merkhet

Member-

Posts

3,070 -

Joined

-

Last visited

Content Type

Profiles

Forums

Events

Everything posted by merkhet

-

FNMA and FMCC preferreds. In search of the elusive 10 bagger.

merkhet replied to twacowfca's topic in General Discussion

They would not. Also, Sweeney just granted the government's request for an extension. -

FNMA and FMCC preferreds. In search of the elusive 10 bagger.

merkhet replied to twacowfca's topic in General Discussion

It may drag on even if she orders the government to pay attorneys' fees. -

I second this. Do an AirBNB out in Tysons near the Tyson's Corner Station and take the silver/orange/blue in to the Trump International Hotel. It's right next to Federal triangle, so it's pretty convenient. Don't drive into DC -- parking is terrible. Unfortunately, I moved to Dallas about two months ago or else I'd have offered to let you crash on the couch.

-

FNMA and FMCC preferreds. In search of the elusive 10 bagger.

merkhet replied to twacowfca's topic in General Discussion

If the government takes away your cause of action (i.e. reversing the NWS) then there's nothing to sue on -- you'd never get to discovery if you can't survive a motion to dismiss. I think you're assuming a settlement would necessarily keep the NWS in place. Moreover, you could probably still keep the NWS in place while coming to a settlement with existing parties that precludes others from "promptly tak[ing] up a new suit." For instance, if the government were to pay off preferred shareholders @ par while carving off 1/5 of the company to give to non-government common, then it'd be difficult to find a future cause of action, etc. There's a lot of room to be creative here. -

FNMA and FMCC preferreds. In search of the elusive 10 bagger.

merkhet replied to twacowfca's topic in General Discussion

I think it would be easier to settle with the preferred shareholders than w/ the common shareholders -- though there are ways to deal with this. (Think class action lawsuits -- they aren't interminable for a reason.) Easier to settle w/ preferred shareholders though because you'd just give them their par to go away. -

FNMA and FMCC preferreds. In search of the elusive 10 bagger.

merkhet replied to twacowfca's topic in General Discussion

Another alternative is for the government to raise their strike price for the warrants as a method to fund capital. Then the government can sell off its stake similar to AIG. This might be more likely than giving up its warrants as it allows the government to capture more of the upside. -

FNMA and FMCC preferreds. In search of the elusive 10 bagger.

merkhet replied to twacowfca's topic in General Discussion

If the warrants and the 2008 bailout end up being in question because of the CFPB ruling, then the give and take would be that the government keeps its warrants, but it unwinds the NWS and/or pays off the preferred shareholders and/or common shareholders. -

FNMA and FMCC preferreds. In search of the elusive 10 bagger.

merkhet replied to twacowfca's topic in General Discussion

It would seem that if we get a remand, the plaintiffs should amend the complaint to include a claim that the FHFA/HERA is unconstitutional based on the CFPB ruling. At the very least, this threatens the government's warrants and might help bring them to the table for a negotiation. -

FNMA and FMCC preferreds. In search of the elusive 10 bagger.

merkhet replied to twacowfca's topic in General Discussion

problem is, the phh dc circuit court panel gave very narrow relief in the case of the cfpb, merely excising the provision from statute that insulated coddrey from removal by potus except for cause. ct didnt say that everything he has done is void. so if someone brought a piggyback action against fhfa, i suspect there would be the same result, just making watt removable for cause Except... HERA requires that the Director be independent... ergo, HERA might be unconstitutional on this basis. Having an independent director and having a director be removable at will seems irreconcilable. -

FNMA and FMCC preferreds. In search of the elusive 10 bagger.

merkhet replied to twacowfca's topic in General Discussion

@merk i dont get this. restitution is unjust enrichment, which doesnt look to what is lost, but what is improperly obtained. I'm just quoting the guy from Cooper & Kirk *shrug* -

FNMA and FMCC preferreds. In search of the elusive 10 bagger.

merkhet replied to twacowfca's topic in General Discussion

The idea is that if you hold preferreds issued in 2007 that have paid out $4, then maybe you restitution is $21 (par minus dividends) whereas if you hold preferreds issued in 2008 that have never paid out, then your restitution is $25. -

FNMA and FMCC preferreds. In search of the elusive 10 bagger.

merkhet replied to twacowfca's topic in General Discussion

Notes from today's call: The United States District Court of DC has heard 308 cases, and we've got 303 opinions. Really should be any day now. Six key legal issues to look for in Perry: (1) Whether FHFA exceeded its statutory authority by failing to preserve & conserve assets (2) Whether FHFA was acting under the direction/supervision of Treasury (3) Whether Treasury exceeded its authority by exceeding the sunset provision (4) Whether there was a breach of contract on the dividend stopper (5) Whether there was a breach of the implied covenant of good faith and dealing (6) Whether there was a breach of fiduciary duty What are the possible damages for breach of contract? (1) Expectancy, put the non-breaching party in the same place it would have been without a breach (2) Reliance, out of pocket costs with some subtraction (3) Restitution, the benefits received by the breaching party minus benefits received from non-breaching party (like dividends) NOTE: It's possible that not all preferred shares would get paid out the same amount. If you never had dividends, you'd get closer to par value. Unclear though. -

FNMA and FMCC preferreds. In search of the elusive 10 bagger.

merkhet replied to twacowfca's topic in General Discussion

"In other words, administrative hubris does not get the last word under our Constitution. And citizens can count on it." Very interesting. -

I voted yes....just to mess with the poll. I think people spend too much time on politics. But Im a jerk like that. The whole reason I have a significant portion of my net worth in Brk is because I think its undervalued and i trust Buffett with my capital. I dont think Trumps investments are undervalued nor do I trust him with my capital and thus do not have my capital with him. Im not really sure what youre trying to get at other than that. Not getting at anything deeper than wanting to know why someone would think that Trump could run Berkshire successfully. Politics aside, Trump has not been a particularly good steward of other people's capital and -- by some -- measures not a particularly good steward of his own capital either. So you were a "fake" vote for yes, but I suppose that leaves 3 other people who voted yes? Was there a serious yes amongst them?

-

FNMA and FMCC preferreds. In search of the elusive 10 bagger.

merkhet replied to twacowfca's topic in General Discussion

IIRC, only the lawyers can view the documents unless they're unsealed. -

FNMA and FMCC preferreds. In search of the elusive 10 bagger.

merkhet replied to twacowfca's topic in General Discussion

He worked on the Homeland Security Council. And it's unlikely that this is grounds for impeachment. There are specific things, treason, etc. that are impeachable offenses. -

FNMA and FMCC preferreds. In search of the elusive 10 bagger.

merkhet replied to twacowfca's topic in General Discussion

If I add this to the conversation that another CoBF poster and I had w/ Berkowitz roughly two years ago where he said that he hoped he could embarrass the people involved into doing the right thing -- it starts to make some sense that Berkowitz might know what's hidden. -

FNMA and FMCC preferreds. In search of the elusive 10 bagger.

merkhet replied to twacowfca's topic in General Discussion

I think this is the case as well. Take a look at the Director of Investment Research @ Fairholme. He left the Treasury in 2011, but my guess is that he has some knowledge of things that transpired re the NWS. http://www.fairholmecapital.com/daniel-e-schmerin/ -

FNMA and FMCC preferreds. In search of the elusive 10 bagger.

merkhet replied to twacowfca's topic in General Discussion

From Fairholme -

FNMA and FMCC preferreds. In search of the elusive 10 bagger.

merkhet replied to twacowfca's topic in General Discussion

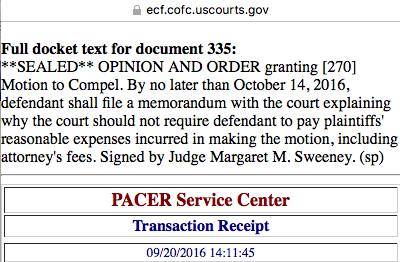

I'd hasten to add that if it was only a partial grant on some docs and not others, I don't think that Sweeney would have added that she thinks the government's lawyers should be penalized and have to pay for plaintiffs' reasonable costs. I don't think this would qualify under an interlocutory appeal (has to be dispositive to the case, etc.), but that doesn't mean they can't apply for one and try and delay some more. -

FNMA and FMCC preferreds. In search of the elusive 10 bagger.

merkhet replied to twacowfca's topic in General Discussion

Here's a screenshot from PACER helping to confirm. This is excellent news. And to answer TonyG, yes, Sweeney is basically saying that defendants have acted inappropriately and wasted everyone's time -- and therefore should be paying plaintiffs' attorneys fees. -

FNMA and FMCC preferreds. In search of the elusive 10 bagger.

merkhet replied to twacowfca's topic in General Discussion

The dissenting Ginsburg is Ruth Bader Ginsburg, a U.S. Supreme Court Justice. The Ginsburg mentioned in this thread is Douglas Ginsburg, a United States Court of Appeals judge for the D.C. Circuit. Totally different people. Totally different courts.