multiple to book that the stock trades at, essentially, expand over time to reflect the increases in intrinsic value of the private holdings? And I cite Buffalo News on the books at, essentially, I think around zero. And even GEICO now will be on the books at, probably, between 3 and 4 billion — worth more than that — as examples of the disparity between intrinsic value and book value? WARREN BUFFETT: Most of the businesses that we own all of, or at least 80 percent of, are carried on the books at considerably less than they’re now worth. And with some of them, it’s dramatic, although it’s not dramatic compared to a $40 billion total market valuation for Berkshire. It’s dramatic relative to the carrying price. Because when we bought See’s Candy for an effective $25 million in 1972, it was earning 4 million, pretax. It earned over 50 million, pretax, last year. When we bought the Buffalo News, it was making nothing. Paid 30 and a fraction million. And it’s now earning, maybe, 45 million. And we’ve got a number of businesses. And GEICO’s worth more than we carry it for because of the accounting peculiarities of the first 50 percent. So, it is true that, overwhelmingly, our businesses are worth something more than intrinsic value — than book value — and, in many cases, very substantially more, although that’s reflected in the market price of our stock. I don’t think you can go from year to year and trace the intrinsic value precisely by changes in book value. We use changes in book value as a very rough guide as to movement, and sometimes I comment. There have been certain annual reports where I’ve said our intrinsic values grew more than the proportional change in book value, and there’s been others where I’ve said I thought it was roughly the same. So, I don’t think you can use it as a — stick some multiplier on it and come up with a precise guide — a precise number. But I do think it’s a guide to movement. Our insurance business, though, is the most dramatic case of dollar difference between book value and intrinsic value. I mean, the number has gotten very big over time there. I personally think it will tend to get bigger, because I think GEICO will grow, and I think our other businesses will do well. The trick, of course, is to take the new capital as it comes along — and not from the issuance of the B, because that’s relatively small compared to the amount of capital we will just generate from operations. Our float will grow from year to year. Our earnings will be retained. And we’ve got to go out and find things to do that three or five years from now that people say, “Well, that’s worth more than the book value.” And that’s a job. It’s a tougher job than it was. But it’s kind of fun. -

Look through portfolio - Google Sheets with live prices

valueinvesting101 replied to Dynamic's topic in Berkshire Hathaway

As per presentation here https://www.bnymellon.com/_global-assets/pdf/investor-relations/financial-supplement-4q-2019.pdf on page 3, Common shares outstanding (in thousands) are 900,683 on 31 Dec 2019. I guess since part of the holding is via pension funds Berkshire might not have reported more than 10% but may be in few months things will change. 13F for Dec 2019 should be coming soon. Thanks a lot Dynamic for maintaining these details and your detailed response. -

Look through portfolio - Google Sheets with live prices

valueinvesting101 replied to Dynamic's topic in Berkshire Hathaway

Did Berkshire sell holding its in Bank of New York Mellon? It seems like its holding is now below 10%. -

Faering, A91 lead funding round in insurance distributor Go Digit The equity funding round, which was also led by TVS Capital, values the three-year-old firm at $800 mn. Digit is also backed by Canadian billionaire Prem Watsa’s Fairfax Holdings, which has invested $140 million across rounds. https://www.livemint.com/companies/start-ups/faering-a91-lead-funding-round-in-insurance-distributor-go-digit-11579545903956.html

-

As per Fairfax India or Fairfax Financial annual report, Prem had indicated IIFL pre-demerger were trading at attractive valuation and now de-merged companies are even cheaper. CSB Bank has also indicated that it is filing for IPO next month and some of the existing investors are also selling their holding in CSB.

-

Is Berkshire required to disclose if they sell any BAC shares going forward since they own more than 10%? Since there has been no such filing about BAC holding since 07/25 when they disclosed > 10% stake, does this mean they got waiver from Fed or at least having discussion with Fed to hold more than 10% without being designated as bank holding company? Wells Fargo has indicated that they will be spending 2/3 of the buyback amount by 12/31. So it is likely, Berkshire can hit 10% limit of WFC if they have stopped selling.

-

Is there disclosure requirement related to Quess shares? It's purchase of around $1.7 million USD. News has pushed price of Quess shares up by nearly 12%.

-

https://www.federalreserve.gov/newsevents/pressreleases/bcreg20190423a.htm Federal Reserve Board invites public comment on proposal to simplify and increase the transparency of rules for determining control of a banking organization This was published on April 23, 2019. 60 days comment period would be ending soon. Looking at Federal rulemaking process as outlined here: https://www.atf.gov/resource-center/federal-rulemaking-process, this should be in final stages of finalizing the rule. Any insights about likelihood of this rule getting done and probable timeline. Considering switch to passive investing may be it already an issue for some smaller banks.

-

2019 Berkshire Hathaway Annual Meeting

valueinvesting101 replied to cm2's topic in Berkshire Hathaway

I think question about ceiling of 10% holding was interesting. I think, Munger's eager response indicates that they really want to increase their position in banks such as WFC, USB and may be others if allowed. -

Buyback question for Buffett...hope it gets asked

valueinvesting101 replied to ugadawg_98's topic in Berkshire Hathaway

Was Singleton as forthcoming as Buffett when it came providing information to value the company? I think I read in outsiders (may be some other place) that Singleton wasn't very open in providing information to value Teledyne. This information asymmetry can explain his ability to buy 90% of the outstanding shares at advantageous prices. This would especially be handicap for non-professional investors during 1960-1980 era when information disseminated slower than today. -

Buffett/Berkshire - general news

valueinvesting101 replied to fareastwarriors's topic in Berkshire Hathaway

Can/Will Berkshire request suspension of requirement to be below 10% for WFC and possibly BAC till this regulation is finalized? Can shareholder give up voting rights completely or some part of it to limit their voting percentage while holding larger economic interest in total equity? Kind of like dual share voting structure but more ad-hoc. I believe Berkshire had deal for Washington Post to give voting control of shares to Graham family. -

Buffett buybacks: Could Berkshire tender stock?

valueinvesting101 replied to alwaysinvert's topic in Berkshire Hathaway

Going by actuarial tables, average 88 year male has ~87% chance of living another year and ~40% of another five years. Odds for women are around ~50% for living another 5 year. Being a billionaire with a very different lifestyle, more resources than average person and going by experience of CM, Buffet may have more than 50% chance of working at BRK for another 5-7 year. That will require deployment of another 120-150 billion in addition to the existing cash pile. So hopefully more than one giant elephant especially if we hit downturn in next few years. -

Could he be referring to buy Bloomberg LP?

-

Auto Industry and Auto Company Valuations

valueinvesting101 replied to nickenumbers's topic in General Discussion

Only part of the Auto maker's profits are available for shareholders. So accounting earning are not really reflection of free cash-flow to shareholders. http://theinvestmentsblog.blogspot.com/2011/06/munger-on-great-lesson-in.html This link has more details explanation. This discussion of Ford and GM in 2005 AGM during afternoon session. Question #4: https://buffett.cnbc.com/video/2005/04/30/afternoon-session---2005-berkshire-hathaway-annual-meeting.html?&start=824&end=1236 I think Charlie Munger was big fan of GM of 1950-60s but saw problems in the industry. I believe he mentioned in some recent video that it's somewhat surprising that Berkshire owns large stake in GM now but it's cheap and they have lot of cash to be invested now so it makes sense. -

Buffett buybacks: Could Berkshire tender stock?

valueinvesting101 replied to alwaysinvert's topic in Berkshire Hathaway

Positively surprised by Berkshire fall too. It is good since buyback can happen at an attractive price. It is all speculation but it could be triggered by Index funds or charities selling stock to meet yearly spending requirements too. -

What are those number for Fairfax India holding in July and August? Does it mean company repurchased and cancelled those shares?