alxcii

Member-

Posts

31 -

Joined

-

Last visited

Content Type

Profiles

Forums

Events

Everything posted by alxcii

-

IF the ETF approved, will you make Bitcoin a NEW position?

alxcii replied to james22's topic in General Discussion

In another universe we could have been two intellectually honest speculators, gaming out possible scenarios and shaping each others' convictions as we learn from each other. Instead we have you, a self-professed tourist in this space, trying to jiu jitsu a victory out of this instead of taking the L. I am seriously impressed at what mental gymnastics you had to go through to come back with a doctoral thesis about why you weren't utterly wrong. I was looking forward to adding another couple satoshis to my stack but thanks for the entertainment anyways. Narrator: ...he was not a man of his word. -

IF the ETF approved, will you make Bitcoin a NEW position?

alxcii replied to james22's topic in General Discussion

Before you make another "sure" bet, I'm here to collect the $100 you owe me on the ETF approval that had a 0% chance. -

IF the ETF approved, will you make Bitcoin a NEW position?

alxcii replied to james22's topic in General Discussion

-

Stock: FFH.TO Riskier stock: GLASF Crypto: BTC Riskier crypto: SOL Honourable mention: DRM.TO

-

ETF speculation and upcoming halving are the two big narratives. I think the next cycle is upon us and we're looking real good if the SEC approves.

-

Curious to know why you keep framing everything in terms of cash flows. A thing could be more valuable just simply because everybody else recognizes it has superior properties and wants to use it. A ton of gold 5000 years ago isn't worth anything, but transport it to today and it's a different story. The metal hasn't changed, the cash flows are still zero yet the "value" is completely different because we have collectively converged on this thing as money due to its properties. How can you reconcile this statement with your view on ETH? You can do many things with ETH that you can't do with BTC, so how is it a complete scam? Yes, it's not as credibly neutral, but ETH isn't trying to be BTC - it just needs to be sufficiently decentralized and integrated enough into the crypto ecosystem for it to have value. An Amazon gift card is centralized but hey, I can still buy shit with it.

-

https://www.docdroid.net/vrehbKf/dc-cir-22-1142-01208547571-0-pdf https://storage.courtlistener.com/recap/gov.uscourts.cadc.38827/gov.uscourts.cadc.38827.1208547574.0_1.pdf "To avoid arbitrariness and caprice, administrative adjudication must be consistent and predictable, following the basic principle that similar cases should be treated similarly. NYSE Arca presented substantial evidence that Grayscale is similar, across the relevant regulatory factors, to bitcoin futures ETPs. The Commission failed to adequately explain why it approved the listing of two bitcoin futures ETPs but not Grayscale’s proposed bitcoin ETP. In the absence of a coherent explanation, this unlike regulatory treatment of like products is unlawful. We therefore grant Grayscale’s petition for review and vacate the Commission’s order."

-

I sincerely hope you don't bet your beliefs because you would go broke in the long run. You keep harping on the offshore volume as if that's the only thing that matters, but you miss the nuance in this situation. A couple of SEC commissioners can tell it better than I can: https://www.sec.gov/news/statement/peirce-uyeda-statement-vaneck-bitcoin-trust-031023 We believe that the Commission’s decision to subject spot bitcoin-based ETPs to a bespoke standard that may be impossible for any product to meet has harmed investors by making it harder for the bitcoin market to mature through institutionalization and easier, and potentially safer, retail investor access.[16] But our concern is not just with bitcoin. If we use the test in other markets, we will prevent other products from coming to market. Had we applied the test to other commodity-based ETPs, they might not be trading today. Arbitrarily depriving investors of access to products does not protect them. Consistent application of the standards Congress gave us does. Importantly, the Commission is required by law to provide an explanation for any change to its policy regarding the approval of commodity-based ETPs.[17] According to the Supreme Court, it would be “arbitrary and capricious” for an agency to enact a new policy that rests upon factual findings that contradict those which underlay its prior policy without providing a reasoned explanation.[18] Additionally, the “requirement that an agency provide reasoned explanation for its action would ordinarily demand that it display awareness that it is changing position.”[19] Here, the Commission has crafted a new standard for determining whether a futures market is “significant.” Not only has the Commission failed to provide an explanation for the change, but it has failed even to acknowledge that there has been a change.[20] Because we believe that spot bitcoin ETPs should be subject to the same standards the Commission has used for every other type of commodity-based ETP and because we believe the poorly designed test being used here is not fit for purpose and will inhibit innovation—and thereby harm investors—in our markets, we dissent. Peirce and Uyeda dissented even without VanEck having an SSA. Do we have what it takes now? a) A comprehensive surveillance-sharing agreement with b) a regulated market of significant size related to spot bitcoin Yes to a), maybe to b). What is considered significant size? If you focus on exchanges with USD onramps or BTC-USD pairs, Coinbase would be considered a significant market. They narrowed the scope with regards to futures before so it's not that farfetched. What about the Grayscale lawsuit? Rao and Srinivasan seem skeptical of the SEC's arguments, it doesn't look like an open and shut case to me. Maybe that the SEC might lose triggered the rush of filings we've seen. I don't have anything else to say on this - they may not approve, but 0% chance is obviously a severe miscalibration.

-

With a bet this asymmetric my concern is whether I will actually get paid out should I win if the stakes are high enough. On crypto twitter I've seen people use a neutral third party to custody the funds until the bet is resolved. On this forum only @Parsad may be able to serve as that person, but I doubt he wants to get involved. Your word against mine, I would commit 0.001 BTC vs your 0.049 BTC for winners purse of 0.05 BTC. If you know of a good way to structure this with minimal trust assumptions I'm all ears. We could settle in USD as well and I'm willing to go up to $20K to win $980K.

-

You seem so confident, want to bet? I'll give you 2% odds of approval settled in BTC - free money since you think it's 0%.

-

Thanks - given that the SEC just greenlighted leveraged BTC futures I think there is a shifting tide. They will let grandma trade 2x futures but not spot?

-

Can you please help us understand why offshore exchanges matter when Blackrock intends to use the CME Bitcoin Reference Rate? Binance isn't a constituent exchange. https://docs.cfbenchmarks.com/CME CF Constituent Exchanges.pdf If you think even these exchanges are unreliable, can you explain why the SEC continues to allow BTC futures being traded with CME BRR as underlying?

-

I see it different and am much more optimistic on this but thanks for your thoughts.

-

- Gensler has stated several times that BTC is a commodity, they have not wobbled on this. - The core argument that the SEC has used to deny spot ETFs is that there is insufficient data to determine whether there exists fraud and manipulation in the spot markets. - This is not directly relevant to the case against Binance US which the SEC has charged with the sale of unregistered securities and misrepresenting trading controls. - The SEC already caught some heat from the judges in the Grayscale lawsuit for not being able sufficiently explain why they approved the futures product which is influenced by spot - The Blackrock filing is unequivocally different than others that came before it - to mitigate against market manipulation, Nasdaq will be brought in to enter into a surveillance-sharing agreement (see pg. 36 of the filing). This directly addresses the concerns Emily Parise made in the oral arguments in SEC v. Grayscale (..."exchange has a surveillance sharing agreement that gives it access to information like market trading activity, customer identification — the tools to investigate fraud and manipulation if it were to occur.") - Blackrock is 575-1 in getting ETFs through the SEC - do you seriously think they made this submission on a whim, without any guidance from the SEC? Can you quantify the probability that you think the SEC will approve? I don't think this is a done deal but I think you've severely miscalibrated the situation here.

-

Where are you getting the 25%?

-

Tempted to add but I already have a chunky position, feels like market underreacted to me.

-

I get your point but I think there's a good chunk of people in crypto that wouldn't have considered crossing back into tradfi. Their choices during the USDC depeg would be something like: 1) Swap to BTC/ETH, take market risk 2) Swap to USDT, take the risk that it's not fully backed 3) Swap to a decentralized stable that lacks liquidity 4) Stay in USDC and hope it repegs After everything settled there were probably people who didn't trust centralized stables anymore and just stayed in the majors. Eventually maxis will realize crypto doesn't equal BTC. Not everything needs to have a monetary premium to be useful.

-

Why wouldn't bank failures and stable depegs be bullish for crypto? Where else are you going to hide out?

-

USDC will repeg, probably slightly off peg but it should be fine. Circle's withdrawal from SVB might not even be stuck as they initiated the wire before FDIC came in. I think the safe haven narrative for majors is going to take hold in the medium term. When banks are failing and stables are depegging, BTC/ETH seems like a good place to be.

-

Nitor Capital Management - Undisclosed Position

alxcii replied to alxcii's topic in General Discussion

Awesome detective work @thepupil, thanks for your wizardry! -

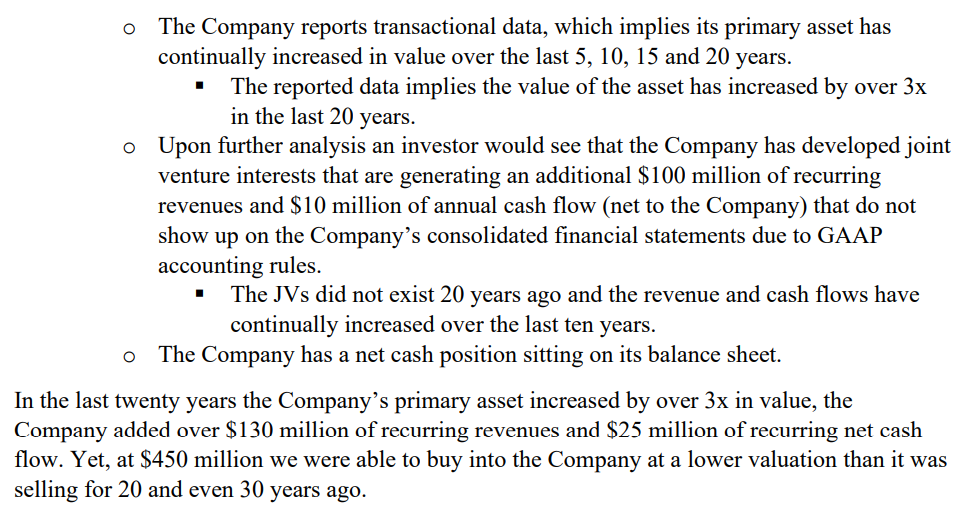

Notable shareholder in JOE just released their annual letter: https://nitorcapitalmanagement.com/annual-letters. Any COBAF sleuths out there can figure out what they were buying in the last two years?

-

I admire you and @rkbabang's attempts to recalibrate the thinking of the crypto detractors on this board but I'm not sure it's a good use of your time. Like you said, it's been 13+ years now since the genesis BTC block and a ton of innovation in the space and still we are going in circles discussing the same basic things since this thread started 5 years ago. If people still think crypto will disappear soon, no amount of well reasoned thinking will change their minds now. The most anti-crypto folks are the ones that are least likely to have ever actually done anything on chain. I haven't met anybody who has earnestly taken the time to play around and learn about crypto conclude that there is no value in it. Anyone can use a fiat onramp, send transactions, self custody using a browser wallet, use AMMs and on chain order books, borrow and lend, trade on an NFT marketplace, contrast slow but high security chains like BTC vs interoperability focused ecosystems like Cosmos vs fast monolithic ecosystems like Solana - all this for less than the cost of a grande americano in gas fees. But it's still easier to conjure up their inner Charlie, denounce it rat poison and call it a day. There are so many brilliant thinkers on this forum, I often wonder what kind of alpha we could have uncovered if we actually got people intellectually honest about crypto. With all of our brainpower could have discovered broken mechanisms like UST and shorted it before the depeg. We could be discussing what color Ferraris to buy, but instead we are bickering about silly things like whether permissionless open networks that enable digital scarcity and new ways for human to coordinate have any "intrinsic" value.

-

Not sure if we're still talking about the same thing - The AAVE attack had nothing to do with stablecoin depegs or money laundering. Here's some background for those interested:

-

Just because a protocol is overcollateralized doesn't mean it can't take on bad debt if the liquidation parameters are insufficient. The LTV allowed could be too high, the speed of liquidation could be too slow and the liquidity available to clear the position may not be enough. Aave took USDC collateral for a CRV borrow. Curve pumped on some news they were building a stablecoin. To liquidate, USDC had to be sold for CRV on an AMM, which kept rising as liquidity decreased. There were some other shenanigans (this was part of a more complex attack involving some whales) but basically Aave ended up with bad debt as the USDC was not enough to cover the position.

-

If the internet was nothing more than an improved version of the postal service, it would still be a tremendous invention. If all we get with blockchains are uncensorable and transparent payment rails (like they are now), it would still be a tremendous invention. As we know now, thinking that the internet was nothing more than an improved version of the postal service would have been a colossal mistake. It turns out that a global messaging system can upend entire industries from transportation to hospitality. Could you have convinced the average person living in the AOL era that in the future it would be perfectly normal to take a ride with a random stranger to stay at another random stranger's log cabin in the woods? The internet's birthday is considered to be 1983 when TCP/IP was invented. What year did you get online? People don't realize just how early we still are - blockchains are still in their infancy. We haven't even coalesced around a standard protocol for blockchains to talk to each other, not to mention all the other infra that still needs to be built out. Stretch your imaginations just a little bit. Open, trustless, permissionless networks of value aren't going to zero.