Leaderboard

Popular Content

Showing content with the highest reputation on 08/12/2023 in all areas

-

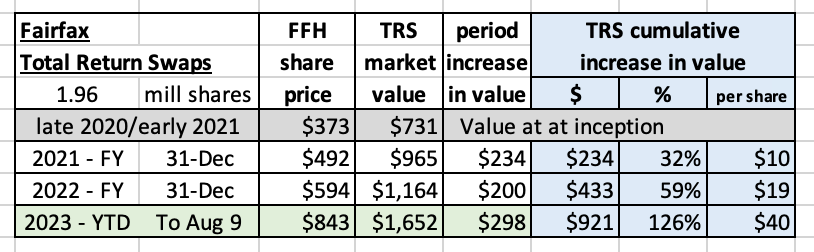

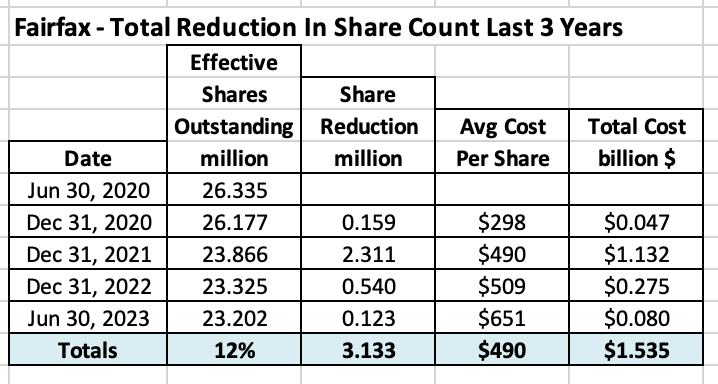

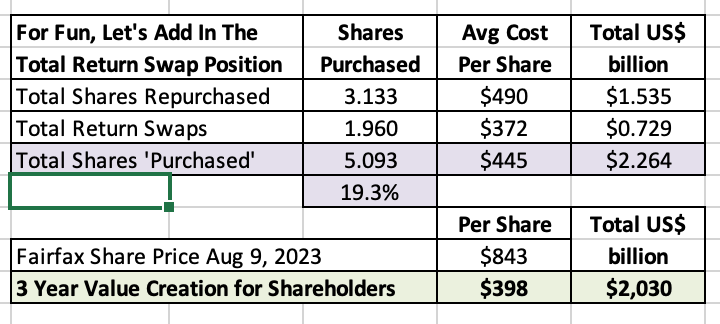

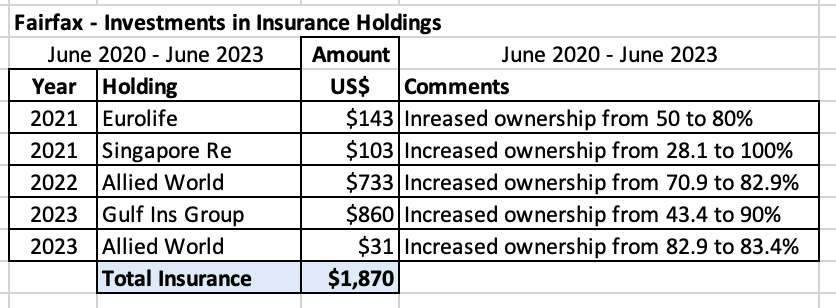

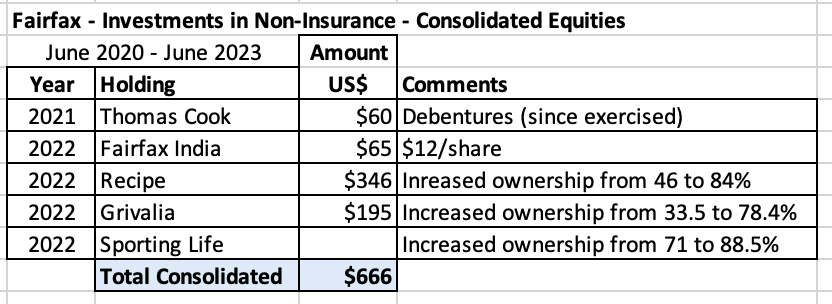

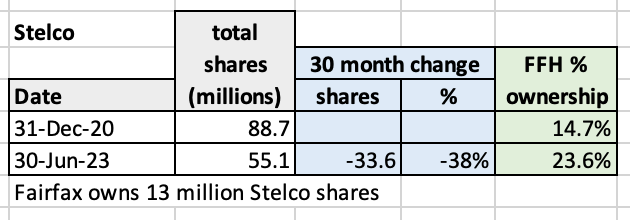

What kind of an investor is Fairfax? Most people would answer: ‘value investor.’ That is the right answer but it doesn’t really tell us much. What kind of a value investor? To answer this question we are going to look at what Fairfax has been doing. What have they actually been buying? What can we learn? We are going to go back three years (June 30 2020, to Aug 11 2023). ————— But first, let’s set the table. 1.) "The single most important thing (when investing in the stock market)… is to know what you own." Peter Lynch The problem with Peter Lynch is he says so many smart (and funny) things that his ‘most important thing’ gets lost in the shuffle. This is the ‘north star’ of everything else he writes. From this naturally flows another of Peter Lynch’s nuggets of gold. 2.) "The best stock to buy is the one you already own." Peter Lynch This makes intuitive sense. You have already done the research on the stocks you own. You know ‘the story’ and you like it (that’s why you own it). Assuming the fundamentals are still solid, then buying more should be a no brainer. Buffett takes this idea a little further with the following quote: 3.) "Diversification may preserve wealth, but concentration builds wealth." Warren Buffett The idea is to invest with conviction around you best ideas. Especially if the stock is on sale. This leads us to our next point. 4.)"‘The three most important words in investing are margin of safety." Warren Buffett Ben Graham introduced ‘margin of safety’ as the central concept of investing in Chapter 20 of his book, The Intelligent Investor. The idea is to only purchase stocks when they are trading at a big discount to their intrinsic value (buy something for $0.50 that is worth $1.00). This approach limits your downside if you are wrong and it provides significant upside if you are right. What do we get when we combine these four points? Often, your best investment is to simply buy more of something you already own - especially when it is on sale. One added twist: 5.) "If you search world-wide, you will find more bargains and better bargains than by studying only one nation." John Templeton Invest wherever in the world the best opportunities are. ————— What does all of this have to do with Fairfax? Well, guess what Fairfax has been doing for the past 3 years? It has invested close to $6.2 billion in stuff it already owns. Yes, during this time Fairfax has been investing in new ventures but the amount spent is much smaller. In short, Fairfax has been feasting at the buffet of companies it already owns. Let’s review the actual investments that Fairfax has been making the past 3 years (Aug 2020 to Aug 2023) that fit this theme to see what we can learn. 1.) Buy Fairfax stock = $2.26 billion Late 2020/early 2021: purchased total return swaps giving them exposure to 1.96 million Fairfax shares Total investment = $732 million (notional) = $372/share Late 2021 - dutch auction: purchased 2 million Fairfax shares Total investment = $1 billion = $500/share June 30, 2020-June 30, 2023 - SIB purchase of an additional 1.133 million shares Total investment = $535 million = $490/share Over the past 3 years Fairfax has ‘purchased’ 5.09 million shares of Fairfax, 19.3% of total effective shares outstanding, at an average cost of $445/share. With shares trading today at $843, the value creation for Fairfax shareholders has been $2 billion. Fairfax saw incredible value in their shares. They invested with conviction (backed up the proverbial truck). Shareholders are now making out like bandits (the value created by Fairfax is flowing though to a much higher share price). Value investing at its best. Who does this string of purchases remind you of? Not Lynch, Buffet or Graham. Who then? Henry Singleton. Who is this guy? From Prem’s letter in Fairfax’s 2018AR: ““I mentioned to you last year that we are focused on buying back our shares over the next ten years as and when we get the opportunity to do so at attractive prices. Henry Singleton from Teledyne was our hero as he reduced shares outstanding from approximately 88 million to 12 million over about 15 years.” At the time, many laughed at Prem for making this comment. I don’t think these same people are laughing at Prem today. 2.) Increase Ownership of Insurance Businesses - Buy Out Partners = $1.9 billion Insurance is the most important economic engine Fairfax has. Top line growth in the insurance businesses is critical to sustainable profit growth at Fairfax over time. And profitability is what determines the share price over the medium to long term. Fairfax is slowly and methodically taking out the minority partners in its insurance companies. They spent $1.9 billion over the past 3 years doing this. As a result they own a larger share of (growing) future earnings of these high quality companies. 3.) Increase Ownership of Equity investments: Consolidated Equities = $0.67 billion These are the equity investments that Fairfax exerts a great deal of control over. They invested $666 million the past three years. The big purchase was taking Recipe private and being able to buy the stock at a big pandemic discount. Remaining Equity Holdings = $1.4 billion These are the equity investments Fairfax doe not exert a great deal of control over. They invested $1.4 billion the past three years. The biggest deal was expanded the partnership with Kennedy Wilson in real estate, with the 2 transactions below being part of much the bigger deal (debt platform and PacWest loans). There are lots of solid single type of investments on this list. In total, over the past three years, Fairfax has invested a total of $6.2 billion to increase ownership in companies it already owns. Many of the investments were opportunistic and made at bear market low prices. Investments were made all over the world - value drove the decision, not geography. As a result Fairfax (and its shareholders) now own a greater proportion of the future earnings streams of these many businesses. The returns on the investments made in recent years are starting to come in and they are very good (in aggregate). With lots of upside in the future. Conclusion: What did we learn? How Fairfax is investing right now is incredibly simple. Invest in what you know. Buy at a discount. Act with conviction. Cast a wide net (global). Boring. Safe. Generating a very good return for shareholders. Something i think the masters would approve of. In short, Fairfax has been putting on a master-class in value investing over the past three years. So, after all that, let’s get back to our initial question. What kind of an investor is Fairfax? Fairfax is a value investor. Their approach is a hybrid of 5 masters: Lynch, Buffett, Graham, Templeton and Singleton. ————— Some of the companies Fairfax owns are doing the same thing: The best example is Stelco who has reduced shares count by 38% over the past 2.5 years, which has increased Fairfax’s stake in the company from 14.7% to 23.6%. Actions like these provide additional benefits to Fairfax and its shareholders. When combined with what Fairfax is doing, they have a ‘multiplicative’ effect for Fairfax shareholders (in terms of owning larger proportion of future earnings).1 point