alxcii

Member-

Posts

39 -

Joined

-

Last visited

Recent Profile Visitors

The recent visitors block is disabled and is not being shown to other users.

alxcii's Achievements

-

Injuries suck - for shoulder pain/rehab I highly recommend looking into using a reverse grip for bench (around 4:10 for info re: shoulders):

-

Thank you everyone for sharing - really appreciate all the sage advice! We put ourselves on the waiting lists of several daycares, hopefully one comes through before we both return to work That's amazing, I hope I feel the same as you did with your daughters! I'm in Canada - to be clear for it's not fully paid leave, I get a top up for some months and then EI for some other months and then I believe benefits would run out before the 15 are up. As for my wife she is self-employed so she can do whatever she wants but does get some benefits from her professional association. This is such gold, thank you! Nice to see staggering works! We were thinking of doing something similar. Great list, working hard on #7 right now. Congrats on the twins! Definitely need to keep this in mind - I think about the Munger quote where he said his kids think that he's a book with legs sticking out. All respect to Munger but I hope to be more than a book... Congrats!

-

It seems to me like a good number of the board has kids - I'm looking to get some advice from all the parents of COBAF. We are expecting our first child and one (of the many) decisions I'm trying to make is how much parental leave to take. I was set on taking 1 year because I thought that was the maximum, but my employer actually offers ~15 months. I keep reading how nobody regrets taking more time but is 15 months too long? My situation is: - Work is not that fulfilling but I generally like what I do - I love the thought of just investing full time (don't we all) and I kind of see this as a break to do just that (not sure how much the sleep deprivation will hurt returns...) - Money not an issue (thank you COBAF) and I don't care about hurting my career prospects I want to take 15 because I'm just thinking of all the moments I can spend with the kid and how priceless that is. My wife is going to take 1 year and what I worry about is the 3 months it will be just me and the kid and how I will feel about it. I'm 100% sure I will cherish the time, but being essentially like a stay at home dad... there's something unappealing about that. Even if I lean into being a "investor" I think I would still have a mini identity crisis. I mean I guess these are feelings I'll have to contend with anyways if I ever actually pivot to investing full time while my wife is still working. Am I overthinking? If anyone here has any related experiences they can share or just about parenting in general, I'd love to hear it!

-

Base fee is burnt, priority fee to miners. https://eips.ethereum.org/EIPS/eip-1559

-

IF the ETF approved, will you make Bitcoin a NEW position?

alxcii replied to james22's topic in General Discussion

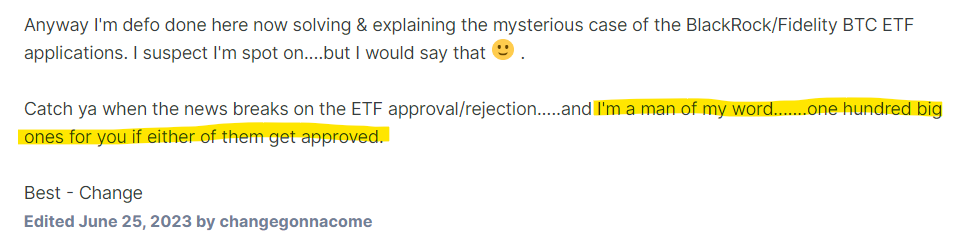

In another universe we could have been two intellectually honest speculators, gaming out possible scenarios and shaping each others' convictions as we learn from each other. Instead we have you, a self-professed tourist in this space, trying to jiu jitsu a victory out of this instead of taking the L. I am seriously impressed at what mental gymnastics you had to go through to come back with a doctoral thesis about why you weren't utterly wrong. I was looking forward to adding another couple satoshis to my stack but thanks for the entertainment anyways. Narrator: ...he was not a man of his word. -

IF the ETF approved, will you make Bitcoin a NEW position?

alxcii replied to james22's topic in General Discussion

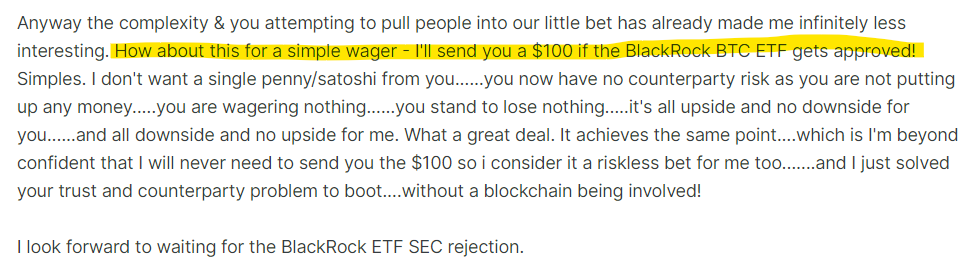

Before you make another "sure" bet, I'm here to collect the $100 you owe me on the ETF approval that had a 0% chance. -

IF the ETF approved, will you make Bitcoin a NEW position?

alxcii replied to james22's topic in General Discussion

-

Stock: FFH.TO Riskier stock: GLASF Crypto: BTC Riskier crypto: SOL Honourable mention: DRM.TO

-

ETF speculation and upcoming halving are the two big narratives. I think the next cycle is upon us and we're looking real good if the SEC approves.

-

Curious to know why you keep framing everything in terms of cash flows. A thing could be more valuable just simply because everybody else recognizes it has superior properties and wants to use it. A ton of gold 5000 years ago isn't worth anything, but transport it to today and it's a different story. The metal hasn't changed, the cash flows are still zero yet the "value" is completely different because we have collectively converged on this thing as money due to its properties. How can you reconcile this statement with your view on ETH? You can do many things with ETH that you can't do with BTC, so how is it a complete scam? Yes, it's not as credibly neutral, but ETH isn't trying to be BTC - it just needs to be sufficiently decentralized and integrated enough into the crypto ecosystem for it to have value. An Amazon gift card is centralized but hey, I can still buy shit with it.

-

https://www.docdroid.net/vrehbKf/dc-cir-22-1142-01208547571-0-pdf https://storage.courtlistener.com/recap/gov.uscourts.cadc.38827/gov.uscourts.cadc.38827.1208547574.0_1.pdf "To avoid arbitrariness and caprice, administrative adjudication must be consistent and predictable, following the basic principle that similar cases should be treated similarly. NYSE Arca presented substantial evidence that Grayscale is similar, across the relevant regulatory factors, to bitcoin futures ETPs. The Commission failed to adequately explain why it approved the listing of two bitcoin futures ETPs but not Grayscale’s proposed bitcoin ETP. In the absence of a coherent explanation, this unlike regulatory treatment of like products is unlawful. We therefore grant Grayscale’s petition for review and vacate the Commission’s order."

-

I sincerely hope you don't bet your beliefs because you would go broke in the long run. You keep harping on the offshore volume as if that's the only thing that matters, but you miss the nuance in this situation. A couple of SEC commissioners can tell it better than I can: https://www.sec.gov/news/statement/peirce-uyeda-statement-vaneck-bitcoin-trust-031023 We believe that the Commission’s decision to subject spot bitcoin-based ETPs to a bespoke standard that may be impossible for any product to meet has harmed investors by making it harder for the bitcoin market to mature through institutionalization and easier, and potentially safer, retail investor access.[16] But our concern is not just with bitcoin. If we use the test in other markets, we will prevent other products from coming to market. Had we applied the test to other commodity-based ETPs, they might not be trading today. Arbitrarily depriving investors of access to products does not protect them. Consistent application of the standards Congress gave us does. Importantly, the Commission is required by law to provide an explanation for any change to its policy regarding the approval of commodity-based ETPs.[17] According to the Supreme Court, it would be “arbitrary and capricious” for an agency to enact a new policy that rests upon factual findings that contradict those which underlay its prior policy without providing a reasoned explanation.[18] Additionally, the “requirement that an agency provide reasoned explanation for its action would ordinarily demand that it display awareness that it is changing position.”[19] Here, the Commission has crafted a new standard for determining whether a futures market is “significant.” Not only has the Commission failed to provide an explanation for the change, but it has failed even to acknowledge that there has been a change.[20] Because we believe that spot bitcoin ETPs should be subject to the same standards the Commission has used for every other type of commodity-based ETP and because we believe the poorly designed test being used here is not fit for purpose and will inhibit innovation—and thereby harm investors—in our markets, we dissent. Peirce and Uyeda dissented even without VanEck having an SSA. Do we have what it takes now? a) A comprehensive surveillance-sharing agreement with b) a regulated market of significant size related to spot bitcoin Yes to a), maybe to b). What is considered significant size? If you focus on exchanges with USD onramps or BTC-USD pairs, Coinbase would be considered a significant market. They narrowed the scope with regards to futures before so it's not that farfetched. What about the Grayscale lawsuit? Rao and Srinivasan seem skeptical of the SEC's arguments, it doesn't look like an open and shut case to me. Maybe that the SEC might lose triggered the rush of filings we've seen. I don't have anything else to say on this - they may not approve, but 0% chance is obviously a severe miscalibration.

-

With a bet this asymmetric my concern is whether I will actually get paid out should I win if the stakes are high enough. On crypto twitter I've seen people use a neutral third party to custody the funds until the bet is resolved. On this forum only @Parsad may be able to serve as that person, but I doubt he wants to get involved. Your word against mine, I would commit 0.001 BTC vs your 0.049 BTC for winners purse of 0.05 BTC. If you know of a good way to structure this with minimal trust assumptions I'm all ears. We could settle in USD as well and I'm willing to go up to $20K to win $980K.

-

You seem so confident, want to bet? I'll give you 2% odds of approval settled in BTC - free money since you think it's 0%.

-

Thanks - given that the SEC just greenlighted leveraged BTC futures I think there is a shifting tide. They will let grandma trade 2x futures but not spot?