alxcii

-

Posts

31 -

Joined

-

Last visited

Content Type

Profiles

Forums

Events

Posts posted by alxcii

-

-

49 minutes ago, changegonnacome said:

No I wont be buying - but I will be shorting Coinbase......in an ETF world where the ETF can be traded commision free via robinhood or Schaeb or whatever brokerage you want.....and then the ETF itself carries a tiny 0.2% annual mgmt charge....your charge for a $51 dollar purchase of BTC at the end of the year is measly and reasonable 10.2 cents on that fifty one dollar purchase and you can sell it too. Same 10.2 c cent cost for a roundtrip.

Contrast that with Coinbase today

- who will charge, as best I can tell, Joe Crypto Sixpack 6% or $2.99 to buy $51 of bitcoin (so much for getting away from greedy/sleazy banks with this new financial system that is democratizing finance for the little guy uh!)...6% in, 6% out if I read that properly.....so up to 12% taken off the table for a roundtrip, oh my lord...........so 30 or 60 times more expensive to transact, hold and sell BTC on Coinbase than it will be to buy,hold,sell inside these ETFs via trading on Schwab or Fidelity or Robinhood......and only one 1099b to deal with at the end of the year to boot!

Coinbase is in deep dog doo.......and all the 0.01% custodial fees in the world looking after the assets of these ETFs is not going to make up for the lost revenue they had during the golden age of scalping their customer that they've enjoyed for the last decade......that party is surely over for them now?

Before you make another "sure" bet, I'm here to collect the $100 you owe me on the ETF approval that had a 0% chance.

-

25 minutes ago, spartansaver said:

I can see the pros and cons of bitcoin. Cons are it could be the next Tulipomania. Pros are its supply is fixed, decentralized, governments destroy their currencies, and if this continues to survive it could be a currency that is used in everyday transactions worldwide. I don't really lean either way, but I do think that even if it is a giant ponzi scheme its somewhat interesting that a lot of people are about to get invited to the ponzi party. Supply is essentially fixed, and demand might go up a bunch as it becomes much less of a hassle to throw a few sheckles at BTC. I don't directly own any but am participating through a position in FRMO.

Gotta pull out Naval here:

-

Stock: FFH.TO

Riskier stock: GLASF

Crypto: BTC

Riskier crypto: SOL

Honourable mention: DRM.TO

-

36 minutes ago, TwoCitiesCapital said:

What's everyone's thoughts on BTC's rally this year despite the liquidity drain globally?

Historically, BTC price was highly correlated with global liquidity. This was a much better predictor of its price than even the years where it was highly correlated with the NASDAQ. But here we are in 2022/2023 where there has been consistent contraction in global liquidity and yet BTC bottomed and doubled.

Thoughts on what might be driving that and how sustainable it is?

ETF speculation and upcoming halving are the two big narratives. I think the next cycle is upon us and we're looking real good if the SEC approves.

-

1 hour ago, ValueArb said:

Utility only provides an investor value if it translates into a stream of cash flows. BTC's utility is the ability to do financial transactions without relying on government fiat, but the utility is the same whether BTC's price is $35,000 or $1,000.

Curious to know why you keep framing everything in terms of cash flows. A thing could be more valuable just simply because everybody else recognizes it has superior properties and wants to use it. A ton of gold 5000 years ago isn't worth anything, but transport it to today and it's a different story. The metal hasn't changed, the cash flows are still zero yet the "value" is completely different because we have collectively converged on this thing as money due to its properties.

5 hours ago, wachtwoord said:The utility IS the value. Not just for Bitcoin but for anything ever.

There's nothing else but utility that gives something value.

How can you reconcile this statement with your view on ETH? You can do many things with ETH that you can't do with BTC, so how is it a complete scam? Yes, it's not as credibly neutral, but ETH isn't trying to be BTC - it just needs to be sufficiently decentralized and integrated enough into the crypto ecosystem for it to have value. An Amazon gift card is centralized but hey, I can still buy shit with it.

-

https://www.docdroid.net/vrehbKf/dc-cir-22-1142-01208547571-0-pdf

"To avoid arbitrariness and caprice, administrative adjudication must be consistent and predictable, following the basic principle that similar cases should be treated similarly. NYSE Arca presented substantial evidence that Grayscale is similar, across the relevant regulatory factors, to bitcoin futures ETPs. The Commission failed to adequately explain why it approved the listing of two bitcoin futures ETPs but not Grayscale’s proposed bitcoin ETP. In the absence of a coherent explanation, this unlike regulatory treatment of like products is unlawful. We therefore grant Grayscale’s petition for review and vacate the Commission’s order."

-

11 hours ago, changegonnacome said:

Nice lesson in counterparty risk & trust services for you @alxcii....think your starting to get to understand how the financial services regulatory structure we have today evolved for very good reasons..........and its good you know about the power of trusted third parties....who can provide custody & settlement services.......between people who don't know each other....its very very appropriate for our regulatory discussion and good lesson why the BTC ETF approval is a crypto pipe dream ..........& that the SEC could never approve a spot ETF in BTC where an exchange that does 60%+ of the volume of BTC is simultaneously & under the SAME roof

an exchange, a broker, providing trust services and a clearing house functions all while being a custodian of the same assets. For anyone who works markets - the structure is preposterous & to the SEC looking at it its laughable.....so the BlackRock ETF will join the what 20 or 30 other BTC ETF applications in the rejection bin.

an exchange, a broker, providing trust services and a clearing house functions all while being a custodian of the same assets. For anyone who works markets - the structure is preposterous & to the SEC looking at it its laughable.....so the BlackRock ETF will join the what 20 or 30 other BTC ETF applications in the rejection bin.

Anyway the complexity & you attempting to pull people into our little bet has already made me infinitely less interesting. How about this for a simple wager - I'll send you a $100 if the BlackRock BTC ETF gets approved! Simples. I don't want a single penny/satoshi from you......you now have no counterparty risk as you are not putting up any money.....you are wagering nothing......you stand to lose nothing.....it's all upside and no downside for you......and all downside and no upside for me. What a great deal. It achieves the same point....which is I'm beyond confident that I will never need to send you the $100 so i consider it a riskless bet for me too.......and I just solved your trust and counterparty problem to boot....without a blockchain being involved!

I look forward to waiting for the BlackRock ETF SEC rejection.

I sincerely hope you don't bet your beliefs because you would go broke in the long run. You keep harping on the offshore volume as if that's the only thing that matters, but you miss the nuance in this situation. A couple of SEC commissioners can tell it better than I can:

https://www.sec.gov/news/statement/peirce-uyeda-statement-vaneck-bitcoin-trust-031023

We believe that the Commission’s decision to subject spot bitcoin-based ETPs to a bespoke standard that may be impossible for any product to meet has harmed investors by making it harder for the bitcoin market to mature through institutionalization and easier, and potentially safer, retail investor access.[16] But our concern is not just with bitcoin. If we use the test in other markets, we will prevent other products from coming to market. Had we applied the test to other commodity-based ETPs, they might not be trading today. Arbitrarily depriving investors of access to products does not protect them. Consistent application of the standards Congress gave us does.

Importantly, the Commission is required by law to provide an explanation for any change to its policy regarding the approval of commodity-based ETPs.[17] According to the Supreme Court, it would be “arbitrary and capricious” for an agency to enact a new policy that rests upon factual findings that contradict those which underlay its prior policy without providing a reasoned explanation.[18] Additionally, the “requirement that an agency provide reasoned explanation for its action would ordinarily demand that it display awareness that it is changing position.”[19] Here, the Commission has crafted a new standard for determining whether a futures market is “significant.” Not only has the Commission failed to provide an explanation for the change, but it has failed even to acknowledge that there has been a change.[20]

Because we believe that spot bitcoin ETPs should be subject to the same standards the Commission has used for every other type of commodity-based ETP and because we believe the poorly designed test being used here is not fit for purpose and will inhibit innovation—and thereby harm investors—in our markets, we dissent.

Peirce and Uyeda dissented even without VanEck having an SSA. Do we have what it takes now?a) A comprehensive surveillance-sharing agreement with

b) a regulated market of significant size related to spot bitcoin

Yes to a), maybe to b). What is considered significant size? If you focus on exchanges with USD onramps or BTC-USD pairs, Coinbase would be considered a significant market. They narrowed the scope with regards to futures before so it's not that farfetched.

What about the Grayscale lawsuit? Rao and Srinivasan seem skeptical of the SEC's arguments, it doesn't look like an open and shut case to me. Maybe that the SEC might lose triggered the rush of filings we've seen.

I don't have anything else to say on this - they may not approve, but 0% chance is obviously a severe miscalibration.

-

7 hours ago, changegonnacome said:

Absolutely I'll take that deal all day long - how much will you let me get into this wager? It is indeed free money. Im interested in as much as possible.

With a bet this asymmetric my concern is whether I will actually get paid out should I win if the stakes are high enough. On crypto twitter I've seen people use a neutral third party to custody the funds until the bet is resolved. On this forum only @Parsad may be able to serve as that person, but I doubt he wants to get involved.

Your word against mine, I would commit 0.001 BTC vs your 0.049 BTC for winners purse of 0.05 BTC. If you know of a good way to structure this with minimal trust assumptions I'm all ears. We could settle in USD as well and I'm willing to go up to $20K to win $980K.

-

2 hours ago, changegonnacome said:

I'll take the other side of that. I would say its hard to see how it happens.

Look forward to seeing what happens & returning here to get the post-mortem when this and Fidelity etf is rejected

You seem so confident, want to bet? I'll give you 2% odds of approval settled in BTC - free money since you think it's 0%.

-

36 minutes ago, changegonnacome said:

What are markets/exchanges......they are venue via which demand/supply for 'x' interact & transact.....in creating a market you also create the by-product of market exchanges.......signal.....because your dealing with 'real' people it turns out signal is really really important.....ever hear of monkey see, monkey do.......well price/volume are the most important 'signals' in markets......you can't have a trustworthy market, one with fidelity if both the price and volume being recorded across the market/exchanges can not be trusted....say when 60%+ of mkt volume is happening on exchanges offshore with no KYC/controls.

CME may be trustworthy, Coinbase/Kraken/Gemini too.....but as I've shown Binance is the 800ilb gorilla in BTC trading volume then add KuCoin/Heubi........the price & volume signal on Binance therefore cross-contaminates the whole market due to its size.

Put simply the CME reference rate is corrupted by the presense of Binance/KuCoin/Heubi - it is a deeply flawed spot market & as such to allow a spot ETF to trade on NYSE/Nasdaq would give crooks on Binance unfettered access to the deepest & most liquid capital market in the world. Trust me the day the SEC approves a BTC-ETF is like the best day of your life if your connected to the Binance crime family.

The classic wash trade game is to create upward price momentum wave using fake volume/price.....creating lots of signal......humans buy stocks when they are going up.....they chase price up......you start a fake upward wave in Bitcoin on Binance and it attracts REAL volume/money via suckers.......the Binance price/volume infects/corrupts the Coinbase price....cause signal feeds into price. You can play this game up and down....attracting naive buyers & sellers into a 'rigged' market........see BTC volatility isnt a bug, its a feature.

(1) the SEC doesn't allow BTC futures with CME BRR - thats the CFTC, not the SEC....so wrong regulatory agency out the gates

(2) why the CFTC allows BTC futures with CME BRR I can only guess is two fold...number one...this is a derivates exchange product its end users predominately are not mom & pop retail....to trade futures your considered to be or certainly have to attest to be sophictated financial market participant (the subtext is you therefore probably realize the 'tape' in BTC is complete bullshit)

(2) but lets even pretend the SEC did somehow approve or allow the futures to trade.....it kind of wouldn't matter for the purpose of our discussion on the BTC-ETF......the US capital markets isn't a monolith....it has layers...those layers are there to protect retail.......there are differing disclosure & effectively safety/risk/experience requirements....derivates/futures/OTC/accredited investor etc. Too many 'layers' to go into.

The MOST important takeaway is that the highest protection & the highest standards are reserved for where you think this BTC-ETF is going to trade......Nasdaq or NYSE.....because this is the market where my grandma and your grandma operates in.....its the deepest pool of capital in the world.

A BTC-ETF approval would effectively be like voluntarily building a money pipeline between scam artists overseas (China/Seychelles/BVI) & the wallet of Joe Sixpack & his Grandma/Grandpa in the United Sates......like I said the day that ever happens there will be the mother of all parties in the offices of Binance.....its like the best thing that could ever happen to you as a fraudster....to get that conduit opened up. CZ & Co. would literally cry tears of joy.

Thanks - given that the SEC just greenlighted leveraged BTC futures I think there is a shifting tide. They will let grandma trade 2x futures but not spot?

-

34 minutes ago, changegonnacome said:

Wrong. Here's the last 24hrs of Bitcoin trading volume by centralized exchange:

Source: https://coinranking.com/coin/Qwsogvtv82FCd+bitcoin-btc/exchanges

Binance is the 800ilb gorilla in spot Bitcoin trading volume as well as altcoins/shitcoins.

As per above - approving BTC-ETF would be totally inconsistent with charges against Binance....

Very possible.....and thats exactly why the SEC will not approve the BTC-ETF.....this is a spot market where nobody, even crypto fans believe the 'tape' has any sort of fidelity to it.

I mean why would they - the guys at Tether in bed with CZ can create effectively fake money out of thin air at any moment they want & go into BTC and do anything they want with the price....so not only do you have wash trading problem in the spot market due to lack of controls.......you've got a market, offshore, that is primarily externally funded via USDT......so even real questions marks around the validity of perceived "real" dollars in the market itself....when the dominating BTC settling currency today arent even dollars at all but rather fake dollar (USDT's) & where the fake dollar folks can't seem to show anyone where the real dollars are.....and nobody in the commercial paper market (where these dollars are supposedly parked) has ever heard of tether.

You see the problem - like I said - the SEC approving a BTC-ETF would be the SEC stating the BTC spot market is robust with sufficient investor protections......I think via your comments & what I've outlined above......its IMPOSSIBLE for the SEC to approve the spot market as robust and by extension then approve the BTC-ETF

Can you please help us understand why offshore exchanges matter when Blackrock intends to use the CME Bitcoin Reference Rate? Binance isn't a constituent exchange.

https://docs.cfbenchmarks.com/CME CF Constituent Exchanges.pdf

If you think even these exchanges are unreliable, can you explain why the SEC continues to allow BTC futures being traded with CME BRR as underlying?

-

10 hours ago, changegonnacome said:

@alxcii where have you been recently? Let me catch you up.

Insufficient data in the past was enough to deny spot ETF's........what the hell have we got now?........an abundance of data, an SEC complaint that includes charges of market manipulation as well as "non-existent trading controls" against the LARGEST mkt share spot exchange in the world...we've also got the dead body of one of the previous largest spot exchange floating around down in the Bahamas..... which imploded in a ponzi scheme where customers funds were co-mingled with an internal prop trading group with all types of fraud and manipulation and a bankruptcy from hell where the guy that did Enron says THIS is way worse than Enron.

To use your words - I think the SEC just went from "insufficient data" to an abundance of data & evidence to show the underlying spot market in BTC is horribly horribly flawed & manipulated.

Couple of other points:

(1) See exchange market share below.......now add up for me all the exchanges listed below and tell me which ones are "on-shore" and within the purview of the SEC and what % of volume it comes too - <15%.........which means that maybe 80% plus but lets be even kinder more than half of the crypto spot market is offshore......outside the eyes, ears or remit of the SEC.

(2) Read this again & tell me about what the SEC thinks of the 62% exchange player in this space: https://www.sec.gov/news/press-release/2023-101

https://www.sec.gov/news/press-release/2023-101

Are we reading the same case.......couple of quotes:

"non-existent trading controls"

"Sigma Chain engaged in manipulative trading that artificially inflated the platform’s trading volume."

The Binance case as laid out by SEC is not about shitcoins & sloppy trading controls...read quotes above.....it effectively articulates a case around a completely criminal enterprise that has "NON-EXISTANT" trading controls & is ENGAGED in manipulative trading activities.....it also goes on to talk about web of related parties where ownership and control is completely & purposely obscured for presumed nefarious reasons.

Short version is the SEC thinks Binance is basically a rats nest.

And all this might be a fart in outer space - if it weren't talking about the worlds LARGEST centralized spot crypto exchange.

How the hell can anyone from Nasdaq surveil & monitor various offshore entities like Binance........when 85% of the trading is off-shore....guess they could go to Binance HQ? Oh wait there isnt a HQ......guess they could hang out with the Kucoin guys in the Seychelles & ask nicely for some trading data to be put on a USB stick and NASDAQ could go through it back in NYC after their few days on the beach.

Nasdaq hasn't a hope in hell of monitoring anything - look what the SEC has just alleged - the largest crypto exchange has non-existant trading controls & is engaged in manipulation..........surveil what.....Nasdaq would be in-gesting nonsense data from Binance, OKK, Kucoin, Huobi....to the extent that they would even give it to them....it would literally be a shit in - shit out trade activity model. Nobody could stand over a megabyte of data.

Agree defo not on a whim.

I know the way these companies work - this ETF project started 18-24 months ago, maybe more...internal working groups bla bla....seventeen layers of committees & papers & proposals....this was all before anybody knew who SBF was and Matt Damon told everyone that fortune favored the brave.......the world has changed & FTX has created a political constituency around tidying things up........but the Blackrock machine had invested x amount and they said scew it we've invested the $$$$$.....lets just put the proposal in and test the system its already a sunk cost........we'll get some innovation theatre value out of this attempt.

0%

How could they? - the 62% player in the spot market has been charged with "non-existant trading controls" and also been accused of engaging in "market manipulation" & "inflating trading volume"

Then think about it could you ever, as the SEC, get to a place where you were comfortable the market was NOT being manipulated.....look at your largest regulatory counterparties in this endeavor......you have to go sit in an office across the table from:

> Binance - HQ - nowhere wherever Cz says he is

> Huebi - HQ - Seychelles

>Kucoin - HQ - Seychelles

>Bitfiniex - HK and/or BVI

Above is maybe what 70%+ of the spot mkt.....Like i said look at your regulatory counterparties......look at the lack of oversight.....think about the fidelity of whatever information they would send the SEC or Nasdaq....come on.

I see it different and am much more optimistic on this but thanks for your thoughts.

-

52 minutes ago, changegonnacome said:

Apologies for my tone - came across a bit harsh there - lets see.........and happy to come back and say you were right!

I think the government can have minor inconsistencies in enforcement or approach......but its rarely completely diametrically opposed to itself on the big stuff & especially inside one agency.....I guess my forcefulness comes from the fact that to approve any of these spot ETF's it would require effectively an enforcement agency to have what I can only describe as a Jekyll and Hyde regulatory approach to the space. The SEC in the Binance case has put its card on the table in regards to BTC and exchanges....... & shown its cards re: tokens & regulatory clarity on the application of howey & securities law. The crypto folks have been asking for regulatory clarity.....they got it.....but the problem is it isn't the clarity they wanted.

- Gensler has stated several times that BTC is a commodity, they have not wobbled on this.

- The core argument that the SEC has used to deny spot ETFs is that there is insufficient data to determine whether there exists fraud and manipulation in the spot markets.

- This is not directly relevant to the case against Binance US which the SEC has charged with the sale of unregistered securities and misrepresenting trading controls.

- The SEC already caught some heat from the judges in the Grayscale lawsuit for not being able sufficiently explain why they approved the futures product which is influenced by spot

- The Blackrock filing is unequivocally different than others that came before it - to mitigate against market manipulation, Nasdaq will be brought in to enter into a surveillance-sharing agreement (see pg. 36 of the filing). This directly addresses the concerns Emily Parise made in the oral arguments in SEC v. Grayscale (..."exchange has a surveillance sharing agreement that gives it access to information like market trading activity, customer identification — the tools to investigate fraud and manipulation if it were to occur.")

- Blackrock is 575-1 in getting ETFs through the SEC - do you seriously think they made this submission on a whim, without any guidance from the SEC?

Can you quantify the probability that you think the SEC will approve? I don't think this is a done deal but I think you've severely miscalibrated the situation here.

-

1 hour ago, Minseok said:

Besides, 20% of all mortgages may be variable, but only about 25% of home owners have mortgages at all. It means only 5% of homes affected.

Where are you getting the 25%?

-

50 minutes ago, Gregmal said:

Grabbed a flyer on BUR into weekend. Pure gamble on ruling

Tempted to add but I already have a chunky position, feels like market underreacted to me.

-

15 minutes ago, TwoCitiesCapital said:

Treasury bills? You know, the old stand by risk-free asset.

As far as why people wouldn't hide out in crypto, they didn't in 2018, or 2020, or 2022.

Eventually we'll get there, but BTC is a risk-asset for now AND has had excessively high correlation with equities since 2020 so I don't think it's obvious that it would be the safe-haven people flee to when bank failures are happening... particularly when everyone is relating those bank failures to crypto institutions like Silvergate and Signature.

I get your point but I think there's a good chunk of people in crypto that wouldn't have considered crossing back into tradfi. Their choices during the USDC depeg would be something like:

1) Swap to BTC/ETH, take market risk

2) Swap to USDT, take the risk that it's not fully backed

3) Swap to a decentralized stable that lacks liquidity

4) Stay in USDC and hope it repegs

After everything settled there were probably people who didn't trust centralized stables anymore and just stayed in the majors.

8 minutes ago, rkbabang said:Eventually people will realize that BTC doesn't equal crypto. I think it's prudent to have 10-25% of your net worth in BTC, but absolutely insane to have that much in dogshitmemetothemooncoin.

Eventually maxis will realize crypto doesn't equal BTC. Not everything needs to have a monetary premium to be useful.

-

42 minutes ago, TwoCitiesCapital said:

Curious to me that while "crypto" banks are failing, and stablecoins depegging left and right, that Bitcoin (and many tokens) are absolutely on fire.

Is this where BTC breaks its correlation of the last two years with traditional markets?

Why wouldn't bank failures and stable depegs be bullish for crypto? Where else are you going to hide out?

-

USDC will repeg, probably slightly off peg but it should be fine. Circle's withdrawal from SVB might not even be stuck as they initiated the wire before FDIC came in.

I think the safe haven narrative for majors is going to take hold in the medium term. When banks are failing and stables are depegging, BTC/ETH seems like a good place to be.

-

7 hours ago, thepupil said:

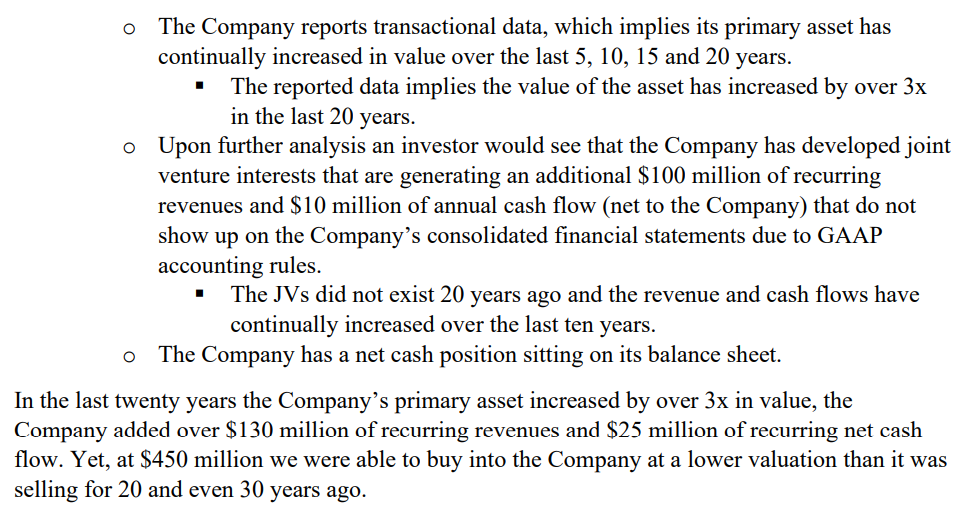

also going back to TRC's 2003 10-K the company generated $18mm of revenue and $52K of operating cash flow...which is very similar to "$15mm of revenue and no reported cash flow"

I think it is beyond a reasonable doubt TRC.

Awesome detective work @thepupil, thanks for your wizardry!

-

Notable shareholder in JOE just released their annual letter: https://nitorcapitalmanagement.com/annual-letters. Any COBAF sleuths out there can figure out what they were buying in the last two years?

-

20 hours ago, TwoCitiesCapital said:

It's 13+ years in. We've gone through these 80+% drawdowns 3 separate times so far. And each time it recovers and makes new highs after bottoming significantly higher than the prior cycle.

I cannot guarantee it will happen again, but the history of BTC has been more indicative of a secular growth trend than a one off bubble that every here seems to infer from the last 18 months.

Obviously past performance doesn't guarantee future results, but then I think the onus on you is to explain why this 80% decline is somehow different from the prior ones?

Hint: It's not the Federal reserve hiking rates which happened in 2017/2018 when BTC was making new all time highs in the last cycle.

I admire you and @rkbabang's attempts to recalibrate the thinking of the crypto detractors on this board but I'm not sure it's a good use of your time. Like you said, it's been 13+ years now since the genesis BTC block and a ton of innovation in the space and still we are going in circles discussing the same basic things since this thread started 5 years ago. If people still think crypto will disappear soon, no amount of well reasoned thinking will change their minds now.

The most anti-crypto folks are the ones that are least likely to have ever actually done anything on chain. I haven't met anybody who has earnestly taken the time to play around and learn about crypto conclude that there is no value in it. Anyone can use a fiat onramp, send transactions, self custody using a browser wallet, use AMMs and on chain order books, borrow and lend, trade on an NFT marketplace, contrast slow but high security chains like BTC vs interoperability focused ecosystems like Cosmos vs fast monolithic ecosystems like Solana - all this for less than the cost of a grande americano in gas fees. But it's still easier to conjure up their inner Charlie, denounce it rat poison and call it a day.

There are so many brilliant thinkers on this forum, I often wonder what kind of alpha we could have uncovered if we actually got people intellectually honest about crypto. With all of our brainpower could have discovered broken mechanisms like UST and shorted it before the depeg. We could be discussing what color Ferraris to buy, but instead we are bickering about silly things like whether permissionless open networks that enable digital scarcity and new ways for human to coordinate have any "intrinsic" value.

-

34 minutes ago, SharperDingaan said:

Sadly, a lot more realistic than many would care to admit.

The reality is that much of the lower quality stable coin collateral is actually worth zero, and the poster isn't going to put up anything more (more and better quality collateral). Were the stable coin issuer to break the peg, it would trigger similar breaks in their other pegs, and very likely bring on a rapid collapse. So the issuer bites the bullet, puts up their own assets, and prays.

Had the launderer used an entire building as the collateral, the facilitator could at least seize it. Thereafter either collect the rents, or closedown/shut the building entirely if warranted. Or level it entirely, to avoid paying ongoing property tax. Total cost including ongoing transaction fee of maybe 5-7%?; higher the building cost, the lower the % cost. Had the launderer used stable coin collateral, it would have been both quicker/easier and the % cost is maybe 3-5%.

Point? Much of the crypto 'capital' isn't going to be available if/when there is a 'run' on the eco-system; and the more private companies in the eco-system the worse it gets. If your counter-party is a private company you have to think they haven't got it, and the bigger they are - the more likely that is. What is worse, is that the bigger they are, the more likely they are also relying on the other big players in the eco-system..... Or identical to the big name I banks at the start of the GFC - just before Lehman Brothers was allowed to fall .....

Back then, the CB's had to step in as the implosion was within the main banking system. Today's crypto eco-system is almost entirely outside of the main banking system .. and much better replacements are waiting in the wings, fully tested and ready to go. Different imperatives.

SD

Not sure if we're still talking about the same thing - The AAVE attack had nothing to do with stablecoin depegs or money laundering. Here's some background for those interested:

-

11 hours ago, TwoCitiesCapital said:

https://protos.com/defi-protocol-aave-faces-bad-debt-and-centralized-points-of-failure/

I've mentioned Aave's strength through the failure of centralized lenders multiple times here, so am shocked to see articles like this.

I feel I'm familiar with the protocol, but maybe someone here is more so?

Aren't all of Aave's loans over collateralized and immediately liquidated when debt covenants are breached? I thought that was part of why they survived the prior fallouts was because they auto-liquidated collateral before anyone else could act.

For anyone else that is familiar with the protocol, is this article just total FUD or does Aave actually extend credit on an uncollateralized basis?

Just because a protocol is overcollateralized doesn't mean it can't take on bad debt if the liquidation parameters are insufficient. The LTV allowed could be too high, the speed of liquidation could be too slow and the liquidity available to clear the position may not be enough.

Aave took USDC collateral for a CRV borrow. Curve pumped on some news they were building a stablecoin. To liquidate, USDC had to be sold for CRV on an AMM, which kept rising as liquidity decreased. There were some other shenanigans (this was part of a more complex attack involving some whales) but basically Aave ended up with bad debt as the USDC was not enough to cover the position.

-

49 minutes ago, LC said:

Bitcoin has been around for 10 years+ now. Forget as a currency- I still haven’t seen a popularized use case for blockchain in general.

1 minute ago, tede02 said:I was thinking something very similar this weekend. Aside from being a token for speculation (and illicit activity), has cryptocurrency proven itself to have any utility? I continue to wonder if all the cryptocurrencies will ultimitely be $0 but the underlying tech survives.

Blockchain is interesting and people make interesting points about potential applications, but that too has yet to materialize. I try to keep an open mind because people like Buterin and Hoskinson are obviously HIGHLY intelligent, but it seems like we're a long way off from widespread application.

If the internet was nothing more than an improved version of the postal service, it would still be a tremendous invention. If all we get with blockchains are uncensorable and transparent payment rails (like they are now), it would still be a tremendous invention.

As we know now, thinking that the internet was nothing more than an improved version of the postal service would have been a colossal mistake. It turns out that a global messaging system can upend entire industries from transportation to hospitality. Could you have convinced the average person living in the AOL era that in the future it would be perfectly normal to take a ride with a random stranger to stay at another random stranger's log cabin in the woods?

The internet's birthday is considered to be 1983 when TCP/IP was invented. What year did you get online? People don't realize just how early we still are - blockchains are still in their infancy. We haven't even coalesced around a standard protocol for blockchains to talk to each other, not to mention all the other infra that still needs to be built out.

Stretch your imaginations just a little bit. Open, trustless, permissionless networks of value aren't going to zero.

IF the ETF approved, will you make Bitcoin a NEW position?

in General Discussion

Posted

In another universe we could have been two intellectually honest speculators, gaming out possible scenarios and shaping each others' convictions as we learn from each other. Instead we have you, a self-professed tourist in this space, trying to jiu jitsu a victory out of this instead of taking the L. I am seriously impressed at what mental gymnastics you had to go through to come back with a doctoral thesis about why you weren't utterly wrong.

I was looking forward to adding another couple satoshis to my stack but thanks for the entertainment anyways.

Narrator: ...he was not a man of his word.