-

Posts

295 -

Joined

-

Last visited

Content Type

Profiles

Forums

Events

Everything posted by Blake Hampton

-

Thought this was interesting and that you all might like to look at it: https://www.ubs.com/global/en/family-office-uhnw/reports/global-wealth-report-2023/_jcr_content/pagehead/link2.0466322293.file/PS9jb250ZW50L2RhbS9hc3NldHMvd20vZ2xvYmFsL2ltZy9nbG9iYWwtZmFtaWx5LW9mZmljZS9kb2NzL2dsb2JhbC13ZWFsdGgtcmVwb3J0LTIwMjMtZW4ucGRm/global-wealth-report-2023-en.pdf

-

Buffett wrote in an annual letter to shareholders that “Our satisfactory results have been the products of about a dozen truly good decisions.” Does anybody have a good list of these 12? I can think of a few but I’m missing some: Apple Coca-cola Gillette Amex GEICO Cap Cities/ABC The Washington Post Wells Fargo See’s Candies National Indemnity I also think it might be interesting to rank them by impact but it sounds like quite the challenge. Also I'm just now realizing that not all 12 are investments, some are decisions regarding people.

-

These are Apple’s figures 3 years prior of when Buffett started buying the stock in Q1 of 2016. Back then, Apple’s market cap was roughly $500-600 billion and 30 year bonds were yielding about 3%. Current 30 year bonds are yielding 4.3%. Buffett is the GOAT and this was obviously an amazing investment. It just seems to me that Buffett doesn’t like to sell even when something is sitting at a crazy price. Hasn’t he been in the same situation before with Coke? I’m not saying that this is a bad trait, and it might actually be a great one over the long-term, especially in his situation with the amount of money that he has to manage. However, I just can’t fathom why people think Apple is a good investment right now. I also found the research on Buffett’s past purchase interesting, so I thought I’d share.

-

That was a rough read

-

This is my main concern and the reason I haven’t decided on it. I really like the extra return but I don’t quite understand the risk, if any, of principle loss.

-

Saw it in a recent write-up in Money Stuff and definitely think it’s interesting. It scares me though how complicated it is.

-

I read an article in the WSJ this morning that was interesting: Link It basically talks about the two gauges of inflation, both CPI and PCE, and states “One place where price-weight differences have mattered a lot lately is housing. In the CPI, shelter costs for homeowners and renters account for about 34% of the index’s weight. They account for only about 15% of the PCE.” This makes me feel like CPI is more indicative of the average American’s experience of inflation. So why then does the FED use PCE as their benchmark? Thoughts?

-

It’s pretty easy to find a mean but I think that median is more representative. The issue being that finding a reliable figure for the median is harder. I’ve looked at a lot of data and I’m assuming that the median hourly wage in the United States is somewhere around $22 dollars an hour.

-

I’m deciding on whether to stick with my Fidelity money market or switch over into BIL. I’m curious on what you guys do with your cash.

-

Indeed, it’s a great interview. I have heard people in the past mention that they don’t like Ackman and I never understood why. I know at least he’s a great investor, not quite sure as a human being though.

-

Thinking about macro is goddamn information overload

-

All amounts are in nominal terms 2019 and 2022 M2 money supply respectively: 15.321 trillion and 21.358 trillion; an increase of 39.40% 2019 and 2022 S&P500 earnings per share respectively: 139.47 and 172.75; an increase of 24.86% 2019 and 2022 median household incomes respectively: 68,700 and 74,580; an increase of 8.56% You can draw your own conclusions from the data, but wouldn't it be possible that we are seeing inflated earnings from the S&P? Shiller PE: 34.24 S&P500 PE: 27.61 I've been thinking about where money has moved ever since the pandemic, and I think that companies have largely seen outsized inflows relative to households. Think PPP loans, increased earnings due to stimulus, and low interest rates. This is all fine and dandy until you realize that households largely dictate the earnings of these companies. What happens when consumer spending eventually decreases simply because people don't have as much money to spend?

-

I've been thinking about the situation at the FED recently and how it could affect long-term rates in the future. The FED has approximately $4.7 trillion in treasury securities on their balance sheet, and they have sold about $700 billion back into the market over the preceding year. This is evidence that the FED is focused on reducing their balance sheet and should be an indicator for higher long-term rates right? Also how many bonds can the market absorb and to what level? I learned about the economics of it all this morning and came to the conclusion that the effect would be the same whether they sell the bonds or not. This is because the U.S Treasury would have to issue the same debt anyway to pay off the principal of the FED's bonds at maturity, in conclusion causing the same outcome. It's odd though because I've heard the Treasury has been using short-term bills moreso to fund the government, and I wonder if they might ever do the same in that situation, but I don't know if any of that is true. Thoughts?

-

The China Securities Regulatory Commission, led by newly appointed Chairman Wu Qing, has also created a task force with the nation’s stock exchanges to monitor short selling and issue warnings to firms that profit from the wagers, the people said.

-

China be like: - CSRC bans net selling by major firms in first, last 30 minutes - Regulator is creating a task force to track short selling

-

Out of curiosity, what kind of bonds?

-

This was my first thought when I finished writing the post. Are there any metrics to review trends in globalization? It would be an interesting study.

-

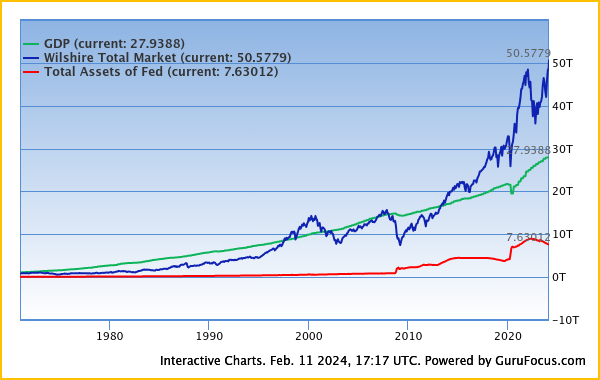

The Buffett indicator looks pretty scary relative to the past. The ratio of total market cap / GDP is currently 181%, what do you guys think about it? Buffett has said in the past that this is “probably the best single measure of where valuations stand at any given moment.” In an interview, I heard Alice Schroeder say that he would like to buy when total market capitalization is at 70-80% of GDP.

-

I want to start by saying that I'm not an advocate for investment in China. I followed Munger into BABA and then proceeded to slowly bleed to death until I decided that China was a no-go, especially when I thought about the structure of ADRs. However, I don't see anything wrong with this particular situation, I believe bondholders should be punished. They are essentially financing a company that built property developments on down payments without ever finishing them. The bottom line is the customers who were sold a false promise are higher up on the claim ladder than some foreign bond owners.

-

So I have seen "the stock market is not the economy" a couple of times and I have to say I don't understand. Wouldn't the stock market essentially be a delayed representation of the economy?

-

Thanks for the great response. I have this feeling that the repercussions from government stimulus are somehow lurking in the underbelly of the economy. I don't know how to explain it so it's probably speculative, and it has been nearly 4 years since the onset of COVID, you would think that any argument would be a wash. Curious what you think.

-

What do you all think of the Shiller PE? Seems to be good metric.

-

Good point

-

I don't know who would buy 10 years at a 4% yield. It seems to be an exceptionally bad deal when you can easily get 5-5.5% on your money short-term. I do know that the Fed owns a shit ton of 10-years and it seems like they are manipulating the market downward, I don't think anybody knows how that situation will end. On your point of DEO and MSGE, I don't disagree that there are deals in larger capitalization stocks, it just seems to me that they are very rare. How do you know that earnings will be this high going forward and that there will continue to be double-digit growth? I'm quite skeptical. Is what you're seeing rational? This is of course very general, but do you think that people will do well getting in at these prices?

-

Also this was great, thanks